5 Financial App Personalization Tactics That Will Transform Customer Engagement

Reading Time: 4 minutes

Mobile banking has transformed the financial world. Today, with a tap, you can manage your savings account, transfer money, and hundred other things. Financial apps have truly made every aspect of banking less complicated and more convenient.

And as a result, the number of consumers using finance apps has skyrocketed. According to a recent Google report, 60% of mobile users prefer these apps over websites when it comes to managing their finances.

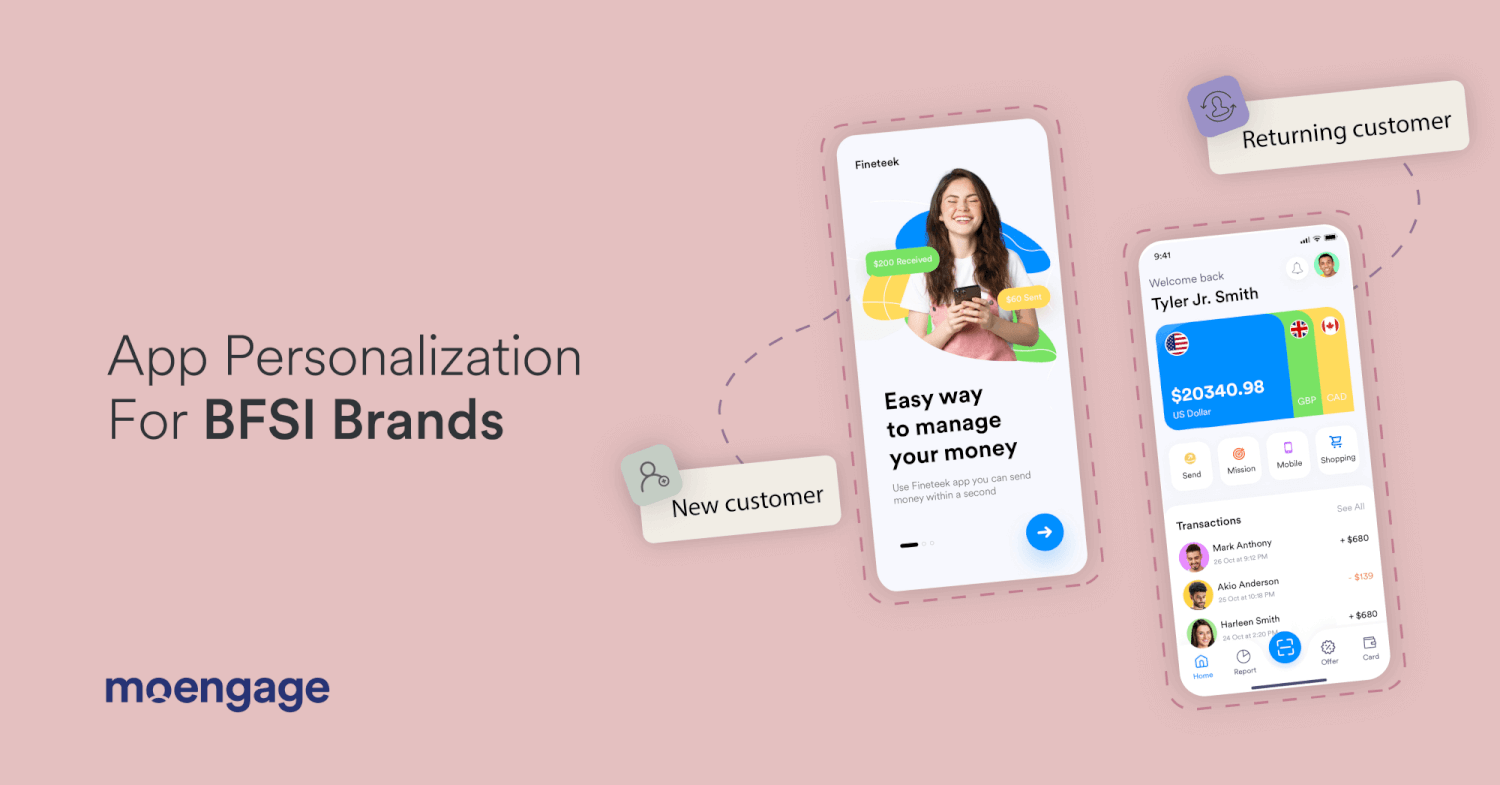

However, financial institutions must keep enhancing their app experience to meet rising customer expectations. And there’s nothing better than leveraging real-time app personalization.

5 App Personalization Strategies Financial Institutions Can Execute Right Away

Let’s look at different app personalization strategies financial institutions can leverage to provide a superior customer experience –

1. Drive Engagement through a Personalized Homescreen Experience

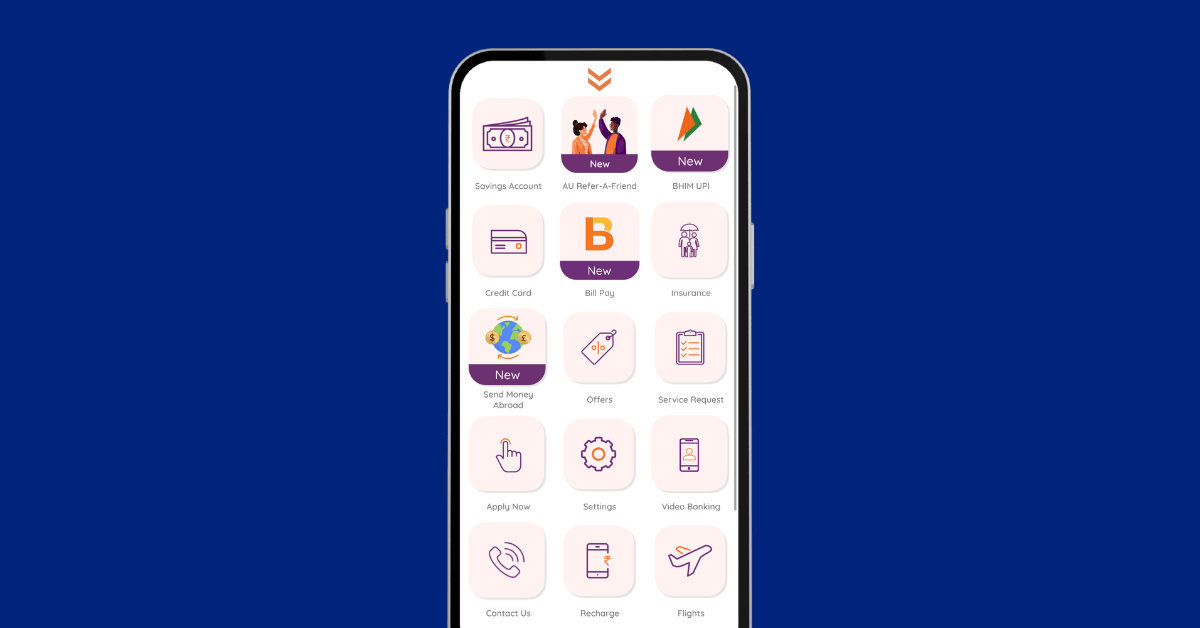

The home screen is the first thing customers look at when they open the application. While often overlooked, it’s a great place to promote offers, upsell various financial products, and drive clicks to relevant categories.

To craft a tailored home screen experience, financial institutions can easily get insights by tapping into customer’s current financial situation, spending habits, and goals. Furthermore, they can also tweak depending on preferences customers set during onboarding.

For example, brands can reorder categories or sections based on customer preferences. So, if customers regularly check their credit card transactions and rewards, those tabs can be displayed prominently.

The same applies when promoting offers. For customers with high credit card usage, brands can prioritize card-specific offers and discounts on the home screen.

The app home screen can also be utilized to prompt customers to perform specific tasks such as completing Know Your Customer (KYC), finishing onboarding processes, showcase payment reminders and more.

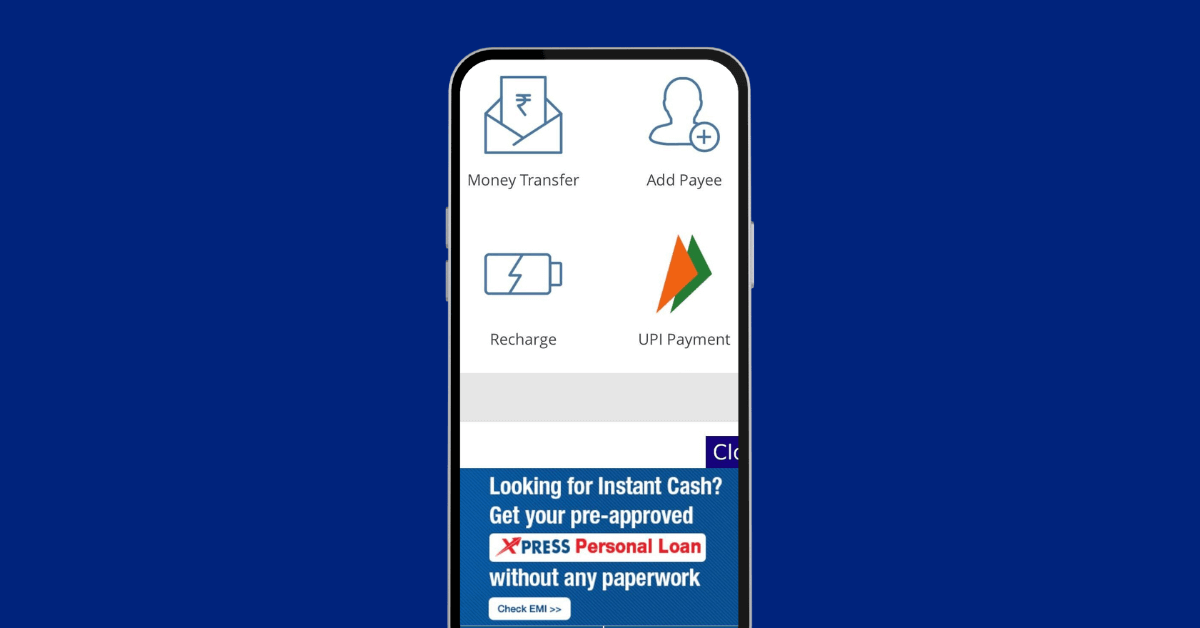

Below is an example of AU Bank’s home screen. If you look closely, you can see how they’ve prioritized relevant categories and highlighted new ones.

2. Increase Conversions Using Personalized Offers

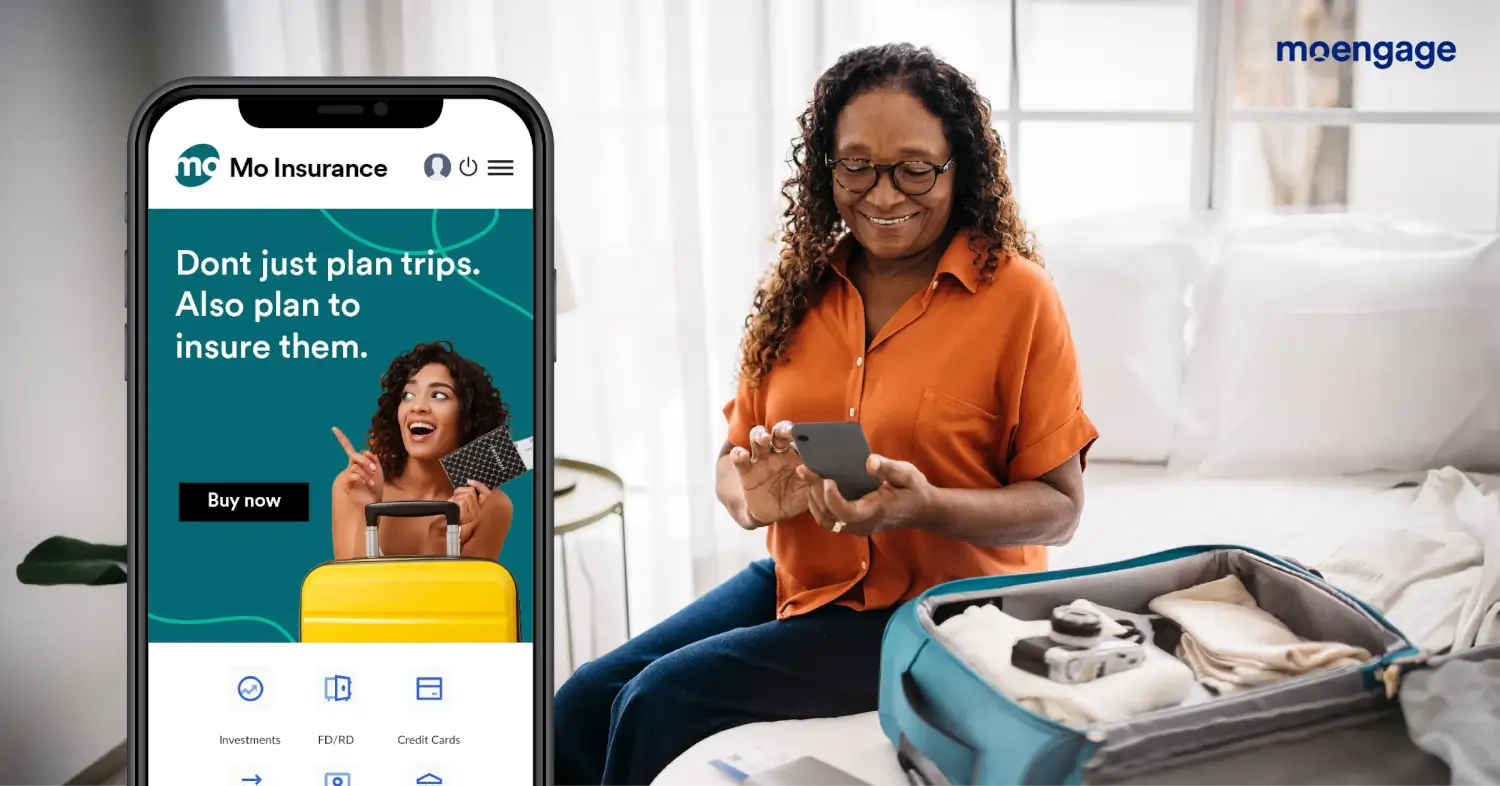

Financial institutions can also leverage customer insights to tailor their offers. It’s common knowledge that personalized offers tend to convert better than generic ones. Also, it ensures brand maintain a superior customer experience. The last thing you want is to bombard customers with irrelevant offers.

For instance, BFSI apps know customers’s spending habits, credit history, and credit score. They can use these insights, customer preferences, and eligibility to show personalized credit card offers. Similarly, if a customer travels frequently, financial apps might suggest a travel-related credit card or display travel insurance offers. On the other hand, if customers spend their money on groceries and utilities, they can promote a daily reward cashback card.

Additionally, rather than bombarding these offers to all possible channels, brands can trigger the offer to only those channels where customers are most active. This boosts engagement and reach significantly.

3. Upsell New Financial Products and Adoption Through Personalized Recommendations

BFSI brands can only succeed through effective cross-selling and upselling. It is critical for their sustainable growth. With increasing acquisition costs and competition, most financial institutions focus on increasing customer lifetime value and retention. This isn’t possible without effective adoption and upselling of new products.

But at the same time, brands cannot afford to upsell irrelevant products. This is because product eligibility depends on multiple factors, especially in retail banking. For example, personal loans can only be offered to eligible customers with a certain credit score and income; the same applies to mortgage loans.

Similarly, BFSI brands can offer more premium credit cards to customers after monitoring their credit card usage after a specific period. They can also upsell vehicle and personal loan during the festive season.

In conclusion, brands must leverage customer insights to offer personalized products like credit cards, loan offers, and insurance plans for higher conversions. They can easily do this by analyzing customer’s credit history, account balance, monthly cash flow, and more.

4. Keep Customers Informed Through Personalized Push Notifications

Many financial transactions are recurring, such as EMIs, subscriptions, credit card bill generation, or monthly deposits. Banks must ensure they inform customers about these transactions especially through push notifications and in-app messages.

Most banking apps also send real-time notifications to alert customers if they find any suspicious activity like a fraudulent transaction. For example, when you log in from an new device or transact from a different location, BFSI apps will instantly notify you over a push notification and email to verify the login attempt.

5. Activate Customers Quickly Using Personalized Onboarding

With ever-changing banking regulations, onboarding has remained a constant challenge for financial institutions. However, for customers to start using their platforms, they need to complete the onboarding. It’s also a great opportunity to understand customer’s financial goals and gain valuable insights into their needs and expectations.

And for banks to achieve the above, they need to provide a personalized onboarding experience. For instance, financial institutions can simplify onboarding by providing incentives such as cashback or rewards and offer personalized recommendations. Similarly, onboarding needs to be tweaked according to the customer segment, as every customer approaches banking with different levels of tech-savviness and goals.

Overall, providing personalized onboarding helps brands to have a competitive edge and fosters stronger connections with customers.

What’s Next?

There’s no denying that app personalization will be relevant in 2025 than ever, allowing financial institutions to convert and retain maximum customers. We’ve already seen few examples of how app personalization can truly transform the app experience. With increasing competition and customer needs, brands must take real-time app personalization incredibly seriously and add it to their customer engagement strategy.

If you’re looking to tailor financial web experiences, you can read our latest guide here.