5 Powerful Ways to Optimize BFSI Customer Journey Strategies

Reading Time: 6 minutes

BFSI marketers know that their challenge is unique compared to other B2C marketers — unlike other industries, BFSI customers aren’t always thinking about their product, app or website. Consumers don’t dream about taking a new loan or credit card like they might dream about buying the newest sneakers. They only open up your app or website when they need to make a financial decision or transaction. This is why customer journey strategies are essential for BFSI marketers — your campaigns must be ultra-relevant to the customer journey, or they’re just falling on deaf ears. Imagine getting a notification about a new credit card when you’ve missed a payment on another one. Or a notification asking you for customer feedback when applying for an emergency loan.

These are some extreme scenarios, but they paint a fair picture of the need for intelligent marketing and campaigns that align with the buyer journey. If you’re wondering where to start, here are five reusable customer journey templates you can apply to your campaigns.

We’re going to list out templates aligned with these common scenarios:

- Lead Generation

- Profile verification

- Important announcements

- Reminders

- Feedback collection

1. Lead Generation

If you had to start counting the number of banking and fintech apps out there, you’d easily run into the thousands! That’s how many options customers have when they want to execute financial transactions. This means that customers might reduce visits to your app or website at the drop of a hat and switch to a different option if they feel dissatisfied.

Here’s where customer journey orchestration can help. You can create campaigns that reach customers at the right touchpoint in their customer journey and incentivize them to convert. In fact, BFSI marketers have been able to achieve up to +30% higher lead generations using customer journey strategies like the ones listed below.

Flow Type: Event-triggered

Set your ‘Flow Type’ to ‘Event-Triggered’ mode, which is triggered when a desired ‘Event’ occurs. You can set the ‘Event’ to be ‘Drop Off’ so that the Flow is triggered when they drop off from your app or website.

Flow Elements

- Conditional Split: Split your customers based on how deep they’ve moved down the lead form. The ones who have left early can be left out since the chances of these customers converting are minimal.

- NBA: Leverage ‘Next Best Action’ to engage with customers automatically on the right channel at the right time.

- In-app or On-site messaging: Based on whether your platform is app- or web-based, you can utilize In-app or On-site messaging to reach customers right when they’re active on your app or website. You can incentivize customers to come back with some attractive winback benefits.

- Automation: Set up automations that nudge customers to complete the lead generation process by filling out a quick form.

Campaign Results

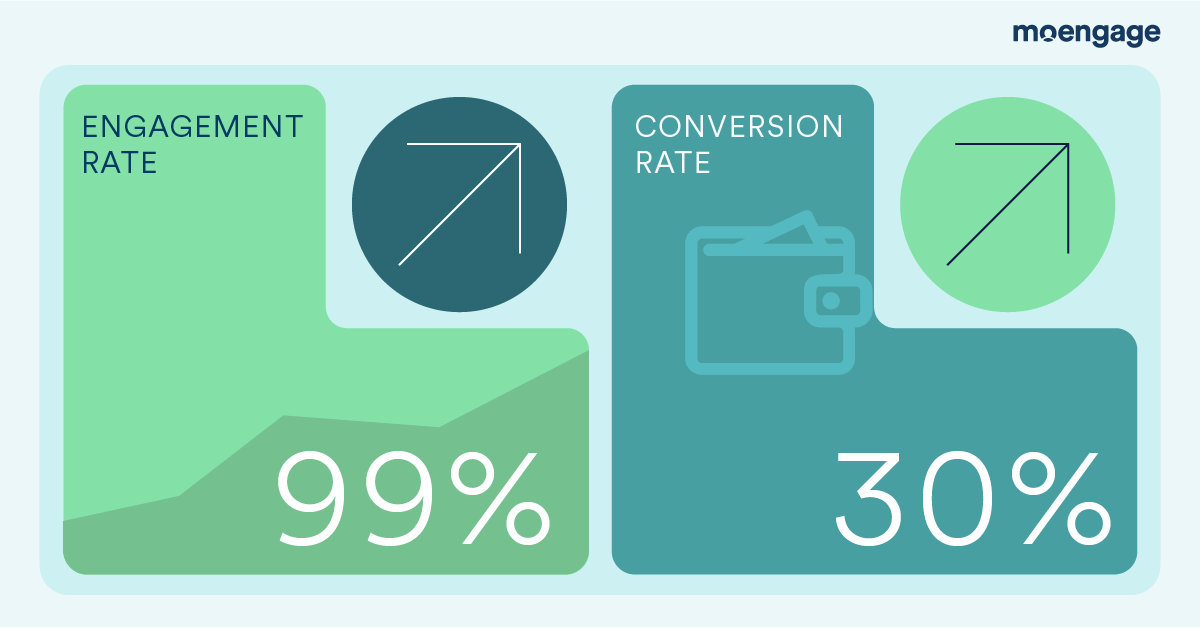

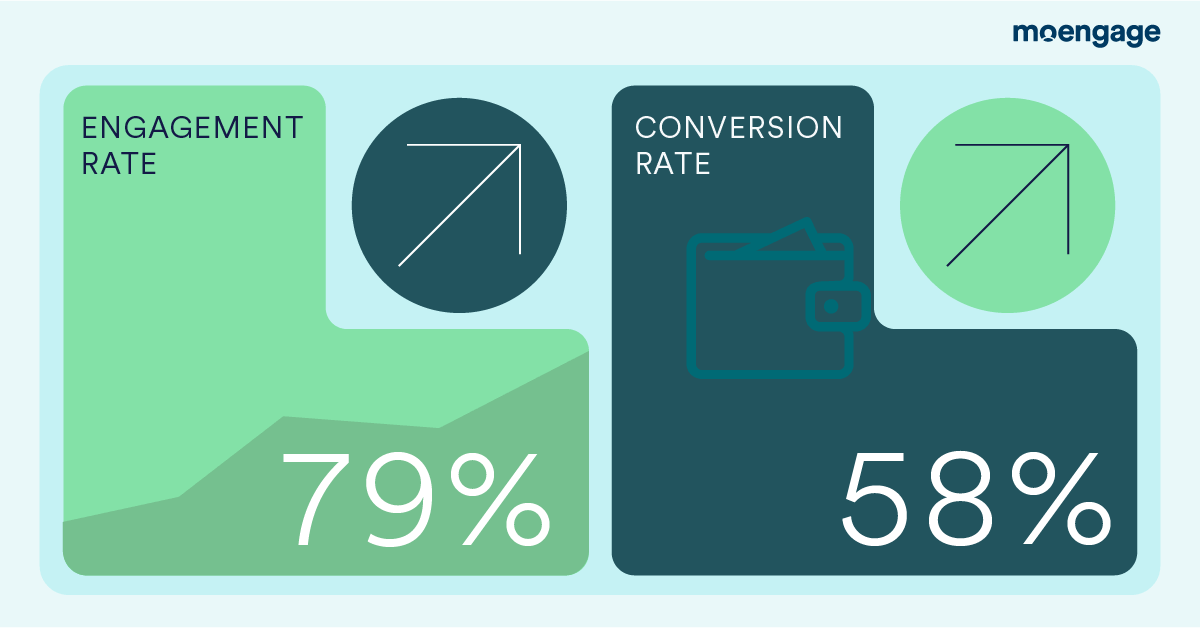

Here are the results a renowned Banking brand has seen by deploying the above strategy:

| Conversion Rate |

| 30% |

2. Profile Verification or KYC

BFSI brands are subject to numerous stringent regulations and processes, one being customer verification or KYC (Know Your Customer). This step is crucial to ensure that the business doesn’t violate government directives, so brands have to ensure that they have set up a foolproof process to capture profile verification.

While customers also know the importance of profile verification, many never complete the process. This could be due to a long turn-around time, a lack of motivation, or unnecessarily complicated steps. Even those who attempt this might not get it right the first time, or have issues with specific steps, such as document uploading or sharing.

Here are some ways brands have leveraged customer journey strategies to get their profile verification right.

Flow Type: Event-triggered

Set your Flow type as ‘Event-triggered’ and set the ‘Event’ as ‘Signup’ so that all customers who sign up are automatically directed to the Profile Verification Flow.

Flow Elements

- In-app and OSM: Set up In-app or On-site Messaging based on whether the customer has visited your app or website.

- Conditional Split: Leverage this feature to split your customers based on whether they have completed verification, left it halfway done, faced a failure, or haven’t initiated.

- A/B testing and IPO: Use A/B testing and Intelligent Path Optimizer to experiment with different campaign sequences, content, and timing. This will help you automatically find the best sequence to maximize verification completions.

- NBA: Set up Next Best Action to automatically send customers a profile verification renewal message or a first-time verification campaign if required.

| 💡Pro Tip💡:

Automate your Flows to run immediately after a customer signs up with your brand because this is when intent is highest. It’s much harder to bring them back for profile verification after they’ve quit your app or website. |

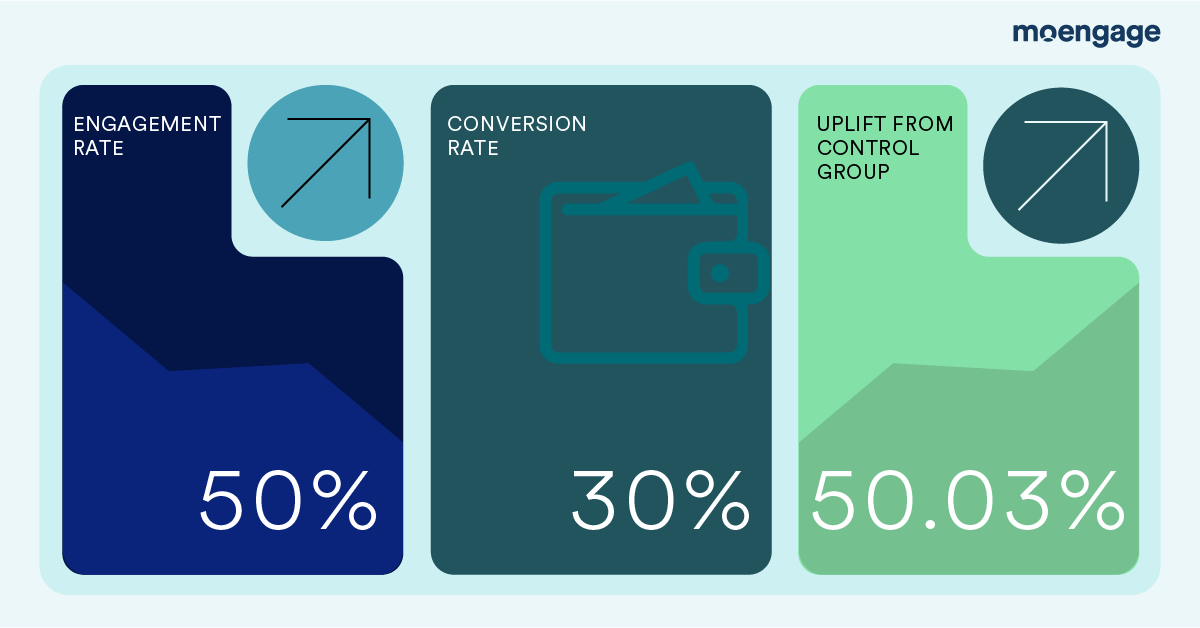

Campaign Results

| Conversion Rate |

| 30% |

3. Important Announcements

BFSI marketers often have to create campaigns to announce changes to the terms and conditions of policies, loans, or credit card plans, information about upcoming products, or regulatory declarations.

Despite the importance of such announcements, many customers might never notice these or react as needed. Here’s how you can change that and ensure customers consume your important announcements using MoEngage Flows.

Flow Type: Periodic

Since these announcement campaigns run only for a specific period, you can select Flow type ‘Periodic’ here and select the campaign period and frequency accordingly.

Flow Elements

- Conditional Split: Split your customers based on loan, credit card, or policy relevant to your announcement, and send campaigns accordingly.

- NBA and IPO: Set up Next Best Action and Intelligent Path Optimizer to experiment with the sending pattern and content and identify the best performing one automatically.

- Wait Till/For: Set this up to control a customer’s exit or entry time for each stage and create timeout campaigns so that customers aren’t bombarded once the relevance of the announcement is over.

- Personalization: Personalize your campaigns using key customer attributes such as their preferred language and content settings, card or loan details, locality, or age group.

4. Reminders

Another common challenge BFSI brands face is reminding customers about renewal dates, policy expiries, or payment due dates. Customers rely on brands to give accurate and timely information so they never have a missed payment or impacted credit score. With that objective in mind, here’s how to craft your MoEngage Flows campaigns.

Flow Type: Periodic

Reminder campaigns are always centered around a specific time period, such as billing, payment, or expiry. Accordingly, you can set your Flow type as ‘Periodic.’

Flow Elements

- Conditional Split: Split your customers based on the number of days remaining before their deadline and send them campaigns accordingly.

- NBA/IPO: Set up Next Best Action and Intelligent Path Optimizer to experiment with the sending pattern and content and find the best-performing ones automatically.

5. Collecting Customer Feedback

As a marketer, you should always be in touch with customers and how they feel about your brand. The best way to do so is by collecting customer feedback in a timely manner, at a point in their customer journey when they’re receptive to giving feedback. You should also strive to create a feedback process with the least friction.

This means that feedback collection is a two-phase process:

- Providing the best possible experience so that customers are happy while sharing feedback.

- Asking for feedback at the right moment so that they engage willingly.

Here’s how you can leverage MoEngage Flows to do so.

Flow Type: Event-triggered

Set your Flow type as ‘Event triggered’ and set the event as ‘Goal Achieved,’ where “Goal” can mean anything specific to your brand, such as a credit card payment, account activation, loan request, customer support call, or balance inquiry.

Flow Elements

- NBA: Most customers only engage with feedback campaigns during the first touchpoint, so it’s best to leverage Next Best Action to decide the best possible next step automatically.

- Personalization: Personalize your campaigns so your customers know you’re asking for feedback around a specific process, experience, or product they recently interacted with.

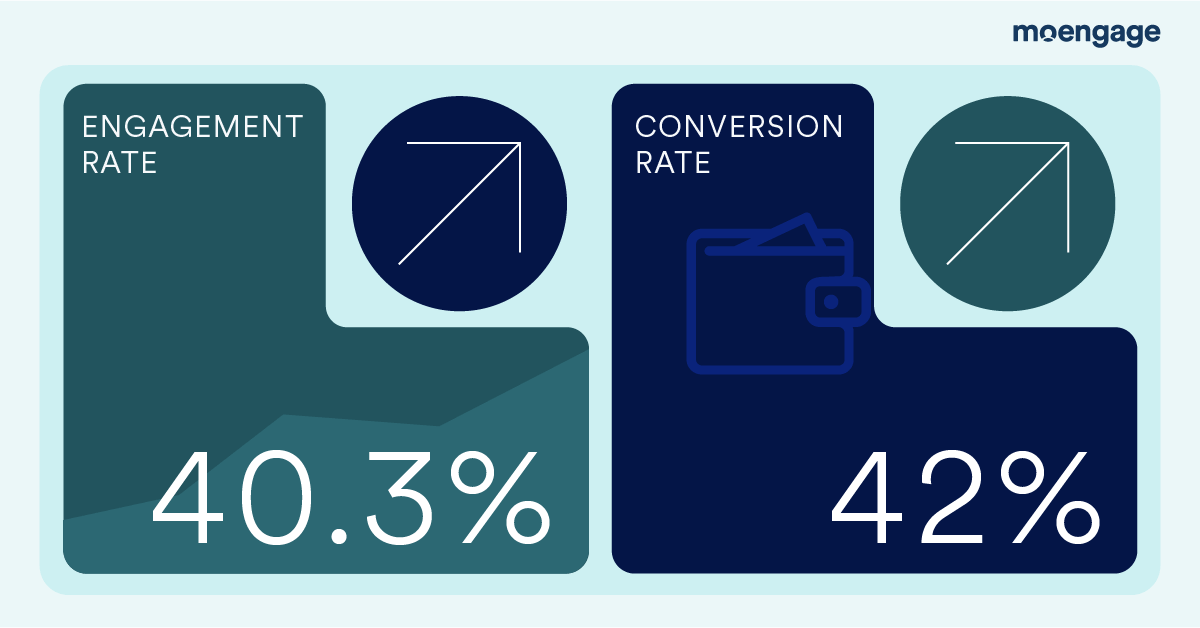

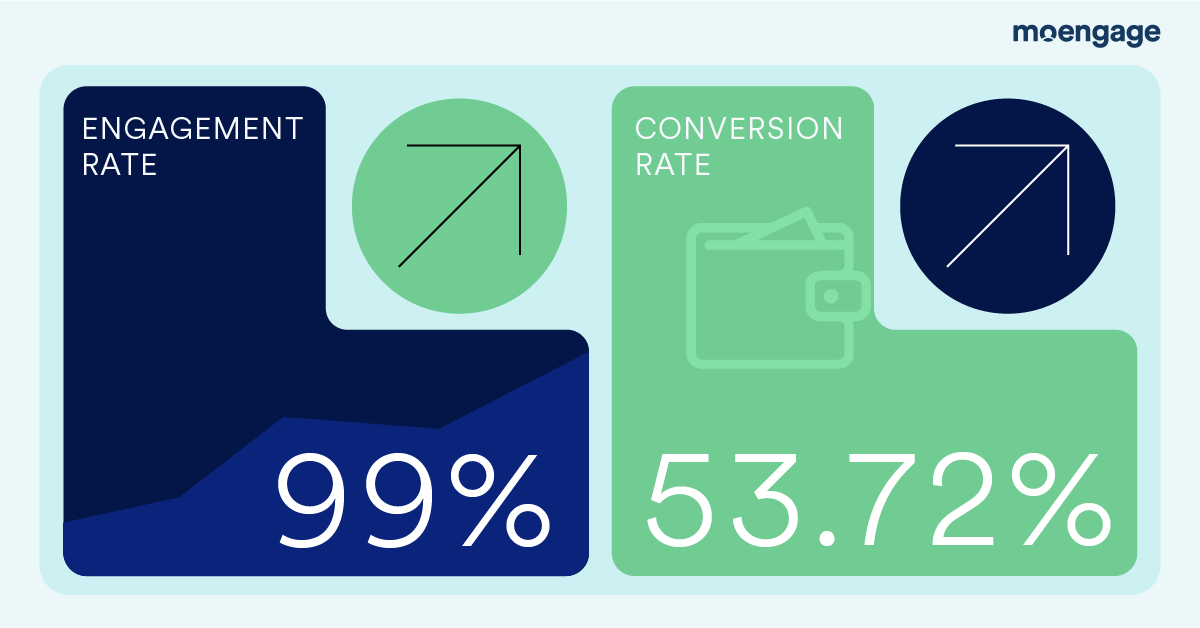

Campaign Results

| Conversion Rate |

| 53.72% |

Conclusion

Navigating the intricacies of customer journey strategies in the BFSI industry can seem challenging, but these five templates should make it easy for you. By leveraging these five templates, you can tackle common challenges in your industry, such as lead generation, profile verification, making announcements or reminders, and collecting customer feedback.

You can always tweak elements to see what fits your brand better and reuse these templates for scenarios beyond those listed here. These templates also offer a good blend of personalization, timely triggers, and strategic campaign segmentation to increase the efficiency and ROI of your campaigns.

These campaigns are set up to be most effective on MoEngage Flows, the only customer journey marketing platform you’ll need, but you can also use the same principles across a preferred platform. However, if you’d like to try MoEngage, you can request a quick demo here.