How Banks Can Use Customer Engagement Platforms to Improve LTV and CX While Reducing Costs in a Secure Environment

In this article, Banks will learn how to use Customer Engagement Platforms to improve Lifetime Value and provide a world-class Customer Experience.

Reading Time: 7 minutes

In the modern banking landscape, Customer Engagement has become a critical factor in driving customer loyalty and improving your customers’ lifetime value (LTV).

With the rise of digital technologies, banks like yours can now leverage Customer Engagement platforms to offer personalized experiences and enhance customer satisfaction.

These platforms can also help you reduce costs and improve your bottom line by streamlining operations and automating routine tasks.

However, with cybersecurity threats on the rise, ensuring that your Customer Engagement platforms are secure and comply with industry regulations is essential.

Here are different scenarios you most likely find yourself in every day and how a Customer Engagement Platform can help you get unstuck:

Digital Onboarding and KYC (Know Your Customer)

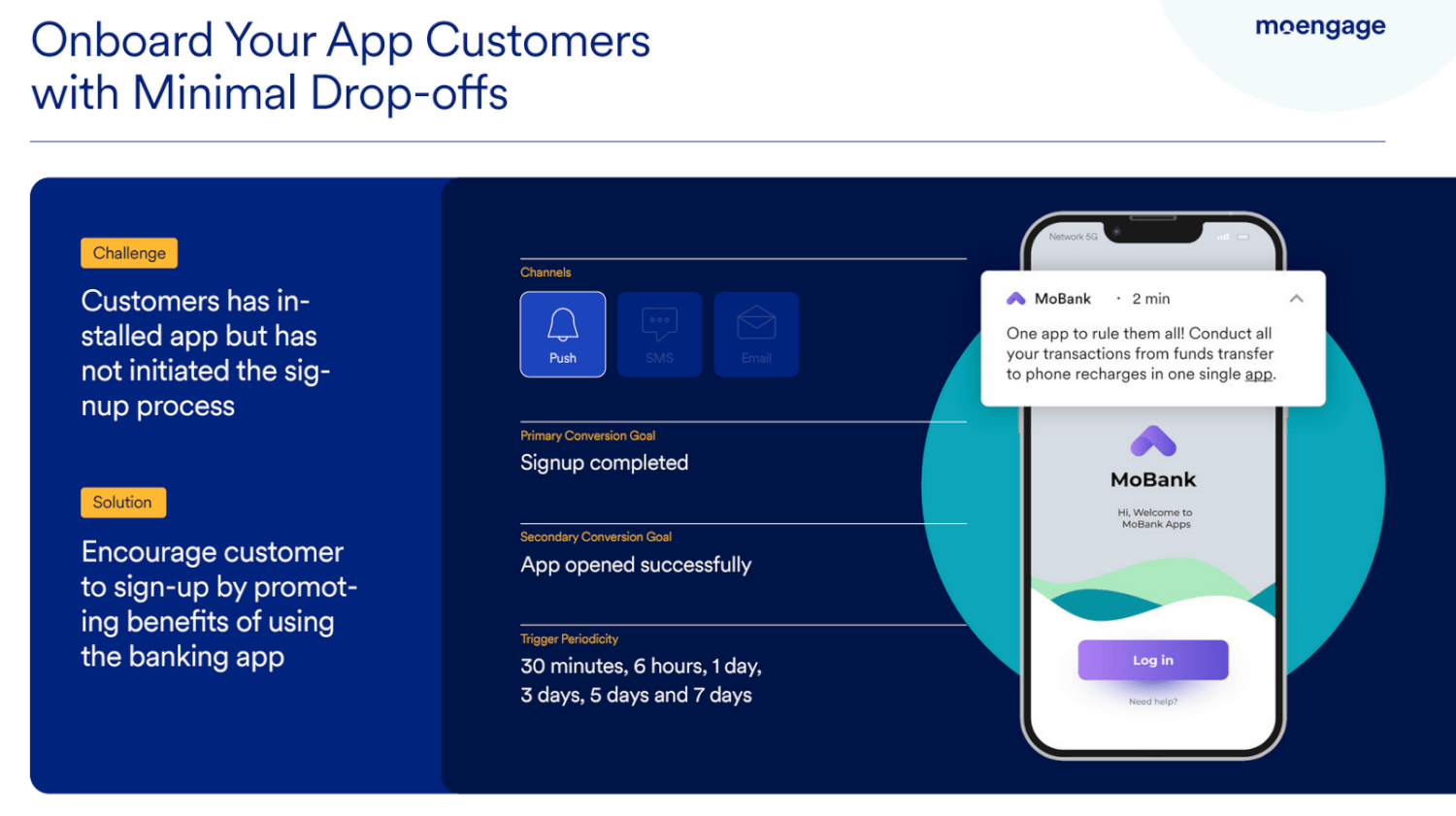

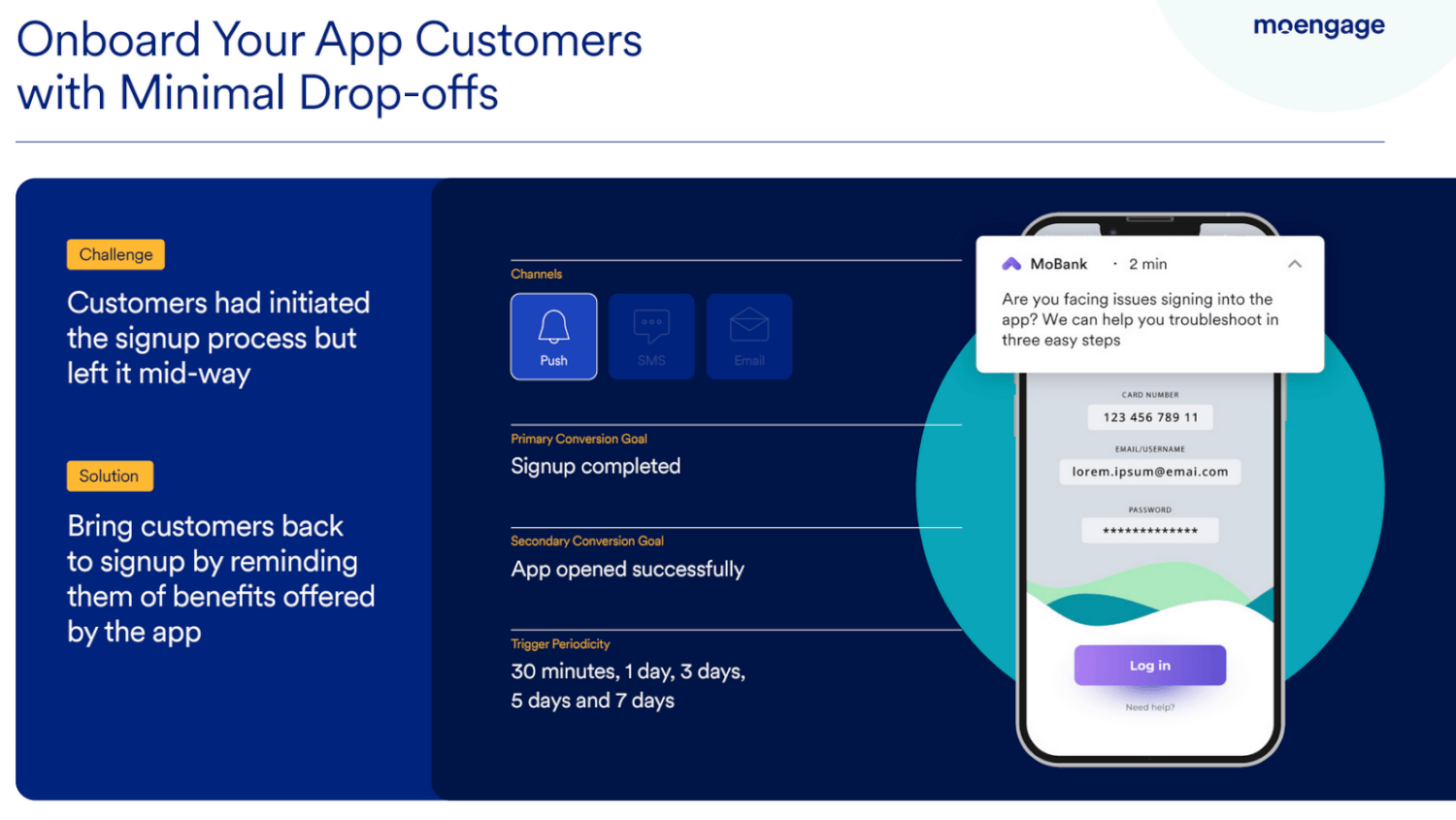

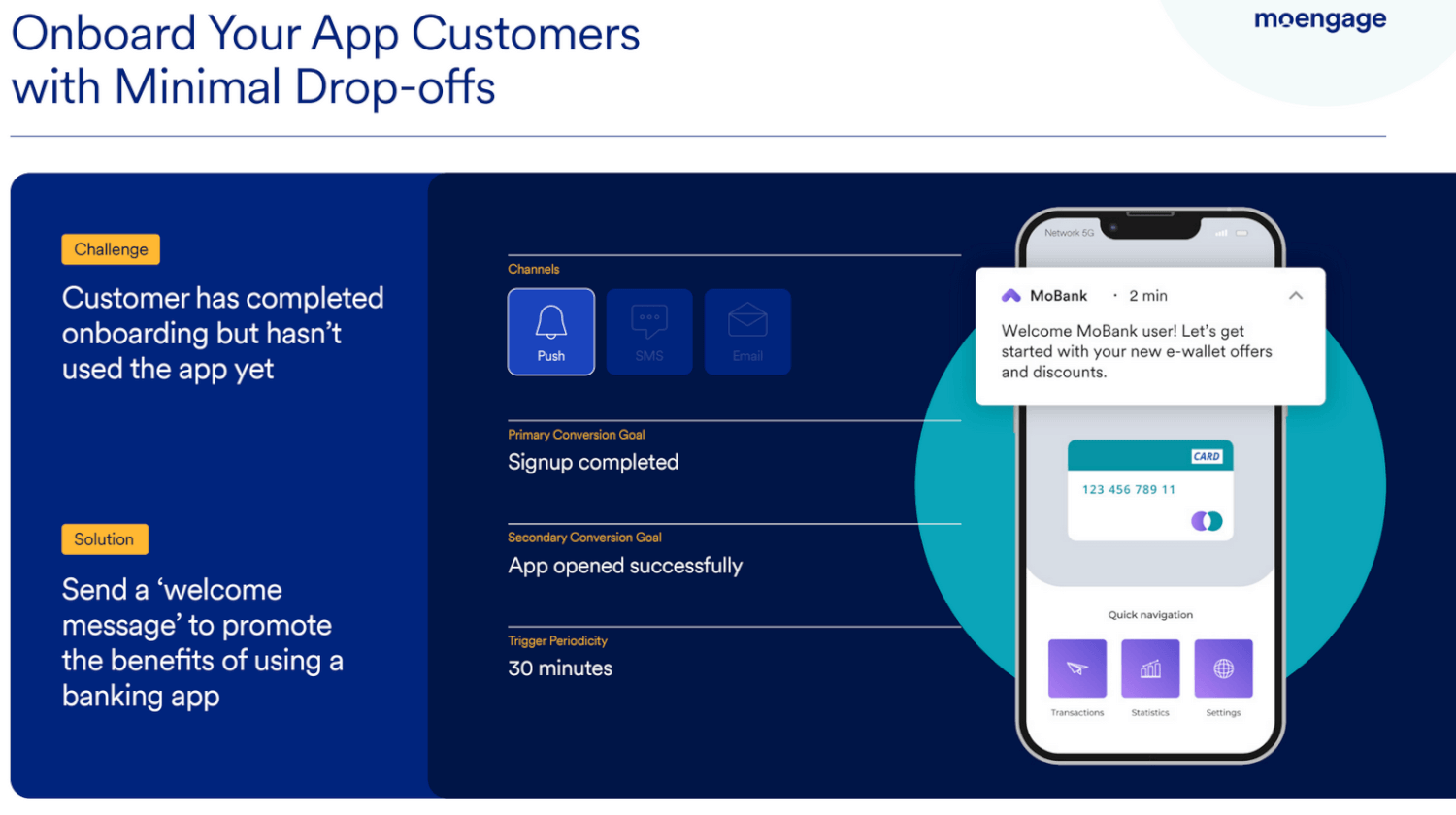

Banking customers prefer a seamless digital onboarding experience when they sign up for a new bank. They wish to install your mobile app or sign up on your website and complete their KYC to begin transacting digitally.

Your primary goal during the onboarding stage should be to help new customers overcome digital inertia, complete their KYC process, and get used to your platform.

Goal:

The primary goal of onboarding should be to increase the number of new customers signing up on your mobile app or banking website.

A secondary goal could also be reducing the time a customer takes to create an account and finish their KYC process. The lesser this window, the faster your customers can start transacting digitally and see the value of your digital platform.

Metrics to measure success:

The key success metric is the percentage of the total number of customers who completed their KYC process among those who signed up in a given month or week.

The secondary success metric can be a % drop in the time taken to complete the KYC process after a customer has signed up on your platform.

Strategy to improve onboarding for new customers:

- Educate new customers about the convenience of digital banking and the benefits of completing their KYC process

- Create a segmented email and SMS flow targeting customers – urging them to install the app/ create an account on the website and a flow to complete KYC

How Can a Customer Engagement Platform Help With Onboarding a New Banking Customer?

1. Build Customer Journeys

Banks can use a Customer Engagement Platform to orchestrate the ideal journey of a new customer on their mobile app or website.

With automation, customers will follow a path that leads them to quickly finish their KYC process after they sign up, so they can start transacting. This involves creating two journeys within one:

- Journey 1 to help them kickstart their KYC process, and

- Journey 2 to help them complete it by sending timely reminders and reminding them of incomplete steps.

2. Use AI to pick the best Customer Journey

By leveraging a Customer Engagement Platform’s AI, banks can see a boost in their onboarding success metrics.

AI will automatically determine the best sequence of messages that new customers need to receive and the best channels they need to receive these messages on.

Banks can use a Customer Engagement Platform to create two or more possible paths new customers can take and then let AI and ML algorithms observe the performance of each path and pick the journey with the maximum goal conversions.

👉 Read all about MoEngage’s Intelligent Path Optimizer and why you need it.

Learn from the leaders: Symbo InsuranceSymbo is an insurtech company aiming to become the world’s largest embedded insurance distribution platform. With MoEngage Flows, Symbo built a seamless, automated, and action-based onboarding journey. Thanks to MoEngage, the team was abel to cater to customers in 4 different stages:

👉 Read how Symbo Insurance used MoEngage to set up onboarding Customer Journeys using MoEngage Flows. |

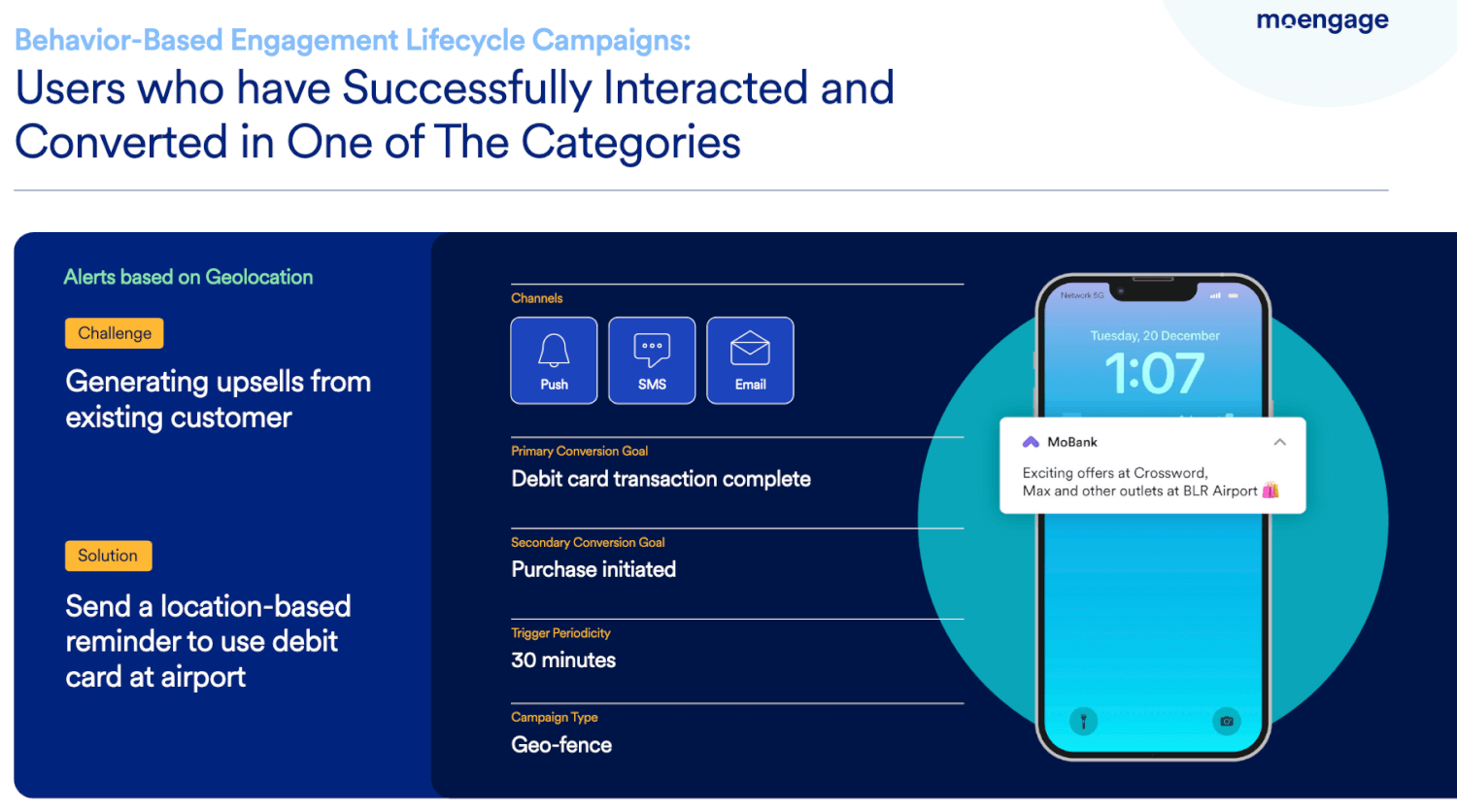

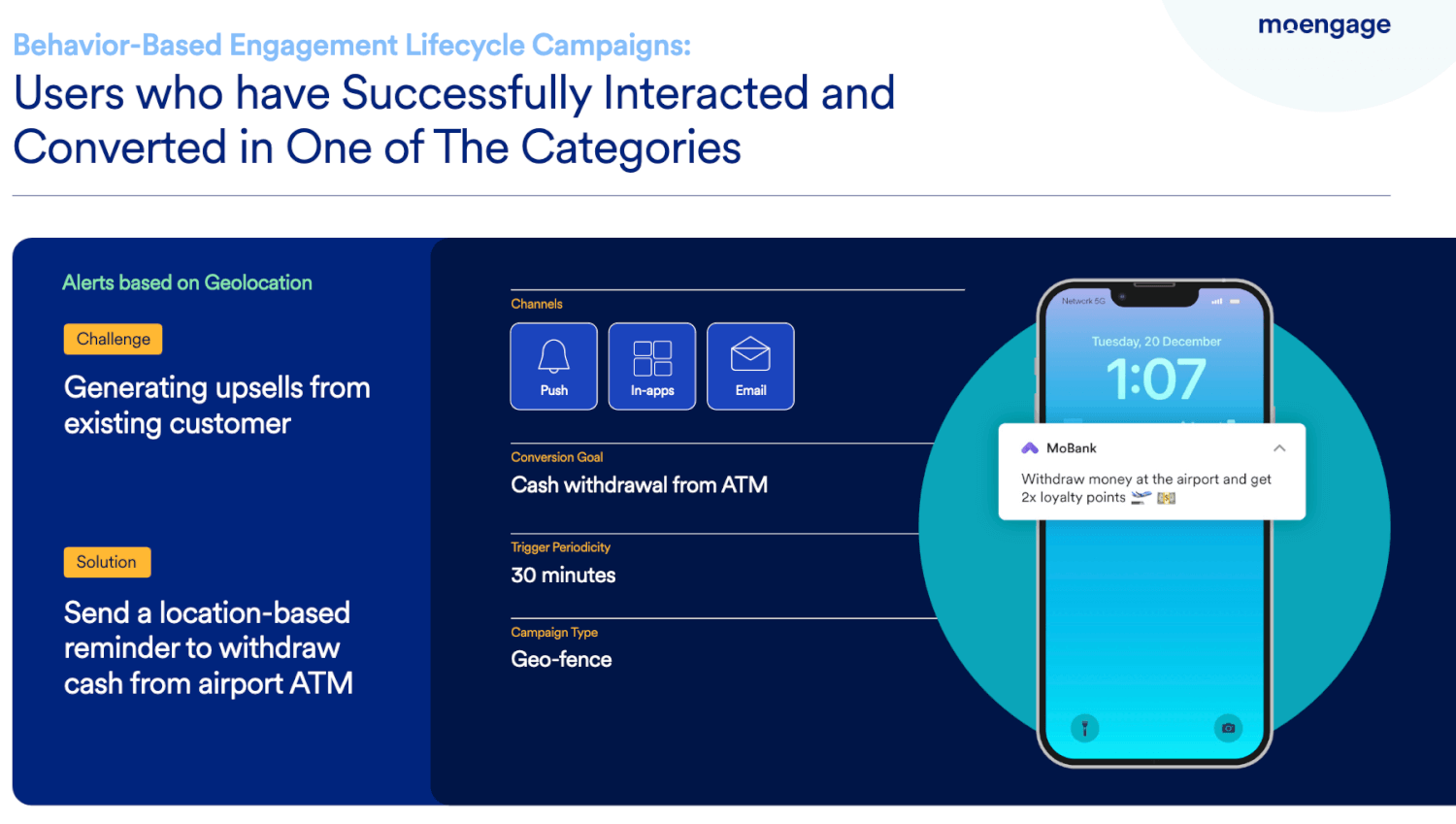

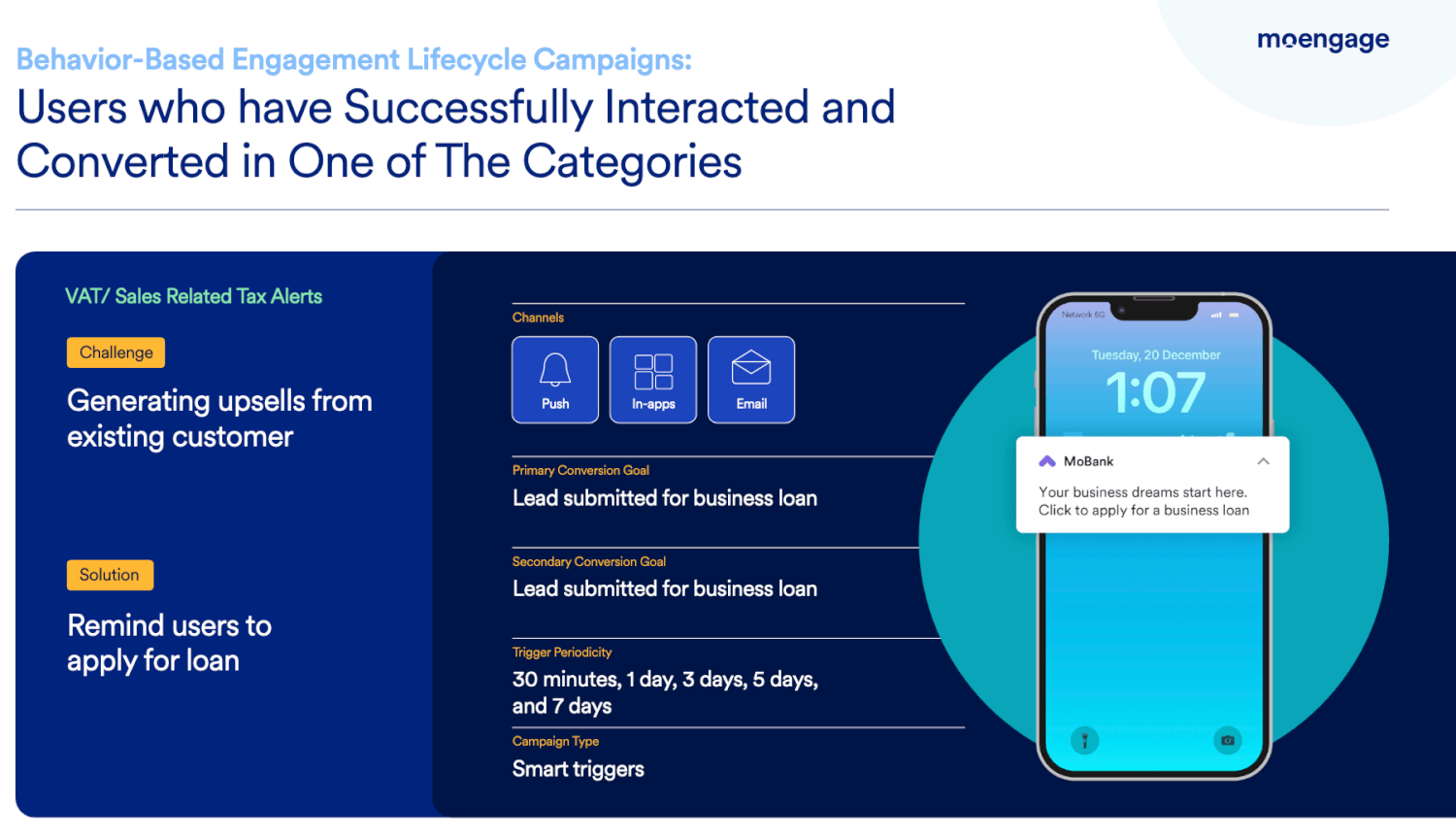

Product Cross-sells and Upsells

Once your customers have been onboarded and are comfortable transacting digitally, you can start launching campaigns to cross-sell and upsell relevant financial products based on their account balance, borrowing history, credit history, and more.

You can also encourage your customers to use their credit cards more often by showing them relevant offers that are applicable to their card.

Goal:

The primary goal of cross-sells and upsells should be to get your customers to purchase additional products and services from your bank.

A secondary goal could be to encourage your customers to increase the usage of their assigned credit cards.

Metrics to measure success:

A key metric to measure the success of your cross-sell and upsell campaigns should be the number of requests or applications for additional products and services. These requests could either be through your bank’s website or your bank’s mobile application.

A secondary metric could be the increase in the amount transacted by each customer via the issued credit card.

Strategy to drive more cross-sells and upsells:

- Create customer segments based on criteria like the range of bank account balance, and promote different relevant financial products to each segment.

- Educate customers on the multiple savings, borrowings, credit, trading, and investment products and services your bank has to offer.

- Build customer cohorts based on their current issued credit card and share personalized offers that are applicable to their card.

How Can a Customer Engagement Platform Help Drive More Cross-sells and Upsells for Your Bank?

Build omnichannel campaigns personalized to each customer segment. Using a Customer Engagement Platform, you can create or import segments while complying with PII protection guidelines and compliances.

You can then create multiple campaigns across multiple touchpoints such as Email, Push Notifications, Website Banners, SMS, WhatsApp, Google Ads, Facebook, and more.

The key to omnichannel messaging is to keep the experience seamless as your customers switch between channels. If you’ve identified a particular financial product to upsell to a cohort, ensure that all messages on all channels promote the same product.

👉 Read about MoEngage’s omnichannel capabilities here.

Learn from the leaders: NaviNavi, one of India’s largest lending platforms, wanted to increase the conversions of upsell campaigns to potential customers. Navi’s marketing team decided to reach out to existing customers interested in loans and insurance via WhatsApp. This new-age marketing channel was made possible thanks to MoEngage’s WhatsApp integration. After using MoEngage and WhatsApp, Navi witnessed a 1.5X increase in the number of insurance upsells, a 75% higher conversion rate for their upsell campaigns, and a 4X growth in the number of reachable customers. 👉 Read how Navi boosted the conversion rates of upsell campaigns using MoEngage. |

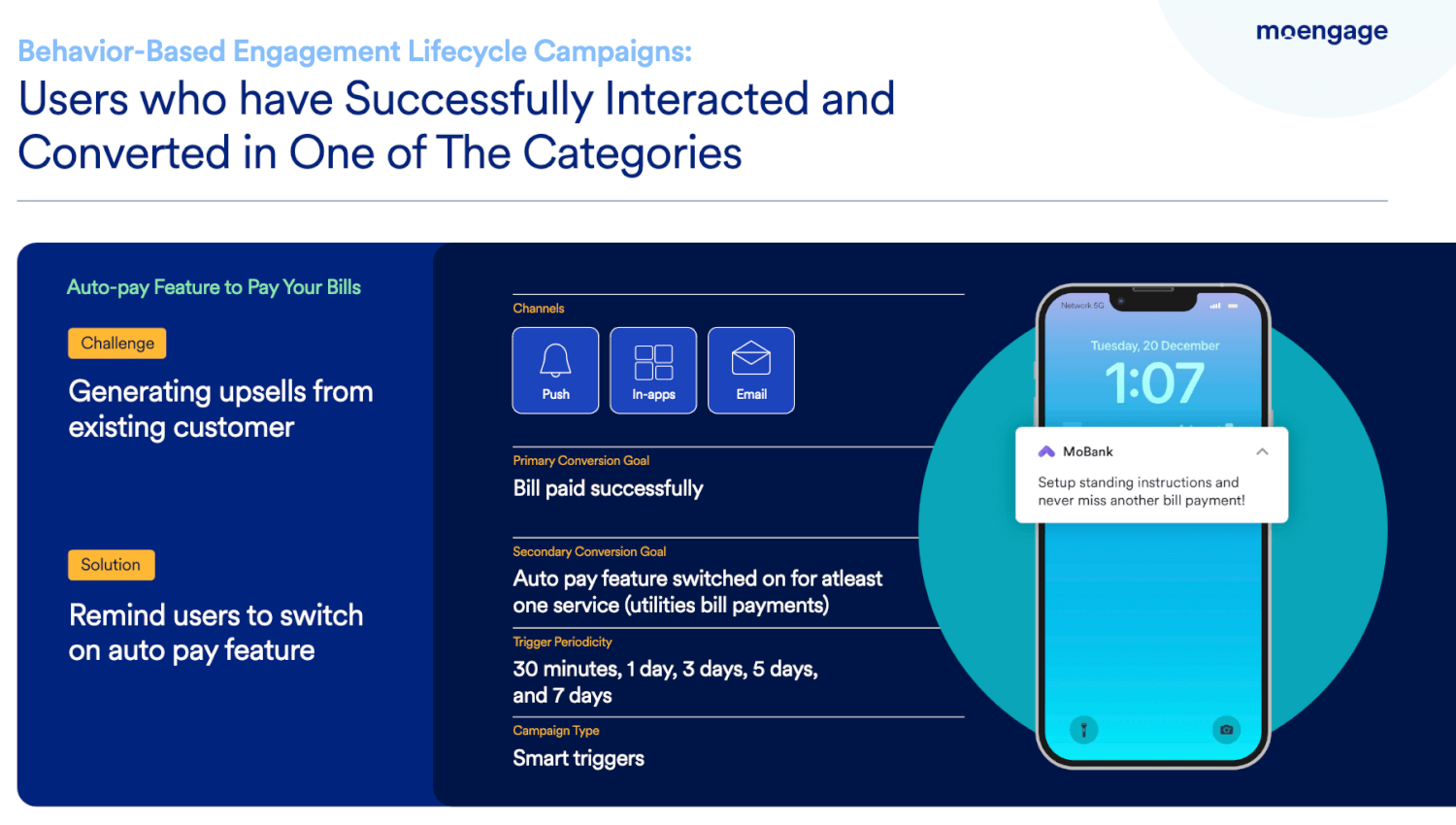

Timely Alerts and Reminders

There are several research papers like this and this that show a strong relationship between the problem of recovery, overdue loans, and the profitability of banks.

A positive correlation between payment defaults and profitability means you must invest in building campaigns that constantly remind your customers for payments and dues.

Engaging customers at the right dates of the month will help ensure they don’t miss recurring payments like bills, EMIs, and loans.

Goal:

The primary goal for timely alerts and reminders must be to ensure that customers do not default on their payments, i.e., miss recurring payments such as bills, EMIs, or loans.

A secondary goal could be to ensure the maximum reachability of your transactional alerts so your customers don’t miss out on important messages.

Metrics to measure success:

A key metric to measure the success of these campaigns is payment completed.

To measure reachability, you can calculate the percentage of the total customers you sent out a specific campaign for and the impressions (for Push Notifications, SMS, In-app Messages, and Website Banners) or opens (for Emails and WhatsApp).

Strategy to send timely alerts and reminders:

- Create a dynamic segment of customers that automatically become a part of the segment when the due date for their payments is less than 10 days.

- Notify these customer segments about the upcoming due date for their pending payments.

- Create a recurring campaign on Email, SMS, WhatsApp, In-app Messages, or Website Banners.

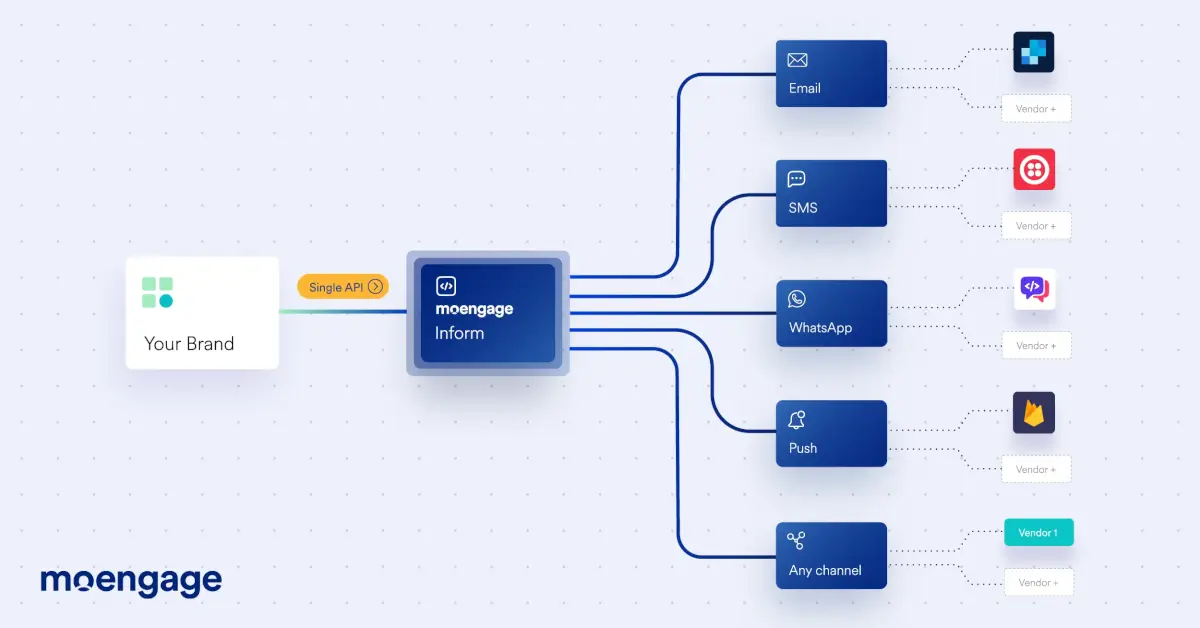

How Can a Customer Engagement Platform Help You Send Timely Alerts and Reminders to Your Banking Customers?

Use a plug-and-play API to scale and maintain your transactional messaging infrastructure. Modern Customer Engagement Platforms like MoEngage have APIs that can be used to send critical transactional messages like alerts and reminders to different customer segments.

Instead of building and maintaining your own transactional messaging infrastructure, you can leverage these plug-and-play APIs to automate template creation, add new messaging channels, and more!

👉 Read about MoEngage Inform, a transactional messaging API, here.

Learn from the leaders: Zeta

This is what Anand Madanapalle Sridhar, the Associate Director of Product Management at Zeta, a next-gen banking tech company in India, had to say about MoEngage Inform:

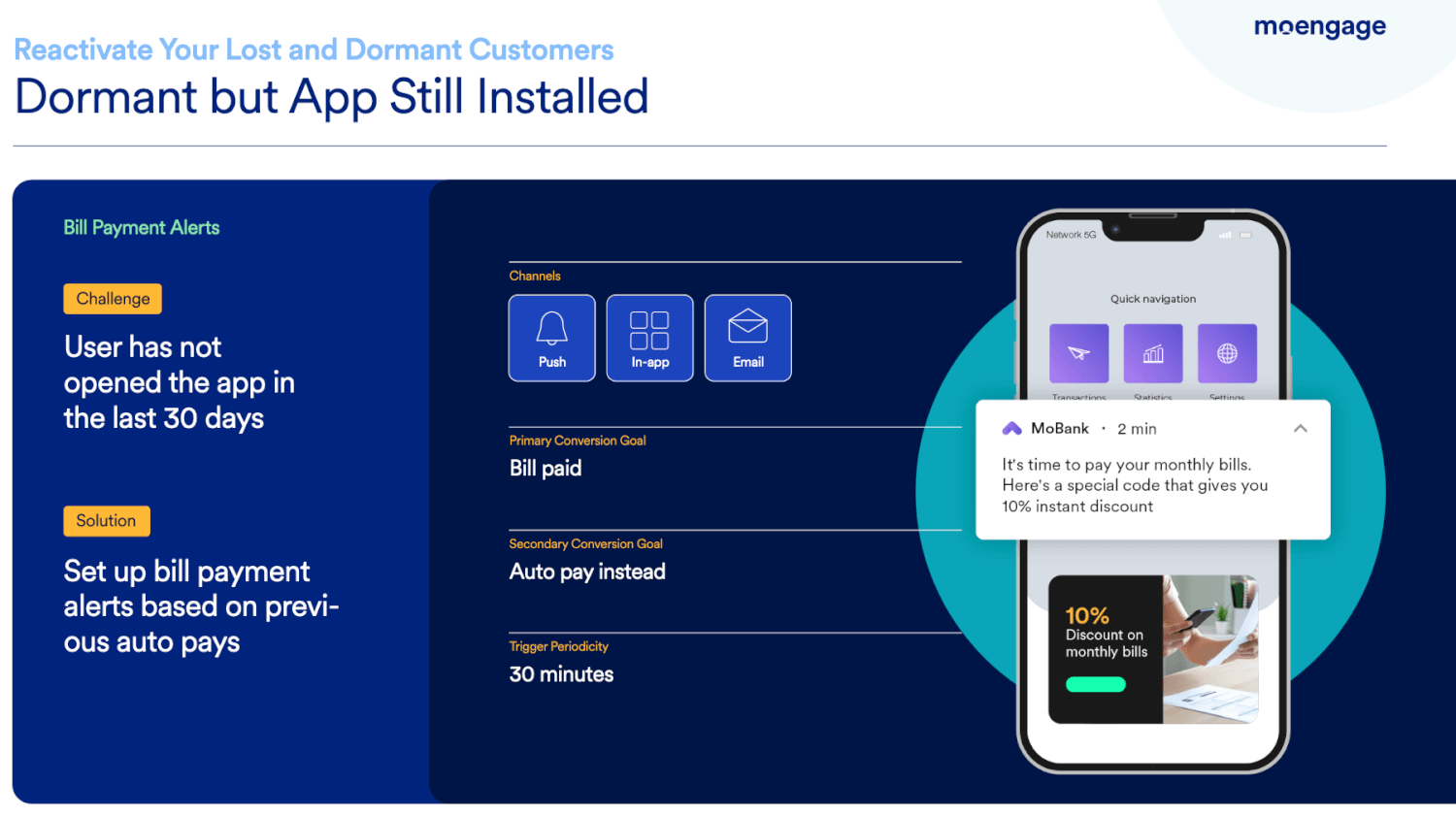

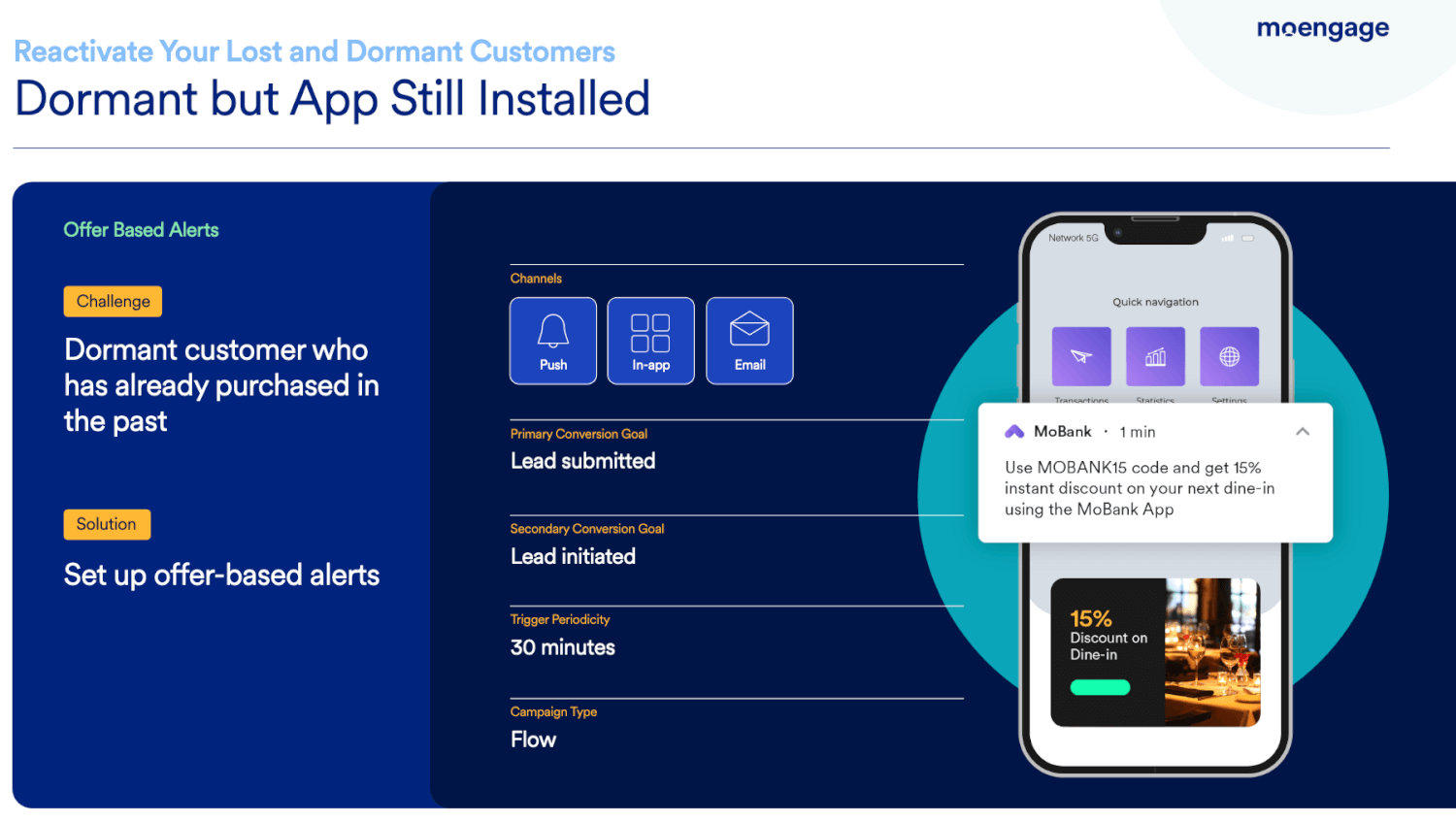

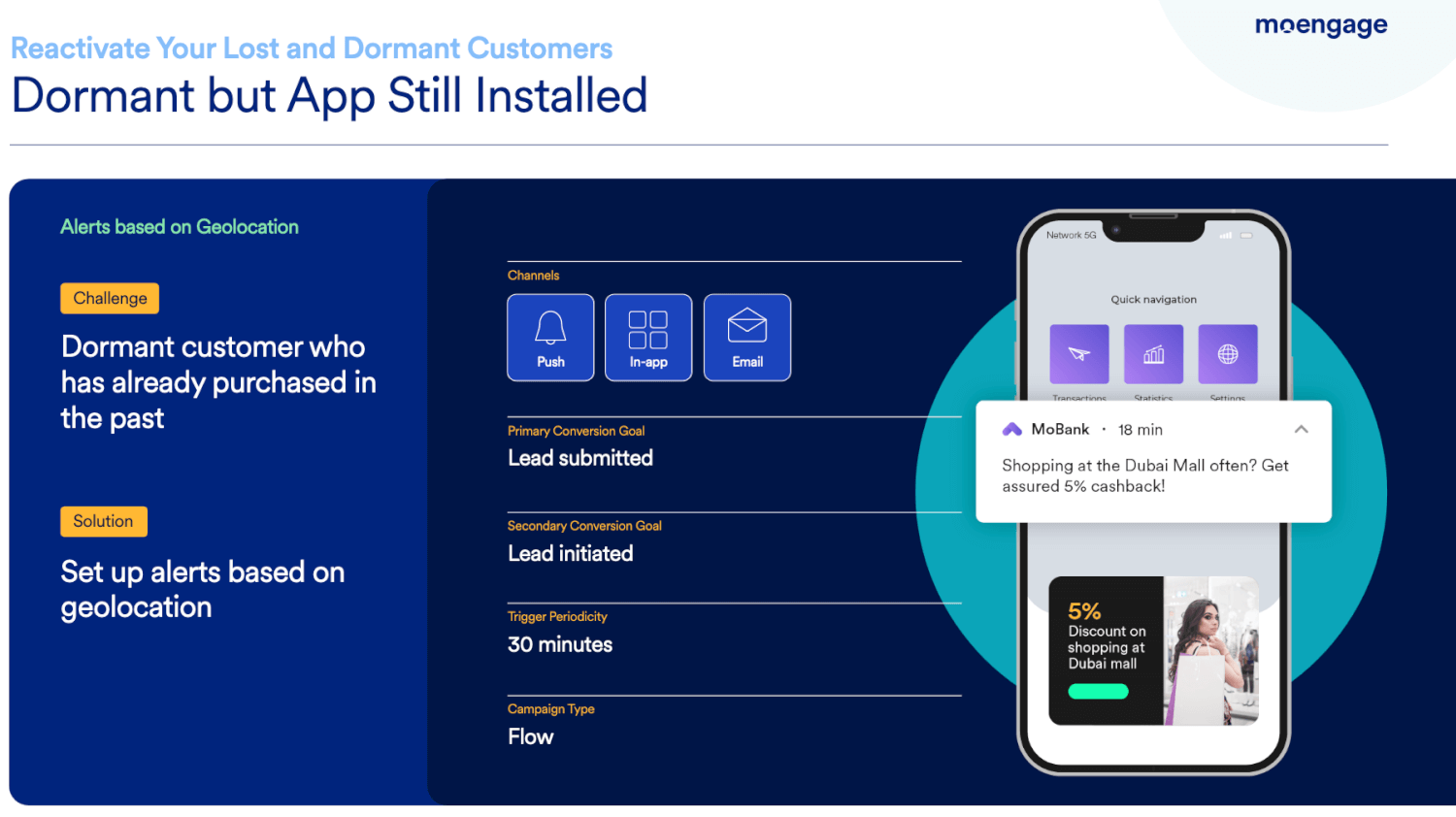

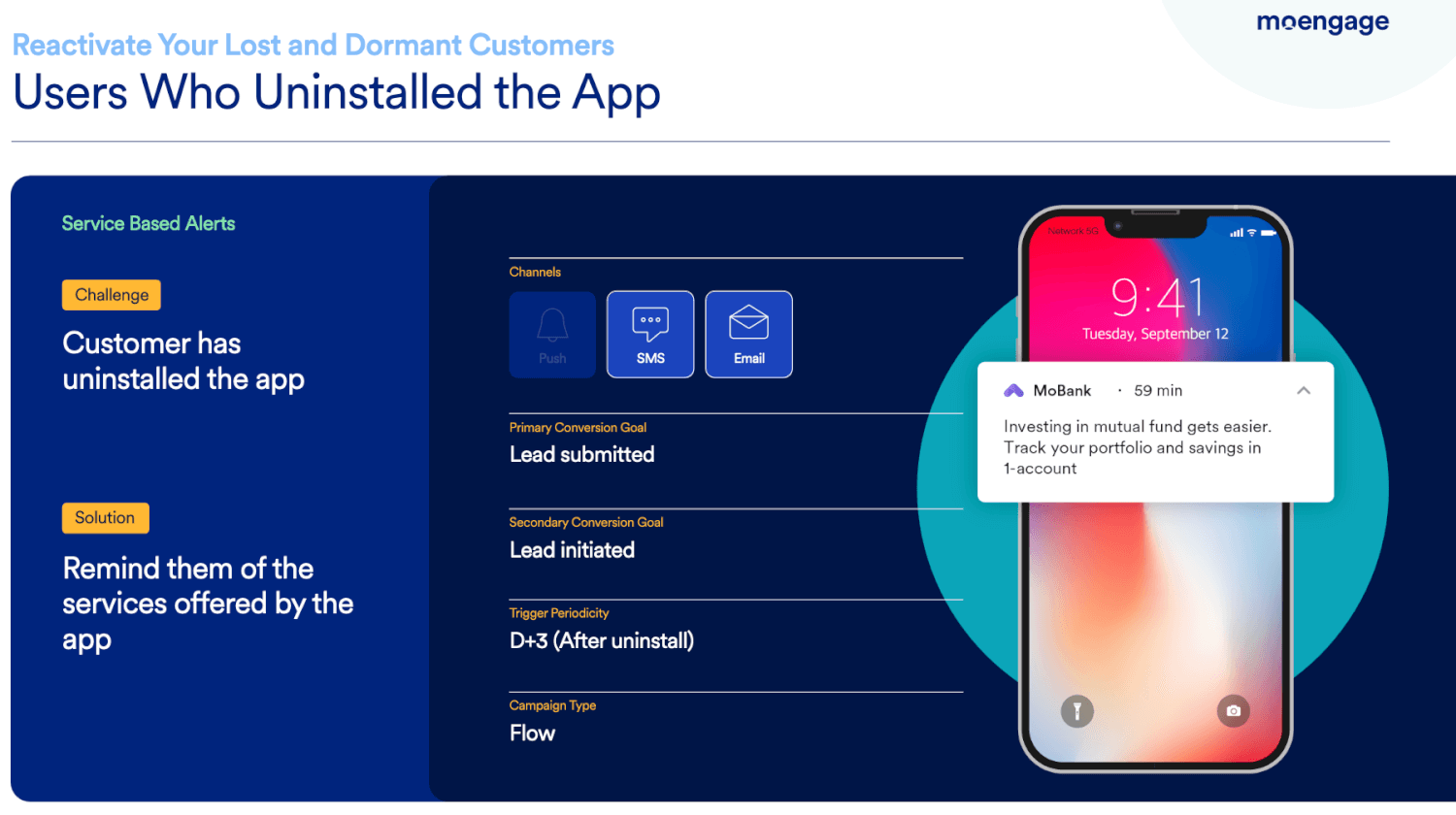

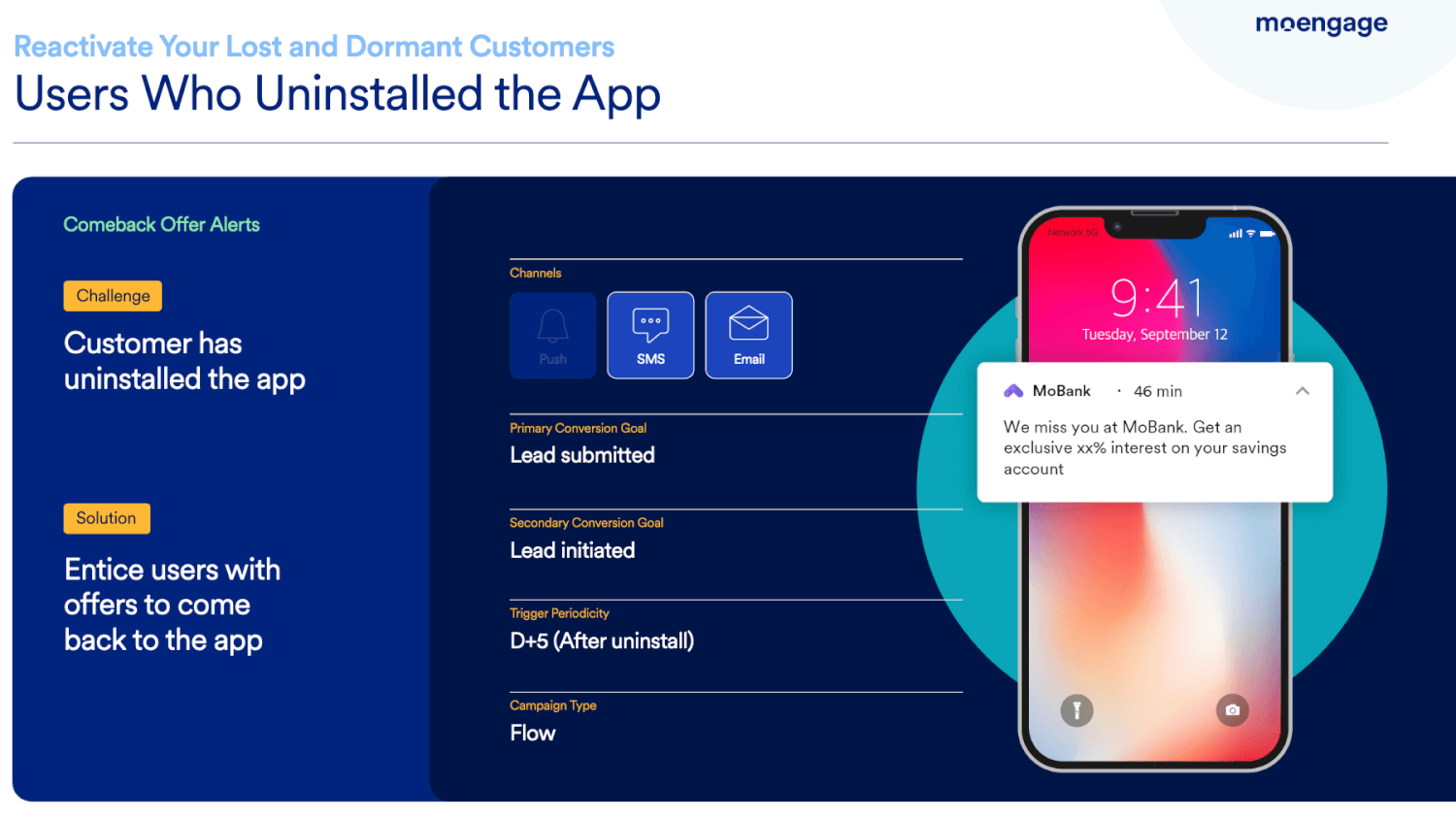

Reactivation

Modern customers often tend to forget what apps they have installed on their phones or forget what tasks they can accomplish via banking websites.

The end result? They either uninstall your mobile app or stop visiting your website altogether.

These dormant customers need to be reminded about the different value propositions of your banking platform to reignite their interest.

Goal:

The primary goal of reactivation should be the number of customers who reinstall your mobile app or login to their account on your website after a long period of inactivity.

Metrics to measure success:

A key metric to measure the success of your reactivation campaigns is the number of mobile app reinstalls or the number of times your website was visited.

In cases where your customer has not uninstalled your mobile app but has not been active for a long time, you can measure the mobile app opened as a success metric.

Strategy to drive reactivation for banking brands:

- Build RFM segments and create customer journeys that engage each dormant customer and convince them to come back and use your digital platform.

- Remind dormant customers about the different value propositions of your mobile app or website by sending relevant messages on multiple channels.

How Can a Customer Engagement Platform Help You Reactive Your Banking Customers?

Identify churned or inactive customers and re-engage them with relevant content. Using a Customer Engagement Platform like MoEngage, you can create customer segments based on their recency, frequency, and monetary (RFM) scores.

To identify inactive customers, look at segments with the lowest recency score.

Once identified, build custom workflows for these segments and include multiple channels like Email, SMS, Google Ads, or WhatsApp.

You can also learn the individual preferences of customers in these segments based on their previous browsing habits and purchasing history.

These insights will help you curate the perfect messages for your reactivation campaigns.

Conclusion

Customer Engagement Platforms (CEPs) provide an excellent opportunity for banks like yours to improve customer experience, increase customer loyalty, and reduce costs while maintaining a secure environment for your customers’ data.

By leveraging CEPs, you can offer personalized experiences that align with customer preferences, streamline operations, and automate routine tasks, all while ensuring the safety and security of your customers.

Customer Engagement Platforms will help you improve LTV and CX if used for:

- Digital Onboarding and KYC (Know Your Customer)

- Product Cross-sells and Upsells

- Timely Alerts and Reminders

- Reactivation

Read more about MoEngage’s Insights-led Customer Engagement Platform here.