3 Ways Banks and Fintech Brands Earn Trust With Gen Z and Millennials

Reading Time: 6 minutes

Two generations ago, bank managers and customers held relationships that were almost as good as decades-old friendships. Today, Gen Z and millennial customers won’t be able to recognize their bank management by name or face.

Thanks to the rapid Digital Transformation in the financial sector, you and I no longer have to visit a bank, an insurance agent, or a financial consultant.

This convenience has also led to a diversification of customers’ wants and expectations. The modern age customer demands more than the default convenience of online banking. They have high expectations for customer service, user experience, and customer engagement.

| Bonus Content

👉 State of Mobile Finance in 2021 [Ebook] 👉 Banking in the Era of the Connected Customer [Ebook] 👉 Winning Customer Experience in Financial Services in 2021 [Ebook] |

Although these factors have contributed to a reform in the BFSI industry, there is still one facet that has not changed in years and may not change forever. It is trust.

Trust is the overarching belief that the customer’s wants relating to financial services would be fulfilled by the business. In the due process, it also safeguards the customer assets, their reputation and gives them a reason to feel certain about their future.

Here are three ways to earn the trust of millennials and Gen Z customers. Each of these ways tries to address a concern that causes trust to erode in the financial services system.

- Customers want to make informed financial decisions, for which they need a simplified way of learning.

- They don’t want to be surprised with hidden charges, so the need to exhibit transparency.

- They are social by nature and hence expect referral programs to make use of their social capital.

Let’s take a deep dive into each of these routes to earn trust.

#1 Simplify financial training

The millennial customer who has little time and interest in financial learning might find it difficult to trust a brand that offers a complex suite of services and talks in jargons. Instead of putting in the extra effort to understand the methodology, they would rather choose not to engage in a business relationship.

To make things difficult, good financial education is hard to find, difficult to consume, and hence usually labeled as disinteresting.

There are countless apps that have transitioned into a lifestyle app with good traction that shows up in their DAU/MAU. They have hacked their way into becoming the most used and frequented of all apps on a user’s device.

How did they achieve it? To begin with they simplified the app UX and educated their customers.

According to 2019 PACE Finding 19% of Gen Xers want to do their own financial planning. Compare this with the Spring 2018 Merrill Edge report that states 87% of Gen Zers take a ‘do-it-yourself’ approach to finances.

Millennials and Gen Zers are adept researchers who are curious and love to learn. Gamification is the new way to educate and engage your users. A great example of such an app is Duolingo, which has more than 300Mn users and the average session duration is close to 10 mins.

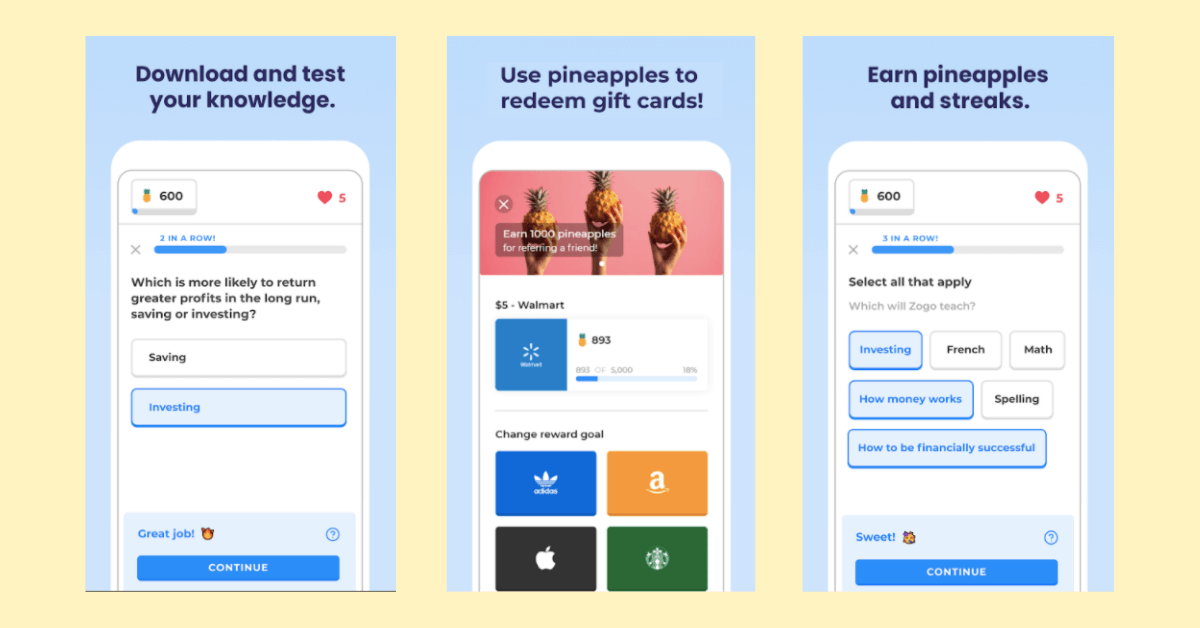

Zogo: Learn Finance & Get Paid is a similar app that draws parallels with Duolingo when it comes to educating their users.

#2 Exhibit transparency

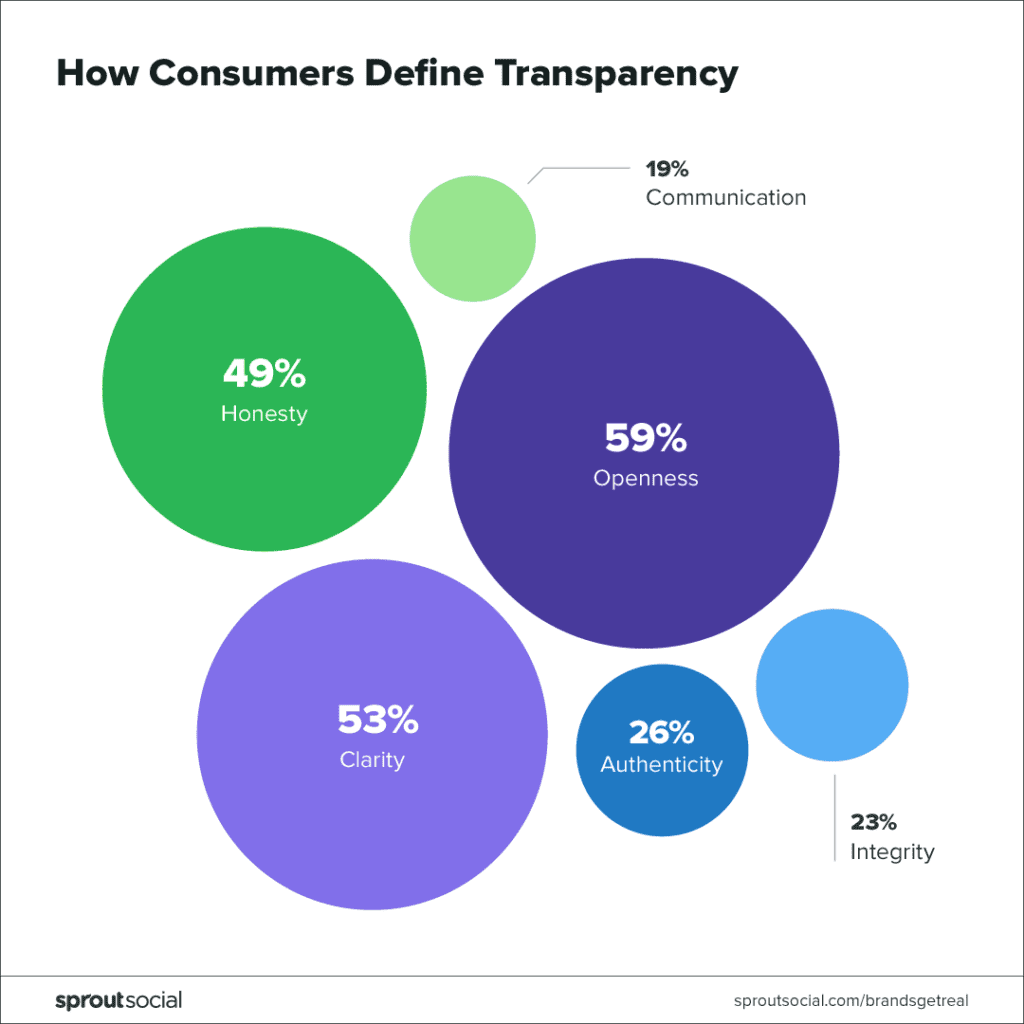

Millennials are loyal to transparent brands. When SproutSocial asked consumers what transparency meant to them this how the cohort responded.

In other words, a financial services firm must be honest in its charges, must be open to dialogue with its customers, provide clarity for its action involving personal assets of its customers, and must have authenticity in its services.

Unfair trade practices like hidden charges, buried terms, and dubious offers derail millennials and Gen Zers alike.

According to a survey done by The Center for Generational Kinetics, 52% of Gen Zers believe debt should be avoided at all costs or reserved for only few things.

Unlike in the past, today there is no dearth for professional financial services. Customers can find an alternative with a quick online search or through referral. A good way to measure transparency and signs of trust amongst your users is to check their willingness to refer your app within their circles.

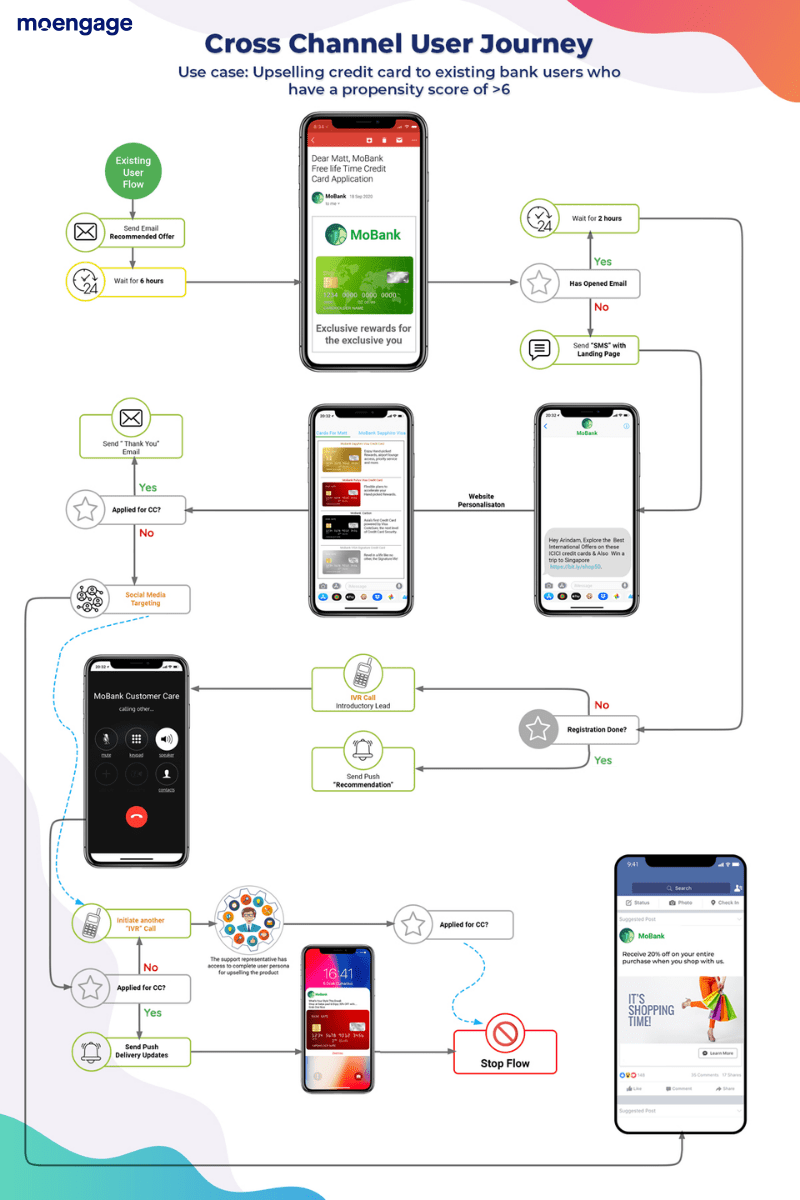

Another way is to engage them across all the available digital touchpoints. Marketing automation tools like MoEngage can help you carve the customer lifecycle and engage them in a personalized manner.

#3 Incentivize referrals

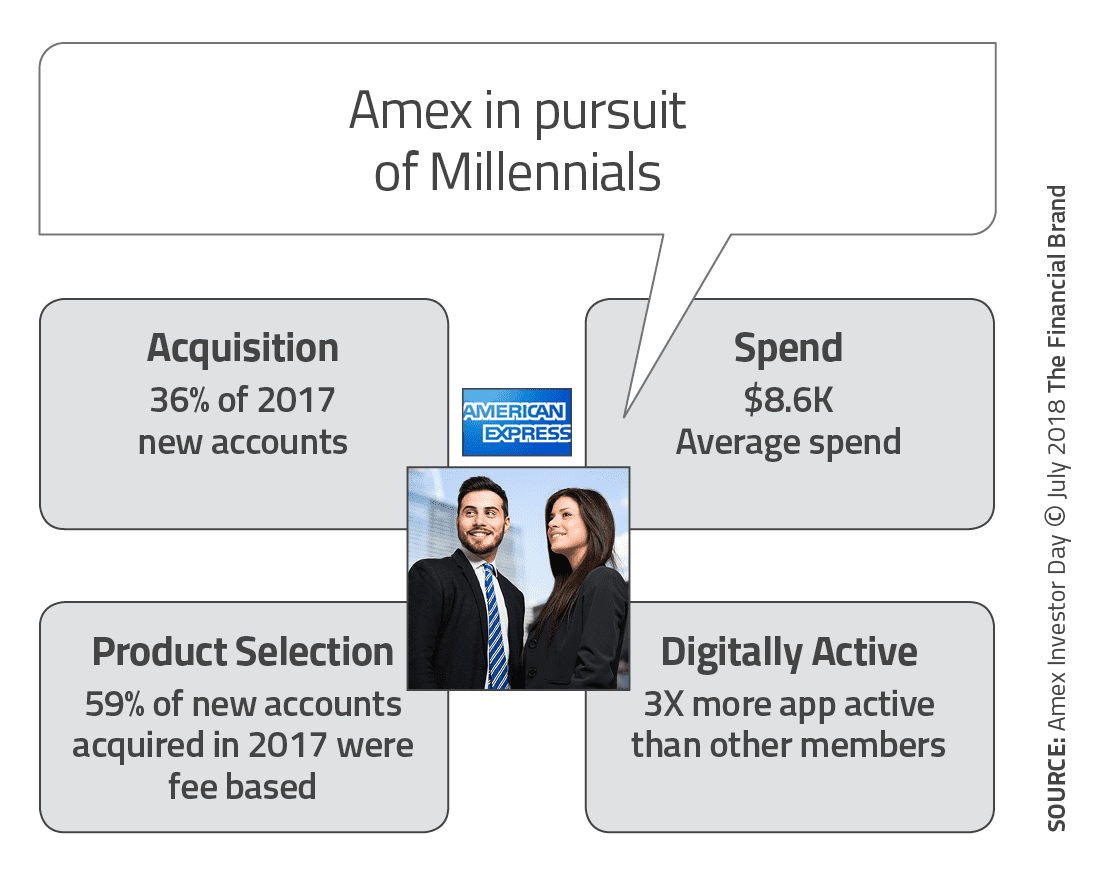

Referral programs have been used by businesses of all types and sizes to increase their customer base. One notable example stands out here from the rest and that is of American Express.

According to their 2018 Investor Day celebrations, more than 10% of new customers come as a result of referrals, with 54% of them coming from Millennial customers. Referral programs have 2 main advantages:

- It brings in new prospects/customers into the fold.

- The existing customer remains loyal with the add-on features provided with a successful referral.

Very few banks or credit unions have built the refer-a-friend program as robust as American Express. Their platinum card referral program continues to be one of the most rewarding ones.

Financial services are personal in nature. New customers think twice before signing up for a service that has an influence on their long-term financial health and security. Referrals can appeal to that emotional concern and appease them to make a quick decision.

If you think Gen Zers and Millennials are not deep pocketed or don’t believe in saving funds, think again. According to The Center for Generational Kinetics, 80% of them already have a bank account and close to 50% of them are already saving money for retirement.

How can MoEngage help

In an era of short attention spans and increased demands for seamless, personalized experiences, banks need to meet customers where they are.

Our platform for BFSI is built for our mobile-first world, helping companies orchestrate campaigns across push notifications, emails, in-app messaging, web push, and SMS. Our platform helps companies create, visualize, and deploy omnichannel campaigns that reach users at the right time through the right channels, and with the right message.

Here are ways in which we can help:

- Make a single (360-degree) view of your customers – Demographic and geographical patterns are first steps. We also help you go the distance and create data views that map the behavioral pattern of your customers.

- Provide a seamless experience across touch points – We help you create experiences that are scalable and compatible across devices and platforms.

- Personalize with intent and not just first names – Addressing your customers with their first name is good, but can you up your personalization game and show them what they desire? With our state-of-the-art segmentation and AI-powered engines we predict what your customer wants and precisely when.

Here’s an on-demand webinar video that we hosted with Bolun Li, CEO and Co-founder of Zogo, and Michael Bohs, Head of Product at Perpay on the same topic:

Conclusion

Winning the trust of Gen Zers and Millenials needs strategic thinking by Banks and Financial Institutions.

Armed with smartphones that spew real-time information on anything in a split of a second, it empowers them to do extensive market research, and find competitive yet trustworthy service providers. If the decision-making proves to be difficult, they always have the abundant social capital to dig and arrive at personal choices.

Financial services should deploy three main strategies to win over millennials and Gen Zers:

- Educate them in a simple and efficient manner.

- Provide transparency into the products and services.

- Incentivize referrals to drive both acquisition and retention.

Here’s What You Can Do Next

|