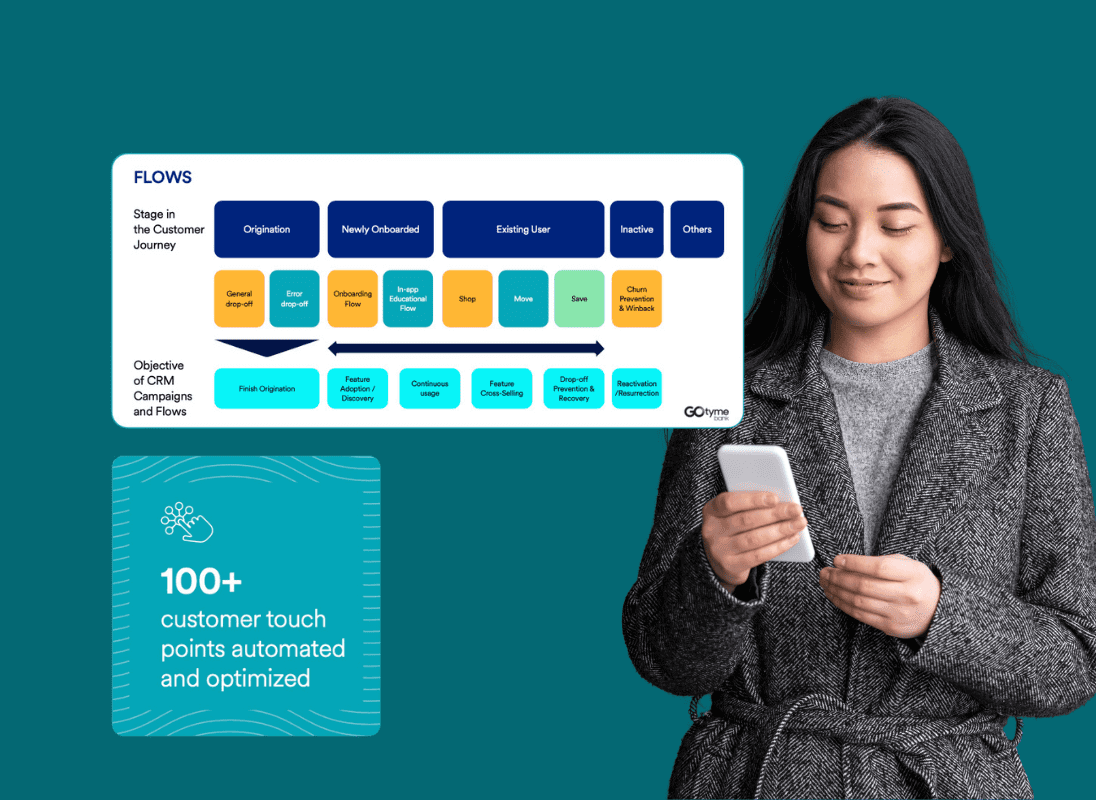

Using MoEngage, GoTyme Bank was able to shake up the banking landscape in the Philippines by:

- Reducing campaign execution time from 1 month to 1 hour

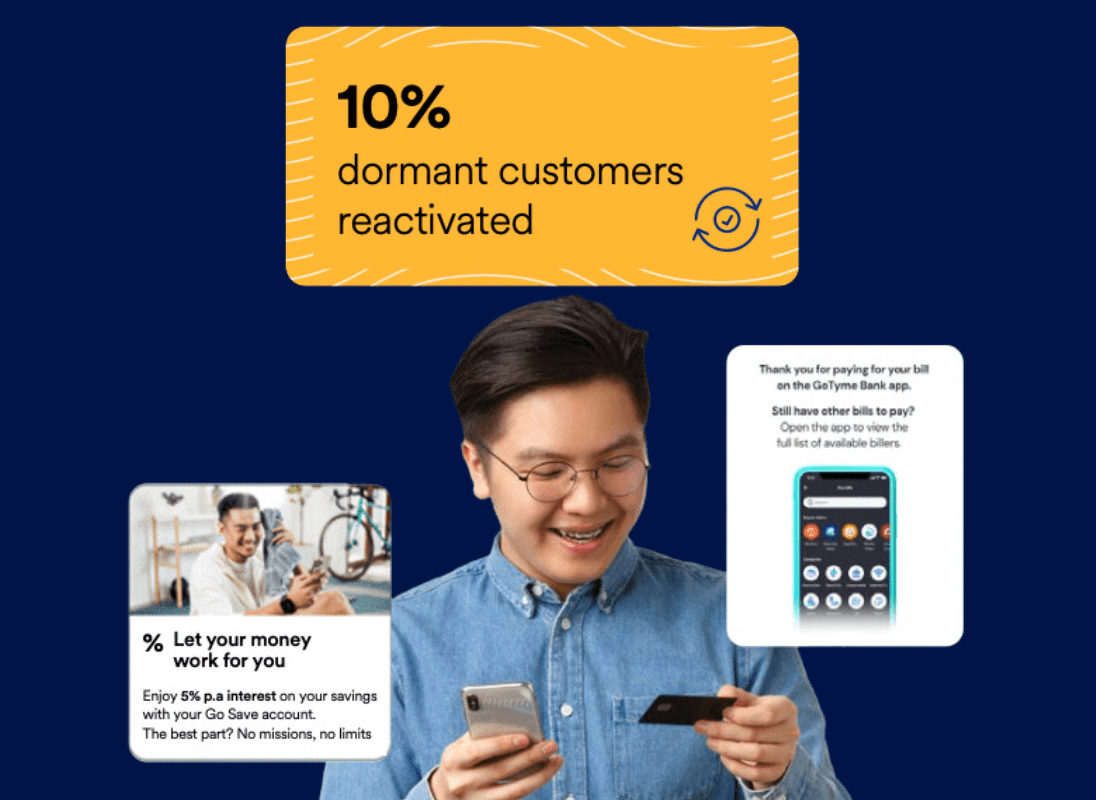

- Reactivating 10% of dormant customers

- Scaling personalized engagement, averaging 14.53 million push notifications impressions and 5.57 million in-app messages every month.

- Beating industry benchmarks for average email open rate at 34.28%

- Boosting MAUs by 93.36% and DAUs by 65%