Customer Engagement for Banking in Southeast Asia: Engagement Benchmarks and Segmentation Tactics

Reading Time: 10 minutes

Southeast Asia’s mobile finance and retail banking vertical has been on a growth trajectory, with investors injecting fresh capital to encourage digital banking drives in the region. With a positive trend of licensing regimes allowing up to 8 additional licenses by the end of 2021, the banking and finance industry in SEA is expected to see further growth. In this article, we’ll break down customer engagement for banking in Southeast Asia, by understanding the growth trends, engagement benchmark, and segmentation strategies that drive personalized experiences.

With the pandemic shifting customer behavior in favor of digital and online banking, it is fair to say branch visits have seen dwindling numbers. Our state of mobile finance report 2021, suggests physical branch visits to reduce from 6 times a year to 2 by 2022, especially among Gen Z and younger millennials aged 18 to 24. In fact, RCBC (Rizal Commercial Banking Corporation), one of the trusted commercial banks in the Philippines, has ordered for closure of more than 70 physical branches in light of digital transactions growing by 208%. Physical banking isn’t the only aspect observing a dip in usage, with app-based personal finance management trumping desktop usage, which is further expected to decrease by 63% by 2022. Evidently, DiskarTech, RCBC’s financial inclusion super app has observed its quarter-on-quarter usage grow by 388%, along with over 4 million downloads and close to 2.5 million registered users.

The emergence of a new, digitally transacting customer segment and how to engage them better

With a new segment of customers primarily transacting digitally, it has become all the more important for banks and financial institutions to rethink customer engagement for banking in Southeast Asia.

In 2020 alone, over 40 million people across Southeast Asia countries like Indonesia, Singapore, Malaysia, the Philippines, Thailand, and Vietnam came online for the first time. With an influx of 400 million internet users in these countries, signaling an 11% in online users, Southeast Asia arguably has the largest number of digitally engaged users. In order to meaningfully engage customers in SEA, banks need to provide personalized financial recommendations and a high-touch, offline experience in an online space.

Banking and financial services need to understand that the key to hyper-personalization is relevant communication that adds value to customers. The ‘spray and pray’ approach is gradually giving way to data-driven, insights-led customer engagement. This approach not only fast-tracks business growth but also helps in optimizing retention, repeat transactions, leading to higher lifetime value.

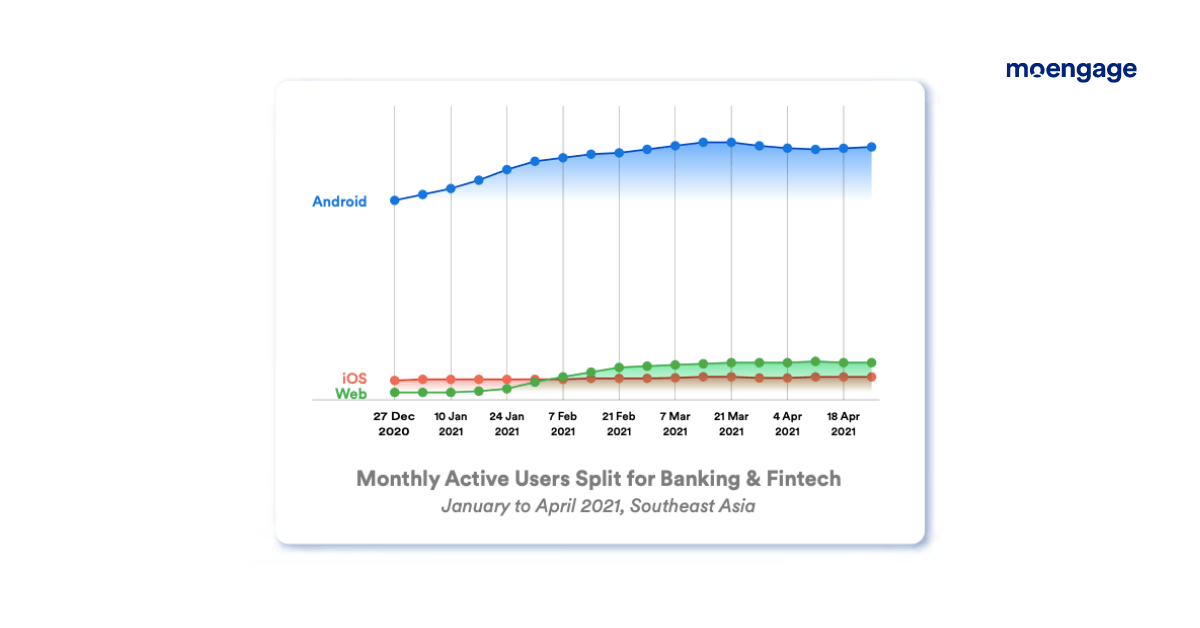

To understand how digital consumers in Southeast Asia are interacting with communication from banks and fintech, check out our customer engagement benchmark report, with insights from more than 6.6 million users. The report contains Daily Active User, Monthly Active User trends (from January – April 2021) along with benchmarks for clickthrough rates and conversion rates across push notifications, in-app messages, and emails.

Reframing customer engagement for banking in Southeast Asia: Understanding change in user behavior and corresponding communication benchmarks

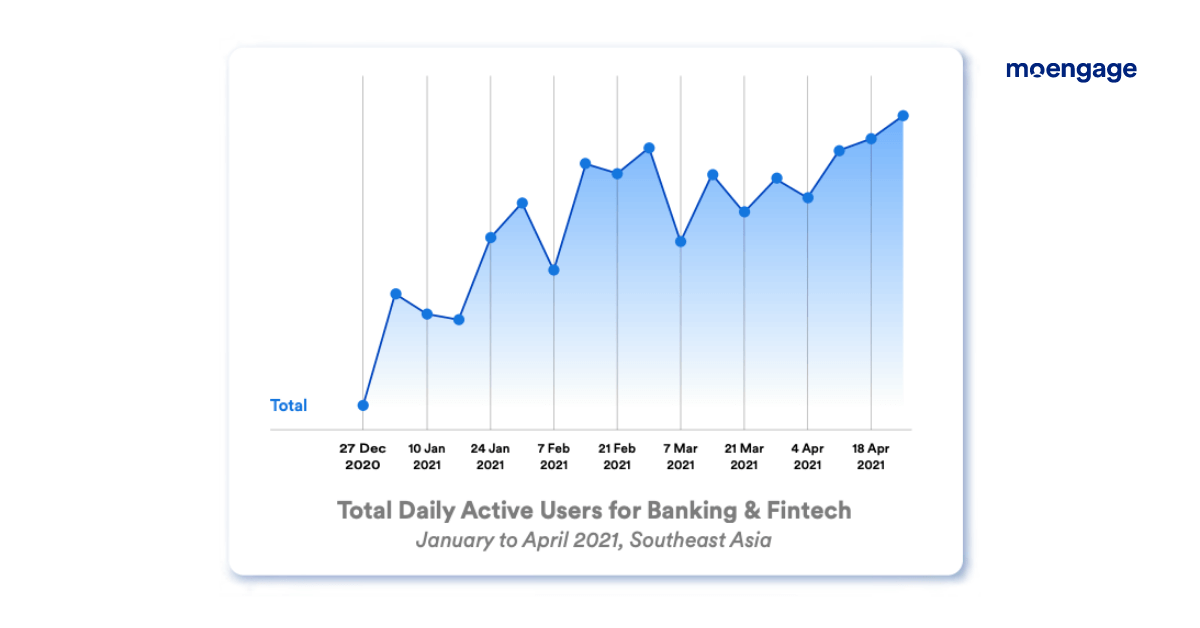

With the influx of new customers coming online for the first time, coupled with renewed interest in improving financial outcomes, there has been a 54.29% increase in daily active users (January–April 2021) for banking sub-segments like payments, P2P lending, insurance, and crypto trading.

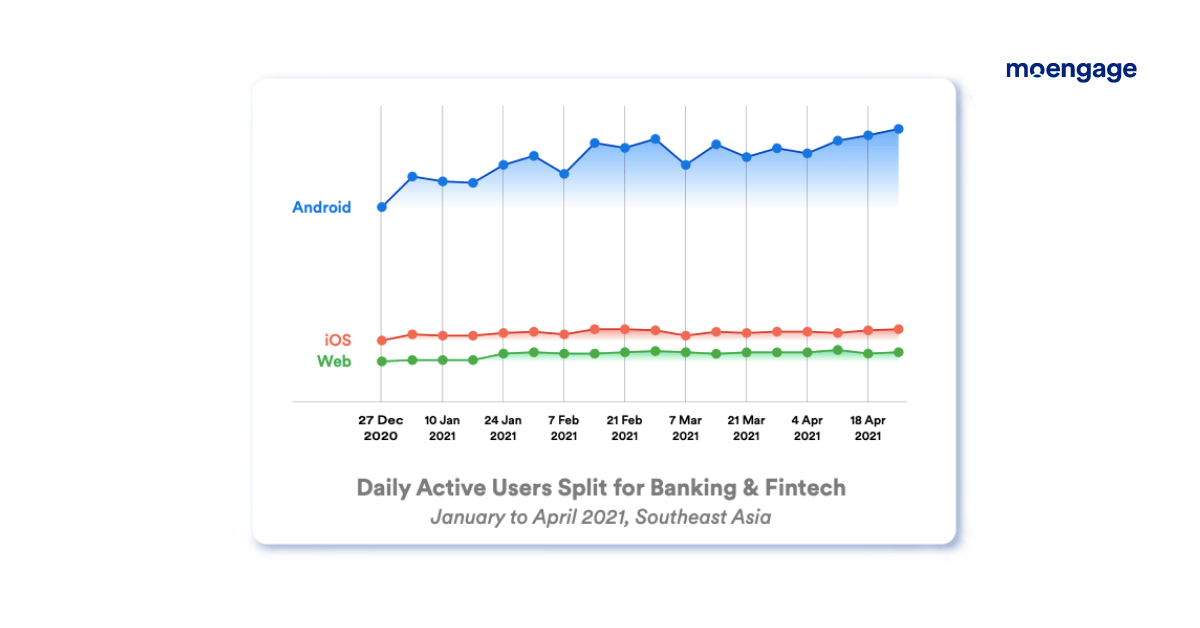

The channel-wise split indicates a 50.07% increase in DAUs for Android devices, with a 48.16% increase for iOS devices.

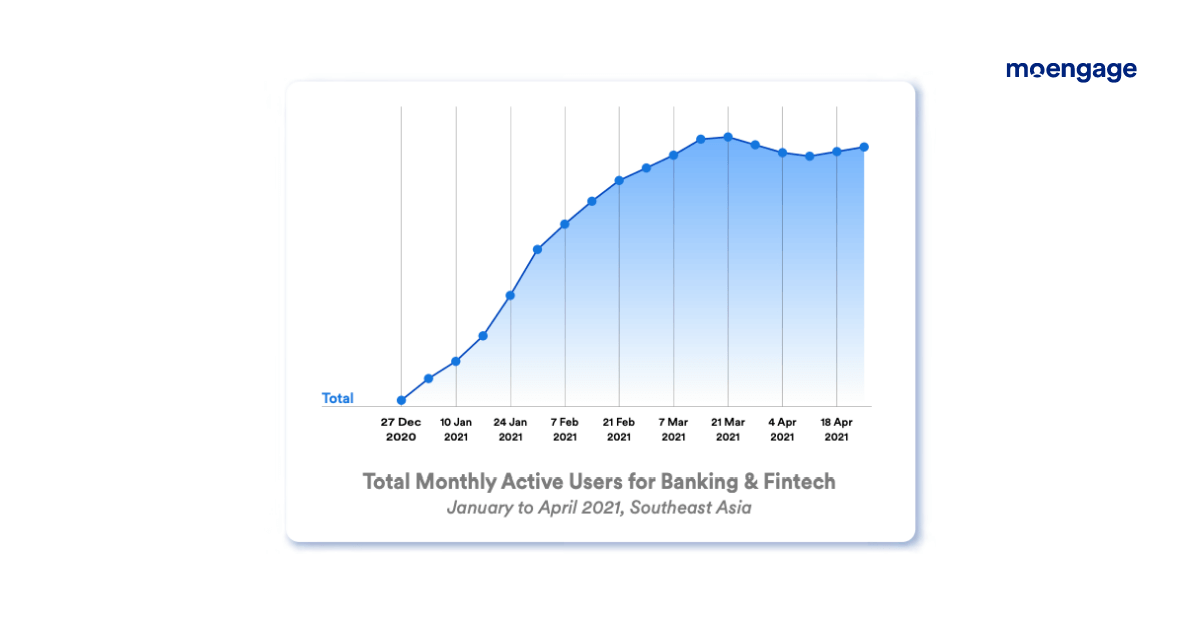

The Monthly Active User (January–April 2021) growth trend follows a similar pattern with an overall increase of 38.43%.

The split for MAU depicts a 26.76% increase for Android devices with a 17.69% for iOS devices.

Now that we have established the daily and monthly usage trends of banking and finance apps, let’s look at the customer communication benchmarks and how behavior-based interaction can help. We’ll be looking at the benchmarks for push notifications, emails, and in-app messages.

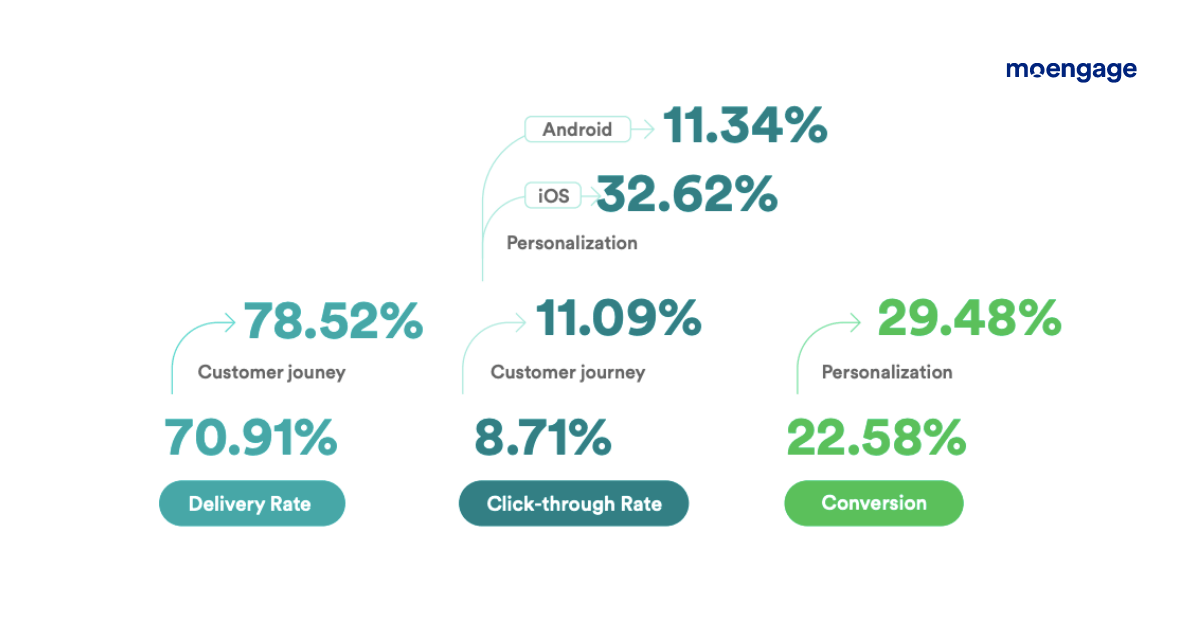

Push Notification Benchmarks

Contextual communication based on user behavior and actions across the customer’s lifecycle has proven to get more traction than generic broadcast notifications. Personalizing fields while sending push notifications have ensured delivery rates hit 78.52% and CTRs improve to 11.34% for Android and 32.62% for iOS devices, along with conversion rates increasing up to 29.48%.

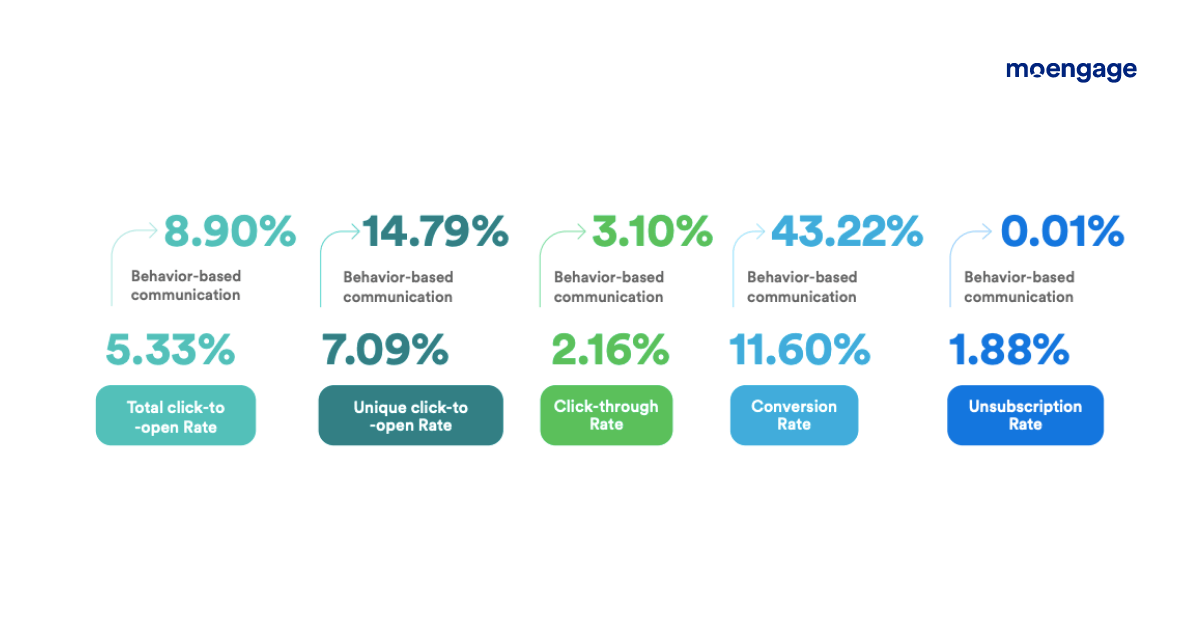

Email Benchmarks

The same trend follows for emails, as indicated by an increase of 8.90% in total click-to-open rate for email communication based on user behavior and past actions. The unique click-to-open rate also increases to 14.79%, with CTRs and conversions going up to 3.10% and 43.22% respectively. With a 0.01% drop in unsubscription rates for campaigns, it goes to show the importance of behavior-based communication.

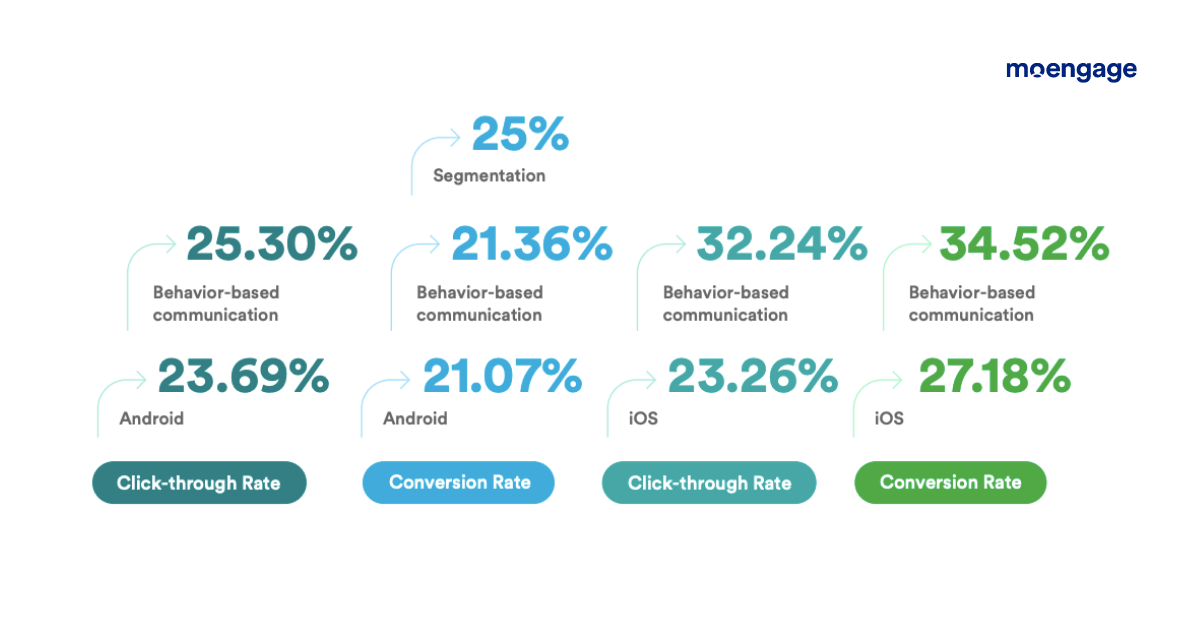

In-app Messages Benchmarks

A behavior-based approach to customer engagement for banking in Southeast Asia, bore fruit even for in-app communication, with improvement observed for both CTRs and conversion rates. Android devices notice a 25.30% increase in CTRs with a 21.36% increase in conversion rates, while iOS devices observe a 32.24% increase in CTRs with a 34.52% increase in conversion rates. This further indicates that banking and finance apps in SEA respond better to contextual and relevant information. Segmentation has emerged as another way to improve conversions, with segment-specific communication improving conversions on Android devices up to 25%.

Lessons in customer engagement for banking in Southeast Asia from top banks and financial institutions

In order to optimize customer engagement for banking in Southeast Asia, brands need to rethink their segmentation and personalization strategies. After understanding the shift in user behavior and communication channel benchmarks, let’s look at the segmentation and personalization strategies adopted by top banks in SEA:

Kredivo’s impact-driven segmentation using an attribute-scoring data model

At Kredivo, our priority is to help our users maintain their purchasing power with access to credit at a very low cost. From a user behavioral point of view, it is interesting to note the receptiveness to new payment and alternative lending methods like buy now pay later, across all age groups – Alethia Tan Head of Growth, Kredivo.

Kredivo of late has observed an increase in receptiveness to digital payments across all age groups post-pandemic. The shift in user behavior is apparent in the sharp increase in digital adoption. As users switch to digital, they have access to a vast amount of information that needs to be validated. Providing customers with the right information at the right time and on the right channel is the key to meaningful engagement. In fact, a 2020 deep study conducted by Kredivio in association with the Indonesian research firm, Katadata, revealed that the frequency of online purchases is comparable across all age groups. This is contrary to the popular notion that millennials drive digital payments.

The Buy Now Pay Later (BNPL) platform leverages data analytics to segment users into various buckets as the kind of content and channels used vary. Data analytics-backed insights play a crucial role in determining how to engage users. For example, while targeting baby boomers, it is imperative to understand their financial preferences and incentivize purchase intent by ensuring the right information is being conveyed.

In addition to looking at the cash transaction behavior of the user, Kredivo maps out the customer journey first and identifies the key drivers of each stage. They then prioritize users based on which group would have the biggest impact. It could be the size of the pool or the ones that are getting the most revenue. The focus is to gather enough data to work with so that your hypothesis can be more accurate.

We use a data science model to score the demographics, geographic, and psychographic information. This results in a heat map, which helps us to prioritize which segment to focus on. Once we collect this data, we profile each segment to get a user persona. Within that segment, we then see if you have similar characteristics and then personalize the messaging for A/B testing with a control group. The idea is to test all hypotheses before launching a full-fledged campaign – Indina Andamari, VP Head of Marketing & Communications, Kredivo

Advanced segmentation tips from Cashalo: Using behavioral data and actions to create tags and values across milestones

The key to advanced segmentation is creating tags and values based on behavioral data and user actions. Permutations of these tags and values, corresponding to certain milestones, can be used to develop customer segments based. Banks and fintechs can then personalize communication and recommendations for each advanced segment’s requirements. Banks and fintechs need to utilize all customer data available to make informed decisions and predict when and where customers are most likely to complete a transaction.

To run a collection campaign, it’s really important to collaborate between the Marketing and the Collections teams. Leverage all the data that you have to navigate customers to the right place from where they can pay back loans- Paul Bantayan, Head of Marketing, Cashalo

Behavioral segmentation, the secret to OVO’s precise customer targeting

One of the most effective segmentation techniques is behavioral segmentation, which buckets customers into different cohorts based on how their actions, i.e. in-app behavior and transaction pattern. This enables OVO to precisely target customers and optimizes their A/B tests. This works out so well because rather than relying on presumptions or hypotheses, the customer experience provided is based on real data. OVO then uses this behavioral data in combination with predictive and deterministic models to drive business growth.

When segmenting users, we look at the product funnel journey and see where the traffic came from (source attribution) and if the customer was acquired through digital channels such as TikTok, Facebook, Google, etc. We then look at different segments within these channels and study their behavior before we dive into behavioral or transactional data. – Agnes Lie, VP of Growth Marketing, OVO

Amar Bank’s effective and efficient need-based and want-based segmentation framework

Amar Bank’s goal is to look at the ‘need-based’ segments (customers who are in need of a loan) while considering ‘want-based’ cohorts (customers in need of a loan for buying an electronic device).

Amar Bank also prioritizes understanding who the target audience is, as it helps in discovering things the customer doesn’t want on top of what they want. Banks and financial institutions need to understand the need, necessity, and demand throughout a customer’s lifecycle. Using the customer data, banks can then create relevant micro-moments to engage customers, highlighting benefits and value adds.

Before you start your segmentation, start with empathy and understand what the customer is lacking in their life so that you can fill that gap. It’s important to backward integrate the product to a forward integrated behavior or vice-versa. – Khalid Raheel, CMO, Amar Bank

Koinworks approach to getting users hooked via customer education

It is very important to educate customers and provide them with all the necessary help, especially in a tumultuous post-pandemic world. Marketing that appeals to the right customer sentiments will go a long way in effective acquisition. If banks and fintechs want their customers to interact with their communications (messages or emails), they’d need to add value or provide a relevant solution to the customer pain points. Banks should also consider the usage of channels to ensure they don’t come across as non-relevant spam.

When you want to push something out in the market, increase the cadence of brainstorming sessions. No idea is ever really small. Building a philosophy or culture of discussing problems, not just solutions will create a more inclusive environment and increase the inflow of fresh ideas. – Aditya Chintawar, VP Product, Koinworks

In the Philippines, there’s a substantial unserved, and underserved market, and CIMB Bank realized that financial literacy is the way forward. They started building a series of ‘How To’ videos called ‘Digital Banking with CIMB’. Through the educational and financial literacy content, CIMB Bank is building trust among customers and understanding what it means to open a bank account with CIMB Bank.

Philippines-based Rizal Commercial Banking Corporation (RCBC), realized that for DiskarTech, their financial inclusion super app, over 70% of the subscriber base are from rural areas. RCBC planned massive education initiatives like their partnership with Viber to educate the masses about financial literacy. They also released a digital coffee table book meant for financial literacy in partnership with the Philippines’ Ministry of Education and Ministry of Credit Industry. The aim is to educate every Filipino about financial jargon by communicating in more than English, in Tagalog and Cebuano dialects.

How financial institutions can rethink customer engagement for banking in Southeast Asia using an insights-led approach

The development in the mobile banking, fintech, and financial services ecosystem is driven by the demand for better facilities, access to financial information, transparency, easier and faster transactions, secure authentication, and meaningful support throughout the customer lifecycle. As evident from the communication benchmarks and usage trends, it is clear that the banking and finance industry in SEA is picking up momentum. While the pandemic acted as an accelerant to this process, engaging these newly gained customers is of vital importance to ensure consistent growth in the future.

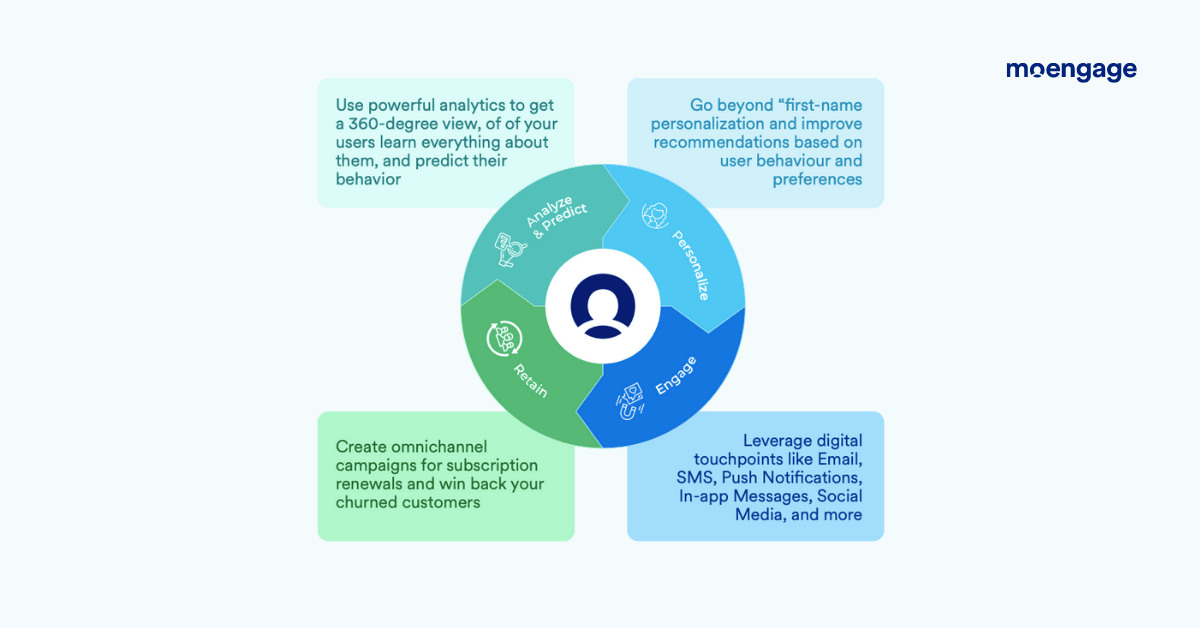

Banks and fintech need to understand that in order to rethink customer engagement for banking in Southeast Asia, they must adopt an insights-led approach. It can help banks and fintechs crack customer-centricity and use behavior-based communication that is relevant to customers and adds value to them.

As more and more digitally-transacting customers join the banking sector, providing relevant recommendations, timely reminders, and valuable offers has become all the more important. Here’s an intelligent, data-driven approach to customer engagement, that we like to call ‘insights-led engagement’, and here’s how it works:

Now, that you understand what an insights-led engagement framework looks like, here’s how you can achieve it:

- Behavior-based communication

- Effective segmentation

- Communication aligned with the customer journey and buyer lifecycle

- Personalization

- AI-driven Optimization

There has been tremendous growth in SEA’s banking and finance sector in the last five years. By 2016, nearly half of the global population and 70% of millennials (key growth drivers) were using mobile banking apps to check balances and carry out financial transactions. Fast forward to 2019, and 87% of banks (with assets between $50 million and $50 billion) were providing customers with mobile apps. To help understand the future scope and potential, estimates suggest that the number of mobile users will reach 7 billion in 2021; 3 billion of these are likely to register on mobile finance apps.

With the rapid adoption of digital banking and finance, it is critical for financial organizations to consider these emerging usage trends and understand the communication benchmarks to better segment and engage customers. We hope this article was able to inspire you with insights from marketing leaders at leading Southeast Asian banks and fintechs.

Further Reading:

- Check out the lessons in customer engagement for banking in India from top players

- Check out how banking apps can win the holidays with a data-driven engagement

- Discover the growth of fintech along with the impact of consumerization and digitization

- Choose the right engagement platform for your bank or financial institution

- Six signs that your financial institution needs an engagement platform urgently!