How to Increase Customer Engagement for Banks in the Middle East

Reading Time: 12 minutes

Today, digital campaigns are at the heart of customer engagement strategy. The proliferation of mobile phones coupled with millennials and GenZ becoming key economic drivers, has made brands redefine customer engagement strategies. A case in point – 67% of Middle East customers are shifting towards digital channels to engage with brands.

Needless to say, the banking and financial services vertical has been no exception.

In this article, you can read about various customer engagement examples and learn effective ways to drive customer engagement in the Engagement 2.0 era.

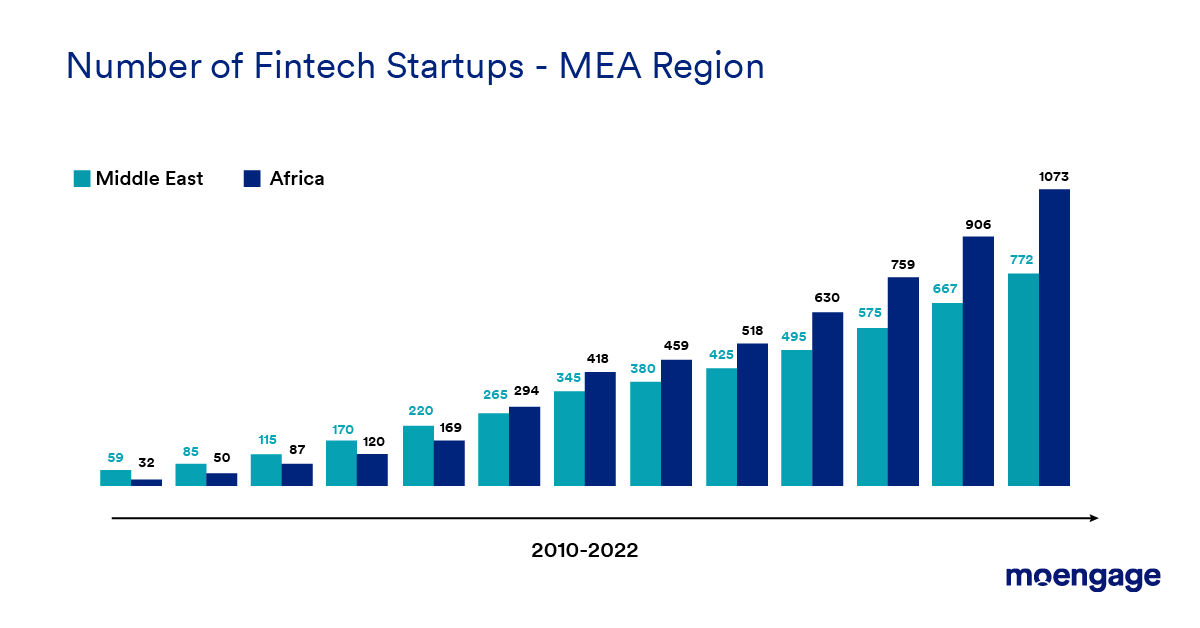

The Rise and Rise of Fintechs in the Middle East

Back in the day, the lay of the land consisted of major traditional banks and dominant offline channels with product-driven campaigns. However, as buyers’ expectations evolved, digital channels witnessed large-scale adoption to boost engagement.

As banks underwent a digital transformation to adopt the new trends, a new breed of digital-only banks entered the ecosystem and influenced customer engagement strategies.

The fintech sector in the Middle East has grown rapidly at a compounded annual growth rate (CAGR) of 30%. By 2022, it’s predicted that 800+ fintech brands will be part of the ecosystem.

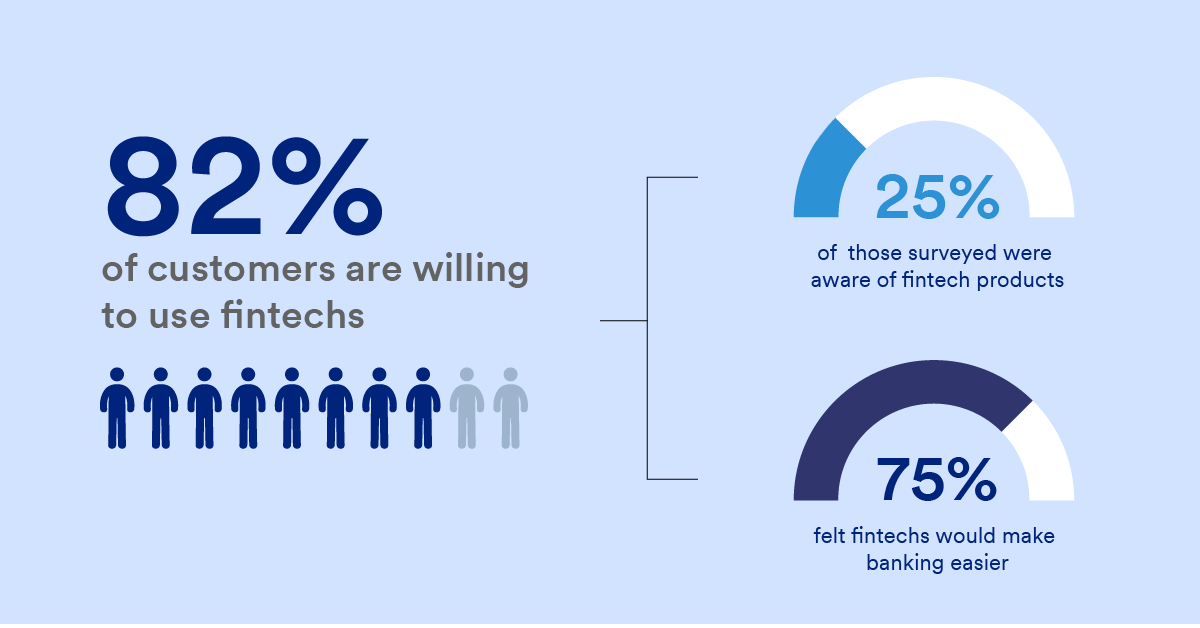

At the same time, customers, especially millennials and Gen Z, are inclined to engage with these new and agile brands. This has yielded successful customer engagement for fintechs across the region, especially in the post-pandemic era.

How Banking and Financial Services Drive Customer Engagement in the Middle East

It is clearly evident that new disruptions have led to changes in customer engagement frameworks. Banks and fintechs have been reactive to these changes in a quick fashion. Here are a few case study examples of fintechs and their current engagement strategies.

Optimizing Customer Onboarding

Typically customer onboarding was a tedious process where visiting the branch was a norm. KYC verification took a couple of days, and the customer engagement was broken.

However, as customers started engaging through apps and websites, onboarding from a time standpoint improved and became a seamless experience.

Let’s take the example of one of the popular bank of Middle East.

Commercial Bank of Dubai develops a customer engagement strategy with a focus on digital innovation

For more than 50 years, the Commercial Bank of Dubai (CBD) has been engaging with customers and providing them with customized services. And today, it is ready with its suite of helpful innovations.

The infrastructure and tech stack allowed the bank to implement and have necessary services on digital channels even before the pandemic hit:

- Opening a new dirham current account

- Getting a mortgage

- Applying for a personal loan

- Opening accounts in different currencies

Additionally, CBD created a quick onboarding experience, allowing customers to open a bank account within 2 minutes.

This has helped build customer loyalty and has also allowed the bank to create a huge difference by driving financial inclusion.

With over 300 million unbanked adults (according to the MENA Financial Inclusion Report 2020) in the region, Commerical Bank of Dubai built brand advocacy by taping into the unbanked segment through key offerings like no minimum balance requirements, free debit cards, along with a host of other benefits like two free remittances per month.

“Most of our retail products are available online, instantly, and with a few clicks. For example, a customer can apply for personal loans on the mobile app and it will be fulfilled and in the account within minutes.” – Stefan Kimmel, Chief Operating Officer, Commercial Bank of Dubai.

Driving Omnichannel Engagement

Within the startup ecosystem, fintechs have been enjoying preeminence status. A large number of brands are operating in the fintech space. However, a challenge that these brands face is around acquisition and retention.

Customer engagement through an omnichannel strategy can help brands retain customers and drive brand loyalty.

This is exactly what Mashreq Neo did and witnessed improvement in their key metrics

Mashreq Neo boosts experience through omnichannel customer engagement strategies

Mashreq Neo initially employed its mobile app in a siloed manner, leading to a disjointed experience and customer communication. This is reflected in high-drop offs and low adoption of key features like debit card spending and customer loyalty program.

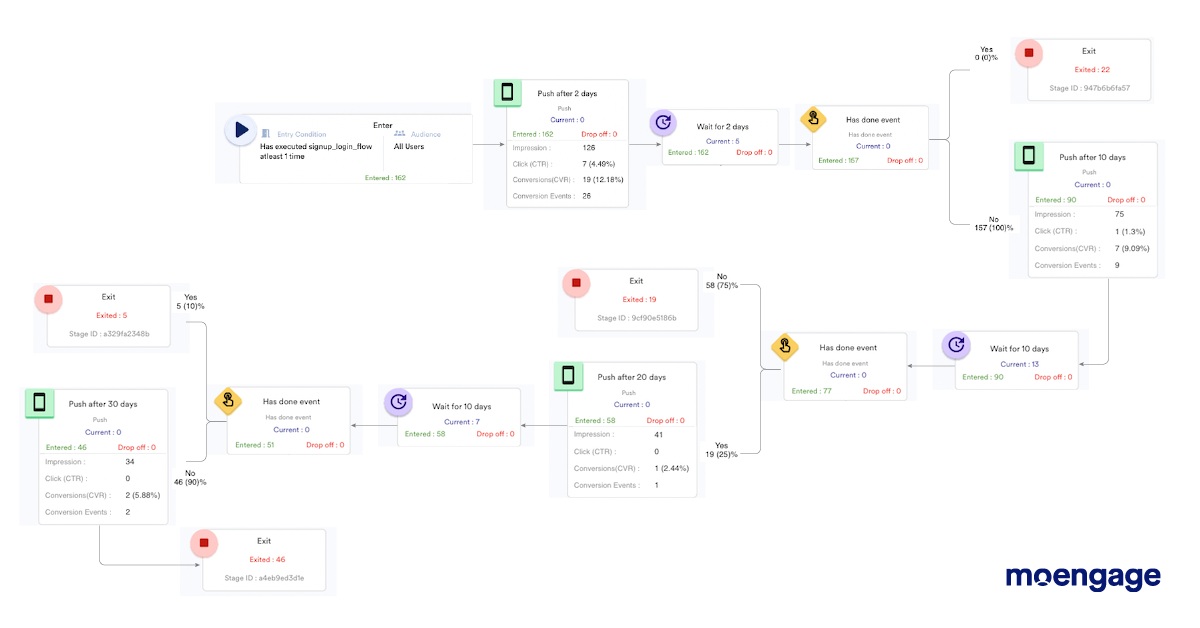

To overcome these challenges, Mashreq Neo analyzed its customers by developing cohorts (across installed to uninstalled stages) and identified peak-drop off points. They also built omnichannel workflows to engage customers based on different risk buckets.

Additionally, Mashreq Neo used various communication channels and customer engagement activities to drive personalization. They urged the customers to opt-in to the loyalty programs that offered cashback and rewards. This helped the bank drive enhanced customer experience across online and offline channels.

Segmentation for Personalizing Customer Experiences

Understanding at what stage the customer is, has become a need-to-have imperative. To provide a hyper-personalized customer experience, brands have to start analyzing every customer engagement touchpoint and build cohorts based on attributes, affinities, and frequencies.

A leading traditional bank uses segmentation to drive personalized campaigns

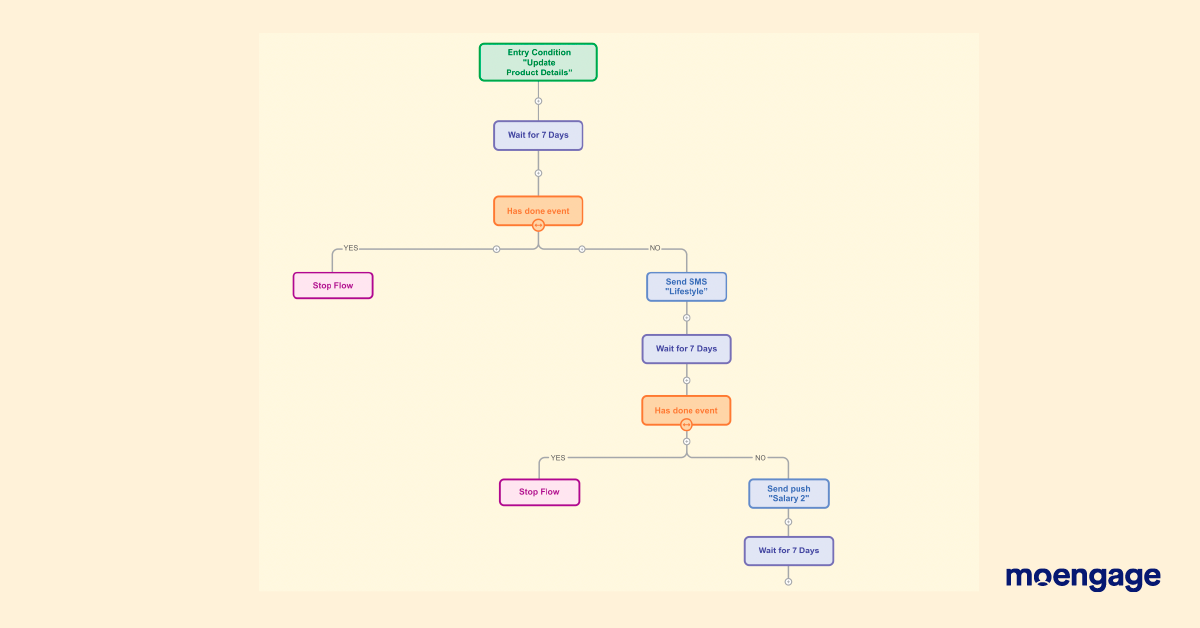

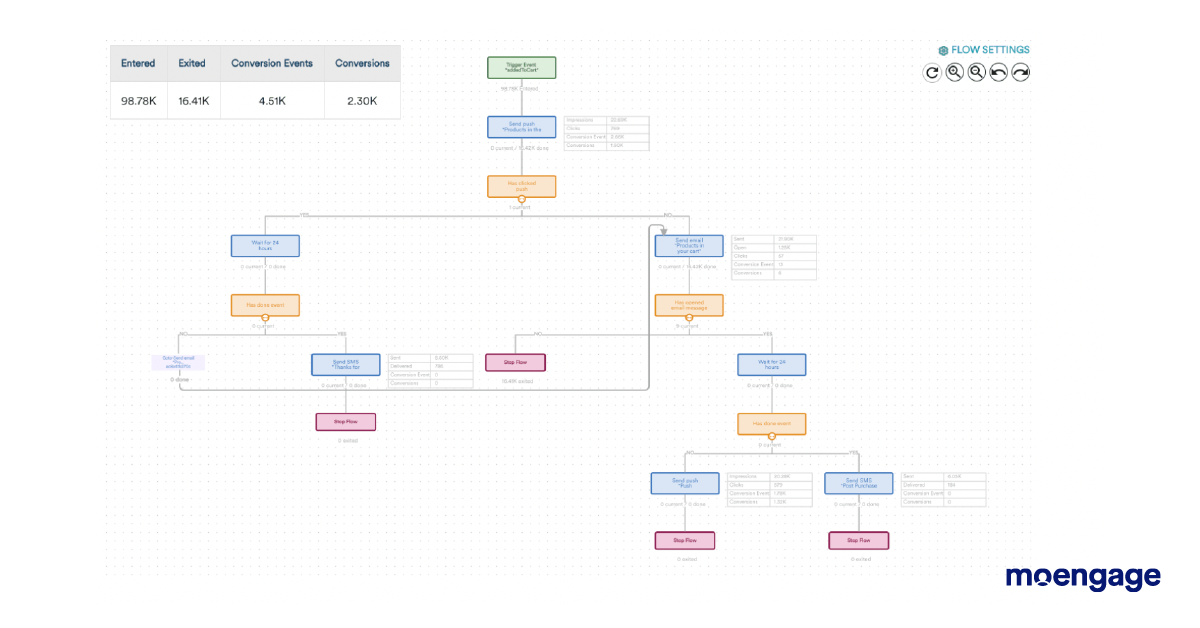

The traditional bank with online and offline presence has been using cohorts and building specific segmentation to engage customers in a timely and personalized manner. The bank utilized flows to orchestrate smart journeys and craft personalized cross-channel journeys to keep customers engaged.

They developed two flows to drive campaigns

- Drop off

- Bring back inactive customers

Using these flows, the team observed improvement in metrics like conversion rates of 28.8% and 24.1%, respectively.

Automating Customer Engagement Strategies to Enhance Brand Voice

Customer engagement strategies have evolved in the last couple of years. With technology driving customer experience, brands are finding ways to engage with customers without manual intervention and build loyal customers. One solution that has come out is using data analytics to build different segments and engage with customers on a regular cadence across channels.

A leading UAE bank drove automated customer engagement strategies to gain traction

Manually creating each push notification in real-time can be tedious, rendering banks to engage customers in a disjointed manner.

To overcome this issue, a leading UAE bank developed to push and in-app campaigns to build relationships with customers. The bank utilized its login page as a good touchpoint to engage customers with pop-ups.

Additionally, the bank, using customer engagement technology, shifted from emails to pop-ups for monthly newsletters, which resulted in enhanced traction.

Moreover, the bank was able to develop a customer feedback loop, thus helping enhance customer engagement amongst the existing engaged customers and new customers.

From the above-mentioned use cases/case studies, it is clearly visible that brands within banking and financial services, and especially fintechs, are engaging customers through various customer engagement strategies and are accumulating positive feedback.

However, this is just the starting point. As expectations evolve, fintechs will need to find innovative ways to engage customers and enhance customer engagement.

Moreover, existing fintechs will also face stiff competition from new fintechs and the traditional banks.

To survive in such a red ocean scenario, fintechs of today will have to redefine their customer engagement strategy and how they track and measure customer engagement.

What Will the Future Entail – Customer Engagement 2.0

By now, it is visible that customer engagement strategies and marketing activities associated with them have clearly transformed. As the world moves forward, so will the evolution around customer engagement.

Loyalty will play a big role and loyal customers will be the differentiating factor.

To build this loyal customer base, brands will have to march afoot with these evolving expectations.

It will entail using technology to understand the customer, reaching out via various channels like social media, and educating them.

A simple 4A framework – Acknowledge, Anticipate, Act and Acquaint – can help brands improve customer engagement strategies as they enter the customer engagement 2.0 era.

Acknowledge – Know your customer has a new facelift

When it comes to banking and financial services, knowing your customer (KYC) has a literal definition. However, for marketers, to draw a new customer engagement marketing strategy, KYC will entail comprehending the existing data and also capturing alternate insights.

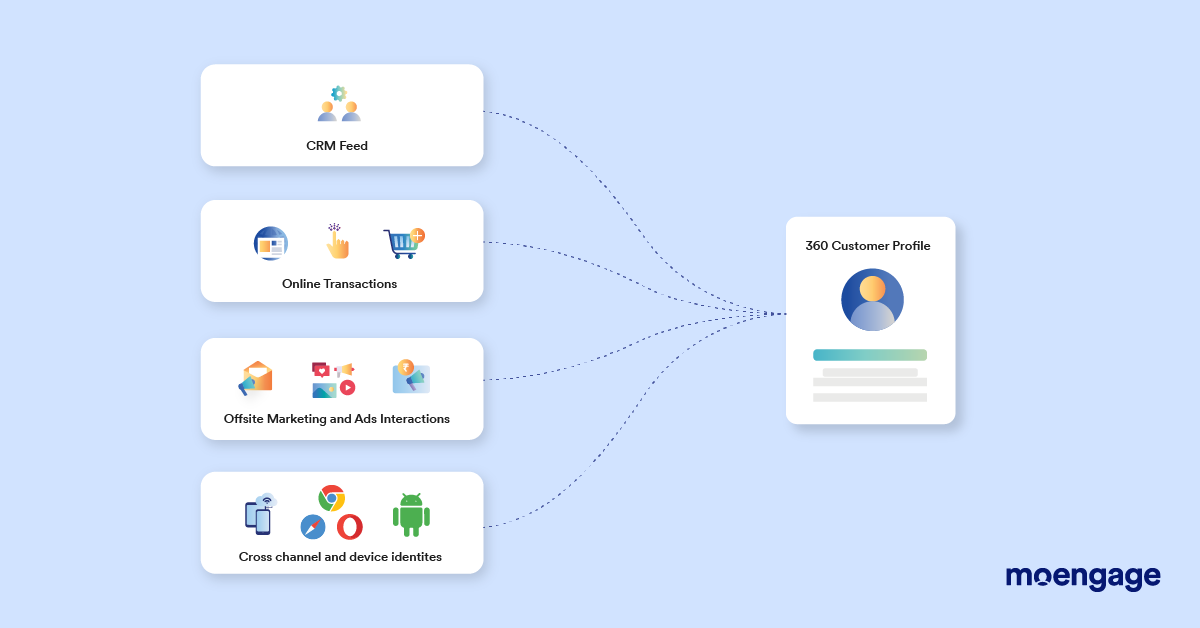

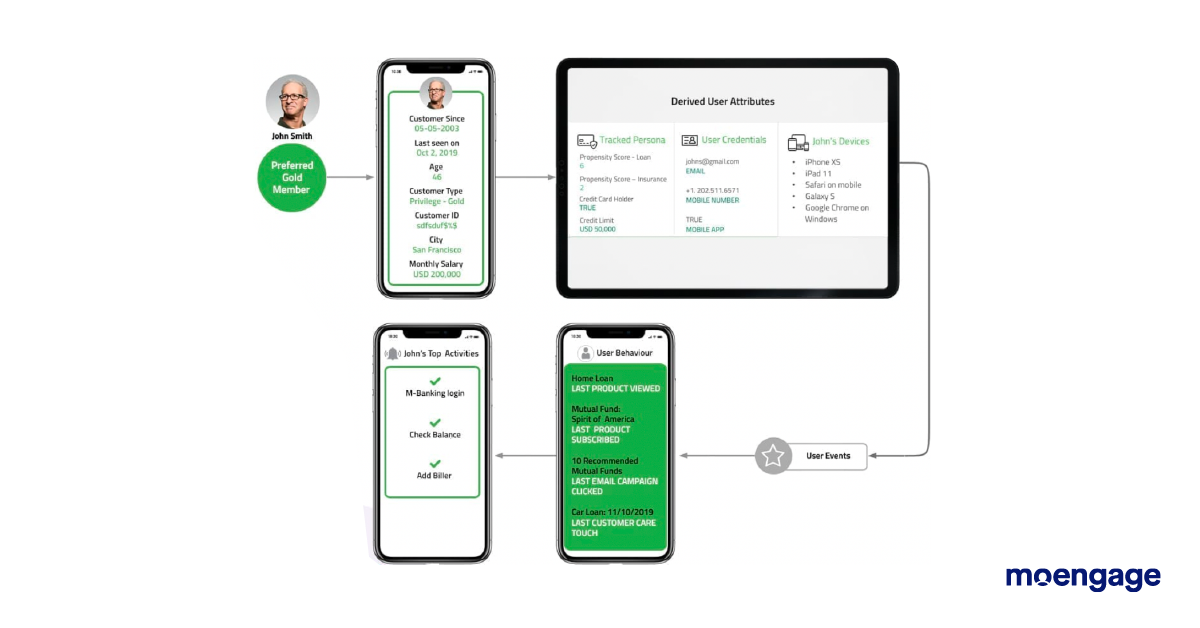

Enter – Building a customer 360 degree view. By definition, a 360 degree customer view is a singular comprehensive view of a customer’s data.

The data could include a customer’s basic contact information, past and present purchasing history, and information on affinities, likes, dislikes, and engagement with several touchpoints in their customer journey.

Because of the wealth of data they contain, 360 degree customer view is a strategic approach that enables businesses to offer the best possible customer experience across unified channels and touchpoints by integrating personalization.

Benefits of building a customer 360 degree view:

- Enhanced personalization: Brands can gain a competitive advantage by developing a holistic view of customers and target them with better personalized and suitable customer engagement campaigns.

Strong relationships then positively impact customer loyalty, reducing customer churn and boosting LTVs (lifetime order values) - Improved customer engagement: Many brands fall into the trap of operating in silos, resulting in fragmented data. This hinders the customer engagement marketing strategy leading to an ineffective experience.

This is where 360 degree view has the ability to help nurture better customer engagements from a singular comprehensive view - Improved customer loyalty: Landing a customer is important for brands, but keeping them coming back is the secret to long-term success. A 360 degree view can help brands anticipate customer needs and develop a strategic communication plan.

Anticipate – Predictions will play a key role

Once fintechs have developed a 360 degree view, the next step comes in the form of analyzing and predicting your customer’s preferences and propensities. Because it is not just about what your customer has done – it’s also about where they’re going.

By creating a complete picture of the customer, fintechs can gain insights into what a customer demand may entail in the future.

Superior predictive analysis & data allows brands to be better positioned to act on cross-sell, churn, or up-sell opportunities.

At the same time, machine learning plays a big part in how well these predictive audiences work. It can allow fintechs to engage customers on the basis of Recency, Frequency and Monetary models.

Overall this benefits brands by enabling them to anticipate, plan and prepare an engagement strategy that drives customer satisfaction and enhances customer retention.

Act – Target the channel which is most used

As mentioned earlier, digital engagement has been a front runner in these last couple of years, and most likely, it will remain so in the near future. For fintech marketers targeting their customers, predictions can lead to the next logical step, i.e., acting on the insights gained.

fintechs using data analytics can slice and dice the existing customer data and build different segments/cohorts.

These cohorts could be around win-back campaigns or drop-off campaigns. Using these buckets, they can engage with customers through a personalized marketing campaign, ultimately enhancing their experience.

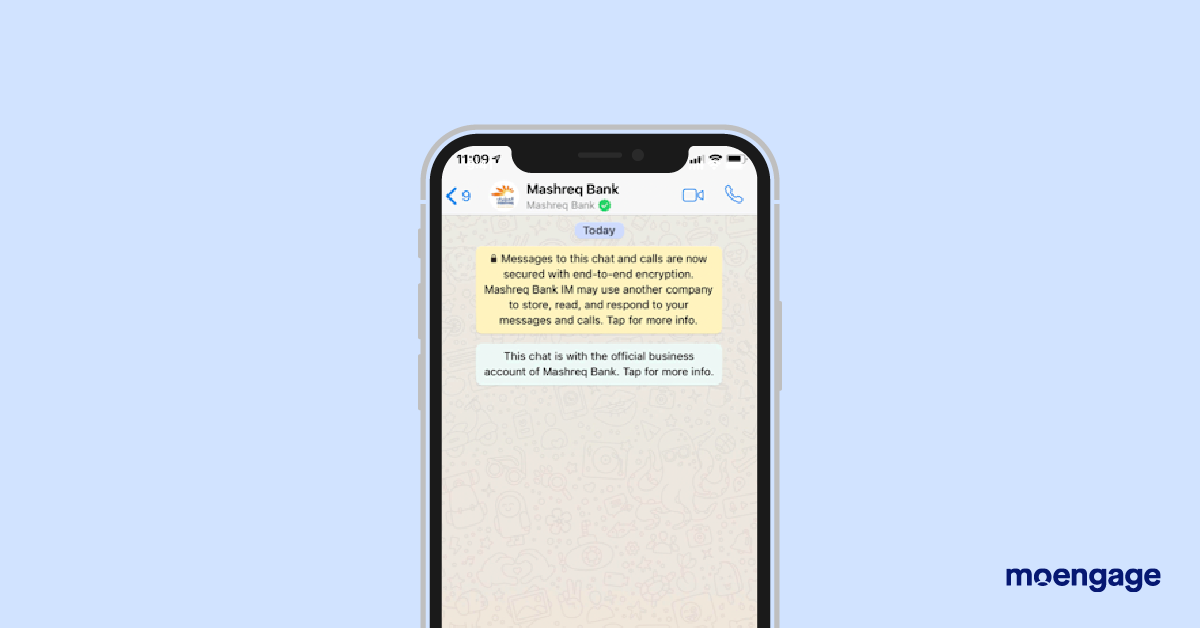

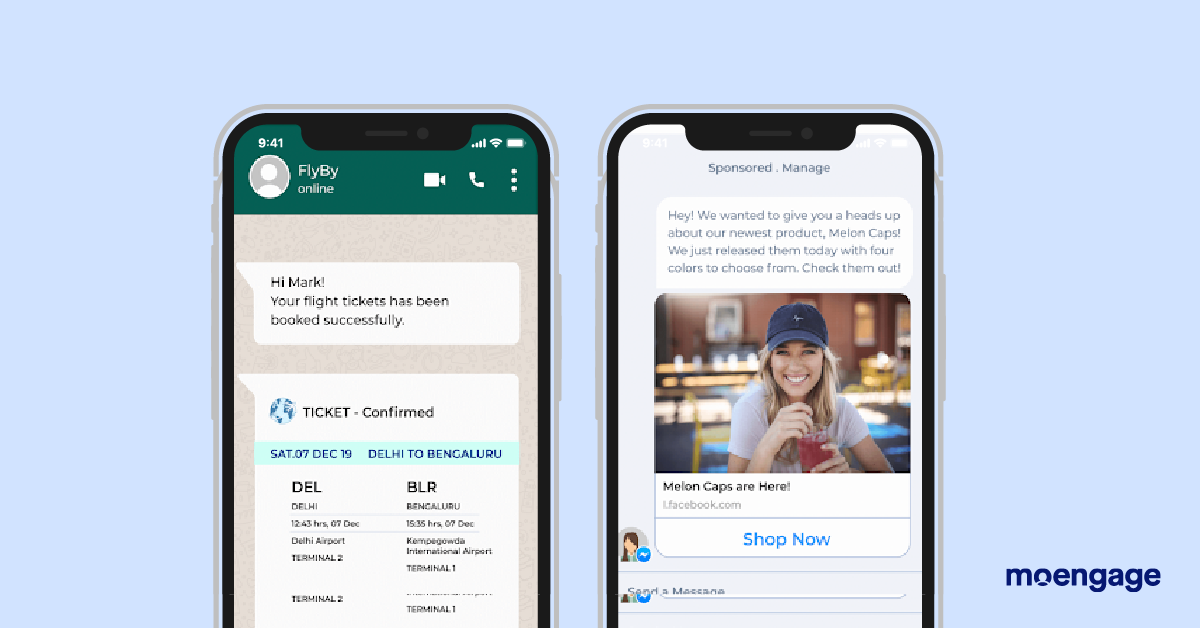

One good example of this can be around the digital channel used for communication. While e-mails and SMSs have been the go to channel for many brands. A trend around social media, especially WhatsApp as a channel, is something brands can adopt.

fintechs can utilize social media channels like WhatsApp to send notifications around key offers, crucial partnerships, new product launches to name a few.

A case in point – If we look at the Middle East region, right now there are more than 115 million WhatsApp customersin just five Middle East countries. No other social media platform has had quite the same impact in the Middle East-North Africa region.

This way, by using the right channels, not only will fintechs be able to crack the code of hyper-personalization through targetted engagement, they will also build strong loyalty base from new and existing customers.

According to a Google study, millennials in the Middle East have more brand loyalty than their peers in the US, UK and Japan. A significant number of millennials in Saudi Arabia and UAE considered only one brand when they buy.

Acquaint – Build a community to share knowledge

The last overarching step and probably one of the most important pillars of the customer engagement 2.0 will be to educate engaged customers and build a knowledge base.

70% of customers learn about a brand through their content instead of ads. What’s more, 60% of customers are more positive about a brand after they consume content from that brand. These statistics show that educational content marketing is a big part of customer experience that introduces customers to a brand, products, and services.

Customer engagement marketing strategies revolving around content can create a win-win situation by providing information that customers want while building long-lasting relationships.

One use case instance for fintechs can be around educating its customers about contactless and digital payments, various digital offerings, Islamic banking offerings amongst others through various traditional and social media channels.

Not only will this help customers relate to your brand and build brand affinity. It will also help fintechs/brands gain the much-needed customer trust.

How Can MoEngage Help Banks and Fintechs?

MoEngage has been instrumental in solving the challenges that banks, financial services, insurance, and fintech brands face every day.

The solution lies in MoEngage’s ability to create orchestrated campaigns across multiple digital touchpoints like emails, SMS messages, push notifications, and social media.

At MoEngage , we analyze, segment, engage, and optimize campaigns that delight customers and improve the performance of our banking customers’ marketing strategies.

It is this razor focus on customer obsession that has made us work closely with some of the biggest banking brands internationally, including Mashreq Neo, Rain, Sympl, Rakbank and Commercial Bank of Dubai. Here are some ways in which we enable our banking customers:

Create a 360˚ view of your customer

By bringing together the best of automation and analytics on one platform, we help marketers design and monitor customer engagement campaigns. This way, we help you get a single view of the customer (geographical, demographical, behavioural data).

Our state of the art machine learning algorithms enables you to make the leap from just a performing campaign to a high performing one. AI-enabled algorithms reduce the time taken to make decisions by automating the right content at the right time on the right channel for every banking customer.

Segment and create user personas

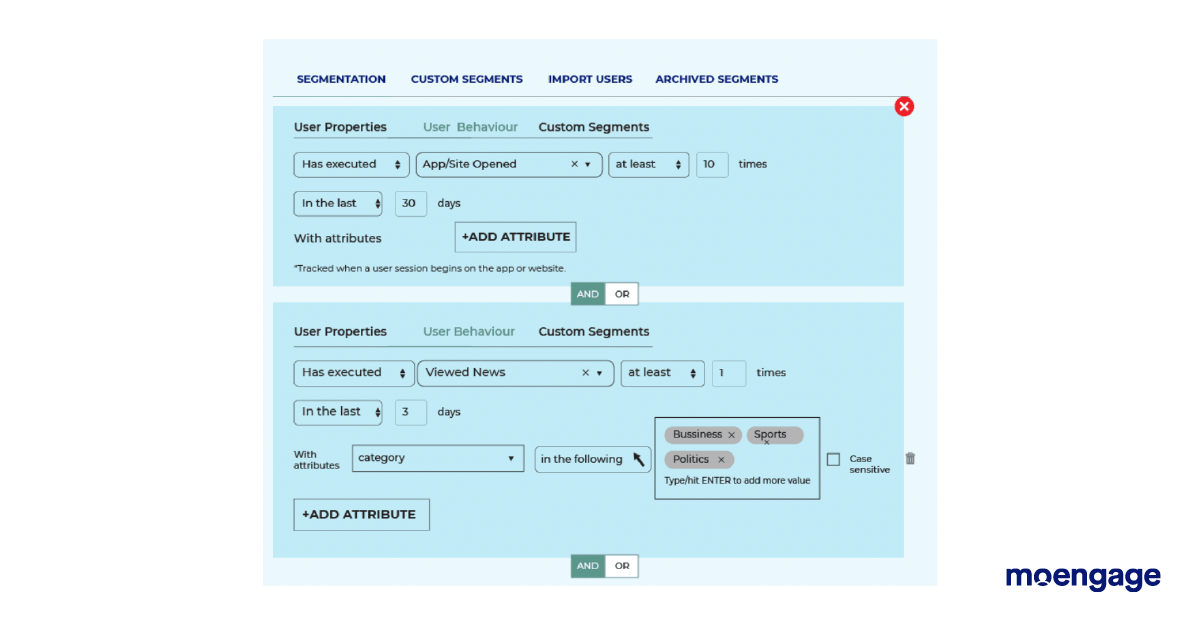

Segmentation is looking at your customer data and grouping them based on similar behavior or attributes.

Some examples of segmentation are ‘customers who browsed for Mutual Fund Investments on the site/ app,’ ‘customers who completed more than five transactions in seven days, ‘customers who are completing transactions using social media’’.

Segmentation could also include customer attributes and affinities like model of cell phone used, place of residence, channel preference, most active time on the app, etc. With MoEngage you can create easy segments of customers in two main ways:

- RFM Analysis (Recency, Frequency, Monetary): Create a chart of your customers based on their likelihood to make a purchase, overall frequency and the monetary value of purchases. The RFM chart gives you a quick overview of all customers right from Dormant to Champion and helps you create appropriate marketing campaigns.

- Advanced Customized Segmentation: Segment your customers based on user events (for example, completed a fund transfer in the last 7 days) and derived user attributes (for example, located in Abu Dhabi). Such custom segments help you design high performing marketing campaigns with ease.

Orchestrate personalized omnichannel journeys across the customer’s life cycle

Banks and fintech brands acquire customerss through multiple channels and mediums. There is an obvious challenge to onboard these customers and get them to explore different product offerings.

With MoEngage, it becomes easy to onboard new customers, engage, retain and seek referrals from existing customers.

Using MoEngage Flows, banks and fintech brands are able to design marketing automation flows that are easy to create, visualize and deploy across channels. For example: from onboarding, new prospects to earning referrals from existing customers, Flows takes care of all customer touchpoints.

Stay connected with customers outside your website or app

We help you scale your customer engagement model beyond the mobile app, website, and email and extend your reach by including social channels, ad-retargeting, and WhatsApp in your omnichannel campaigns.

With MoEngage’s customer engagement plan, it becomes easy for your brand to:

- Analyze customer behavior and campaign performance by integrating with third-party tools

- Make Facebook, Google ads, and other third-party channels a seamless part of your omnichannel campaigns.

- Trigger contextual and hyper-personalized communication over messaging platforms.

- Send personalized messages over WhatsApp and Facebook Messenger.

Conclusion:

In the Engagement 2.0 era, the answer to the question – how to increase customer engagement? – is that brands need to further personalize their campaigns and communicate effectively. To gain customer attention at every touchpoint, brands can use the 4A framework, Acknowledge, Anticipate, Act and Acquaint as the stepping stone.

These will help brand in boost engagement and also assist them in developing measurable tactics to drive brand loyalty.

To know more about how MoEngage can help you drive growth, you can schedule a call with us here.