MoEngage For Financial Services: The Ultimate Digital Transformation Catalyst for Financial Service Brands

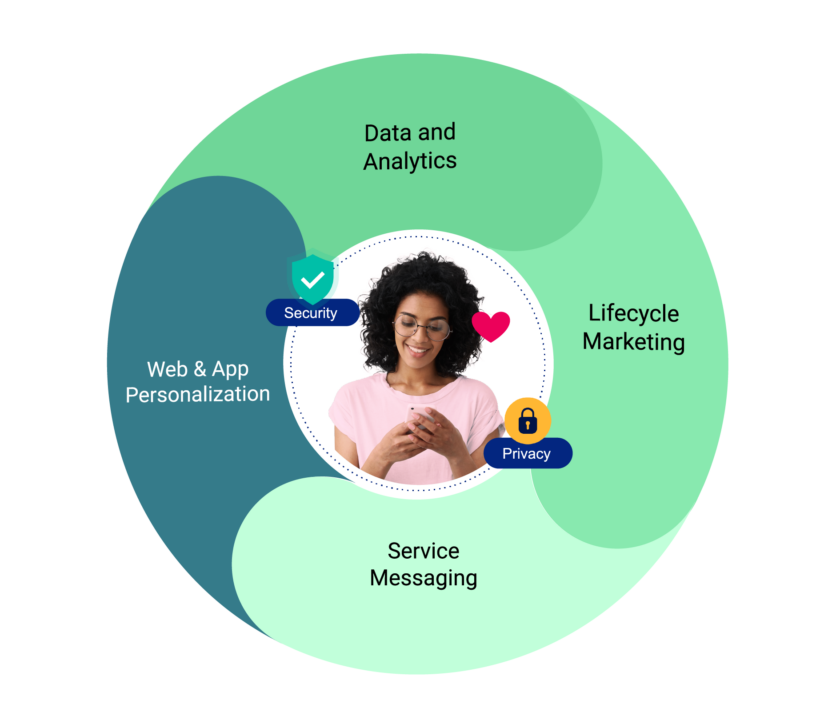

A purpose-built solution for financial services to deliver contextual and relevant customer experiences in real-time.

Reading Time: 6 minutes

Nothing is ‘As It Was’ in the world of financial services. Many factors are constantly changing, from customer expectations to mandates from regulators and policy-makers.

In the past five years, financial institutions have strived hard to master digital channels like apps, internet and mobile banking, e-wallets, and chatbot solutions. However, financial institutions have also realized that the disparity between the customer experience across channels is widening. Also, the level of personalization experienced in in-person interactions has been diluted by adding new channels to the mix.

Financial institutions are cognizant of what stands between them and their customers: their current martech stack which consists of multiple tools that only increase the complexity and time required to execute.

This begs the question: How can financial institutions provide a seamless, frictionless customer experience across channels and devices in 2024?

It is impossible to paint a complete picture of the financial service industry’s state without discussing the importance of data security and privacy in all areas. Marketers across the financial service industry are looking for new-age martech tools built with data security in mind.

Growing Pains From A Bloated Martech Stack

Operational inefficiencies and dependencies on external teams and agencies shackle marketers in the financial service industry from providing customer experiences that every customer needs and deserves.

While the requirements for financial service brands in 2024 are for a flexible and agile martech stack, legacy tools only increase dependencies and complications for even a simple task such as automating an onboarding campaign.

Some commonly faced challenges by financial service brands include:

1) Inability to Leverage New-Age Channels Seamlessly:

The modern customer would prefer to be engaged through channels beyond emails and SMS, namely push notifications, WhatsApp messages, pop-ups, etc. With a bloated martech stack with numerous point solutions for each channel, the customer experience will be far from seamless.

2) Siloed Promotional and Service Messaging:

Multiple tools that send promotional and transactional messages only result in a broken customer experience. Without a unified view of the transactional and promotional messages a customer has received, it’s hard for teams to identify if the customer has already received a critical alert on one channel and stop the same message from going on to other channels.

3) Longer Time and Effort to Execute Campaigns:

With a fragmented stack consisting of numerous solutions that are not compatible with each other, tasks that should be completed in minutes take days and weeks. Not to mention the reliance on external implementation partners and agencies to complete the simplest tasks.

4) Inability to Engage Customers in the Moment:

Obscurity around campaign performance and customer behavior makes it difficult for financial service brands to engage with customers in real time.

The result of these bottlenecks is lackluster performance on digital channels, unnecessary spending, and frustrated teams.

Why Should Financial Services Modernize Their Tech Stack?1) Efficiency vs. Bloat: Compare the steps required to achieve your goal with the customer engagement platform (CEP) vs. without. If the number of steps and complexities reduces with the addition of a CEP, and if the platform integrates with other tools in the martech ecosystem, then it’s a sign that you should modernize your tech stack with purpose-built CEP solutions. 3) Speed vs. Time-consuming: Consider the implementation time and the degree of involvement required from external consultants, developers, and agencies. The more external stakeholders are involved, the more time it takes to execute campaigns. If this is your situation, then it’s a clear sign that you should invest in a modern tech stack. 4) Ease of use vs. Unnecessary Complexity: Automating cross-channel workflows is an important capability a customer engagement platform requires in the financial service industry. The ideal CEP should make setting up your customer journey easy, whether the use case is onboarding or reactivation. |

Financial Industries Needs a Digital Transformation Catalyst

After working closely with 200+ leading financial institutions worldwide, including global behemoths like Standard Chartered, Citi Bank, and Ally Bank, we at MoEngage understood what impedes financial institutions’ ability to provide easy and frictionless customer experiences—the culprits: lack of agility, flexibility, and security.

Financial brands need access to real-time and actionable customer data without compromising agility and security. With MoEngage for Financial Services, financial brands can build digitization flywheels that drive growth and enhance customer experiences.

MoEngage for Financial Services: Purpose-Built Solution to All Engagement Woes

MoEngage for Financial Services is built to revolutionize your financial service brand’s presence in this digital-first world. With an agile, security-first, flexible solution, it’s time financial service brands bid farewell to dependencies and overheads associated with redundant legacy technology platforms.

With MoEngage for Finserv, you can:

-

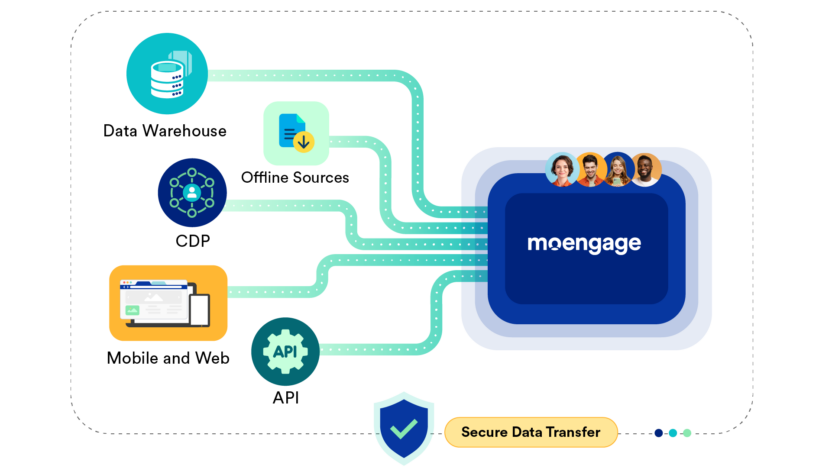

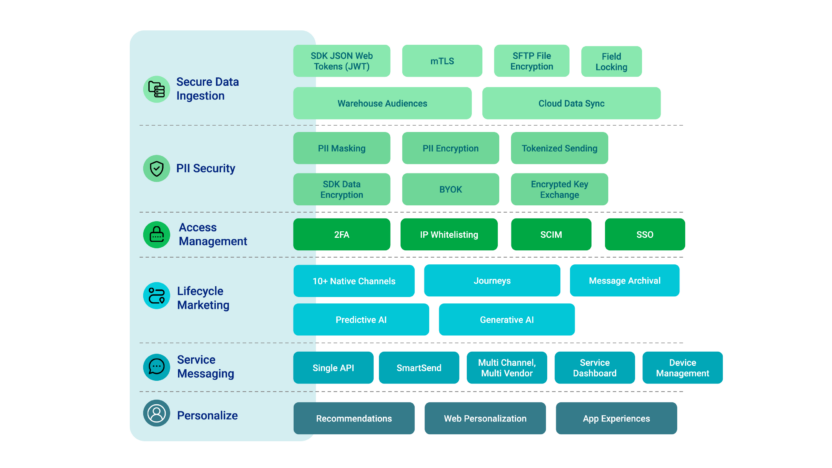

Safely Ingest, Store and Access Your Data

MoEngage for Financial Services comes with industry-first features that enable faster data ingestions through direct connections with data warehouses and robust security through PII Masking, PII Encryption, and SDK Encryption. These features ensure that your customer data remains protected by adhering to global and regional data privacy and security standards.

-

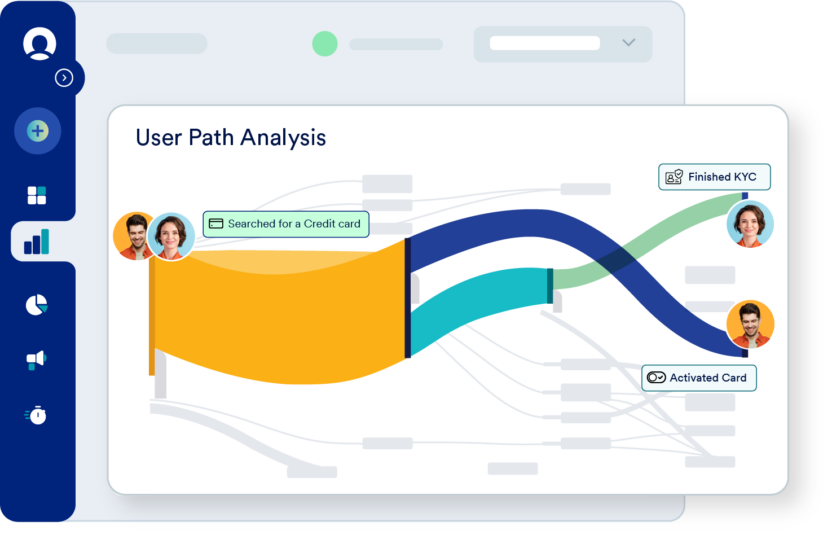

Leverage Data to Uncover Insights with Actionable Analytics

Get complete clarity on customer behavior across channels and devices with MoEngage’s robust analytical features. Understand how your customers navigate through app or website with user paths, identify friction areas in app/ website that cause drop-offs with actionable funnels, discover the right customer segments with cohort analysis and RFM, and get AI-driven insights with Proactive Assistant.

-

Automate Customer Journeys Across 10+ Channels

With MoEngage’s PII Tokenization, financial institutions can send promotional messages without storing customer PII data. MoEngage’s omnichannel capabilities will help financial institutions to utilize channels beyond email and SMS like push notifications, on-site, website, in-app, and messaging apps. Optimize and iterate campaigns effectively using Sherpa’s Predictive AI and Merlin’s Generative AI.

-

Unify Promotional and Service Messaging Effectively

Cut through the siloes when it comes to promotional and service messaging with MoEngage’s Inform that helps brands to build, manage, and scale service messaging across channels through a single API. Also, reduce costs and ensure deliverability through SmartSend.

-

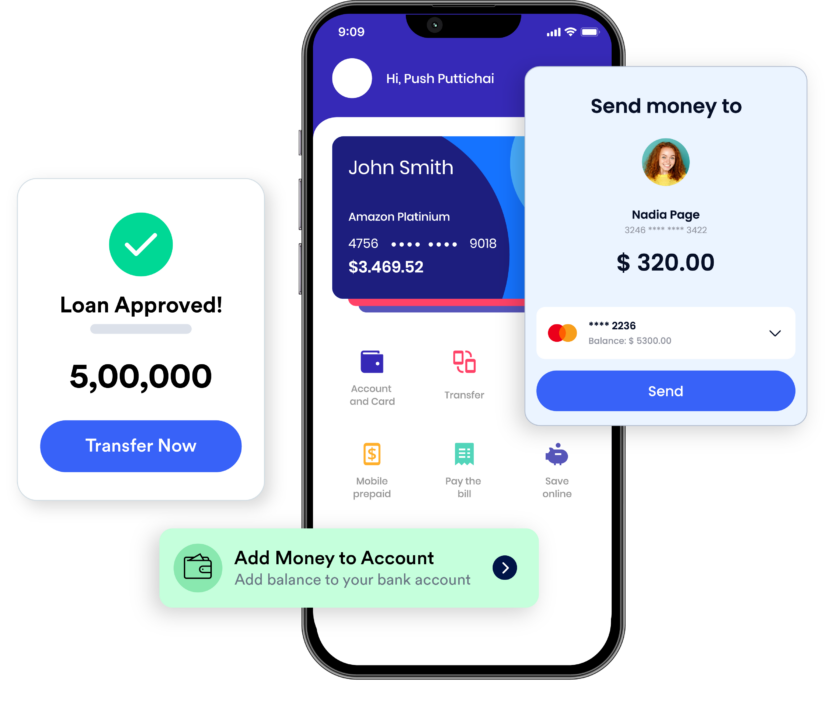

Boost Conversions Across Website and Mobile App

MoEngage’s connected experiences and rapid experimentation capabilities allow financial brands to extend the personal touch across all digital banking platforms like website and mobile app. Now financial institutions can personalize experiences based on preferences, affinities, and behavior in real time. The result: Increase in new customer acquisition and conversions.

Want to know how ‘MoEngage for Financial Services’ can help accelerate your brand’s growth and digital transformation? Talk to our financial services expert here.

Related Reading:

- Your One-Stop Shop To All Resources Related to Financial Services

- Keep Customer Data Confidential with PII Masking

- Website Personalization For BFSI Brands: How To Tailor Personalized Financial Web Experiences For Customers

- How Banks Can Use Customer Engagement Platforms to Improve LTV and CX While Reducing Costs in a Secure Environment