The Gamestop Saga: What Banking and Fintech Brands Need to Know About the Stock Market Frenzy

Reading Time: 6 minutes

When George Sherman, the CEO of GameStop, joined the left-for-dead retailer in 2019, he was offered stock options valued at $10.5 million. As of last Friday of January, in an exciting turn of events, his shares were worth nearly $1 billion.

In case you haven’t heard of the Reddit-fueled rally of the company’s share price on the U.S. stock market, here’s a brief rundown:

Over the past couple of months, popular hedge funds have been shorting (bet against) the GameStop stock. Members of the subreddit WallStreetBets caught wind of it, and decided to take on the established fund houses in a typical David vs. Goliath tale, forcing a short squeeze (lifting the stock price higher) by buying more of the stock.

Still, confused? Here’s a meme to help

Still, confused? Here’s a meme to help

What happened next is one for the history books. At one point, the GameStop stock was up 20X since its March 2020 low that occurred when the news of Coronavirus swept investor wealth off of global financial markets.

However, it wasn’t just the amateur retail traders who had an opportunity to knock on their doors; popular investing apps weren’t far behind in gaining from the viral, global press coverage of the events.

Bonus Content

|

Rise And Growth Of Trading and Investing Apps

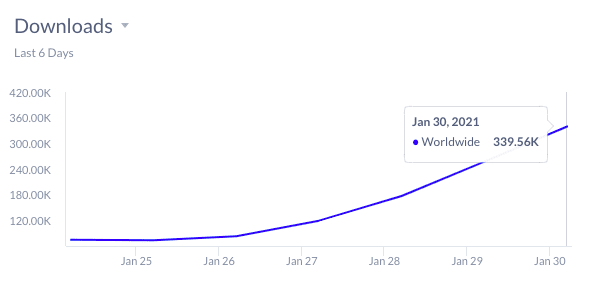

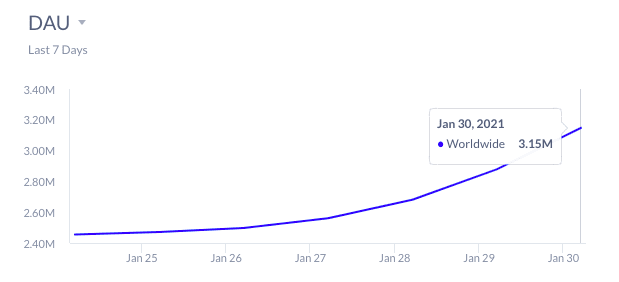

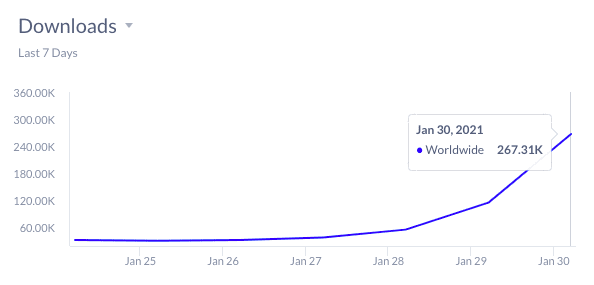

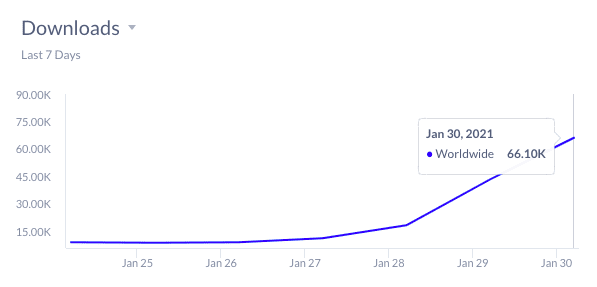

As the battle between WallStreetBets and the real Wall Street turned into a juggernaut of the average Joe wanting to cash in on the deal of a lifetime, Robinhood, the de facto trading app WallStreetBets enthusiasts sworn by, saw an unprecedented growth curve in terms of its number of downloads and daily active users (DAUs).

In just one week, the Robinhood mobile app saw its downloads increase by a whopping 352%, and its DAUs soared likewise as well.

Mobile App Downloads For Robinhood as of Jan 30th | Source: Apptopia

Mobile App Downloads For Robinhood as of Jan 30th | Source: Apptopia

DAUs For Robinhood as of Jan 30th | Source: Apptopia

DAUs For Robinhood as of Jan 30th | Source: Apptopia

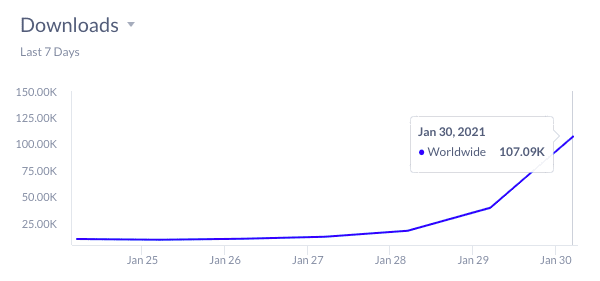

In a similar vein, Robinhood’s competitors also saw a steep rise in the number of consumers signing up for the mobile app in the hope of capitalizing on the ongoing frenzy. Here’s how Fidelity, WeBull, and E-Trade, all Robinhood peers, performed during this period.

Mobile App Downloads For Fidelity Investments as of Jan 30th | Source: Apptopia

Mobile App Downloads For Fidelity Investments as of Jan 30th | Source: Apptopia

Mobile App Downloads For WeBull as of Jan 30th | Source: Apptopia

Mobile App Downloads For WeBull as of Jan 30th | Source: Apptopia

Mobile App Downloads For E-Trade as of Jan 30th | Source: Apptopia

Mobile App Downloads For E-Trade as of Jan 30th | Source: Apptopia

Interestingly, all of Robinhood’s competitors experienced significant traction only after Jan 28th. In a surprising (read disappointing) move, the platform decided to stop trading of GameStock, and other similar shares.

Robinhood’s blog announcing the ban on trading $GME, $AMC, and other stocks

Robinhood’s blog announcing the ban on trading $GME, $AMC, and other stocks

And that’s when users decided to flock to other avenues, resulting in a surge of downloads for Robinhood’s competitors and a massive opportunity for these trading apps.

How Banking And Fintech Brands Can Prepare Themselves For The Next Big Opportunity

Although this was an unprecedented scenario, this is surely not the last one. It’s 2021, and today, more and more mobile-first consumers prefer to use their phones for trading, investments, banking, and a lot more.

As a guardrail for similar opportunities in the future, here’s what Banking and Fintech brands can focus on to ensure they’re delivering value to their users right off the bat:

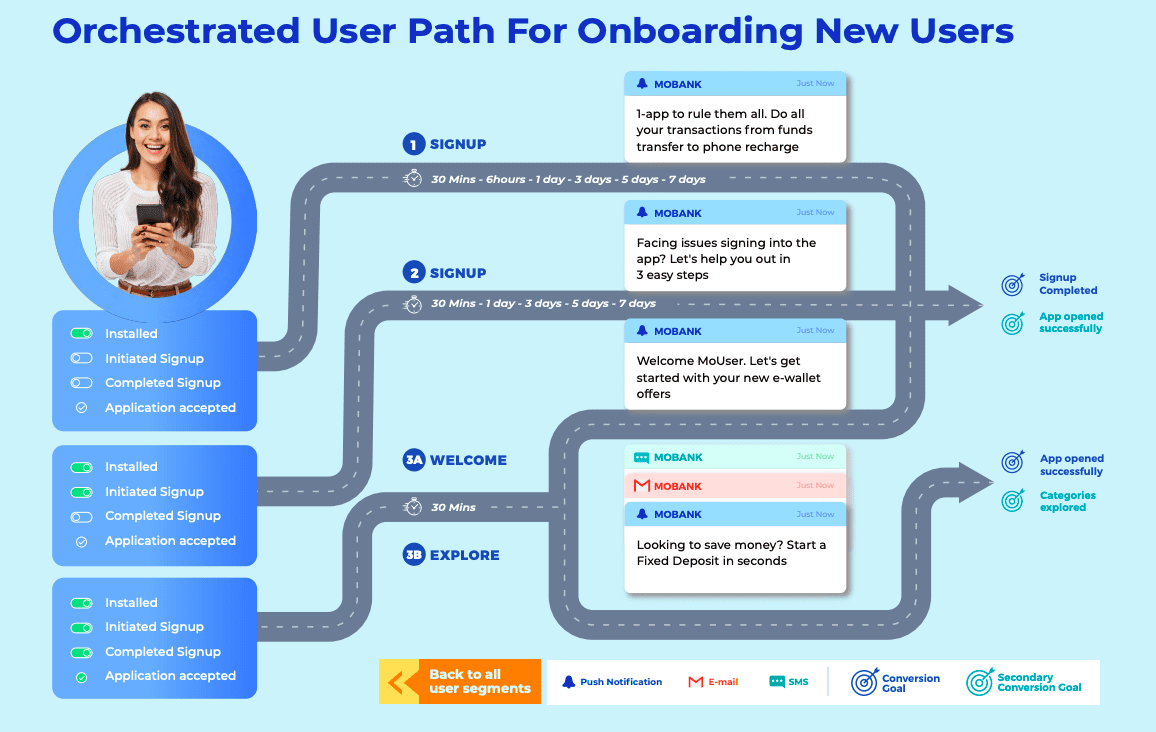

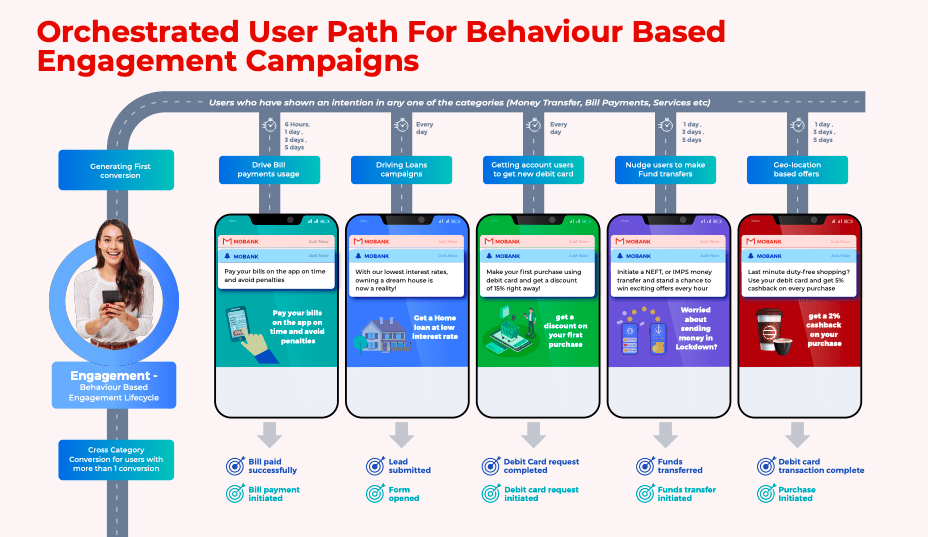

1. Orchestrate an engaging onboarding flow across multiple touchpoints

When a user downloads your mobile app, you need to ensure the time it takes for them to realize value off of your platform is as little as possible. New customers are hungry to learn more about what they can achieve by using your service, so, delivering the right insights at the right time can be tremendously influential on their actions and decisions.

From guiding users to complete signup, opting for paperless notifications for their portfolio and account statements, their first transactional activity, and more, having a robust onboarding flow aimed at enabling them can help you achieve the same with much ease. Here’s an example of a typical user path for a mobile banking app from our eBook, Banking In The Era Of The Connected Customer:

Each interaction you have with your new user, in turn, provides insight into what they value, both in terms of your product offerings and their communication preferences. By having the right set of processes and tools in place, these insights can help you drive future marketing campaigns that are relevant, contextual, and offer a delightful user experience.

2. Make product discovery a seamless experience for your users

One of the most vital parts of the customer journey is product discovery, especially for financial service offerings such as loans or credit cards. For example, campaigns for personalized offers, including introductory rates for card signups or balance transfers are great opportunities for banking apps to leverage.

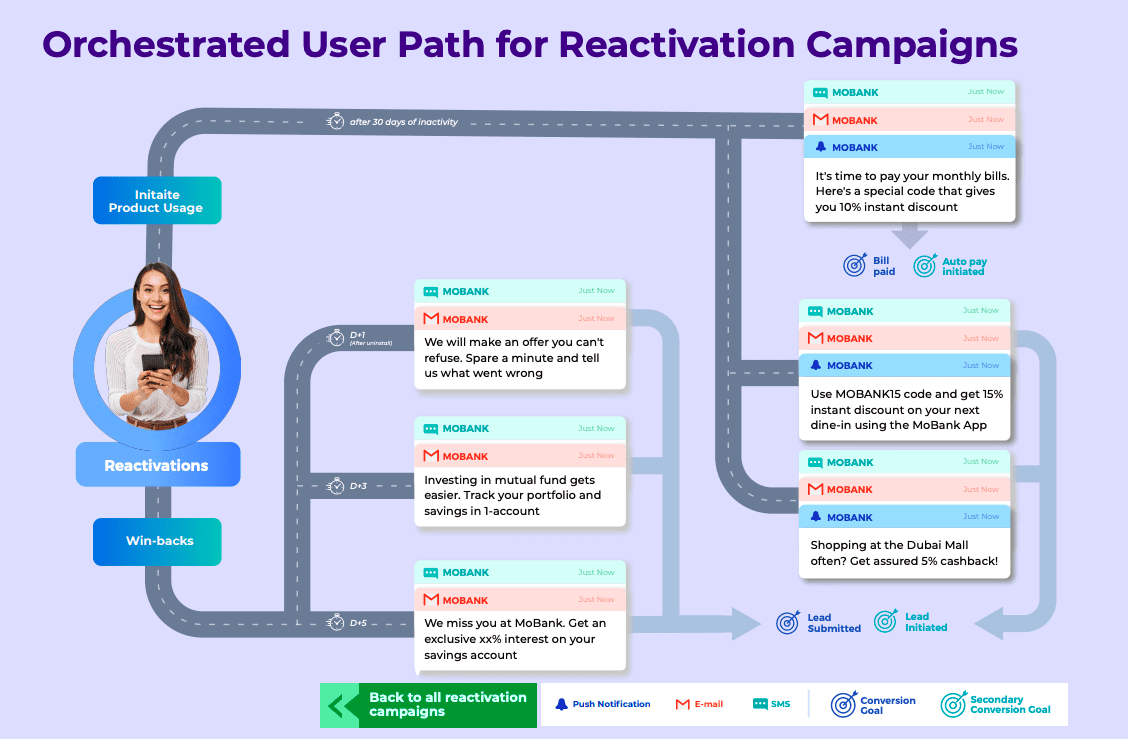

3. Re-engage dormant users by highlighting urgency (or fear of missing out)

Imagine a Robinhood user who hasn’t made any investment in the last three months. They’d expect to be the first to hear about any high-value investment opportunities that are doing the rounds (case in point being the GameStop, AMC, and other meme stocks), and take advantage of the same.

Today’s users expect banks and financial services companies to reach out to them only when it’s relevant, and adds value to them. And reactivating users during the surge periods would be one such great opportunity. Here’s an example orchestrated path for a reactivation campaign for dormant users of your banking app:

As a marketer, you have to know what the customer wants, even before they realize they want it. If done right, urgency can be a great lever in helping you drive growth for your brand.

4. Build and invest in a robust customer engagement or marketing stack

What good is an idea without having the tools to execute it? And it couldn’t be more true for your customer engagement. It’s far easier to develop ideas you believe would move the growth needle, only to run into operational roadblocks, hampering your campaigns’ effectiveness.

To achieve the two takeaways we shared above, having a robust marketing stack that stitches your customer engagement strategy together is of prime importance. Make sure only your imagination, and not the tools, limit you.

It will be critical in 2021 for financial services organizations to scale their customer engagement strategies to meet consumers’ omnichannel demands.

Wondering where to start? Download this guide to build a winning customer experience in financial services in 2021.

And The Saga Continues…

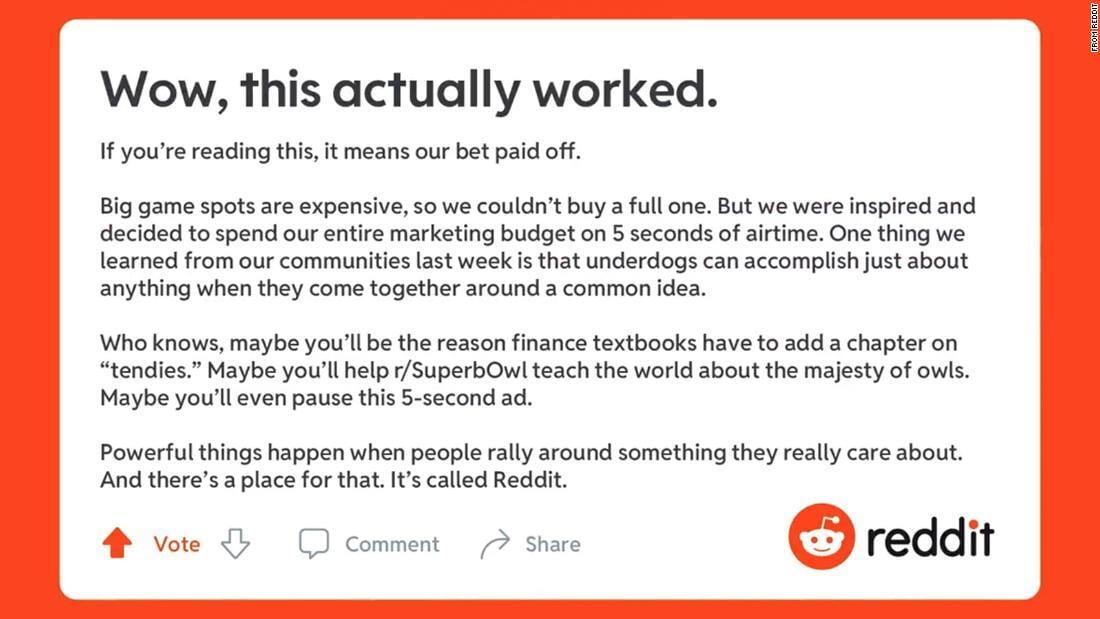

In the Redditors on WallStreetBets’ own proclamation, the saga is far from over, and below is their latest response.

There’s a lot to see in how this will unfold, but there’s one thing for sure, it has only strengthened the fact that change is the only constant.

As Wall Street incumbents evolve in the aftermath of one of its worst nightmares, it’s time for your marketing to grow with the ever-so-dynamic customer.

Here’s What You Can Read Next

|