🔥 [Panel] Personalization, AI, Trust—What Top BFSI Marketers Are Doing Differently.

Register Now

Let's look at buying habits and shopping habits globally.

• Before making a purchase online, 68% of Indian shoppers interact with a brand app or website at least 4-5 times.

• 32.4% of Indian consumers have spent the most on shopping.

• 80.3% of Indians prefer purchasing products on their smartphones via mobile apps or websites.

• More than 53% of North American shoppers visit an app or website more than three times before making a purchase online.

• 31.6% of North American consumers have spent the most on online shopping.

• 55.8% of North Americans buy new products on their smartphones via mobile apps or websites. Many consumers in North America prefer it over a physical store.

• More than 55.2% of European shoppers visit a shopping app or website at least 4-5 times before making a purchase.

• 33.6% of European consumers have spent the most on shopping.

• 63.2% of European shoppers prefer shopping on their smartphones via mobile apps or websites vs in-store shopping.

• 25% of Latin American consumer spending has been towards shopping.

• 68% of Latin Americans prefer using their smartphones to shop online.

• 44.8% of Latin American shoppers visit an app or website more than five times before purchasing.

• 73.2% of Southeast Asians prefer buying products online on their smartphones.

• 62.6% of Southeast Asians prefer buying groceries at least once a week.

• 8% growth in new customers for Food Delivery and Grocery platforms.

• Research shows that 34% of consumer spending in the Middle East has been towards shopping.

• 2 out of 3 shoppers in the Middle East prefer using their smartphones to shop online.

• 28% growth in MAU for E-commerce platforms.

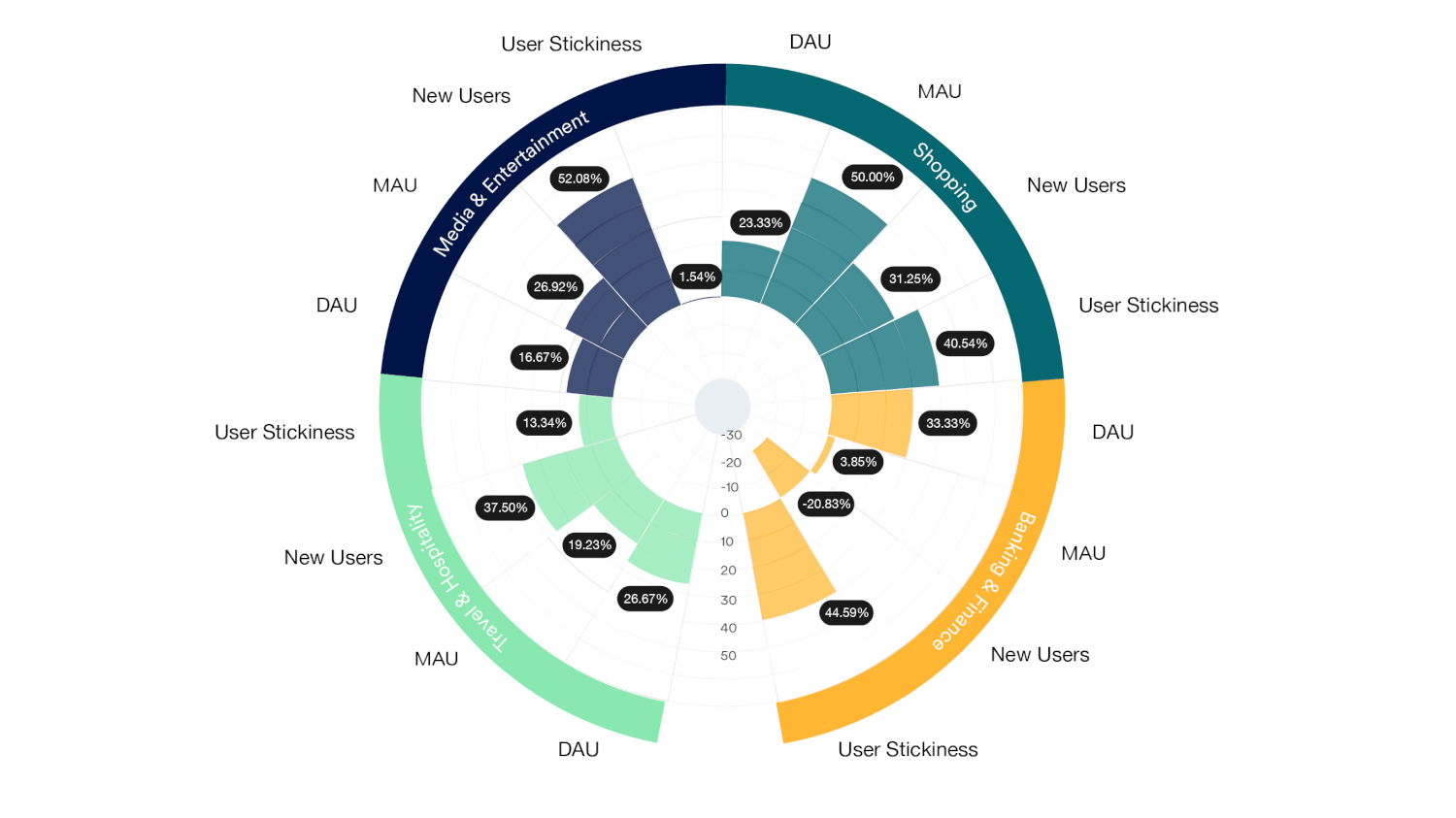

Let’s look at consumer trends in the Media and Entertainment industry.

Let's look at the top trends in the Travel industry.

• 1 in 2 Indians prefer using ride-hailing and cab services 3-4 times a week.

• MAUs have grown by 23% for Hotels and Travel platforms.

• 75% of Indians prefer to get information for travel plans and reservations from travel apps and websites.

• 58.8% of North Americans prefer to get information for travel plans and reservations from Travel websites on mobile and desktop.

• 65% of North Americans use ride-hailing platforms fortnightly.

• 32% of Europeans prefer using ride-hailing and cab services once a week.

• 65.2% of Europeans prefer to get information for travel plans and reservations from mobile websites and apps.

• 1 out of 4 younger consumers in Europe prefer to use Ride-Hailing platforms 3-4 times a week.

• 63.4% of Latin Americans prefer to get information for travel plans and reservations from mobile websites and apps.

• 42.2% of Latin Americans prefer using Ride-Hailing apps at least 3-4 times a week.

• 66.5% of Southeast Asians prefer to get information for travel plans using their smartphones.

• 34% of consumers in Southeast Asia use ride-hailing services at least 3-4 times a week.

• 64% growth in DAU for Hotels and Travel platforms.

• 5 out of 7 consumers in the Middle East prefer to get information for travel plans from a travel application on mobile.

• 27.2% of consumers in the Middle East prefer to use Ride-Hailing or cab services 3-4 times a week.

Let’s look at the top consumer trends in the BFSI industry.

The consumer trend in India shows that Indians have shifted their attention away from Crypto and Logistics platforms and have become more active on Shopping, Travel, and Streaming platforms. Additionally, our report shows that brand loyalty towards gaming brands has sharply risen.

What is the Global Consumer Trends Report? How did you gather insights in this report?

The Global Consumer Trends Report is a collection of the voice of the global customer and the latest benchmarks from the Shopping, Banking, Media & Entertainment, and Travel industry. The Consumer Trends Report helps marketing teams in global companies understand consumer demands and brand loyalty trends across geographies and strategies on how they can leverage it to grow sustainably. Apart from analyzing platform data, there were over 3200+ consumers surveyed for the report.

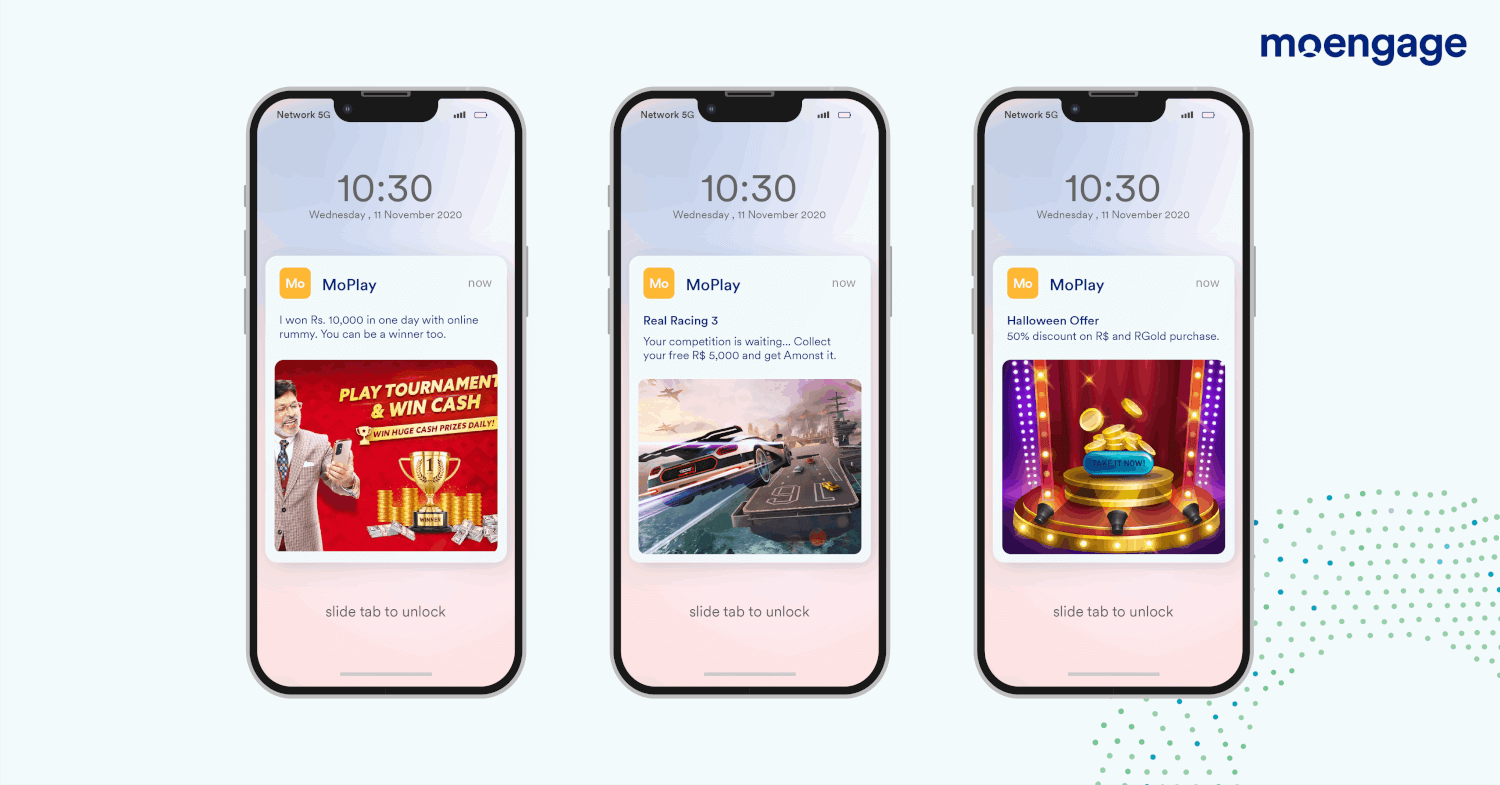

What is MoEngage? How does MoEngage help improve my marketing strategies and customer experience using data?

MoEngage is an insights-led Customer Engagement platform that helps global businesses and companies understand customer preferences, likes, and behavior to send the right communication across multiple channels to drive Northstar metrics like revenue, LTV, retention, DAU (Daily Active Users), and MAU (Monthly Active Users).

What brand loyalty strategies can brands implement for retention?

Brands can significantly improve customer retention by focusing on loyal consumers. This is because they drive revenue growth and attract new customers through brand advocacy. And there are multiple ways how brands can build loyalty. For example, brands can identify loyal customers through RFM segmentation and add them to loyalty programs. Another way to build loyalty is through referral campaigns.

What is Digtal Customer Engagement? How does technology help drive better results for my company?

Digital Customer Engagement is the interaction between your company and your customers over digital channels. Data shows that technology like AI and machine learning can improve your Customer Engagement metrics by determining the right message to send to the right customer at the most optimum moment and on the best channel.

MoEngage is an insights-led platform trusted by 1,350+ global brands like McAfee, Flipkart, Domino’s, Nestle, Deutsche Telekom, and more. MoEngage’s powerful analytics, personalization, and AI capabilities give a 360-degree view of your customers and help you create journeys across digital channels.