Banking in the Era of Connected Experience: Customer Retention (Part 3)

Read this eBook, to get access to:

• Cross-channel marketing strategies for customer retention.

• How customer experience yields high ROI.

• Reactivating your lost and dormant customers.

• Creating personalized omnichannel journeys.

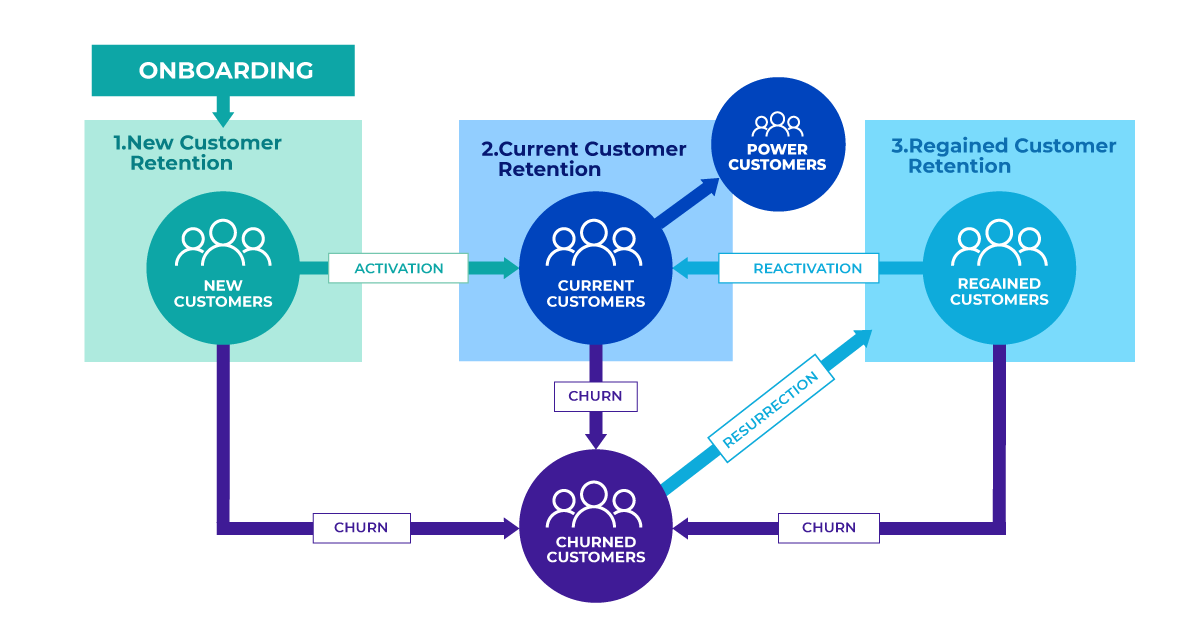

Managing Retention Across the Customer Lifecycle

Retaining customers is not an end function. It starts right from onboarding and providing an impeccable customer experience by keeping your new and existing customers engaged.

3-step Approach to Customer Retention

Once you have built loyalty, upselling consumers becomes another revenue driver. Getting customer loyalty is the goal of all retention strategies. Banks can increase retention by implementing the following:

Focus on Customer Experience

Customer experience in banking is moving from the traditional high-touch offline model to purely online interactions - or a blend of both.

Build Customer Relationships

As banks become more digital, they must work harder to connect with their customers in new ways to build solid relationships and retain them over time.

Personalize Experiences

Develop personalized ways to communicate with your customers as traditional retention marketing strategies don’t work well in the banking sector.

Frequently Asked Questions

Why is it important for banks to retain the customers?

Reports in the banking industry indicate how dissatisfied customers discourage their friends from using that bank’s services. Hence, it becomes crucial for banks to offer impeccable customer experience and keep their customers engaged.

How can banks improve customer retention?

Banks can improve customer retention by collecting timely customer feedback, hyper-personalization, sending newsletters, addressing customer reviews, and building customer loyalty.

How do you attract and retain bank customers?

Banks can attract and retain customers by understanding the customer’s needs, providing consistent experience both online and offline, building customer relationships and sending relevant communication.