🔥 [Panel] Personalization, AI, Trust—What Top BFSI Marketers Are Doing Differently.

Register Now

One of UAE’s best performing banks for five decades, Mashreq is a leading financial institution with an expanding footprint across the Middle East. The brand has a strong presence in the financial capitals of the world with international offices in Europe, Asia, Africa and the U.S.

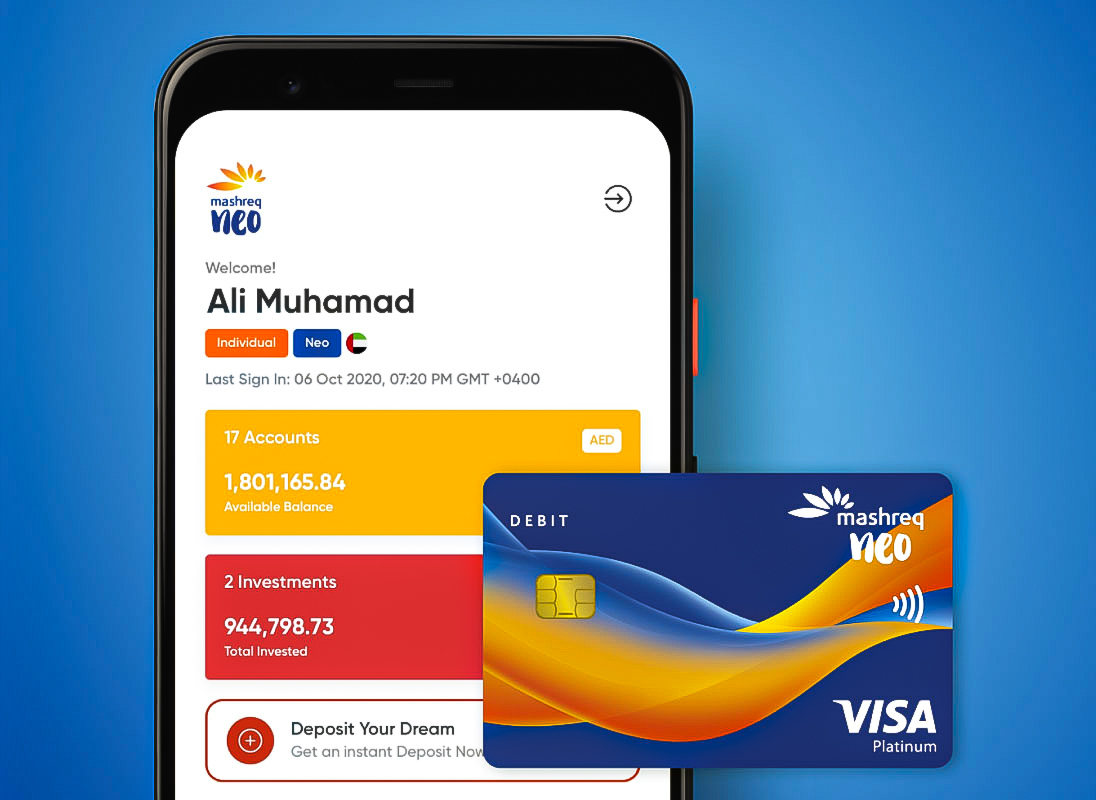

Three years ago, Mashreq launched its very own digital banking app – Mashreq Neo. The mobile app offers a personalized full-service banking experience where customers could create instant bank accounts, initiate bill payments, quick remit (money transfer), opt-in for debit/credit cards & loans, and manage investment banking along with international trading. The mobile app also offers loyalty programs based on the customer’s app usage and purchases.

At first, Mashreq Neo perceived their mobile app as just another touchpoint to engage with their customers. The app was not integrated into the larger omnichannel customer experience. As a result of the siloed approach, customer data across channels and services was stored in silos and not flowing into a centralized platform or tool. They noticed side-effects that would impact the overall engagement strategy. Some side-effects observed were: - High drop-off in customers at the onboarding stage. - Low adoption of debit cards, quick remit for salary and international transfers, and bank loyalty program(Salaam Points) based on debit card usage.

We have partnered with MoEngage over the past three years to leverage ‘Sherpa’ which is an intelligent customer engagement platform. This application has enabled Mashreq Neo to better understand customer behavior thereby allowing us to make proactive decisions through the use of artificial intelligence.

Mashreq Neo’s team observed that a substantial set of customers were downloading and activating their bank accounts on the mobile app. However, the onboarding process across digital touchpoints was not accurately mapped which led to unaccounted drop-offs. As a first step, the team created an event dashboard to analyze every customer’s peak and low active timelines on the app. Post that they used MoEngage’s Cohort Analytics to create different cohorts(across installed to uninstalled stages) that helped them map leaky spots across the funnel. Based on this analysis, the team identified peak drop-off points (stages with more than 60% losses). They built omnichannel workflows to engage users in these high-risk buckets. Using MoEngage Flows, the team created customer journey workflows with primary goals aligned to revenue (such as debit card activation, quick remittance initiated, etc.)

The team analyzed the customer's current app behavior. Actions such as checking account balance and reward points, and downloading bank statements signal a higher intent.

User attributes coupled with his/her online behavior on the bank’s website/app helped the team predict a customer’s propensity towards new offerings and services. This helped the relationship managers to intelligently identify, communicate, and convert an existing customer across other categories with ease.

With targeted, automated, and personalized communication, customers were urged to opt-in for loyalty programs (Salaam Points) as it offered benefits such as cashback, and one-time vouchers across select outlets.

In order to place their mobile app at the centre of their customer experience, the Mashreq Neo team chose MoEngage to implement a contextual app engagement strategy. This strategy was aimed at improving customer engagement, onboarding, upselling, and rewards.

• 9K month-on-month increase in new app customers

• 25% surge in ‘quick remit’ usage

• 54% increase in ‘salaam points’ consumption

• 50% increase in CTR using personalization and AI

Using MoEngage’s Cohort Analytics, the team created customer cohorts to map leaky spots that were harming revenue goals. Post this, peak drop-off points were identified and omnichannel workflows around card activation, transfers, and loyalty programs were built to engage those in high-risk buckets.

The team also used performance data of past messages to optimize customer messaging. Proactive actions were then taken to engage customers at the right time, with the right message, on the right channel. This personalization of recommendations using MoEngage led to massive response rates on the app.

Please wait while you are redirected to the right page...