A Deep Dive into E-scooters Market Strategy and Growth Perspectives

Reading Time: 9 minutes

Note: This is a blog by AppFollow as part of a thought exchange series between MoEngage and AppFollow.

Ever since 2017, micromobility has been a trend on a fantastic rise, but not without its own line of problems. The market is fluid with the competition, both international and local. Things appear to be so lucrative, even Apple and Google are expected to enter the space. Despite its novelty (or thanks to it), the e-scooter market is expected to reach 40 to 50 billion US dollars in 2025.

|

Bonus Content 👉 The Complete Growth Strategy [Download Handbook] 👉 Beginner’s Guide to Omnichannel Marketing for 2021 [Download Ebook] |

Every micromobility company relies on its app to deliver the service, however. Without a secure payment system and quick access to available scooters, the whole appeal of renting an e-scooter fades. Is there an app amongst any player on the market that stands out? Why? How are they faring? What do the users and app stores say? Let’s learn about that — and the market’s current health — below.

What’s on the market

A few words on the current situation:

The US is the biggest market so far with a bigger number of players. Scoot, Spin, Jump, Bird, and Lime were among the first. Then in 2018 Uber acquired Jump and partnered with Lime, and a year later Bird acquired Scoot. Everything points to e-scooters’ continued market growth in the US.

The European market has a shorter history. A Bosch-owned service Coup was among the first there, but at the end of November 2019, the company announced shutting down operations in all of its locations. Local services like Tier, Voi, Cirk, Flash, and Arolla are actively growing across the EU, while the US-based Lime, Jump, and Bird increase the competition by entering the market.

Jump was expected to hit in Latin America, but eventually Uber decided to deliver e-scooters under its own brand there. Another service in LatAm, Grin, is announced to merge with a Brazil-based Ride.

Now it’s time for global invasions: services enter new countries, deal with local legal systems, and try to win new users.

Legalization issues

E-scooters regulation is the only way to turn a chaotic mess of scooters into a novel form of transportation.

While the city of Austin ran a pilot program designed to help keep Austin moving safely, San Francisco completely banned electric scooters until the companies obtained city permits. As a result, four companies got permission: Jump, Lime, Scoot and Spin (that’s when Bird didn’t get a permit and acquired Scoot).

Germany was the latest nation to approve the use of e-scooters on roads and bicycle lanes.

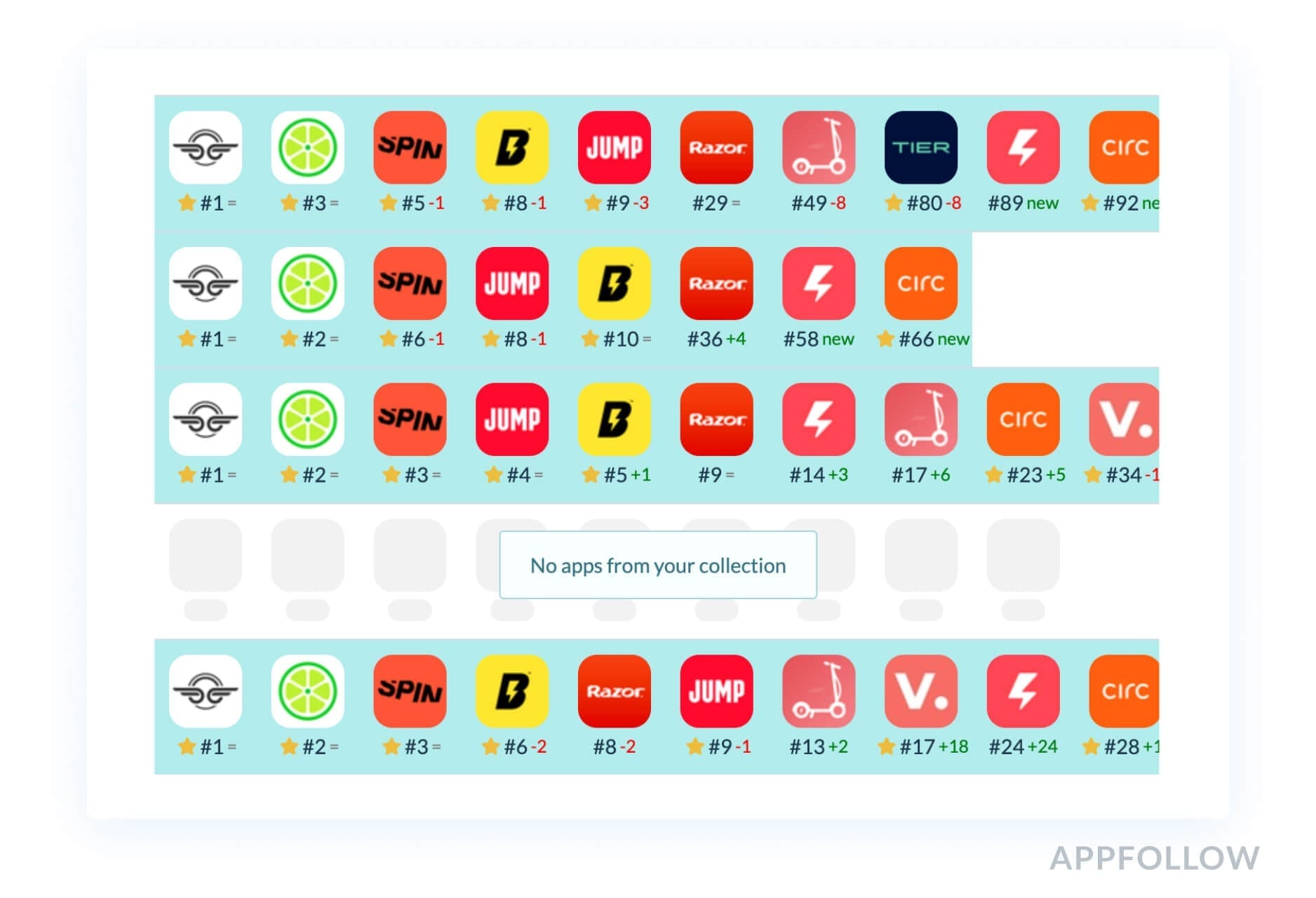

When the law finally came into effect, two Europan-based e-scooter services, Voi and Tier, blew top charts of App Store and Google Play in Germany:

There are still countries that haven’t been able to regulate the use of e-scooters. Mostly it turns into user complaints.

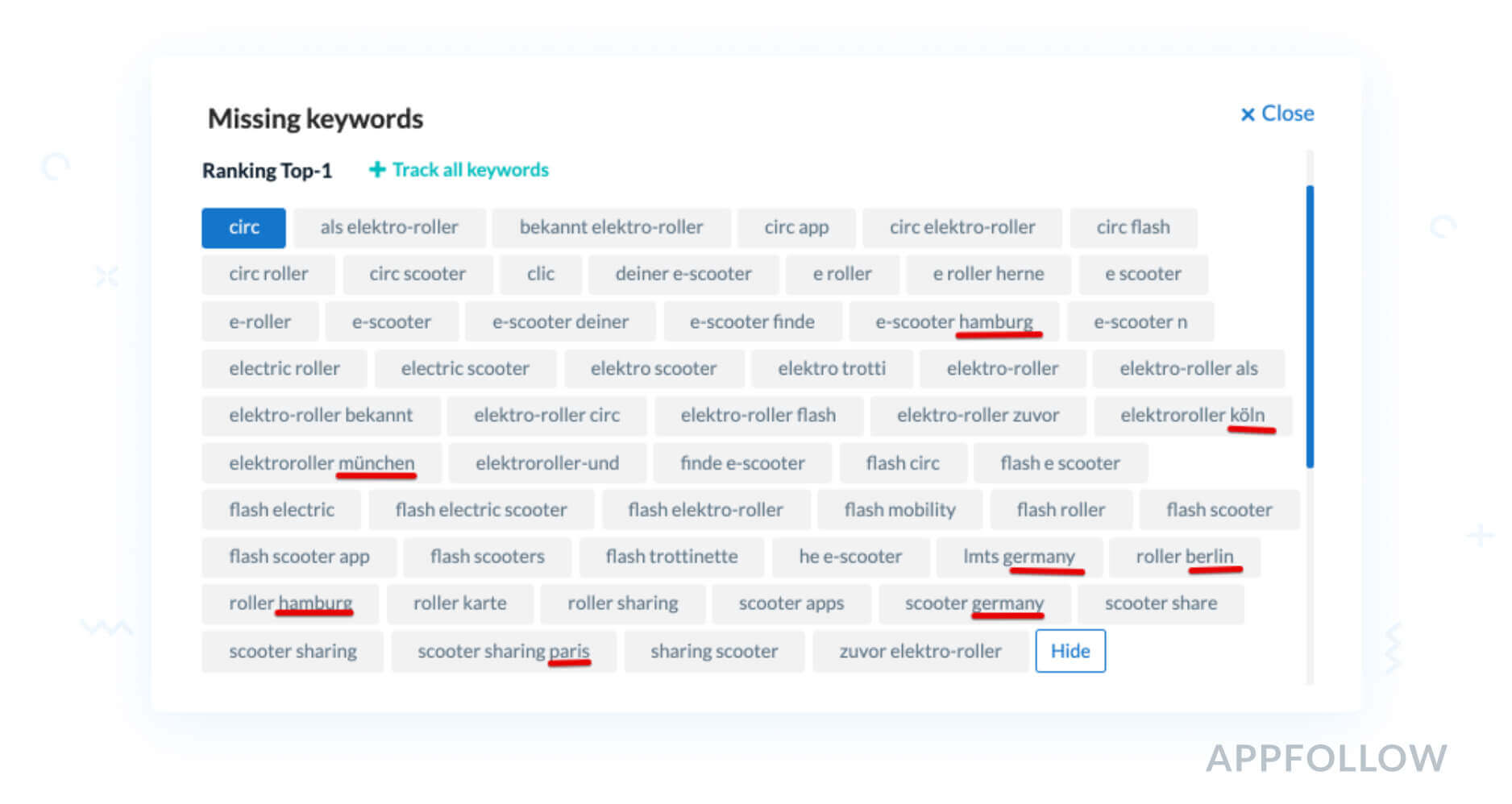

To get a picture of how the international competition is trying to penetrate the market, simply check the keywords that leaders use in their App Store Optimization (ASO) strategy.

Here are, for example, the keywords from top-1 where Circ mentions cities they’re targeting:

And this tactic is working, especially for tourists looking to sign up for a local service before going there. As one of their customers says: “circ came up on the App Store first under a search for scooters in Berlin.”

And this tactic is working, especially for tourists looking to sign up for a local service before going there. As one of their customers says: “circ came up on the App Store first under a search for scooters in Berlin.”

Here are the most mentioned cities in search requests the leading rank for:

However, if launching in a new location was that simple, we would all be drowning in e-scooters. So what else is there?

How do micromobility companies work with their app users

Spoiler: most of them don’t.

Most leaders don’t pay attention to the issues their users experience. That is surprising, given how important feedback and customer support is to a demand-based service with an expensive inventory.

Customers file complaints on a variety of issues, and every single one of them makes a difference for the person that didn’t subscribe to the service yet. For instance, in Germany, Circ appears to be the only company that takes its online reputation management very seriously and makes a big effort towards customer support. Could it be a coincidence that Circ leads the market with almost twice the headway as opposed to the closest runner?

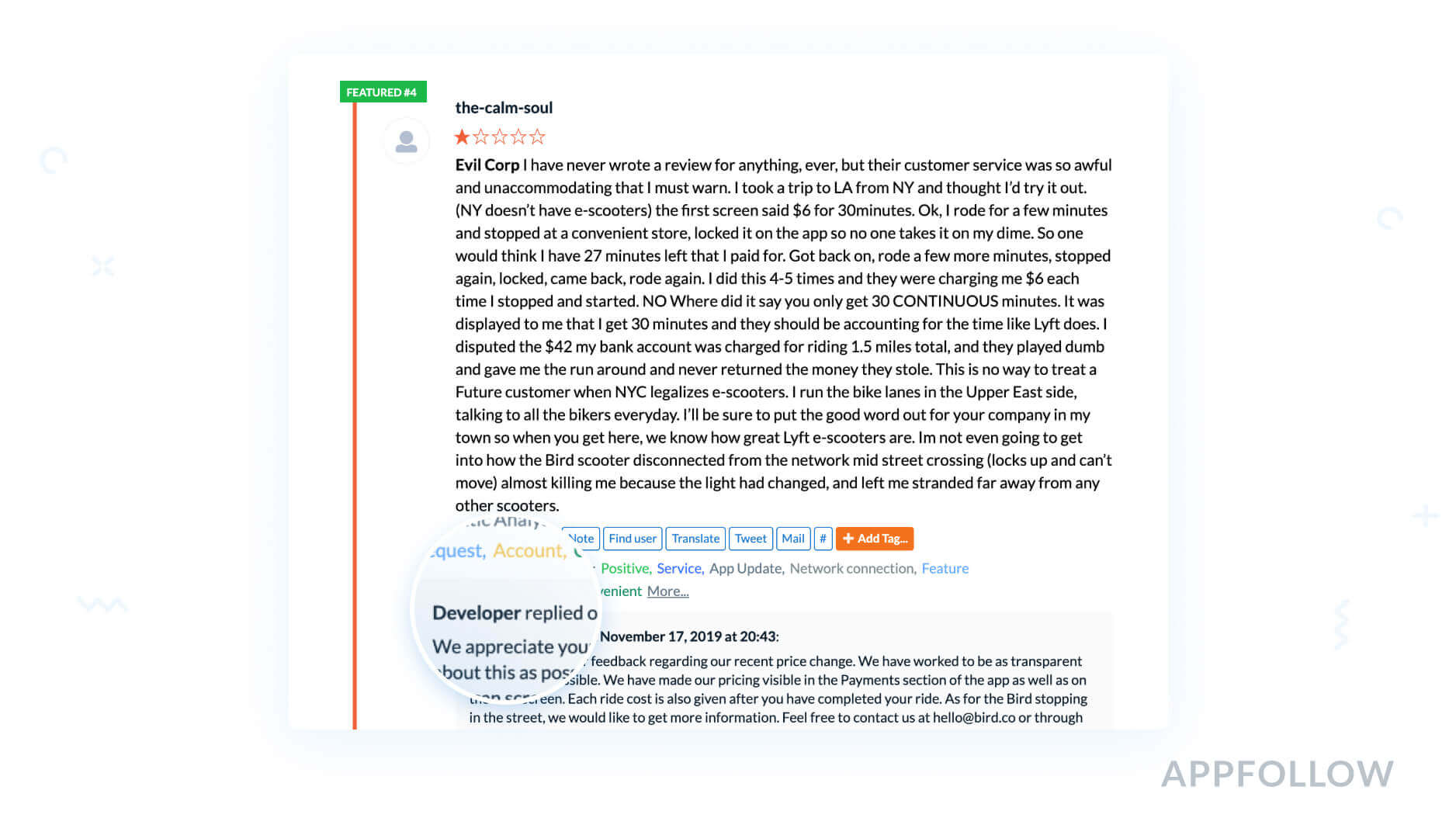

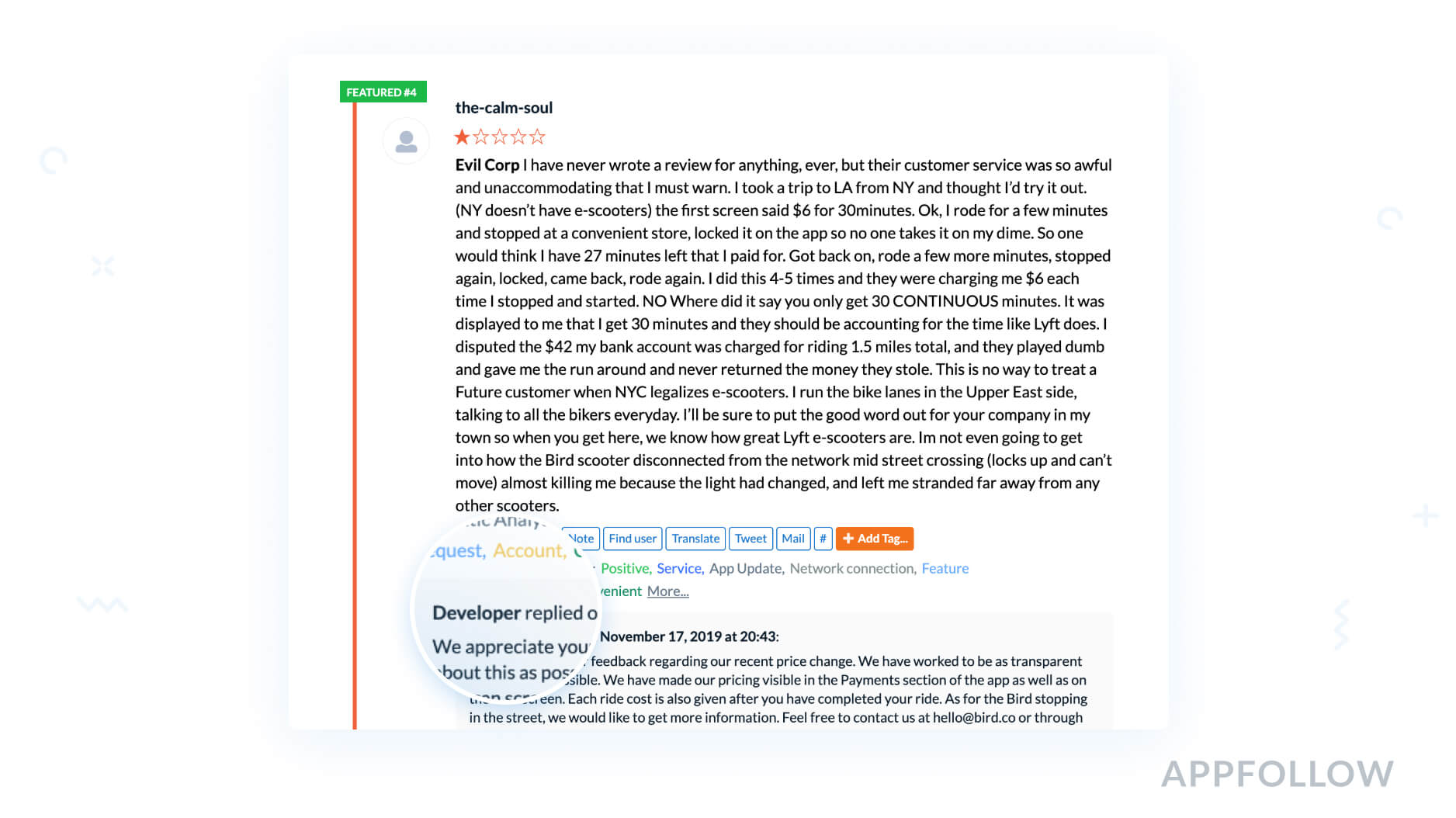

Sometimes things go awry and the company’s app store reviews end up with a wound like this one:

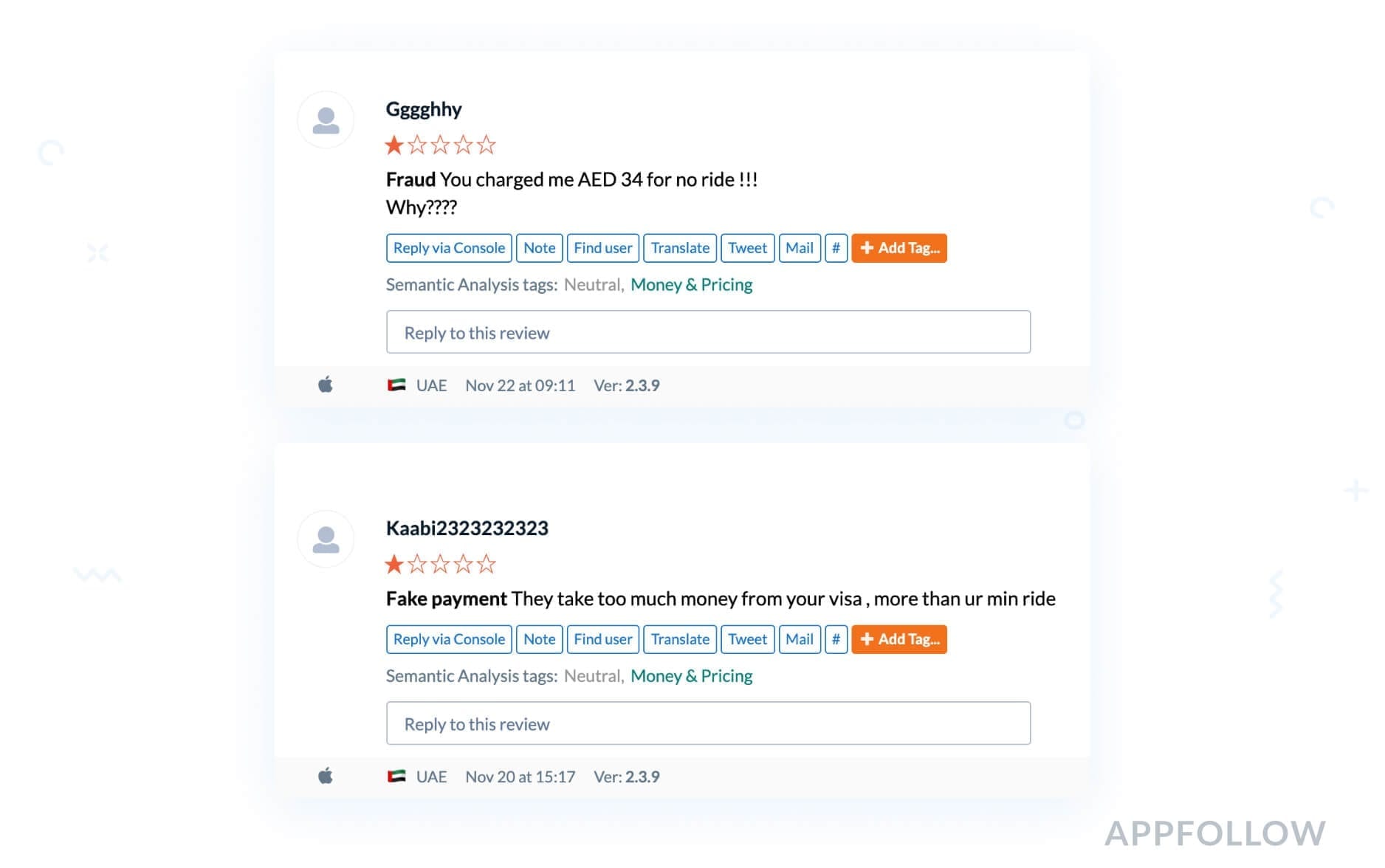

At the very least, this particular review got an answer. Most of the feedback is left unanswered, which makes those services look like crooks:

At the very least, this particular review got an answer. Most of the feedback is left unanswered, which makes those services look like crooks:

A new user paying attention to reviews would be wary of using a service that lets this kind of situation unfold and does nothing.

What are the most popular user complaints?

- Slow scooters

- Broken scooters

- Battery issues

- Weak internet or GPS signal: leads to the inability to find a scooter

- App’s bugs and crushes: lead to the inability to unlock a bike or end a ride

- Being overcharged: mostly because of app crushes or vague pricing policy

- No restricted zones identification: leads to penalty charges

- No parking zones indicators: leads to pricing complaints as well

- Inability to sign up in another country: leads to losing tourists in the area

- Bad customer service and their inability to help faster

What an opportunity for a brand new e-scooter service to take on, hah! And some services did their homework and came up with solutions to some of the problems.

The first one is a California-based startup Swiftmile that operates using solar or plug-in power, promising to deal with battery issues. Moreover, the company bills itself as “a gas station in the middle of where all the scooters are”. So far Swiftmile announced to create branded charging hubs for Spin e-scooters.

A Dublin-based service Luna states to resolve issues with pedestrian safety and scooter parking. And another service Tortoise is inspired by the idea of autonomous parking in the U.S. They promise to spread e-scooters out to areas that need them most.

Although these services didn’t make it big yet, one should never underestimate the importance of user feedback in a race to the highest revenue.

App rating and reputation of e-scooter apps

Obviously, there are other consequences for services and apps that don’t take care of their users: drop of rating and as a result lower visibility and a drop in downloads.

Micro mobility app statistics

Why don’t we take a look at hard data we researched and draw some conclusions as to what really affects the micromobility’s market growth, based on numbers.

Top downloads vs monthly active users

The distribution by country in countries is approximately the same, the difference in the number of users. The data is based on the time period between October 16 and November 15, 2019.

US

- Lime: present both in the US and the EU. MAU on the App Store is 3x lower than on Google Play. Compared to the US, the difference is 4x.

- Bird: MAU on the App Store is 3x lower than on Google Play, Compared to Spain, the difference is 5x.

- Bolt: dominates in the US. Users on the app stores are not active.

- Spin: US users make up to half the size of Lime.

- Jump: As many users from Italy as there are from the US. MAU is 20x less than Lime.

EU

- Tier: Popular in Germany.

- VOI: also popular in Germany. Sweden is the second most popular country. MAU is comparable to Bird. This company responds to reviews only in Google Play.

- Circ: popular in Germany and the UAE.

- eCooltra: – not many users, based predominantly in Spain. The feedback is great, however.

- Coup: not a popular service, based in Germany and Spain.

Top Charts Ranking

The apps are in the Travel category. Growth trends are correlative for both App Store and Google Play.

- Lime: sees sharp growth in Germany’s App Store and Google Play since June. Keeps its position in the top 5 Travel categories. Started to trend in Korea in October. Lime – 4.9 in AS vs 4,5 in GP

- Bird: ranks in the USA and France grew during summer (top 3) and fell by the end of the year. The app barely remained in the top 100 on Google Play. In Spain, the service began to see sharp growth in September.

- Jump: on the rise since March in the US. Held the top 30 positions in the App Store, but couldn’t do the same in Google Play. Remained for a while in the top 30 in Italy, but in Spain and Germany couldn’t even make it to the top 200. Jump – AS: 4.6 in the US compared to 3.8 in Europe and 3.2 in GP

- Tier: impressive growth in ranks in Germany – since June 24, the app has risen to top 1 and holds positions in top 10. In France, they couldn’t reach the top 20 and since October they have fallen behind the top 200. Tier – 4.5 on average across AS vs 4.0 in GP

- Voi: the second most popular service in Germany. Got into the top 10, did not catch up with Tier, but stayed in the top 10. In Spain, reached the top 40.

- Bolt: low positions even in the USA, even though their main user base is there. Didn’t manage to stay in the top 50 even during the summer season.

- Spin: weak position in the USA, despite being home country. Made it to top 30 during summer, but fell behind the top 70 since then.

- Circ: remained in the top 10 in the App Store in the Travel category, on Google Play switched the category to Auto & Vehicles. That didn’t help, and thus they are in the top 200.

- eCooltra: good ranks in Spain and Italy. Throughout the year, positions jump from top 70 to top 30 and vice versa.

- Coup: unstable positions in Europe. Tried to stay in the top 100 in Germany, Spain, and France, but fell below the top 200. The best ranks were held from March to June.Market leaders reached an average of 4.8 stars rating, which is clearly difficult for average players to reach. Google Play users complain more than the App Store users. The average rating there is lower on average by half a star.

Average rating

- Lime – 4.9 in AS vs 4,5 in GP

- Bird – 4.7 in AS (4.8 in the US) vs 4.4 in GP

- Jump – AS: 4.6 in the US compared to 3.8 in Europe and 3.2 in GP

- Tier – 4.5 on average across AS vs 4.0 in GP

- VOI – 4.8 in AS vs 4.3 in GP

- Bolt – 4.7 in AS vs 4.2 in GP

- Spin – 4.5 in AS vs 4.2 in GP

- Circ – 4.8 in AS vs 4.2 in GP

- eCooltra – 4.1 in AS vs 4.2 in GP – the only ones with approximately the same rate

- Coup – 4.5 in AS, GP – 2.5

Visibility score

Lime is the leader in visibility in both Google Play and App Store in the US and France. Bird catches up to Lime in the App Store, yet in Google Play visibility is 4x worse.

Tier and Circ are leaders in Germany. Circ has almost twice as much growth as opposed to their competitors.

Everyone has active users in Spain, yet companies don’t make a bet on it, and thus the average visibility is poor. This means that the top spot is up for grabs. Italy and France are also underestimated in terms of visibility.

Notice the trend to red icons, certainly, something is behind that too.

Reputation score

Lime responds to user reviews from the United States (and the US users), where the reputation score is higher than in other countries (and competitors) – 4 out of 5.

Bird does not work with users, a has a low reputation score (~ 3.5). The level of satisfaction with the service as a whole (sentiment score) however is within the acceptable range of 75.

Spin and VOI have the level of satisfaction with the service (sentiment score) in the App Store that is two times lower as opposed to the Google Play. Users complain about app instability, bugs, and some other things.

eCooltra has few users, but most of them are happy. The sentiment score holds at 75, reputation score at 4.2.

Takeaways

While it’s no surprise that customer-obsessed companies conquer and win the market, most of the e-scooter apps don’t talk to their users. Certainly, companies that show their support to users and answer to reviews are getting headway and increase in downloads (and thus, revenue). It’s definitely something to keep in mind.

Unless new regulations wreak havoc to e-mobility as a whole, the reformation of urban mobility has just begun. No matter how you look at the micromobility market, everything points out to its continued growth. While it is seasonal for a good chunk of the world, it also leaves the competitors to prepare for competition at the beginning of spring.