COVID-19 Impact on App Marketing, Usage, Acquisition & LTV in EU

Reading Time: 6 minutes

Businesses across all verticals and geographies are reeling under the impact of the global pandemic. Subsequently, the COVID-19 crisis and its impact on apps have been unprecedented. During such times we need to come together share insights, understand pain points, and discover remedies.

In our ongoing effort to offer varied perspectives to our community, we partnered with Adjust. The most reliable name in mobile ad measurement and fraud prevention, trusted by over 35,000 apps worldwide. Just like us, Adjust believe in making marketing simpler, smarter, and more secure. They provide measurement, fraud prevention, cybersecurity, and marketing automation products.

| Bonus Content

👉 Customer Engagement During Crisis Playbook [Download Ebook] 👉 Coronavirus Business Impact: Data-driven insights for brands during COVID-19 [Download Report] |

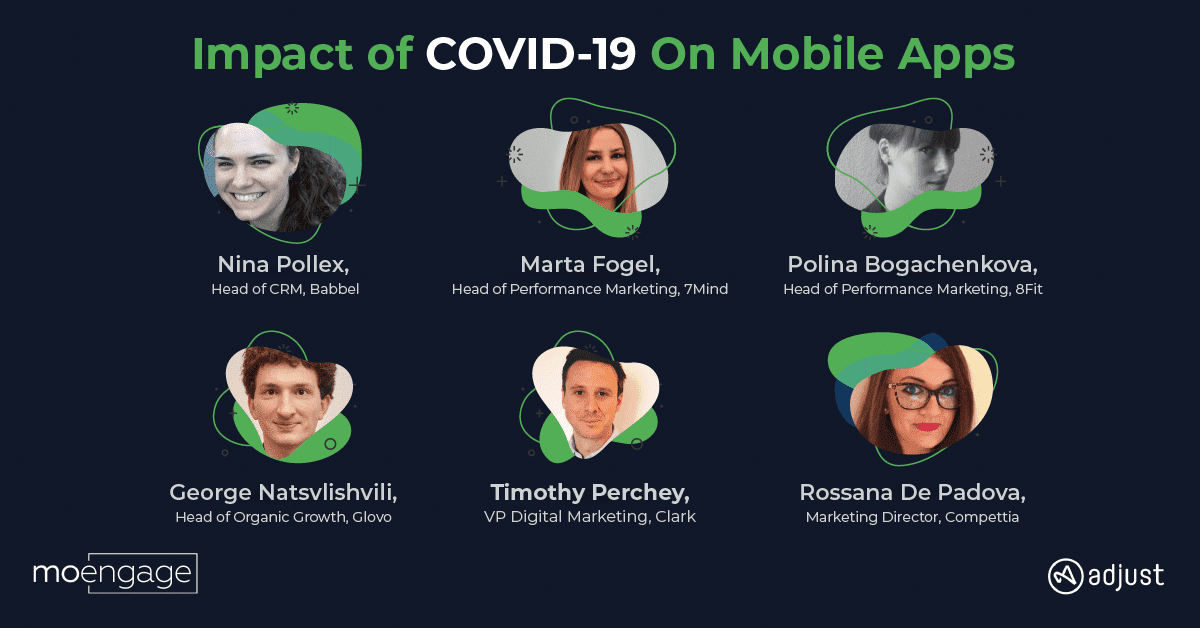

We brought together six individuals with years of experience leading marketing teams across verticals like e-learning, fitness & mindful meditation, on-demand courier service, insurance, and gamification in the EU region:

- Nina Pollex, Head of CRM, Babbel

- Marta Fogel, Head of Performance Marketing, 7Mind

- Polina Bogachenkova, Head of Performance Marketing, 8Fit

- George Natsvlishvili, Head of Organic Growth, Glovo

- Timothy Perchey, VP Digital Marketing, Clark

- Rossana De Padova, Marketing Director, Compettia

This roundtable session aimed to discuss the COVID-19 impact on apps these brands represent and to understand changes in user behavior from acquisition and engagement point of view.

Let’s dive into some of the experiences and learning shared by our panelists.

Impact of COVID-19 on app users

- While some industries like travel and hospitality, mobility, and real estate are bearing the brunt of the pandemic, others like fitness are enjoying a surprising COVID-19 impact on their app. The Berlin-based fitness app, 8Fit, has observed demands they never expected with daily and weekly active user numbers going through the roof. According to Polina Bogachenkova, Head of Performance Marketing at 8Fit, the brand has been offering free exercise lessons. The brand is engaging users through their 700,000+ follower Instagram account by organizing daily 5 PM guided exercise classes. 8Fit has also noticed a positive change in the user activity curve, with users coming to the app every day and, in fact, multiple times, due to the unavailability of offline gyms. With various apps offering free services during this situation, 8Fit is now more focused than ever on providing quality content to the end-user, ensuring they stick to the platform.

- The mindful meditation app, 7Mind, has recorded a massive uptick in user activity, installs, and all other KPIs they track. They have adopted a holistic approach to user acquisition and CRM. They had quickly rolled out dedicated crisis content to help users unwind, relieve the stress, and deal with anxiety. This content is offered for free and is accessible to anyone when they download the app. The brand has changed from a premium to a freemium model and introduced meditation programs for young children to help stressed-out parents.

- Compettia (Atrivity) the gamification platform offering customized solutions to businesses has reported good acquisition numbers while retaining a lot of the existing users. Most of the new users came from inbound efforts as more and more brands realize that the gamification app for learning is not just a bonus but a genuine need. The brand is covering pain points for different buyer personas through their content apart from spreading awareness and highlighting how other companies are dealing with the crisis.

- Babbel, the subscription-based language learning app offering 14 different languages, has also observed a massive boost to their numbers with an upswing in DAU and installs. The brand is offering ad hoc personalizations without being too emotional and instead focusing on what Babbel can provide at this time by being a positive distraction in people’s lives. A personal message from the Babbel CEO received extremely positive feedback from its user base.

Engaging users & ensuring activity

Gamification platform Compettia (Atrivity) is helping out clients by providing customized gaming programs to keep their employees engaged, ensuring they don’t feel abandoned or lost. They are working on ad hoc strategies specific to each vertical and industry they serve.

The customized gaming programs help train employees about business processes and company information. With two of Compettia’s biggest partner verticals, pharmaceutical and retail in turmoil, the brand is offering training programs via trivia games to teach medical reps and retail workers about their industry in this downtime to utilize once things return to normalcy.

Apps alleviating the impact of COVID-19 pandemic

- Clark, the Germany-based Insurance company, noticed an initial dip for 1-2 weeks as consumers focused on food, shelter, and essentials in favor of other expenditures. The unusual user behavior has stabilized since. The insurance provider is focusing on educating the user about being insured during the crisis. Being based in Germany, where employees are working part-time and the government subsidizes the difference in salary, it is essential to explain to the users how policies change as they’re no longer full-time employees and work out of home offices. Clark is doing precisely that by giving indications as to how the current situation affects insurance cover by creating content that helps users understand better and feel secure during these uncertain times.

- Glovo, the Barcelona based on-demand courier service, is working with charity organizations like UNICEF, delivering some products for free to senior citizens, helping the medical industry by providing pharma essentials. During this crisis, the brand has shifted its focus and strategy from food & restaurants to grocery and essentials, with restaurants shutting shop (thereby declining orders) and people not stepping out of homes due to social distancing.

Changed online marketing strategy due to COVID-19 impact on apps & acquisition

- 7Mind is offering daily live meditation across all social media channels, helping users meditate together. They are also engaging with their community on the active Facebook group, where they’re getting a lot of requests from the users asking for advice. The CRM campaigns run by the brand about different tips on releasing stress and how to deal with the situation saw an overwhelmingly positive response from users. 7Mind is ensuring that the content assets i.e. copy and creatives, they’re releasing focus on stress reduction without talking too much about the COVID-19 situation which users are tired of hearing about. They have noticed that CPI/CPS has dropped considerably, making user acquisition cheaper depending on channels.

- 8Fit has changed its user acquisition strategy to ensure they allocate budgets where there is an apparent demand, and the app can provide a solution. They are quick to shift budgets to content with a market, even if it wasn’t a focus area before. According to Polina, marketers generally prioritize ROI, but now is the time to focus on helping the user and come out as an empathetic brand. 8Fit is tailoring their communication to help users to workout from home using everyday objects like chairs, water bottles in the absence of fitness equipment.

- Babbel has taken a step back and scrutinized their communication viz. emailers, automated flows, and daily/weekly notifications to ensure there is no irrelevant information going out during these sensitive times to prevent being tone-deaf. They’re introducing personalization in their welcome flow, and point towards offerings like podcasts, free one-month for students, and one week of free trial for every user. They have tweaked their user acquisition and engagement strategy to increase the content frequency bearing in mind the engagement patterns.

- Clark has been quite agile in its user acquisition strategy by shifting budgets to different avenues where the users are, like podcast/influencer advertising. In contrast, their offline and TV spends have taken a hit. The insurance industry is such that the content is super evergreen, due to which the brand wasn’t able to leverage on relevant content much, which they’re working towards resolving. The users have neither engaged more nor less; however, there has been a slight increase in their performance.

- Compettia has started focusing on verticals, where they have most customers like Pharma and Retail. They have also changed their social media strategy, increasing their presence on LinkedIn. The brand has gone from publishing once a week to posting every day to show clients that they haven’t stopped working. The brand’s communication has evolved from ‘engaging employees who’re working from home to ‘talking about bounce back strategy’ as the situation changes. Compettia is focused on adding value to the users through their content, as their users have ample downtime owing to the lockdown.

COVID-19 impact on apps & LTV Considerations: Bounce-back & business continuity

Most of the brands echoed the same sentiment of prioritizing users and helping them even if it doesn’t yield immediate profits or means incurring short term losses. Right now, it is about showing how your app is a genuine need and can resolve pain points, and that will have a long term positive effect on the LTV. Brands doing it right like 7Mind are already recording uptick in retention and session duration.

Change in user-preferences and shifting focus from the main category.

- Glovo’s main category (i.e., food) and critical partner McDonald’s shut down across many countries. The brand has leveraged opportunities to enter other categories like grocery, which is experiencing growth as people are in lockdown and prefer ordering groceries online.

- The high-priced all-language package of Babbel has seen more adoption. Usually, not many people buy it because of the price and the commitment of earning multiple languages simultaneously. The change in user-behavior is due to downtime.

- Clark has recorded an organic rise in morbid insurance schemes like Sterbegeld i.e., funeral insurance.

Changed user acquisition budgets due to COVID-19 impact

The cheaper acquisition costs mentioned earlier by 7Mind are increasing, according to Marta. She suggests, according to the recent trends over one week, she expects the prices to get more expensive further saying, it is not the time to drive user acquisition for apps negatively impacted by COVID-19 viz. travel.

In conclusion, the essential learning across all verticals has been to empathize with the user during these tough times and focus on helping them, solving pain points rather than hard selling.