What Customer Lifetime Value is and Strategies to Boost It

Reading Time: 13 minutes

Until a decade ago, Customer Lifetime Value (CLV) was the middle child of marketing and customer engagement. Mainly overshadowed by the eldest child (Customer Acquisition), who has always been the most trusted and the new favorite kid on the block, like the social media follower count.

The radical digital transformation that came with the pandemic and the global economic downturn also changed customer spending habits and behaviors. This change also meant the importance of keeping existing and loyal customers engaged increased multifold. That said, customer acquisition and customer retention has become an expensive affair. Hence, it becomes crucial to invest, first and foremost, in the customer relationships that are most lucrative to the brand. It is vital to understand these relationships’ intricacies and engage with them with the right message through the proper channels at the right time.

It starts with focusing on metrics like customer lifetime value and making it the foundation of an efficient engagement and marketing strategy.

What is Customer Lifetime Value?

Customer lifetime value predicts the amount or the revenue a customer could bring in from buying your brand’s product or paying for your services for the complete duration of their relationship with you. It is a metric that’ll help you gauge customer loyalty, how effective your customer acquisition is, and customer satisfaction.

Why is Customer Lifetime Value Important?

This metric has a significant impact on customer loyalty and customer retention. It helps brands better understand their customer base and direct their marketing efforts towards their most valuable customers to increase future revenue. Optimizing their customer lifetime value would mean better financial viability and steady growth for brands.

But how does it impact the “big picture” metrics?

It helps you increase revenue gradually.

It’s simple: the longer the entire customer lifecycle, the more revenue the brand earns.

CLV will help brands pick out their most loyal customers from their entire customer base, those who spend the most and have the highest average purchase value. Once you identify your best customers, you can increase engagement and pinpoint upsell opportunities by offering them a personalized customer experience.

It helps you remove customer journey friction points that increase brand loyalty

A commitment to analyzing this metric also helps you draw patterns and trends from customer data. It allows brands to understand where customers are falling through and rectify these friction points in their journey to ensure optimal engagement. This gives you an edge over your campaign-centric competitors.

It helps you identify the best customers

This metric helps you easily build customer segments with a higher average purchase frequency rate, spending patterns, and behavior. Instead of spending the bulk of your marketing budget on new customers that eventually churn, you can invest your resources in building personalized campaigns for higher-value customers.

Prerequisites to Measure Customer Lifetime Value

Now that we understand the impact of a high customer lifetime value, let’s look at some other metrics you’ll need to have handy before you get to a customer lifetime value formula.

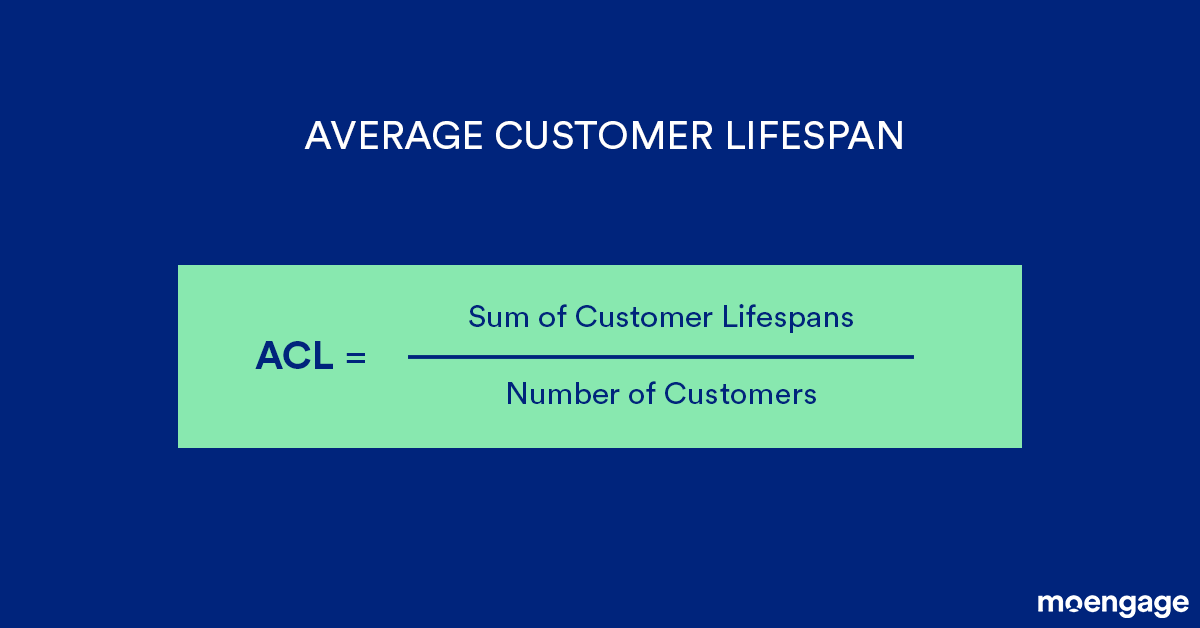

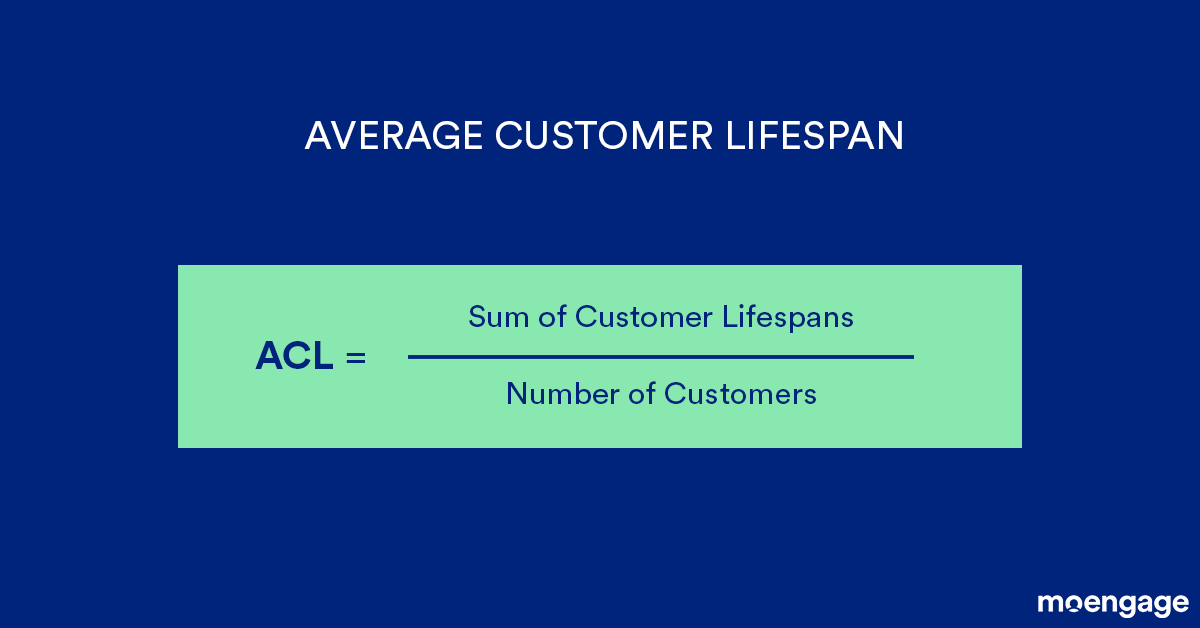

Average customer lifespan:

Average Customer Lifespan (ACL) is calculated by adding all of your customer lifespans and dividing by the total number of customers you have.

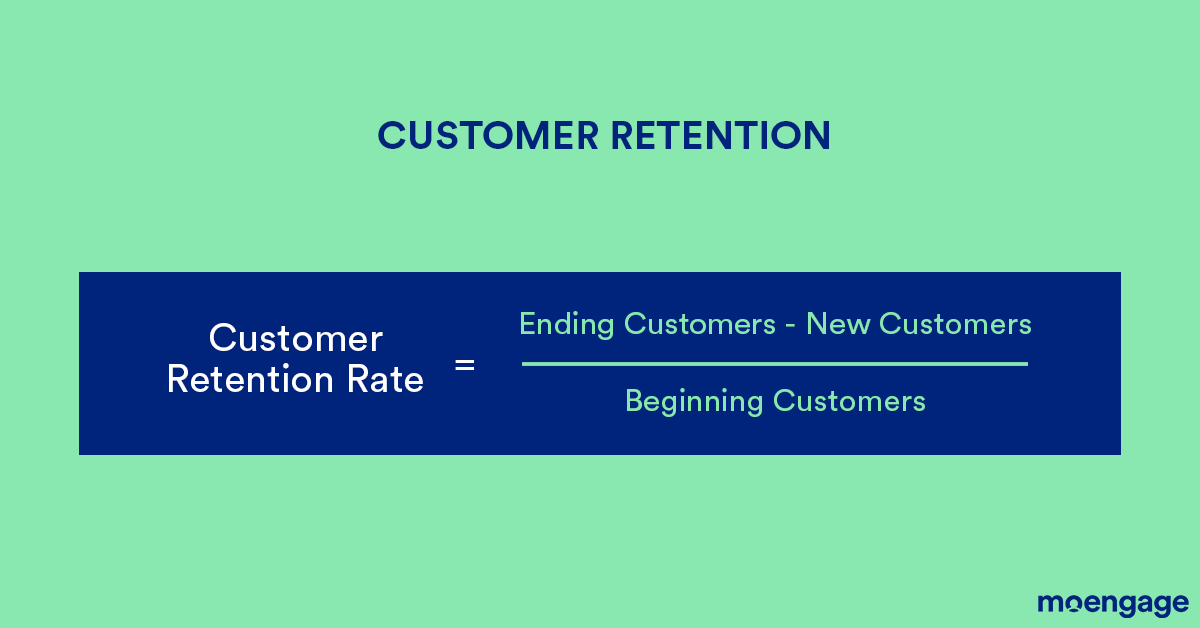

Customer Retention

Customer retention refers to a company’s ability to turn customers into repeat buyers and prevent them from switching to a competitor.

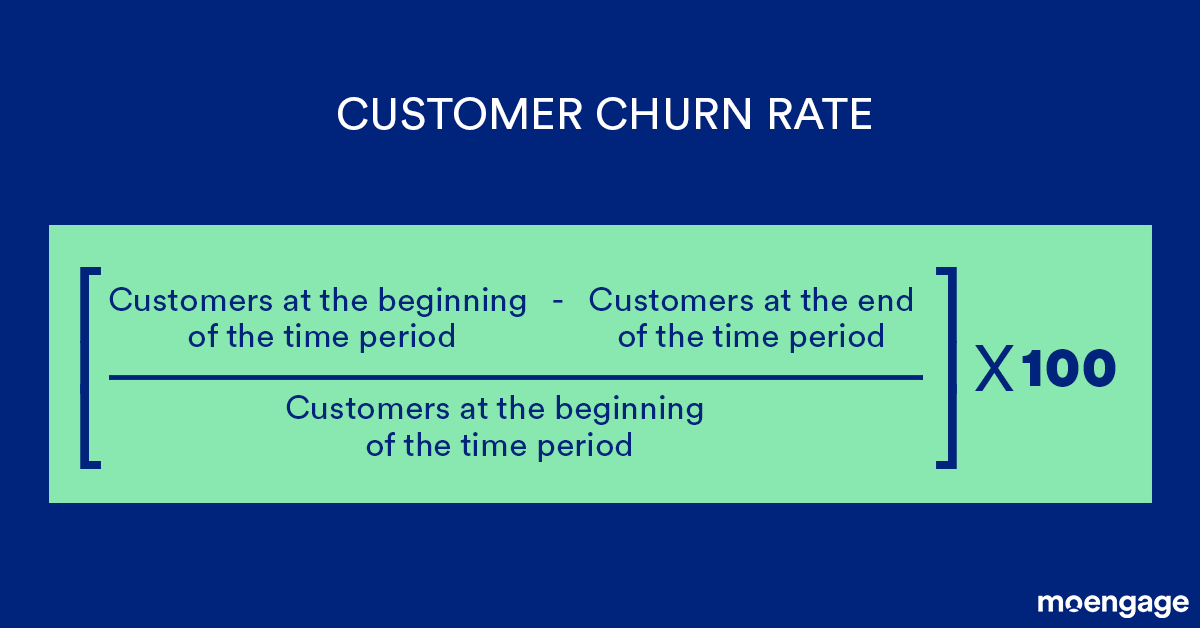

Customer Churn Rate

The churn rate, or the rate of attrition or customer churn, is when customers stop doing business with an entity. It is most commonly expressed as the percentage of service subscribers who discontinue their subscriptions within a given time period.

Average profit margins (per customer)

Put simply, the profit margin represents the total percentage of sales that result in a profit.

How To Calculate CLV: Customer Lifetime Value Formula

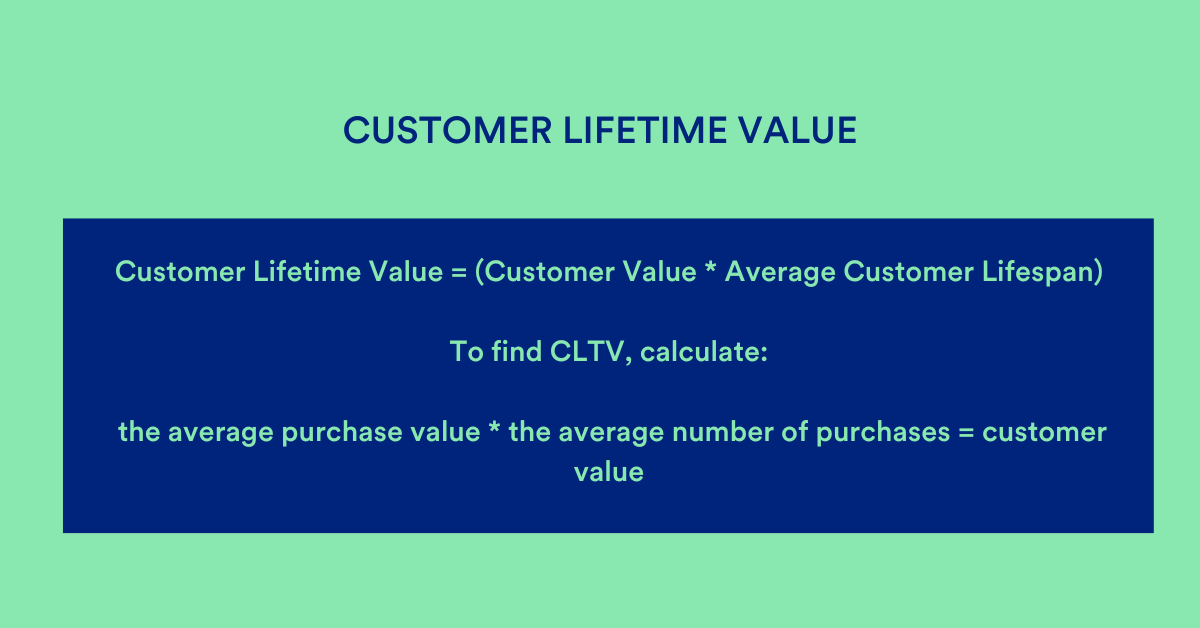

Now that we have all the elements, let’s look at the basic formula to help you calculate customer lifetime value.

Once you calculate the average customer lifespan, you can multiply that by customer value to determine customer lifetime value.

Customer Lifetime Value Models

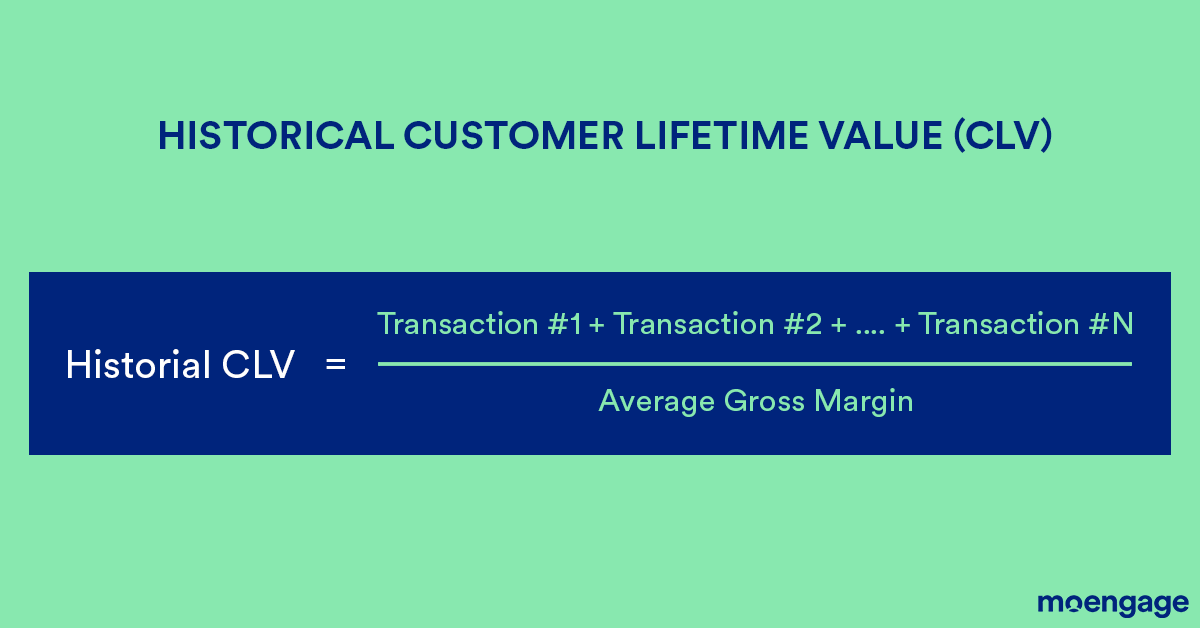

Historical customer lifetime value (CLV)

Historical CLV is the sum of all the gross profit from a customer’s past purchases. To calculate it, you must add all the gross profit values up to the last transaction (N) a customer made. Measure CLV based on the net profit to get the actual profit a given customer generates. This involves service costs, return, marketing, acquisition, etc.

The downside is that you might have to do some complicated math at the individual level to have the most up-to-date data. Still, gross margin CLV gives you a thorough understanding of your customers’ profitability.

Where: AGM = Average Gross Margin

In principle, this method is handy if customers share the same preferences and interact in the same way with your brand over roughly the same time.

Remember that calculating historical CLV means putting all customers, old and new, into one basket. That might be tricky because they can vary when it comes to behavior and preferences. Differences between clients can affect CLV.

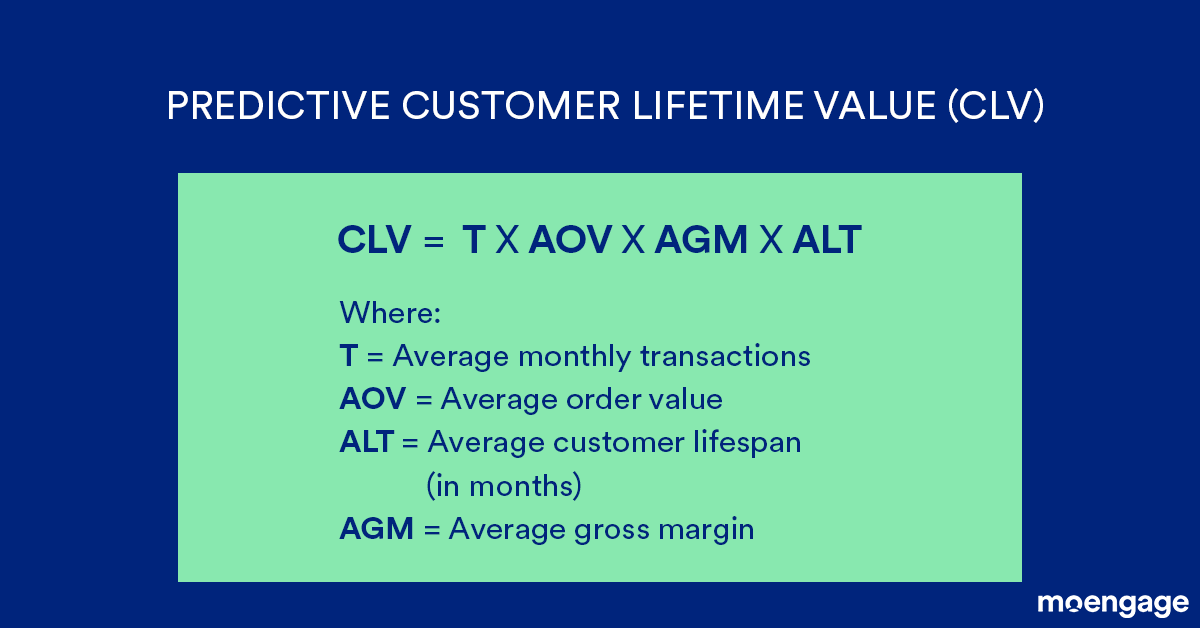

Predictive customer lifetime value (CLV)

Predictive CLV aims to model your customers’ transactional behaviors to forecast what actions they will take in the future. It’s a great indicator of CLV, better than historical CLV.

The predictive model uses algorithms to generate a precise CLV while predicting a customer’s total value. It works based on a history of past transactions and the customer’s actions.

Again, you can choose from different CLV formulas. We’ll focus on a simple one for clarity’s sake.

Here’s the formula:

Where:

T = Average monthly transactions

AOV = Average order value

ALT = Average customer lifespan (in months)

AGM = Average gross margin

| PRO TIP

An analytics platform with a CDP can quickly integrate with your CRM to give you easy calculations for AOV and ALT. However, remember that this approach is a prediction, so it won’t always be 100% accurate. To improve accuracy, you should adjust CLV calculations to the specific industry you operate in. Precision in your CLV gives you a tool for developing sound marketing strategies. |

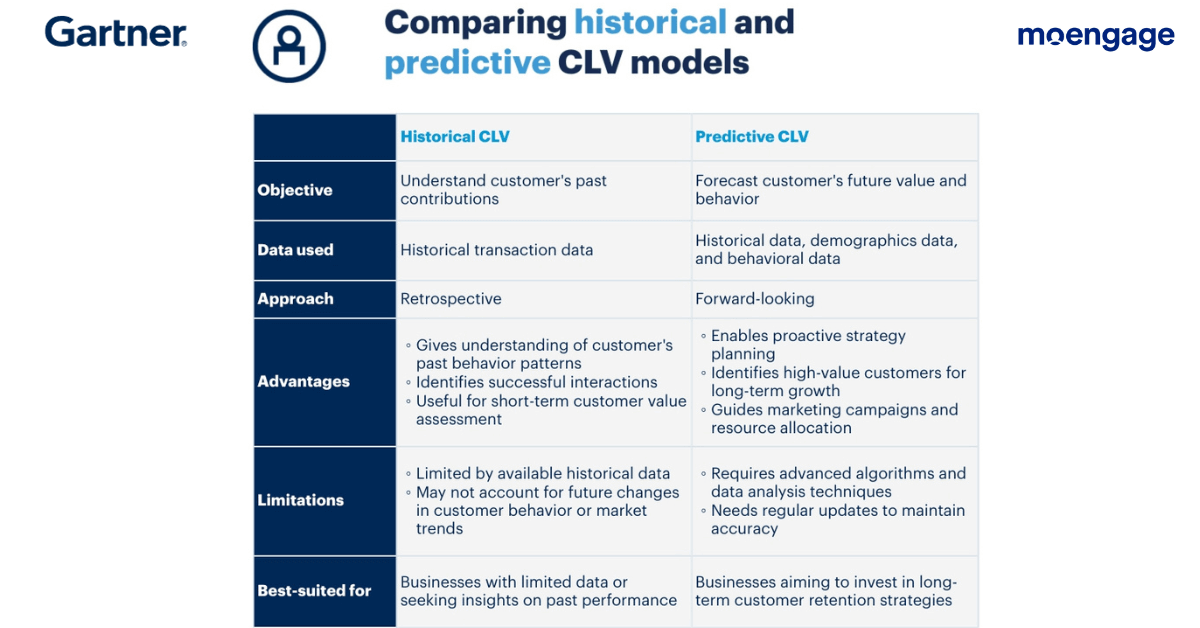

Calculating Customer Lifetime Value V/S Historical and Predictive CLV Models

While both the Historical and the Predictive customer lifetime value models may seem quite similar in their purpose or end goal, the main difference between them is that the historical model is best utilized for understanding your current performance but may prove to be a little less accurate at predicting the future than predictive CLV models are. Let’s see how they are both different and which model would suit your brand best.

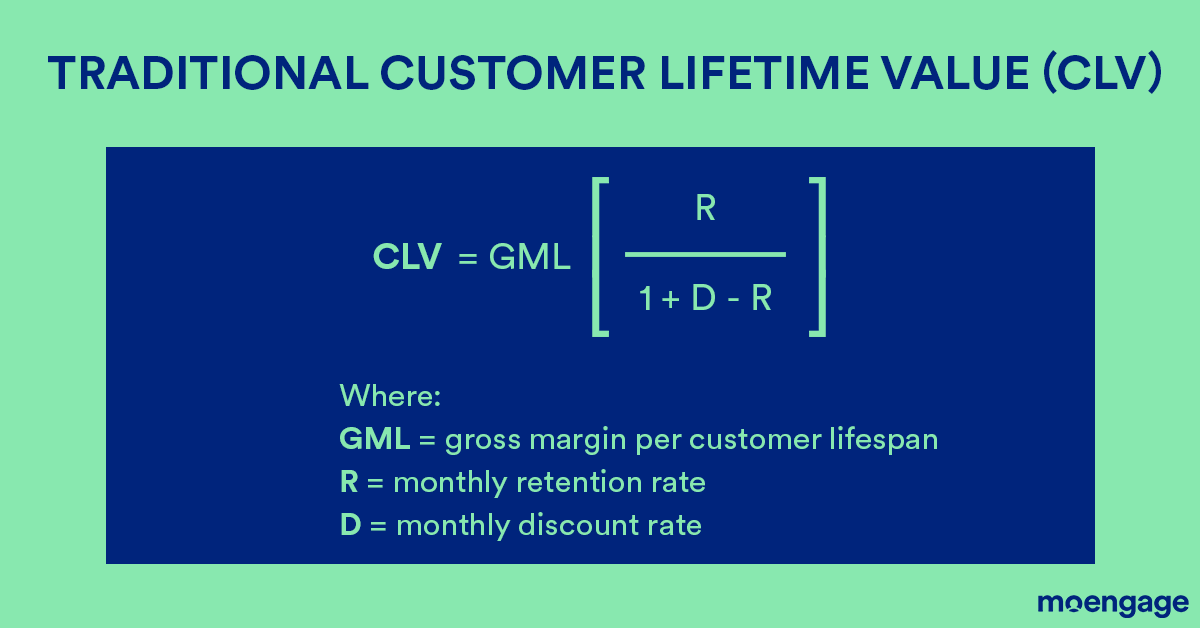

Traditional customer lifetime value (CLV)

Sometimes, a more traditional but in-depth CLV formula might work better, especially when your yearly sales aren’t flat. In such situations, it’s essential to consider the discount rate, average gross margin per customer lifespan, and retention rate.

Here’s what your final formula will look like:

Where:

GML = gross margin per customer lifespan

R = monthly retention rate

D = monthly discount rate

This formula looks at possible changes in customer revenue throughout a period of time, and each year is corrected by a discount rate to account for inflation.

How to Go About Improving Customer Lifetime Value

Now that we understand the intricacies of measuring customer lifetime value, let’s look at what brands could do to improve customer lifetime value.

1. Improve Customer Onboarding

One of the main reasons for customer churn is the customer needing to understand and realize the value of your offering. A good onboarding process could immediately help solve this problem. A seamless onboarding process can improve customer experience right at the onset of their business relationship with you. It will encourage customers to engage with your brand consistently and inspire brand loyalty.

It is at this stage that the customer truly engages with your brand, which is why this is where you can make a strong positive impact on the customer relationship.

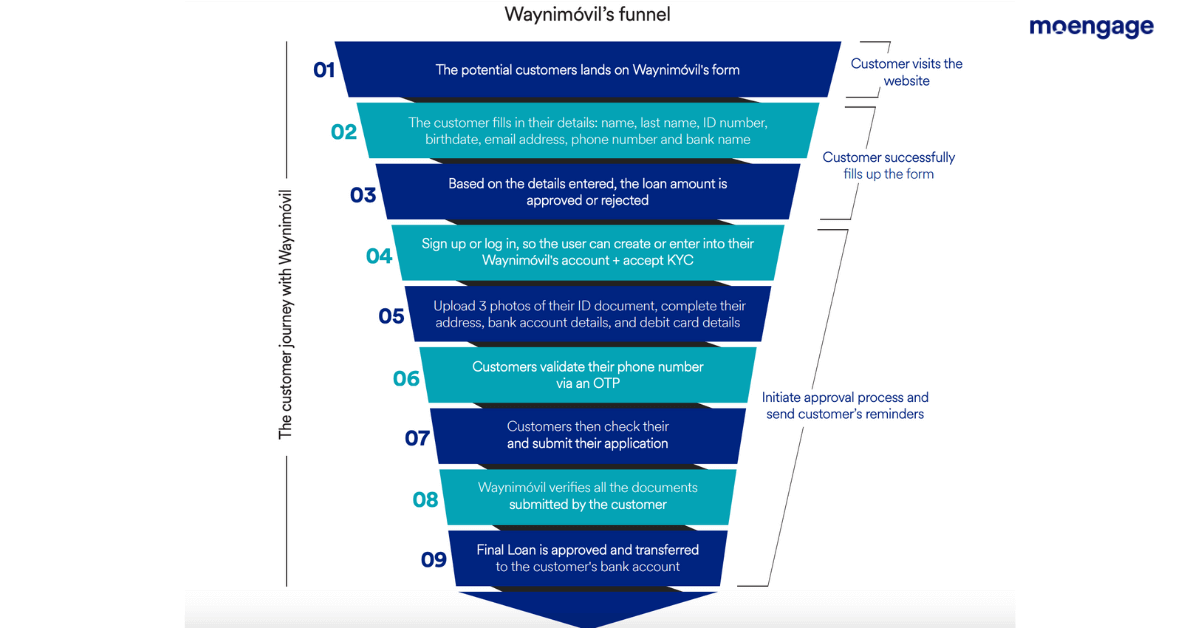

A great example of a brand that focused its marketing efforts on creating a seamless journey for its new customers is Waynimovil.

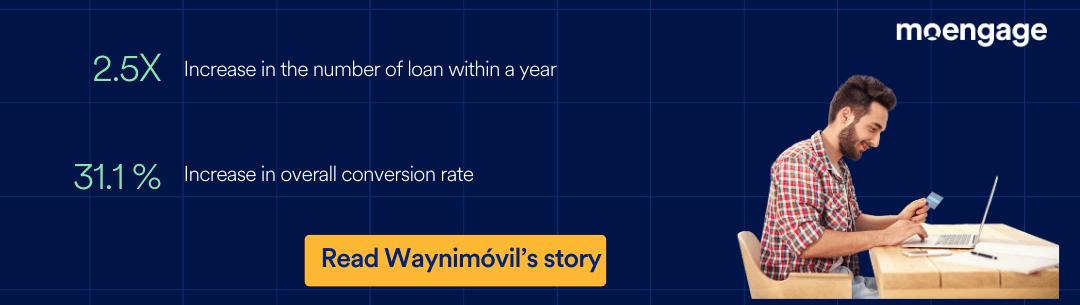

How MoEngage Flows Helped Waynimóvil Increase The Number of Loans Issued By 2.5x

Waynimóvil’s thorough process for their customers to apply for a loan includes 9 steps that are as listed:

Business Challenge

As witnessed in most leading financial services brands, since the process to get a loan consists of multiple steps, Waynimóvil wanted to proactively optimize the customer journey and help them move forward from the first touch point of landing on the website to click the CTA “¡Solicitá tu préstamo”, to begin the loan application process.

MoEngage’s Solution

Using MoEngage Flows, Waynimóvil optimized their customer’s journey from Step 1 to Step 8. To ensure optimal efficiency from their onboarding flow, Waynimóvil employed MoEngage to automate the process and set up pre-requisite conditions to engage with high-value customers. This resulted in a 31.1% increase in their overall conversion rate.

2. Stop and Listen to Customer Feedback

To ensure that your existing customer base is satisfied and engages with your brand consistently, listening to their feedback and incorporating it into your strategy is vital. Listen to their feedback and analyze what drives them and what they need. To do this, make every touchpoint in their journey an easy opportunity for them to interact with you. You can also deploy on-site surveys to reach and get real-time feedback from your website visitors. Another, less direct way to get customer feedback would be to A/B test.

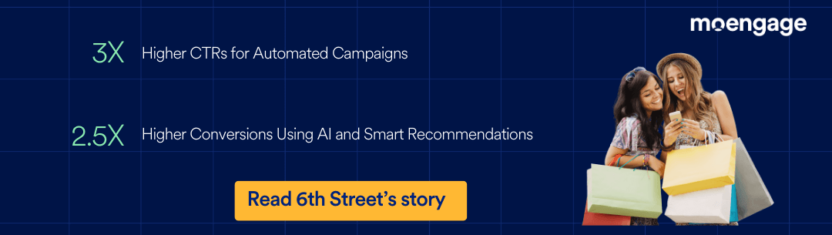

A brand that saw massive success with this approach was 6th Street.

Business Challenge

6th Street, an E-commerce fashion brand with 1000+ international brands for customers to choose from, wanted to test the most effective approaches to best timings, content, and journeys to nudge customers from inactivity to browsing, to “add to cart” and finally towards purchase.

MoEngage’s Solution

6thStreet.com used Sherpa optimization to do A/B testing, which enabled them to drive curated communication that worked best for different segments of customers. The brand also leveraged Intelligent Time Delay to understand the best time to communicate with each customer. The commitment from the brand towards letting customer feedback and preference dictate their engagement strategy helped them achieve a 24% boost in repeat purchases during Black Friday.

3. Pay Attention to Retention

With customer acquisition costs reaching new peaks each day and increased awareness and caution on how much customers care to spend, focusing on meaningful customer relationships becomes increasingly vital. As per Semrush, 44% of businesses focus on customer acquisition, while only 18% focus on customer retention.

The words ‘positive’ and ‘seamless’ are crucial when we speak about engagement because 67% of the customers cite bad customer experience as the reason for churn.

A huge factor is that consumers tend to buy from brands they trust. This is why converting a new customer takes a lot more effort than holding on to existing customers. 89% of companies say that excellent customer experience significantly affects customer retention. To see an impact on customer lifetime value, sending customers personalized, value-packed content across every channel your existing customers are present on is crucial.

Simply put, customer retention matters!

Let’s examine how a strong retention focus helped customer-centric brands grow their existing customer base.

Sweatcoin Observes a 15% Uptick in Customer Retention Using Advanced Analytics

Business Challenge

Sweatcoin was already growing phenomenally in 2022; they knew they could acquire customers at scale. Their goal was to retain customers at scale; this is where MoEngage’s Analytics came in.

MoEngage’s Solution

The Sweatcoin marketing team onboarded MoEngage to understand their customers on a deeper level and automate all manual customer engagement processes. MoEngage’s Advanced Analytics helped them get detailed, actionable insights on customer behavior and campaign performance. The platform also boosts productivity by eliminating manual work across multiple teams.

4. Upsell and Cross-Sell to Loyal Customers

Engaging with customer segments with whom you’ve built a great customer relationship is much more effective, as they are more likely to purchase, transact, and stream your offering. Customers who already trust you and have found value from previous purchases would like to buy from you again. But to ensure their continued engagement in the form of cross-sell and upsell, brands must understand their customer’s journeys and personalize cross-sell and upsell campaigns based on these insights.

Many successful brands achieve this by onboarding a martech platform that not only helps them build a unified customer profile rich with insights from across different engagement channels, but also helps with effective and deep-level segmentation.

How GIVA Increased Its Repeat Purchase Rates by 50%

Business Challenge

Here’s a glimpse at the challenges that the GIVA team was facing:

- Finding relevant ways to engage customers: With the heavy influx of customers that GIVA was acquiring, there wasn’t a precise and relevant way to engage with them

- Low repeat purchase rates: The probability of customers coming back to the app to make repeat purchases was also relatively low

MoEngage Solution

In the jewellery industry, most of the purchases happen during the birthday months of customers, and the GIVA team wanted to capitalize on that. Using multichannel, Birthday-related Flows by MoEngage, GIVA informed the customers that there was a surprise jewellery gift for them via push notifications and WhatsApp. The team also used Dynamic Product Messaging to counter the high cart abandonments by sending emails and push notifications with the image of the exact product that has been left in their carts.

5. Expand Your Engagement With An Omnichannel Strategy

Reaching your customers where they are will make them feel valued and increase their spending and recurring revenue. Today’s customer is hyper-connected and engages with various channels on the daily. Your brand must create enticing and consistent experiences for each touchpoint — whether it’s a social ad, an email, an SMS campaign, or an in-store purchase.

Customers interacting across multiple different channels have a 30% higher lifetime value. They expect brands to engage with deals, promos, and recommendations and reach them where it’s most convenient. And this checks out in the long game that is customer lifetime value. When you remove barriers between channels and integrate all these touchpoints to form an omnichannel strategy, you enable the customers to engage with your brand on their terms, wherever and whenever it suits them best. It makes it much easier to interact, repeat a purchase, transact, stream and become a loyal customer.

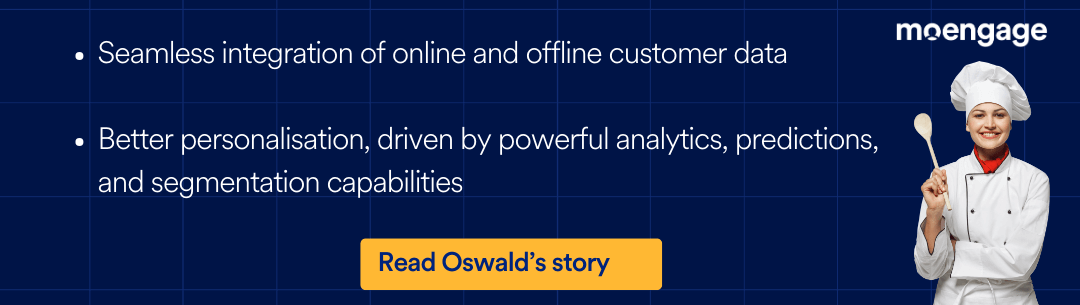

Brands who have aced the execution of an omnichannel strategy have seen great ROI from their omnichannel campaigns. Let’s delve deeper into how Oswald, a Unilever brand, benefitted from their omnichannel strategy.

How Oswald, a Unilever Brand, Uses MoEngage to Power Omnichannel Engagement

Business Challenge

As a brand committed to building an omnichannel strategy that spans offline and online channels, Oswald’s current martech stack didn’t allow them to unify data from these channels and build unified customer profiles. In addition to these functionalities, they wanted to onboard a platform that would help them with segmentation and powerful analytics capabilities.

MoEngage Solution

Oswald onboarded MoEngage for its 360-degree customer data unification, powerful predictions model, and segmentation capabilities. Oswald uses MoEngage’s powerful analytics and segmentation capabilities to optimise online engagement and help field sales representatives use these insights to personalize their communication.

6. Achieve Your Personal(ized) Best in Engagement

Personalization in engagement has quickly gone from a “good-to-have” to “losing customers if you don’t have”.

We’ve moved beyond running campaigns with variable tags that look like “<hi_firstname>” and call it a job well done. Customers realize that brands collect their data to build better quality experiences personalized to their liking. Martech platforms have also started offering intelligent tools that help marketers segment and personalize better. These tools could include ones that help you segment based on the recency, average purchase frequency rate and monetary (RFM segmentation), affinities, common behavior traits and other custom behaviors.

Brands that do it right witness more meaningful customer relationships, improved customer retention, increased lifetime value and higher total revenue.

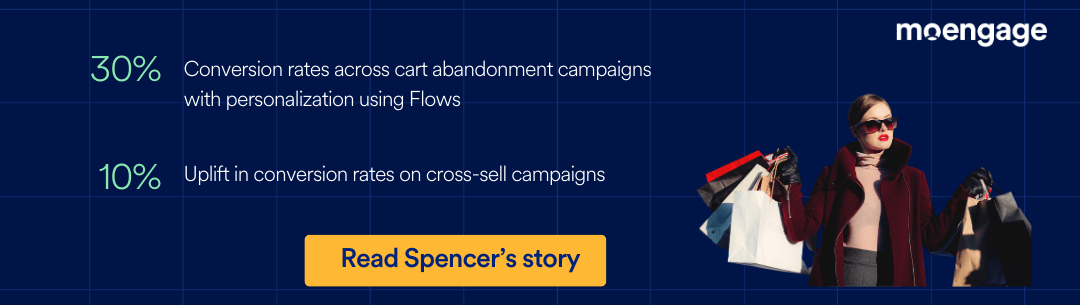

Spencer’s Uses Insights-led Personalization to Drive 30% Conversion Across Cart Abandonment Campaigns

Business Challenge

Spencer’s was struggling with low levels of data transparency owing to the limited capabilities of the existing martech solution. For a brand with ambitions of providing personalized omnichannel experiences, having an intelligent platform capable of providing a 360-degree view of the customer profile was imperative.

MoEngage Solution

Using MoEngage, Spencer’s drives personalized, omnichannel customer experiences by segmenting them based on their attributes and actions taken on the website or the app. Spencer’s Retail also utilized advanced segmentation (RFM model) to divide customers into loyal, promising, about-to-go dormant cohorts. This helped the team push relevant communication to each segment, thus reducing the churn rate and improving retention (critical for a retail brand), especially in the current macroeconomic climate. Using the advanced segmentation, Spencer’s observed a significant transition between segments, from hibernating or about-to-go dormant segments to loyal (or potential) segments.

How Should You Not Think About Customer lifetime value

Now that we’ve read a lot about the right approach to customer lifetime value, let’s look at some common misunderstandings around it. These errors almost bring down the value of a lifetime value-focused strategy.

“Discounts is my fail-safe solution to increase customer lifetime value and total revenue.”

Discounts are tempting, time-tested and effective (at least short-term). Discounts encourage customers to buy more from you. However, brands offering too many discounts may end up loosing a lot more than the customer gained through the discount campaign might bring in.

In a recent webinar talking about “No-Fuss Retention Strategies: How to Retain Holiday Shoppers” , one of the speakers, Sam Pazner, Director of Industry Strategy (Talon.One) stated, “Discounts are tempting because they increase customer purchases. But these are highly driven by discounts, who may not shop with you otherwise. These customers may end up costing your brand more than they bring in. Asos is a really good example, 6% of their customers cost them a hundred million pounds a year. To rectify this, the brand sent out personalized recommendations to attract long-term customers instead of one-time discount-motivated buyers. This made their order profitability increase 35% year-on-year.”

We’re saying all this to say that discounting may entice impulse buyers or customers but will more often than not be a long-term customer relationship.

“Phew, finally, we have the only metric we need to make marketing and engagement decisions.”

That’s not it. While customer lifetime value sums up the expected turnovers from a customer within a certain period of time, which can vary from a few weeks up to several years according to application and industry, it can definitely not be the sole basis for all your marketing decisions. This metric helps you evaluate the effectiveness of your distribution channels and of engagement campaigns, but it cannot replace the older metrics.

“So, in future we’ll focus our measures on customers with a particularly high customer lifetime value.”

While this may seem like the way to go, just because a particular customer segment CLTV may be high, it will not indicate that further campaigns will increase it. It could however help you analyze what are the reasons for the high CLTV in this segment and how you could replicate it across others.