How E-commerce Marketplaces can Boost Retention in Vietnam

Reading Time: 5 minutes

Amidst plummeting GDP rates in Vietnam, the rise of profitable E-commerce businesses is keeping the vibes alive for the economy. Thanks to an upbeat consumer attitude towards E-commerce, coupled with a parallel rise of mobile internet and digital financial services, online shopping marketplaces have seen a steady rise.

70% of Vietnamese consumers have mobile internet connectivity coming from a massive 61 million smartphones. In addition to that, 38% of online buyers have paid using E-wallets in Vietnam which is already way ahead of a projected 22% by JP Morgan, making Vietnam a preferred choice for many overseas and homegrown E-commerce marketplaces and startups.

These marketplaces host sellers and attract buyers to drive sales, similar to the rest of the world. However, what differentiates marketplaces in SEA from the rest of the world is the additional aspect of shoppertainment. It is not surprising to see Lazada, Shopee, and other leading marketplaces hosting shoppertainment events from time to time in Vietnam.

While the underlying idea of engaging customers using entertainment looks promising, low retention rates in Vietnam and the SEA region leave many aspiring E-commerce startups perplexed at the same time.

This post will examine how E-commerce marketplaces look from a functional perspective in Vietnam and SEA. Additionally, we will also look at the common retention bottlenecks and map them to the respective functional part of a marketplace, and finally to the most common customer complaints in the app store for these apps. In the end, we will see if insights-led solutions can help overcome these challenges and boost your retention rate.

E-commerce Marketplaces in Vietnam and SEA

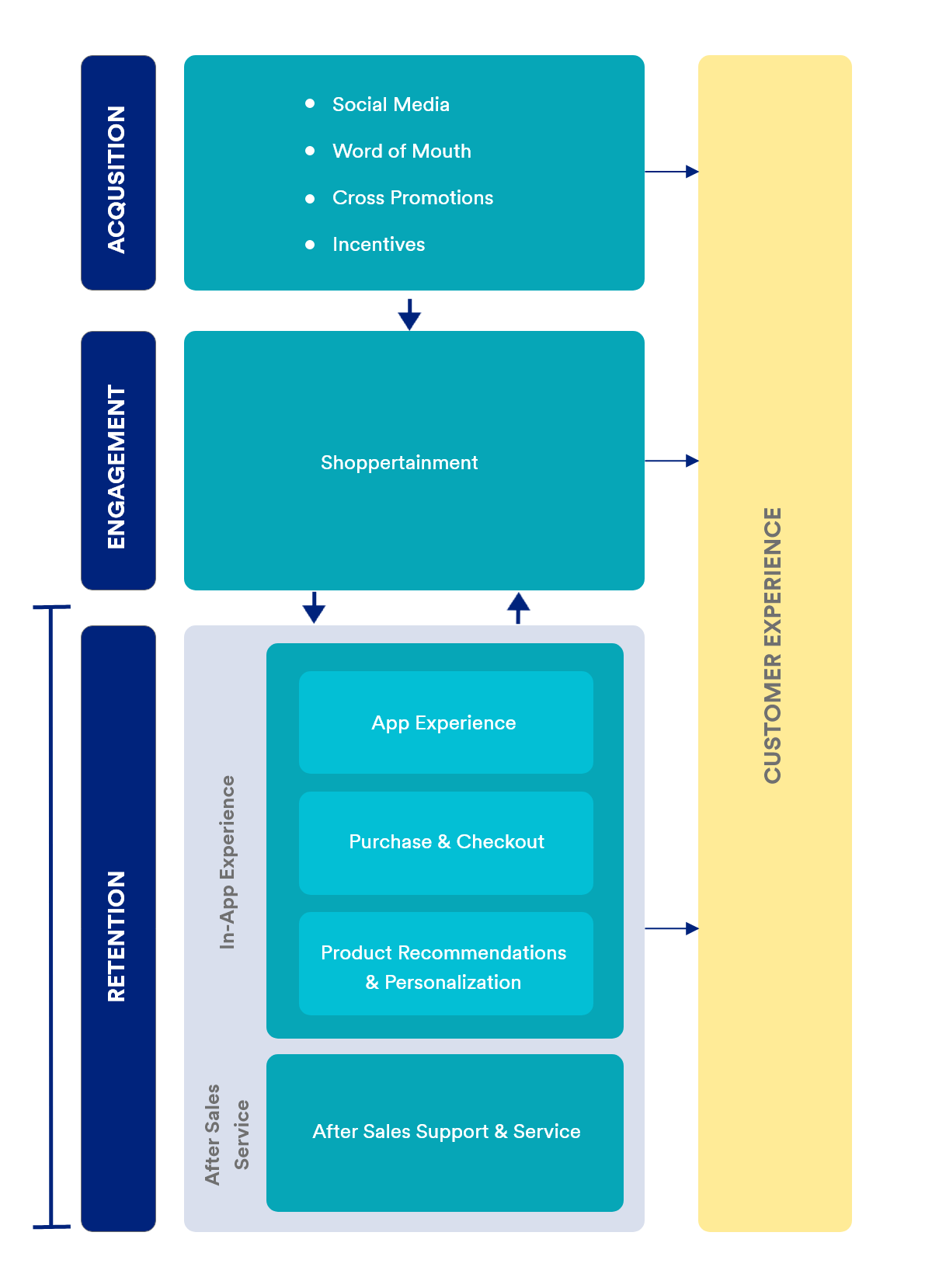

When we look at leading E-commerce brands of Vietnam from a functional point of view, it seems like most of them have evolved into marketplaces focused on three key aspects. These are:

- Acquisition

- Engagement, and

- Retention

Acquisition: Marketplaces in Vietnam acquire customers mainly from social media channels like Facebook, Instagram, and Youtube. Lazada, Shopee, and Tiki have successfully acquired millions of customers from these platforms from time to time.

In addition to that, word of mouth marketing triggered by low fees, free deliveries, and cross-promotions also contribute a lot to customer acquisition for these E-commerce companies.

Engagement: Unlike other parts of the world, where E-commerce marketplaces are all about driving value by offering relevant products, the E-commerce landscape in Vietnam and the SEA has a strong customer engagement angle to it as well.

Shoppertainment activities and events frequently happen within these marketplaces to keep the customers entertained, engaged, and drive sales as a byproduct.

Additionally, these events serve as an excellent platform for sellers to showcase and merchandise their products in attractive ways to drive more sales. The engagement factor makes marketplace models in Vietnam and SEA different from the rest of the world, where engaging customers using entertainment is not common.

Retention: Two aspects create a great E-commerce experience – Product and Delivery. You can expect to retain customers and drive recurring purchases only when you get both aligned. And this is what the third functional aspect looks like for marketplaces.

A great in-app shopping experience, hassle-free checkout, and product recommendation make up the first part while the delivery and after-sales support make up the second part of the experience that drives retention.

Leading marketplaces in Vietnam such as Tiki, Lazada, Shopee, Thegioididong, Dienmayxanh, and Sendo try to ace the retention part by all means. Not only do they work tirelessly to build the best in-app purchase experience, but also complement it with an array of support services to empower the seller.

The ultimate goal is to get regular customers to drive recurring purchases and revenues for the seller that translates to more commissions and more profits for the marketplace. But despite all of this, E-commerce retention in this region remains on the lower side.

Dissecting low E-commerce retention rates in Vietnam and SEA

You might be surprised that the average retention rate is less than 25% for E-commerce businesses in the SEA region. Yes, dissatisfied, disloyal, and disengaged customers are plentiful in Southeast Asia, who seem to be unhappy for multiple reasons.

A peek into the Play Store, and you will find many reviews that are mostly centred around:

- Poor Customer Service

- Poor in-app experience

- Late Delivery

- Misleading product description/merchandising

- Unavailable Product option

- Unavailable payment method

- Card/coupon not working

If your E-commerce app has got critical reviews similar to this, working your way backward towards in-app experience and then mapping them to the most common factors that hurt retention in E-commerce can give us some solid insights.

So, let’s map the respective app functionalities and after-sales service to common churn factors and app store reviews in one single representation.

| Focus Area | Reasons that hurt experience and retention | What’s reflected in the app store |

| Site/App Experience | 1. Cluttered UI 2. Being asked to type billing and address more than once 3. Key feature(s) out of reach 4. Overall bad UX and product photography |

1. Poor in-app experience 2. Misleading product description and merchandising |

| Purchase and Checkout | 1. No guest checkout 2. Failed checkout with hard to understand reasons 3. Not showing cart items during checkout 4. Limited payment options |

1. Unavailable payment method 2. Card/coupon not working |

| Product Options and Recommendation | 1. Absence of product width and depth 2. Overall bad assortment and product mix 3. Not saving last browsing history or purchases (Lack of Personalization) |

1. Unavailable product option |

| Support Services | 1. Unsatisfactory refund policy 2. Late delivery 3. Poor customer support |

1. Poor after-sales service 2. Late delivery 3. Late refund |

Solution

Develop a personalization strategy

Just the way retail shopkeepers offer or upsell products based on your preferences, your E-commerce marketplace must do the same. Personalized recommendations routed using an omnichannel approach can effectively drive sales from disloyal customers who switch to your competitors.

Personalized omnichannel marketing helped Tokopedia, Indonesia’s leading E-commerce marketplace, create a robust workflow to guide customers from installation to first purchase to recurring purchase sessions. Tokopedia boosted its retention by 60% and sales by 20%.

Focus on customer drop-off

Poor app experience, especially a bad checkout experience, makes customers drop off and become dormant. These customers often complain about payment options not being available or invisible items in the cart and failed payments.

Insights on the customer journey must be tapped into and decoded with the help of user paths. These not only allow you to uncover the hidden reasons behind drop-offs but also open up multiple opportunities.

Capitalize on loyal customers using RFM

One of the ways to score a higher retention rate is to enable recurring purchases for your loyal customers and the best way to do that is by further segmenting them based on recency, frequency, and monetary value (RFM).

RFM allows you to segment your customers by calculating their RFM scores behaviorally. After the scores are assigned for the segments, discreet engagement strategies using RFM are applied to engage these customers to drive recurring sales.

Conclusion

Vietnam is a hot spot for E-commerce startups, with marketplaces leading the market. But despite being a lucrative market with an enthusiastic customer base, and active seller support from marketplaces, the retention rate in Vietnam and the SEA remains challenging. An insights-led approach towards personalization, customer journey analysis, and behavioral segmentation can help entrepreneurs and E-commerce marketplaces to address these bottlenecks and thrive in Vietnam and Southeast Asia.

Further Reading

- How Alfagift boosted their transacting customer base by 45% using connected retail approach

- How POPS Worldwide Increased Product Stickiness by 19% via Personalized Content Recommendations