Festive Season 2021 Report For App Marketers in Southeast Asia

| 👉 We recently partnered up with InMobi to study the spending behavior of consumers and in-app strategies of brands in Southeast Asia this Festive Season. Grab a copy of the report here. |

Southeast Asia is one of the most diverse regions across the globe, renowned for its rich mix of cultures, ethnicities, and identities. Starting as early as October, the festive spirit sets in across the region giving consumers an opportunity to celebrate for the rest of the year. Owing to the COVID-19 pandemic, Southeast Asian consumers have witnessed a rather different Festive Season in 2021.

The pandemic has led to an accelerated and sustained shift in consumer behavior. Southeast Asia is one of the leading regions for smartphone users. Consumers in this region make all their shopping decisions on their first screen: The Mobile.

To reach and engage mobile-first consumers effectively, it is imperative for brands to understand these consumers and their preferences. It is also important to get the right in-app strategy in place to build real connections and memorable experiences.

Festive Season 2021 statistics and trends

Here are some statistics and trends to understand the connected Southeast Asian consumer in 2021:

Spending statistics

- 1 in 2 Indonesian consumers is expected to spend more than IDR 500,000. This indicates a massive growth in Festive Season budgets.

- In the Philippines, mothers don the role of primary influencers during the Festive Season, looking to make smarter purchasing decisions in 2021. The average Filipina family is expected to spend over PHP 7627 this year.

- The average consumer in Singapore is expected to spend SGD 336, with 1 in 2 consumers willing to spend more than SGD 1000 during the Festive Season in 2021.

- There is a 24% increase in budgets for online shopping in the Southeast Asian region. At the same time, offline budgets are expected to decrease by 47% this year.

Purchasing behavior trends

- 93% of consumers in Southeast Asia are planning to leverage online channels this year for their shopping needs.

- 70% of Southeast Asian shoppers intend to use smartphones to explore and buy products this Festive Season 2021.

- 39% of consumers in this region are first-time online shoppers.

- 56% of Southeast Asians intend to shop online while only 7% of consumers plan to shop offline this Festive Season.

Consumer behavior statistics

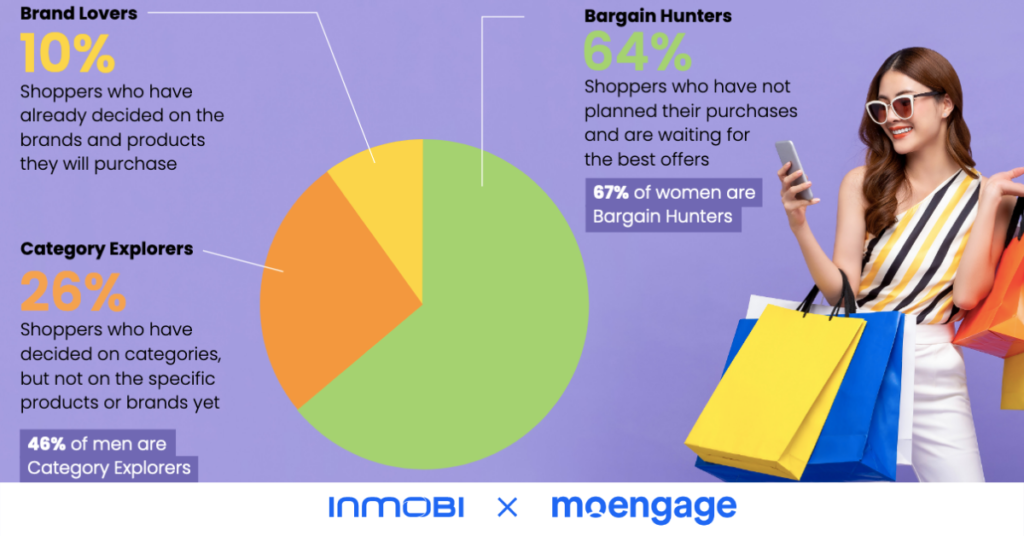

- 64% of shoppers in Southeast Asia are waiting for the best offers this year before making a purchase. 67% of women shoppers in this region are “Bargain Hunters”.

- 26% of Southeast Asian consumers have decided what categories they want to shop for, but have not narrowed down on specific products or brands yet. 46% of male shoppers in this region are “Category Explorers”.

- 10% of consumers are “Brand Lovers” and have already decided which brands and products they will be purchasing.

What app categories will see growth during the Festive Season in Southeast Asia?

In this mobile-first region of the world, where millions of consumers use smartphones for work, shopping, entertainment, recreation, leisure, and personal finance, the Festive Season ushers in a tremendous opportunity for growth.

1. The shopping boom this Festive Season is inevitable

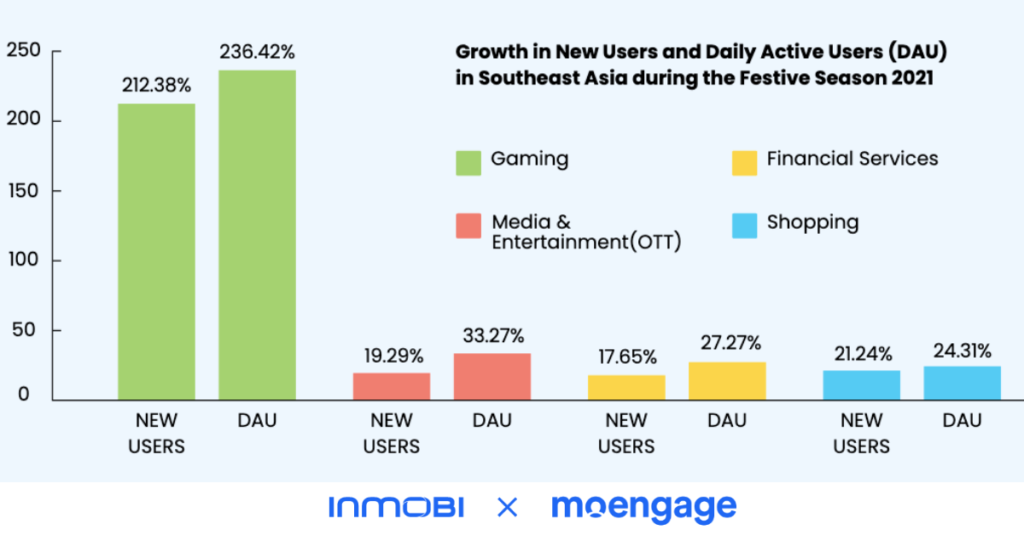

In 2021, over 40 million consumers in Southeast Asia came online for the first time, leading to the number of new users of E-commerce, Retail, and D2C brands shooting up to about 17 million. The number of new users is expected to go beyond 20 million during the festive season, growing by 21.24%.

The number of daily active users (DAU) is predicted to increase by 24.31% while the number of monthly active users (MAU) is expected to reach 35 million for Shopping apps during this Festive Season.

2. Real money and hyper-casual games are the new go-to entertainment sources

The past year has been responsible for introducing new and unpredictable trends, throwing experts in a frenzy. One of the most exciting trends is the rise of the popularity of real money and hyper-casual games across age groups that were not regularly active before. Mobile gaming is no more exclusive to Millennials and Gen Z.

With mobile gaming expected to see a 212.38% surge in new users and a 236.4% boost in DAU, clearly, entertainment priorities seem to have shifted in Southeast Asia.

3. Short-form video and OTT will continue to be strong contenders for screen time

Perhaps the most consistent growth in Southeast Asia has been witnessed in content streaming mobile apps. While the rest of the world embraces Connected TV, mobile OTT in Southeast Asia is giving traditional TV a run for its money.

With content platforms doubling or tripling their budgets to create more original and vernacular content to delight and retain their customers, mobile apps in this space are expected to grow by 33.27% in DAU and 28.28% in MAU. A surge of about 19.29% in the number of new users embracing digital entertainment on their mobile phones is also predicted during the Festive Season 2021.

4. Personal finance will remain the top priority for consumers

Digitization has reduced the friction in traditional banking and financial processes. This has led to a surge in the adoption of mobile banking in Southeast Asia, making it, arguably, the region with the highest number of digitally active banking and fintech consumers.

Online banking, Fintech, P2P lending, Insurance, and Crypto apps are expected to grow their DAU by 27.27%, MAU by 25.38%, and the number of new users by 17.65% this Festive Season in Southeast Asia.

iOS versus Android: Engagement benchmarks for the Festive Season in Southeast Asia

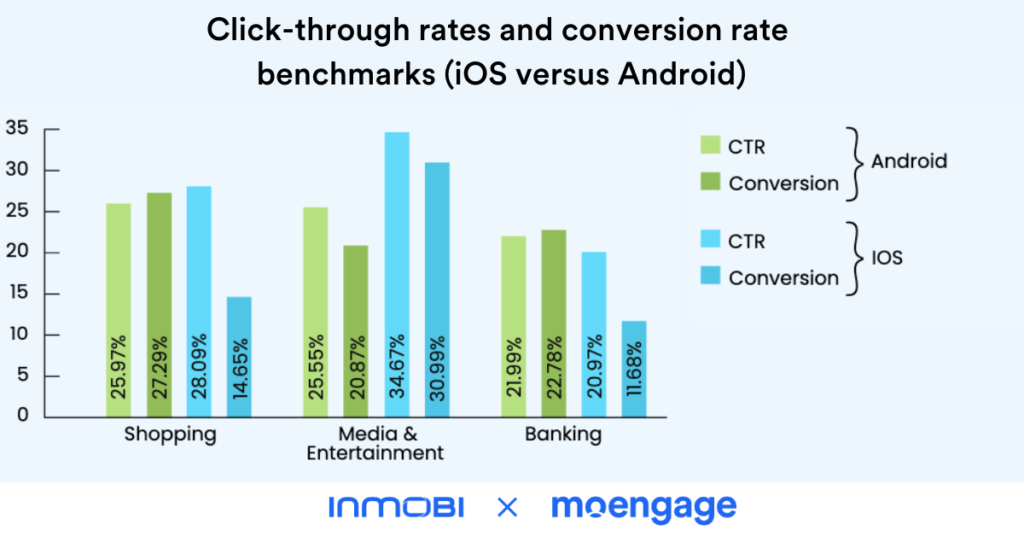

Mobile app marketing is one of the most effective digital channels to announce upcoming sales, promote discounts, and offers. While digital banks, fintech mobile apps, and retail and mobile E-commerce apps witness higher conversions on Android devices than iOS devices, OTT and content streaming mobile apps generally see a higher conversion and click-through rate on iOS devices.

Here is a quick overview of the benchmarks for in-app messaging campaigns on both iOS and Android devices:

| Vertical | iOS CTR | iOS conversion | Android CTR | Android conversion |

| Shopping | 28.09% | 14.65% | 25.97% | 27.29% |

| Media & Entertainment | 34.67% | 30.99% | 25.55% | 20.87% |

| Banking | 20.97% | 11.68% | 21.99% | 22.78% |

The impact of personalization on Engagement metrics

Given how in-app messages play a significant role in the engagement strategy, it is important for marketers to know how to maximize the ROI from this channel through personalization. There are two ways marketers can personalize their communication:

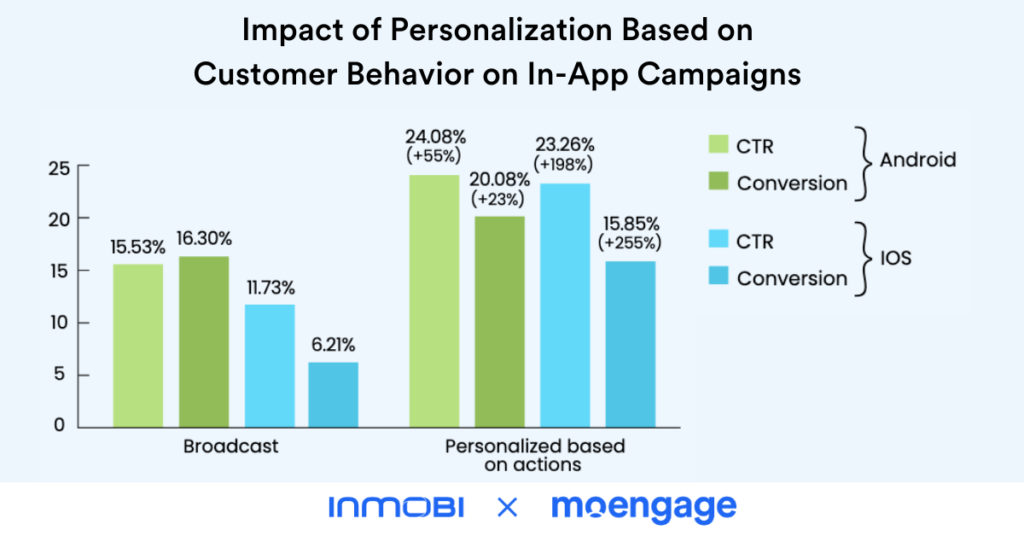

1. Personalization based on customer behavior

In this approach, before setting up campaigns for mobile app marketing, marketers should create different customer cohorts based on the actions they have taken inside your app. For example, browsing a product from a specific category, watching a certain genre of content, filling out an application for a loan but not completing it, or being unable to clear a certain game level.

By creating these cohorts and sending messages based on the actions taken, marketers can personalize their communication and witness an immediate boost in performance. The impact of this type of Personalization is shown below:

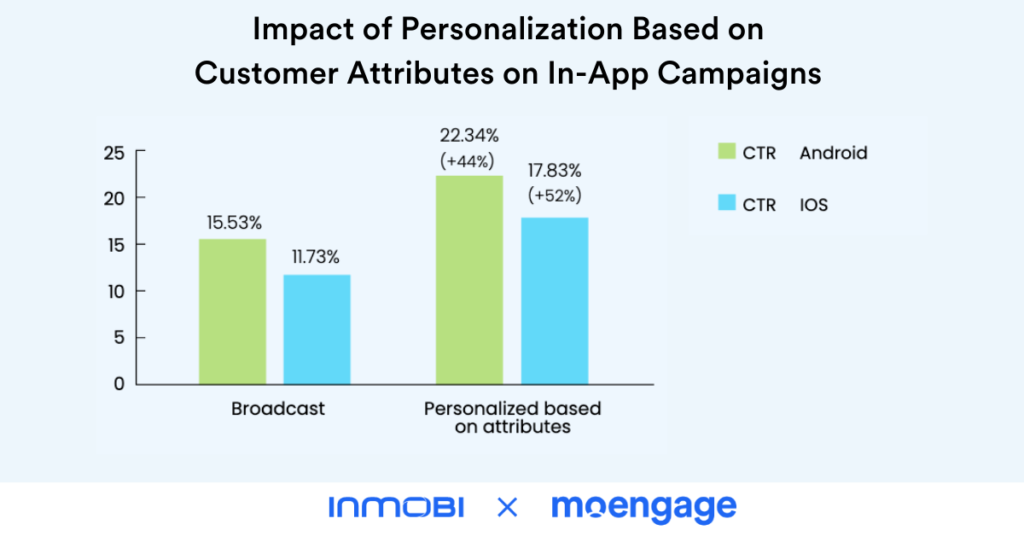

2. Personalization based on customer attributes

In this approach, marketers should create segments of customers based on their properties such as geolocation, language preference, or affinity (for example, most viewed product category or most seen movie genre).

By categorizing customers based on such attributes, marketers can curate dynamic offers that are personalized for each customer, and witness much higher conversions from their mobile in-app campaigns.

Insights-led Engagement: The Key to Unlock Growth in Southeast Asia

This festive season, there will be a divide between consumer brands in Southeast Asia that will witness high engagement, retention, and conversion and those that will not. And this divide will be determined by the adoption of Insights-led Engagement.

What is Insights-led Engagement and how it can help?

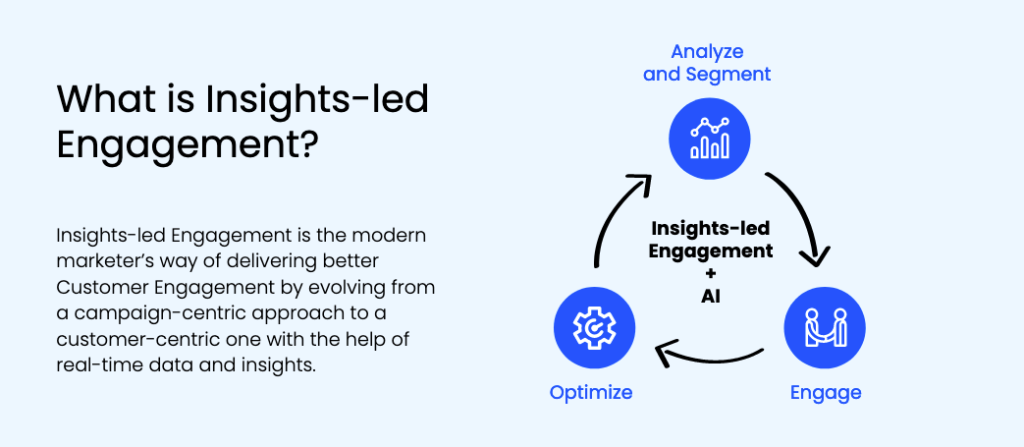

Insights-led Engagement is the modern marketer’s way of delivering better Customer Engagement by evolving from a campaign-centric approach to a customer-centric one with the help of real-time data and insights.

Powered by Artificial Intelligence, the Insights-led Engagement flywheel has three major actions that contribute to its momentum:

- Analyze and Segment: Analyze customer behavior and identify the right customers to engage, what type of campaigns to run, and what improvements to be made in the product to improve customer experience.

- Engage: Create personalized customer experiences and orchestrate customer journeys across the various digital touchpoints.

- Optimize: Leverage machine learning to identify the best time to send communication, the right communication messages, and the most optimum customer journey.

Marketers that use real-time insights to build their engagement strategy will see much better ROI from their campaigns. Marketers will need to be proactive in their approach to engagement in order to deliver relevant and delightful customer experiences than other marketers.

Real-time insights such as which product has been recently added to the cart can help convert more cart abandons to purchases by sending highly targeted communication. Similarly, insights on a customer’s latest browsing history can be leveraged to send customized discounts within a few minutes after their activity, to incentive a purchase.