Banking and Fintech & The Black Swan Event: Building For Post-Crisis World

Reading Time: 8 minutes

According to World Bank estimates, the Indian economy would decelerate close to 5% in 2020. This trend will continue well into 2021 with 2.8%. A rebound can happen only in 2022. Coupled with one of the worst stock market crashes (Sensex –38% by 23rd March), this probably isn’t good news. But the silver lining is the renewed customer interest evidenced by reactivations across brokering firms and bitcoin traders. The NBFCs are busier than ever, and fintech startups like EarlySalary are observing an increased demand from specific user segments. How is the BFSI segment in the post-crisis world shaping up?

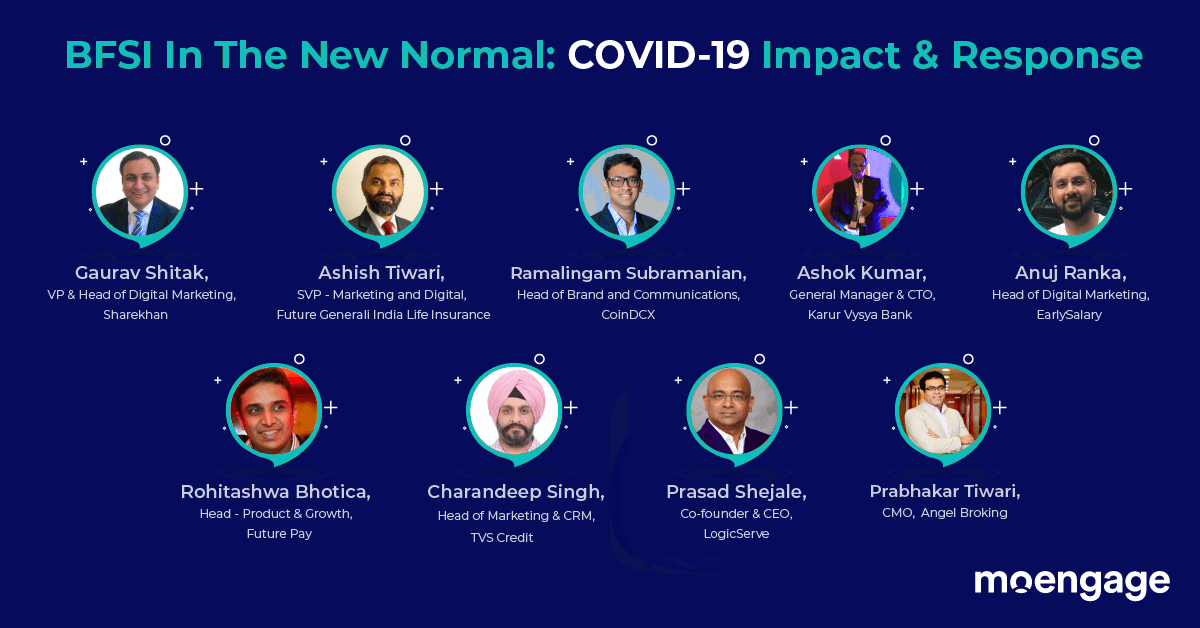

Who better to shed light on the topic than the leaders from fintech, traditional banking, trading, NBFCs, and insurance. Meet the distinguished panel of marketing leaders, Co-founders, and CXOs from some of India’s household names:

- Gaurav Shitak, VP & Head of Marketing, Sharekhan

- Ashish Tiwari, SVP – Marketing and Digital, Future Generali India Life Insurance

- Ramalingam Subramanian, Head of Brand and Communications, CoinDCX

- Ashok Kumar, General Manager & CTO, Karur Vysya Bank

- Anuj Ranka, Head of Digital Marketing, EarlySalary

- Rohitashwa Bhotica, Head of Product & Growth, Future Pay

- Prasad Shejale, Co-founder & CEO, LogicServe

- Prabhakar Tiwari, CMO, Angel Broking

- Charandeep Singh, Head of Marketing & CRM, TVS Credit

Let’s dive into the BFSI segment discussion: Impact of COVID-19 on post-crisis user behavior and marketing challenges.

How has the pandemic affected and shaped the new normal for the BFSI segment?

Reactivation emerges as silver lining among the crisis for brokering firms:

- Sharekhan is observing many reactivations from its customers.

- This jump in reactivations can be attributed to consumers using their downtime to start trading.

- Dormant users with accounts are now seeing this as a significant opportunity to trade and invest; hence reactivations across the industry have gone up.

- Despite the market being in a slump, long term investors have nothing to fear.

- Unlike retail, hospitality, or aviation sectors, Sharekhan’s topline is still there, with exchanges happening and businesses going steady.

5X jump in day zero trading & 3X increase in market share; Positivity amid an air of despondency:

- Angel Broking has been busier since March and April, with 100,000 new Demat accounts opening in a single month.

- There has been a 3X jump in market share compared to April 2019

- Angel Broking has observed a higher percentage of organic leads from users who had considered equity buying earlier, but are doing it now.

- Despite the market going down, people are joining because of the low rates.

- There are high intent and high urgency with day zero trading increasing by 5X.

Cryptocurrency trading sees growth spurt amid Supreme Court verdict and Bitcoin Halving:

- Owing to the small size of the cryptocurrency market in India and globally, it has been mostly unaffected.

- Events like ‘Bitcoin Halving,’ i.e., supply reduced to half, is bringing in increased activity amongst bitcoin traders, observed by CoinDCX.

- Mostly the segment is growing while solving for challenges from service delivery point of view like KYC or bank requirement.

- After the Supreme Court verdict on allowing cryptocurrency trading, the industry-wide adoptions have increased.

- CoinDCX has acquired 50,000 users in the last month alone with a 10X growth in signups.

Banking sector focuses on NPA identification and moratorium announcements:

- The business for the banking sector is down with transaction levels reducing by 50%, as recorded by Karur Vysya Bank.

- RBI has announced three months moratorium along with three months’ deferment of interest or working capital to provide incentives for the SMEs.

- NPA identification is postponed for three months and might get extended for another three to four months

- Cashflows are tight since a majority of planned activities aren’t live yet.

- According to estimates, it might take another 6-9 months for the economy to recover once businesses open up.

- The segment is expecting a slippage in NPAs with increased NPAs for March 2021 quarter.

Communicating with the right balance to ensure awareness creation, business continuity, and stakeholder well-being

- TVS Credit empowers Indians from various socio-economic backgrounds with financial products that serve their needs and enable them to achieve their aspirations

- A multi-pronged communication approach was designed in response to the COVID-19 pandemic that addressed the needs of different stakeholders such as employees, customers, and partners

- The key differentiation was in terms of our dynamic content buckets which were relooked at on an on-going basis and modified based on the evolving situation at hand. This applied to both employee communication and customer communication on our social media channels

- Some of the content buckets were on educating stakeholders on preventive measures to be taken during these testing times and business continuity communication as the markets opened up for business.

- We followed a proactive approach to our Moratorium communication campaigns. Since it involved deep understanding by the customers in order to make a decision, we created educational content in the form of videos on ‘Moratorium Simplified’ and ‘Busting 21 Myths of Moratorium’ – both of which were also recreated across multiple vernacular languages

- Since most of the customers are from the rural heartland and were transacting with us through cash payments, we created exclusive content to educate them on the alternate digital payment methods.

- As a result of these awareness campaigns, a lot of the EMI payments from cash customers are now being collected through our digital channels.

Fintech startup EarlySalary records increased community engagement:

- A vast majority of the EarlySalary user base is composed of young people who take instant loans for aspirational needs viz. travel, buying something new.

- The demand for money from such reliable customers has reduced because of the lack of luxury spends.

- There is an uptick in organic demand from avid credit card users who are a risky segment for EarlySalary (given their high propensity for expenditure) in the current economic crisis.

- EarlySalary further notes that user engagement is high as people have more downtime to interact.

- The fintech brand is using that opportunity to understand the pain points and solve them.

Reduced footfall at Future Group’s physical stores affects digital wallet Future Pay:

- The Future Group offline retail stores are observing drastically reduced footfalls due to social distancing, lockdown, and health concerns.

- The reduced footfall has resulted in a drop in the number of app opens for Future Pay.

- The stores have now started home delivery and are servicing loyal customer needs over WhatsApp and other platforms.

- The organized retail segment should benefit soon as people trust them to be more hygienic.

- The brand thus is taking preemptive steps towards building consumer trust.

Frequent communication with users is key to Future Generali’s business continuity plan:

- The Life Insurance provider is focussing on existing customers with enough data points rather than pursuing a new unknown

- The brand’s communication efforts focus on helping users understand if they have protection against the pandemic and offerings they can avail to ease the uncertainty.

- The insurance giant believes in living up to the ethos of insurance i.e., protection and prevention, by demonstrating through brand’s actions when everyone looks with a keen eye.

- The key to ensuring business continuity post-COVID-19 is to continue communicating with the audience using multiple digital touchpoints.

- Future Generali has invested in a series called ‘Mythbusters’ to cut down on fake news by distributing content curated by medical professionals.

- The Insurer has also integrated WhatsApp chatbots to help users with the right information.

- The brand is conducting a series featuring thought leaders where they share insights on how to protect the businesses amid crisis.

How is the BFSI segment approaching business continuity in the new normal?

Insights from LogicServe, a digital marketing agency serving some of the biggest names in the BFSI segment:

- The overall media spend dropped but by 30%.

- The queries from brands now revolve around setting up analytics, digital transformation strategies with CMOs going through various frameworks.

- For a life insurance company, more than 50-55% of consumers have at least one digital touchpoint before converting; folks are now enquiring on how to measure this.

- Data implementation is happening with a lot of adtech and martech tools integrated into systems.

- It is too early to say, but brands aren’t spending much, while spends from essentials are happening, but no discretionary spends.

- Clients aren’t pushing their services at all but trying to comfort the end-user and understand the pain points.

How are BFSI brands changing their marketing initiatives to account for the new consumer behavior and engagement in the post-crisis world?

Sharekhan using trading classrooms and virtual meets to engage with the community:

- The brokerage firm has started a COVID-19 package recommending relevant books and other reading material to its users, e.g., five books that investors need to read recommended by Sharekhan CEO

- The brand is conducting webinars and Facebook Live sessions with industry experts discussing topics like the situation of mutual funds market and strategies to adopt.

- As a community engagement plan, there’s much emphasis on Sharekhan classrooms teaching users the basics of trading.

Angel Broking’s synergizes content marketing, digital marketing, and advertising efforts:

- The first bucket of marketing initiatives came through content marketing practice, with the official handle involved in brand building and engagement activities with Sharekhan, HDFC securities, and more.

- In the second bucket, it was digital marketing practices like Accelerated Lead Conversion Program (taking warm leads and extracting additional conversion percentage from them) and performance marketing.

- The brand also focused on scaling up the Influencer Marketing program by building app/web-based platforms to be used by influencers.

- The third bucket surprisingly comes in the form of TV advertising at a time when many brands are curtailing their ad spends.

- Hot on the heels of recent successful TV ad campaigns, the brand is leveraging low media rates to build a stable relationship with the user

Cryptocurrency exchange & liquidity aggregator focuses on two key areas of users education and community engagement

- CoinDCX, India’s largest and safest, cryptocurrency exchange and liquidity aggregator is investing in user education as a lot of new customers take time to understand things like automated KYC

- As a business invested in community engagement, the users are the biggest sales force

The brand is empowering them by creating interesting programs and adding more and more cryptocurrencies - Announcement about a CRO coin brought from Hong Kong into the INR markets for trading saw a huge volume of interested traders

- The brand is running a trading specific competition on the platform to keep users engaged

- CoinDCX has launched ‘#TryCrypto’ campaign and invested in user education, influencers, and community efforts

- Through associations, the brand is figuring out self-regulation and in fact, CoinDCX was the first in the crypto exchange segment to be ISO certified

- The brand is ensuring guarantees and insurances on funds to provide additional benefits to users and earn their trust

Digital transformation and paradigm shift in traditional banking services:

- Karur Vysya Bank has noticed a jump in transactions through digital modes i.e., internet and mobile banking.

- Banks have started using online modes like Aadhaar identification for user onboarding.

- These offerings were available pre-COVID-19, but the shift in behavior has boosted it.

- KVB has tied up with Amazon for disbursement of loans and has already acquired 25,0000 new customers

- Amazon handles the borrower assessment while KVB’s rule engine ensures loan disbursement happens in two minutes.

- Banks are now transforming their services to ensure users can transact without having to step out.

- KVB’s effort drives these initiatives to stay relevant, helping the customer, and ensuring business continuity.

Driving user enablement through content and winning consumer confidence key to BFSI growth in the new normal:

- As a fintech company, EarlySalary is creating financial wellness programs to help users.

- As a significant chunk of the audience is salaried professionals worried about job security and career graph, the brand is creating enablement content that overlaps with EarlySalary as a business.

- EarlySalary is using multiple channels to reach and engage with users via social media.

- Through their partnerships with more than 500 corporates, EarlySalary is communicating with HRs and trying to solve the employee engagement problems through motivational speeches and knowledge sessions from industry leaders and influencers.

- One surprising fact is that the Chinese partners are open to start conversations, viz. TikTok willing to invest in brands in a very different way trying to build relationships

- With many industries operating at minimum capacity, EarlySalary is using this opportunity to engage with partners building long term understanding with a better negotiation.

Offline organized retail solving for user pain points and building for a post-COVID-19 world:

- Future Group has noticed high growth in the e-commerce and delivery segment, something the offline retailer has never considered.

- More customers are now ordering online rather than visiting the actual stores.

- The rise in online customers is because the local Kirana stores and grocers might be running short on supplies.

- Despite the massive spike in the number of people requesting for home delivery, Future Group hasn’t been able to service some of the requests due to staff constraints, and the process itself is in the nascent stage.

- The brand has integrated features like COVID-19 chat on the app, financial tie in allowing users to buy health insurance on the app, locate nearby stores, and identify the rush.

- These initiatives align with the brand’s desire to plan and build the foundation for a post-COVID-19 world.

In conclusion, it is time for brands in the BFSI segment to live up to their core motto of protection and prevention. The key to thriving is understanding the customer’s pain points and being empathetic while communicating with them. The focus should be on business continuity while protecting the employees, distributors, customers, and in turn, the brand.

Want to know more insights and business responses from other industries?

- User behavior has changed and what does that mean for marketing practices? Check out how brands are evolving their Marcom strategies to cater to the changed rules!

- How are the businesses across various verticals affected by the pandemic? Check out the industry-wide impact as we speak to marketing leaders from India’s top players.

- How are the brands and apps in Europe coping with the COVID-19 pandemic? See for yourself as our expert panel discusses the impact on LTV and acquisition for apps.