How Brands in India’s Gaming Industry Can Better Engage Their Customers

Reading Time: 9 minutes

Glossy boxes of chocolate, candies, and often, the latest video or PC games from overseas! Sound familiar? Reminiscing about the time before smartphones and sleek gaming laptops, we had to rely on the kindness of our geographically advantaged relatives (usually in the west) to get access to the latest gadgets in gaming.

Hours spent getting the Prince through the perilous castles of medieval Persia, navigating the Mushroom Kingdom in the garb of a well-loved Italian plumber, and shooting down ducks with the help of a suspiciously orange dog. That’s how we 90s kids were introduced to gaming- 2 whole decades ago!

But India’s gaming industry has come a long way since then! In 2023 for starters, we no longer have to rely on the kindness of family from across the world. The gaming industry here is coming into its own- from Minecraft, launched back in 2011, to the more recent popularity of Angry Birds, PUBG, and Ludo King. India’s internet users have taken to the online gaming market with a passion, elevating them to the level of cultural phenomena.

The COVID-19 pandemic only accelerated this popularity, with lockdowns resulting in newer customer cohorts (did you know 49% of women started mobile gaming during the pandemic?) and an exponential rise in time spent playing! Now, as the pandemic comes to an end (or so we hope), it’s time for the next phase in India’s gaming industry. What lies ahead? What are the emerging trends in the space, and is it finally being perceived as a real contributor to the country’s economy? Read on to know more!

An Introduction To The Gaming Industry in India

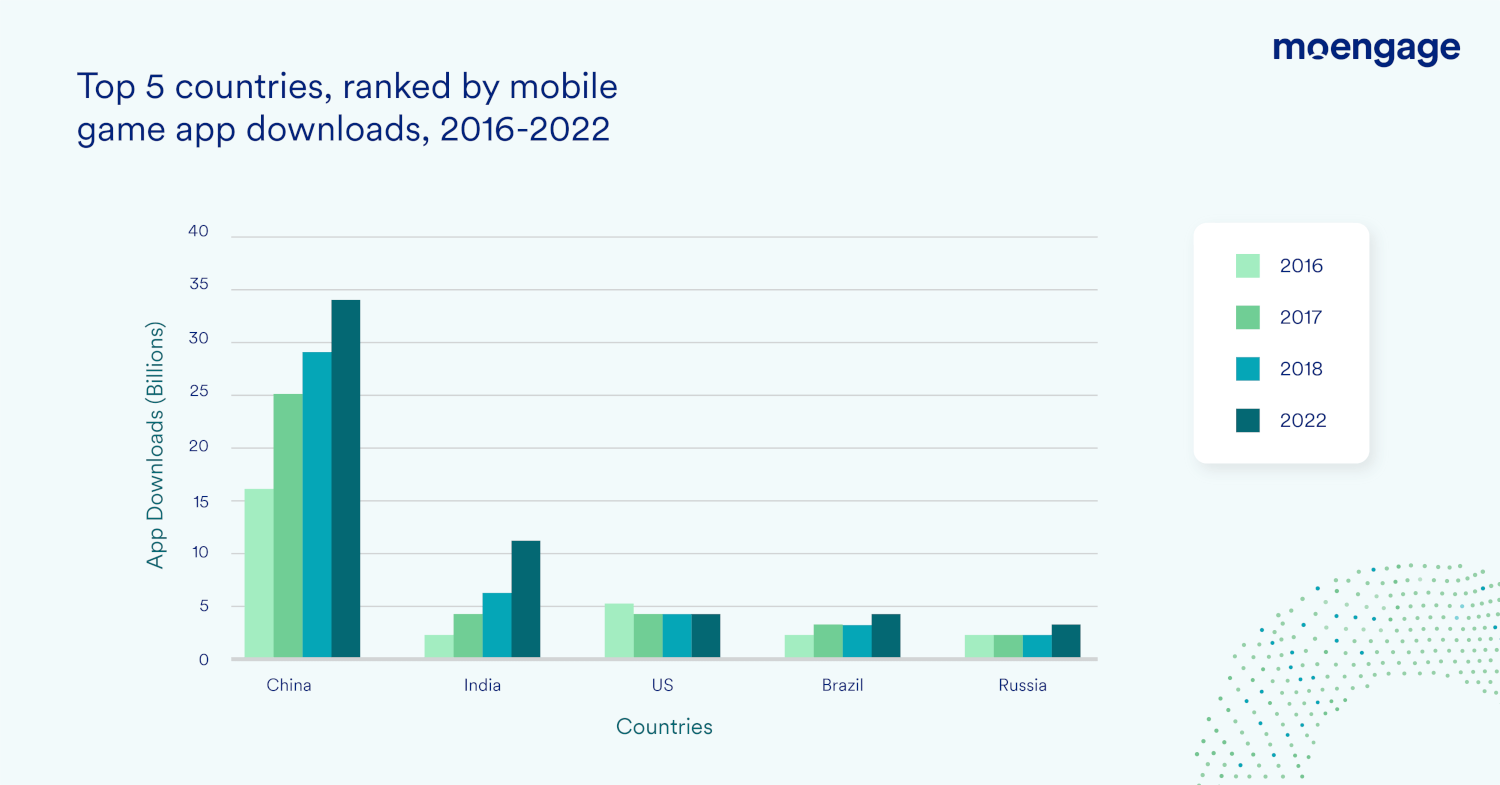

Today, there are 4oo online gaming companies in India, and the country is home to over 400 million online gamers! These numbers come as no surprise, given a number of factors. Firstly, India has a rapidly growing base of smartphone users, with the number projected to hit 1 billion by 2026 – and 86% of all online gaming apps were phone-based, at least till 2021.

Secondly, over half of India’s population is under 30. It’s safe to assume that a large portion of this population is made of internet users – and that many of them are likely to kick back and enjoy some or other form of online games after a hectic day to unwind. Clearly, conditions have been ripe for the online gaming industry in India to boom.

Popular Segments in The Gaming Industry in India

The online gaming market continues to go from strength to strength, with the three most popular segments being:

Hyper Casual Games

This segment of the online gaming industry is characterized by its simplicity and basic gameplay mechanics. These online games are often designed and released quickly, and make money through in-app advertising. Hyper-casual games peaked in popularity a few years ago but have seen a downward trend in 2022.

Casual Games

These online games are those which require minimal effort to play. They, too, are free and monetize through in-app advertising. In 2020, they comprised 78% of all game downloads (based on analysis from 11 industries and 30 markets).

Real-Money Gaming Apps

Real-money games are those that allow the player to wager, stake, or participate using real money to obtain a prize with real monetary value – think Dream11, the title sponsor of IPL 2020! In the 2021 financial year, the value of the real money gaming industry stood at INR 49 Billion.

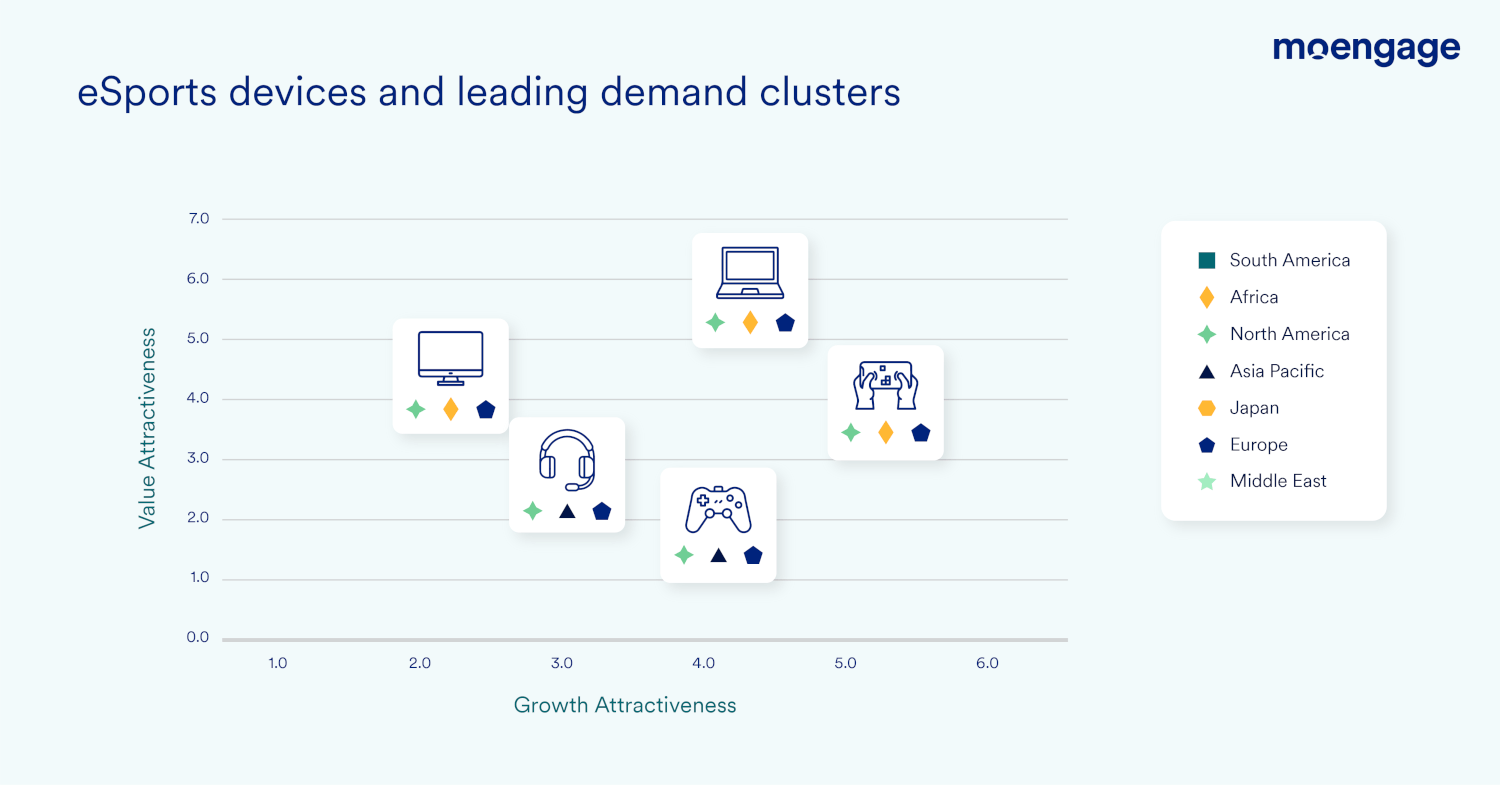

eSports: The Rising Star

As mobile gaming consolidates its place in Indians’ lives, another trend is slowly but steadily emerging side by side in the gaming industry. Often confused with online games, e-sports are games of skills that are played in tournaments like physical sports. According to EY, the e-sports market size in India quickly scaled to INR 3 billion in FY2021, and it is projected to reach INR 11 billion by FY2025. However, the sport has a much larger economic impact and will generate an economic value of around INR 100 billion between now (2023) and FY 2025.

Want to explore India’s casual, hyper-casual, and real money gaming app industry trends? We analyzed over 100+ gaming apps to get you the insights you need! Read more here!

Current Regulatory Challenges

While the eSports segment is evolving at an exponential pace in India, there are certain regulatory barriers that exist. Despite the sector being a favored one amongst the younger population, the domain remains a regulatory grey area.

Currently, there is no specific set of regulations that govern eSports or any aspect related to the same. The government is yet to promulgate an enactment, which means it remains fairly unregulated apart from certain state regulations. With a booming market like eSports in hand, the government’s support in putting a regulative infrastructure in place would ensure is going to help revolutionize the space and encourage young Indian gamers to take it more seriously.

Challenges Faced By The Indian Mobile Gaming Industry

Coming back to mobile gaming – the Indian gaming market, while growing at a rapid pace, is dealing with its own set of challenges. Retaining customers and keeping them engaged are some of the crucial ones that are cropping up often as new apps emerge across the gaming industry in India. In fact, according to some reports, less than 15% of mobile games retain 35% of players after the first day!

So does that mean that mobile gaming brands in India should just accept these issues, make the best of the situation and move on? Or is there actually a way to tackle the issues of customer engagement and customer retention?

This is where Customer Engagement Platforms (CEPs) come in handy! A CEP helps gaming brands by implementing segmentation correctly and consequently reaching out to their prospective customers through the right channels. A powerful tool like that can help brands turn a one-off gamer into a regular, paying customer! With a CEP, mobile gaming apps can:

- Boost engagement with behavior-based messaging

- Re-target users who have dropped off and bring them back on their apps

- Create customized journeys that enrich the customer experience

- Drive conversions and boost revenues

Gain An Edge In The Online Gaming Industry With a CEP

While all the above-mentioned perks sound lovely, you must be wondering how exactly does a CEP like MoEngage do that and more? Well, our platform helps gaming apps analyze and segment customers for a more effective retention strategy. Here’s a breakdown of all the different ways in which MoEngage enables online gaming apps to gain a competitive edge in the online gaming industry:

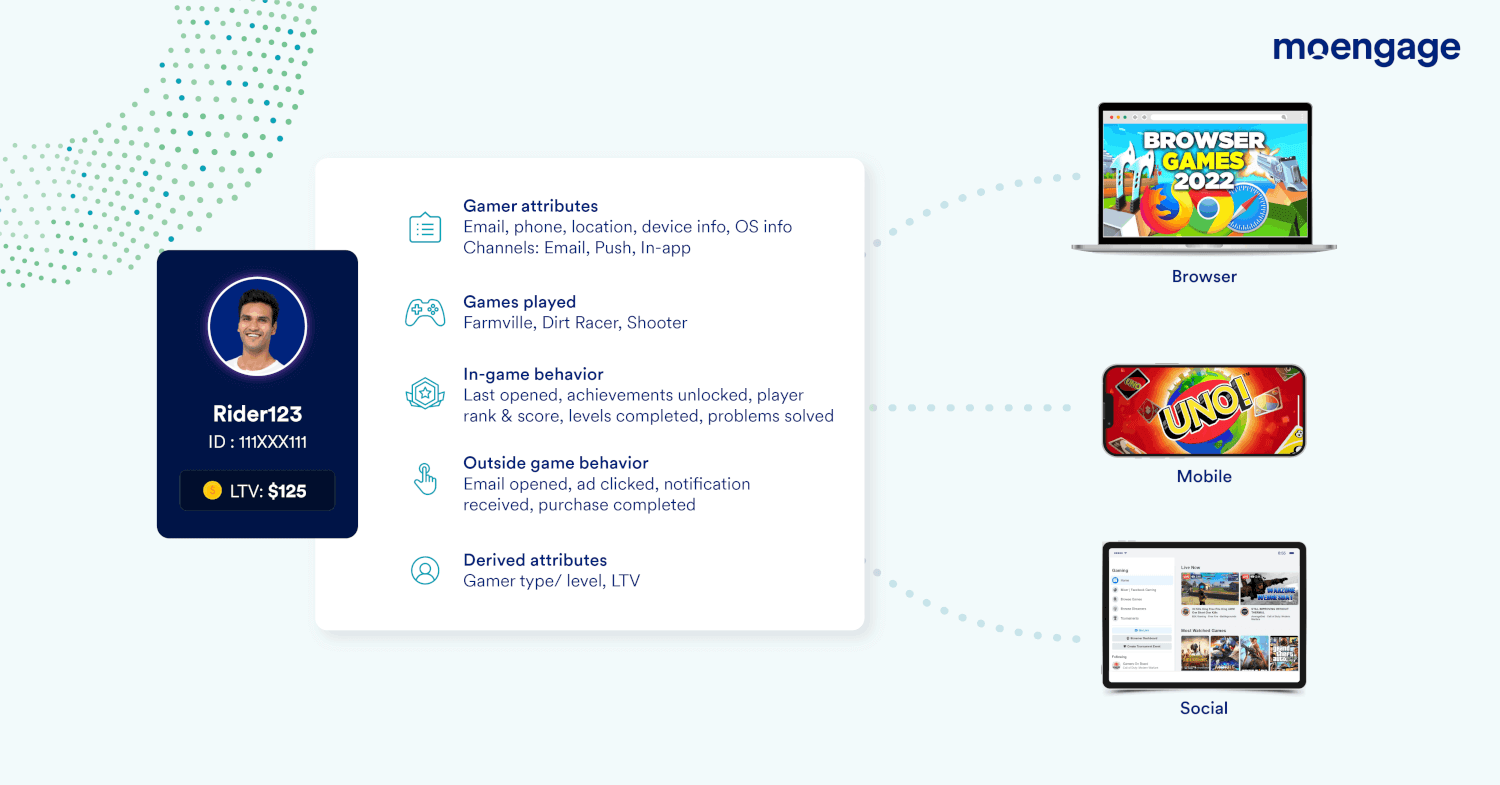

Get To Know Your Customers (Really) Well

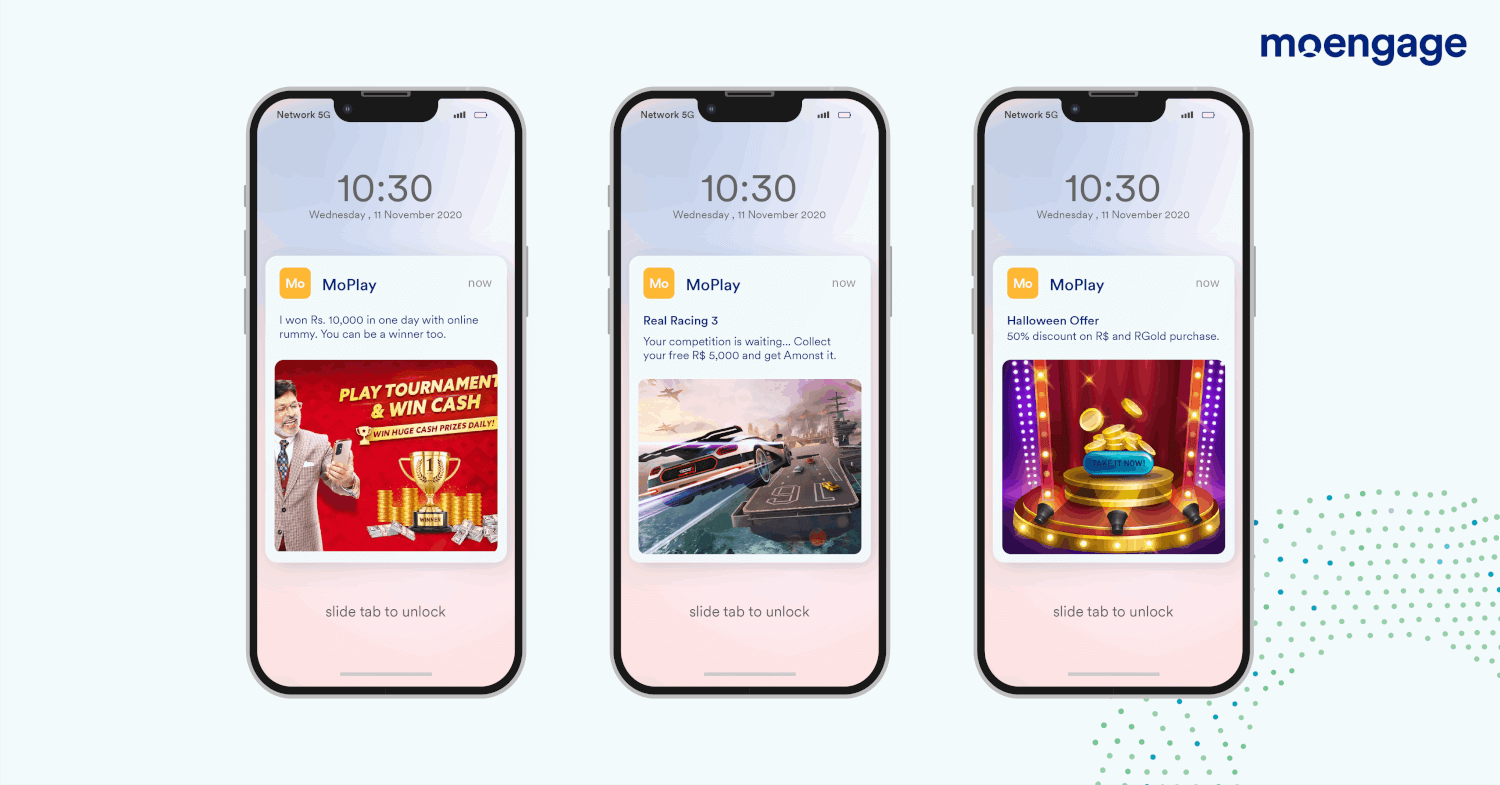

Our artificial intelligence (AI) driven capabilities will allow you to tap into customer insights around preferred channels, times, geographies, and much more! So whether your customers are next door or halfway across the world, you can design targeted omnichannel campaigns that drive engagement and prevent uninstalls on your online gaming app. MoEngage’s customer analytics and insights allow you to get to know your users inside out – so you can improve your onboarding process, increase product searchability, and double down on the best time, frequency, or channel to engage each one of the users!

Predict Their Every Move

Boost customer engagement with your online gaming app with our AI-powered journey orchestration. With it, you can craft unique journey paths relevant to each customer’s interaction with your app.

In fact, marketers earlier only had the option of creating ‘yes’ or ‘no’ conditions while building customer journeys – but as we all know, human behavior is a tad bit more complicated. So now, our Conditional Split feature allows you to customize every flow to add up to 25 possible combinations following each touchpoint.

Essentially, you can create targeted notifications and triggers for gamers who may or may not have performed different actions – e.g., say, someone who installed your online gaming app but is yet to play, another who abandoned a game mid-way, and yet another segment who has shown interest in an in-app purchase but is yet to follow through.

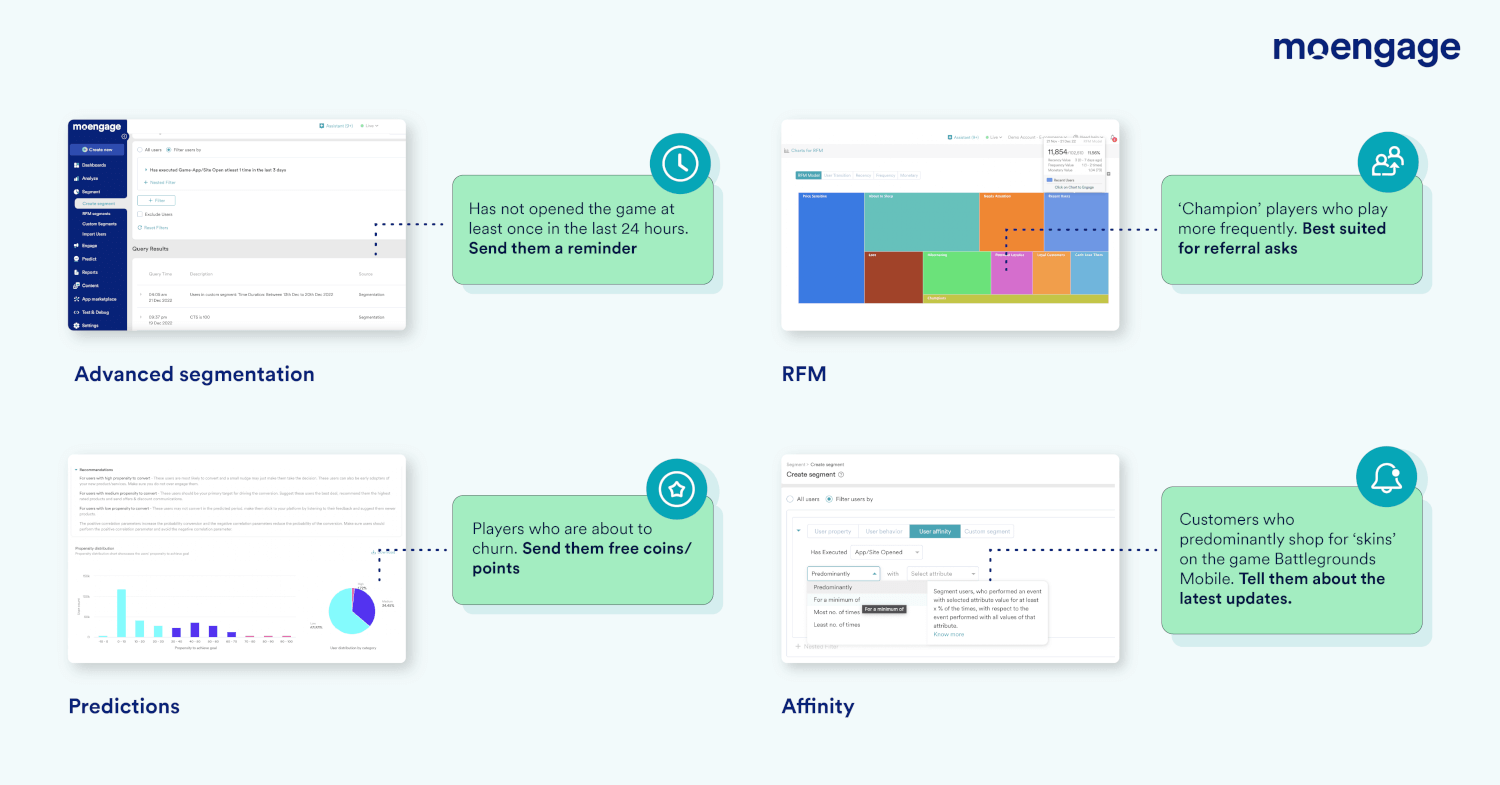

Create Segments For Effective Targeting

Our advanced analytics help you identify how different customers interact with your app so you can understand their collective personas to engage them better. You can also improve the effectiveness of your engagement strategies by segmenting customers based on their Recency [R], Frequency [F], and the Monetary [M] Value of interactions with your app.

This way, you know exactly how to engage each customer – say, the one that’s used the app a hundred times over the last ten days and the one that’s barely opened it at all. Additionally, Affinity segmentation helps you group customers based on dominant preferences beyond their past behavior and create promotional strategies that appeal to customers’ emotions.

Check out how SkillClash, an Indian real money gaming app, achieved a 30% uplift in revenue using MoEngage’s Segmentation capabilities!

Craft Campaigns With Pinpoint Precision

MoEngage’s AI engine, Merlin, allows you to go beyond past actions and current interests to understand your customer’s future actions and also bring in new paying users. It analyzes their behavioral patterns so you can increase click-through rates with the right message, at the right time, and on your user’s preferred channel. For example, once the engine tells you that a particular user is on Instagram for most of the day (as most of us are), you can target that user with an ad that’ll show up while he or she is scrolling away.

Simply put, Merlin can predict which customer segments are more likely to churn, become inactive, or convert – so you can then set up omni-channel campaigns to engage them proactively with the relevant recommendations or offers.

The Way Forward For The Indian Gaming Market

Demand for online gaming continues to grow, but the country needs a solid infrastructure to bring in more and more game developers. Part of the reason is that game development was only considered a serious career very recently. The good news, however, is that private educational institutions across the country are now offering degree and diploma courses related to the gaming industry.

Even though government institutes are yet to offer such courses, Finance Minister Nirmala Sitharaman announced plans in this year’s Budget to set up an animation, visual effect, gaming, and comics promotion task force to raise awareness around the gaming industry.

Government Policies In Favor Of The Gaming Industry

While there are no clear regulations currently around the online gaming market in India- that could soon change. An inter-ministerial task force set up by the Ministry of Electronics and Information Technology in May 2022 recently proposed the creation of a central regulatory body for the Indian gaming market and recommended that online gaming is under the purview of the Prevention of Money Laundering Act, 2002.

In addition to that, there has been speculation about the government introducing a uniform law to regulate online gaming and determine what forms of online gaming are legal. So far, things definitely appear to be on a progressive course!

Tools Like CEPs To Help Brands In The Gaming Industry Retain Users

With increasing competition in the online gaming industry, the fight to acquire and retain customers is fiercer than ever. In this context, a CEP can give game developers the edge they need to boost customer retention and engagement rates. That’s exactly where we at MoEngage come in. We help you build a holistic view of each user, so you can leverage insights into their behaviors to create personalized engagement strategies and journeys.

Learn more about how MoEngage can help your brand retain and engage a loyal gamer base.

Frequently Asked Questions

- What is the Indian gaming industry size?

India has over 400 million online gamers. The mobile gaming industry in India is projected to exceed USD1. 5 billion in 2022 and is estimated to reach USD 5 billion in 2025 - What are hyper-casual games?

These games are characterized by their simplicity and basic gameplay mechanics. These online games are often designed and released quickly and make money through in-app advertising. Hyper-casual gaming apps peaked in popularity a few years ago but have seen a downward trend in 2022 - What are casual games?

These games are those mobile games that require minimal effort to play. These are free and use in-app advertising as their main source of revenue. In 2020, they comprised 78% of all game downloads - What are real-money games?

Real money games allow the players to wager, stake, or participate using real money to obtain prize money. Dream11, the title sponsor of IPL 2020, is one example of a real money gaming app. In the 2021 financial year, the value of the real money gaming industry stood at INR 49 Billion - How can you retain players for your gaming brand in the long run?

Find out the mobile gaming industry trends for India’s casual, hyper-casual, and real money gaming apps in this report and unlock the key to long-term retention!