3 Marketing Automation Strategies that Reduce User Drop-off for Fintech Companies

Reading Time: 7 minutes

User drop-offs on website/app can be a major concern for fintech companies as it does not offer instant gratification like social media or a retail website/app.

A recent article by Forbes revealed that user churn could go up to 77% if the marketers fail to engage the users in the first two weeks. The author of the article suggests understanding the user’s journey and using tools such as marketing automation to decrease user drop-offs.

To delve more into this topic, we spoke to Anuj Ranka, Performance Marketing Head of EarlySalary, to share his expert knowledge and strategies.

Here’s what you will learn, if you read this article:

- Why is marketing automation important for Fintech companies?

- How to build a smart marketing automation strategy like EarlySalary?

- Why is email marketing still a relevant strategy?

- How to improve email deliverability?

- Next actionable tips

So let’s get started.

| Bonus Content

👉 State of Mobile Finance in 2021 – [Download Ebook] 👉 Your Guide to a Winning Customer Experience in Financial Services in 2021 – [Download Ebook] 👉 Beginner’s Guide to Omnichannel Marketing for 2021 – [Download Guide] |

Why do fintech companies need marketing automation?

Consumers are becoming digitally savvy. They expect the same experience that they receive from retail apps or a cab-hailing app from a fintech app. Accenture’s study reveals that 61% of banking customers want access to more online interaction. They also want little to no human interaction in their day-to-day transactions. The only way to provide them this experience is by sending them the right information at the right time. You cannot possibly do it manually. That’s where marketing automation can come to your rescue.

How to use marketing automation to your advantage?

You are probably already aware that marketing automation can help you to personalize your communication. But personalization is not just about starting your email with Hello [First Name]. It’s about personalizing the content at every stage of the funnel. Anuj tells us how EarlySalary uses marketing automation to personalize its content.

- Educate and inform your customers: Unlike retail apps, fintech companies have to think beyond promotional content. You have to create educational content for customers at different stages of the marketing funnels to nurture them. EarlySalary, for instance, sends emails to help users complete certain tasks step-by-step. They use marketing automation to personalize the content, so the user receives solutions to specific issues that they face at a certain stage rather than receiving an answer to an issue at a broader level.

- Entice and excite your customers: Sometimes, the users may not complete the steps such as, completing their profile or uploading their information. There could be various reasons to it, ranging from trust issues to unwillingness to complete the profile. In such cases, the onus lies on you to find ways to entice and excite your customers to complete their profile.

- Increase the LTV and create long-lasting relationships: Every user has different expectations from a brand. Personalization gives the user the power to engage with the brand the way they want. This has a direct correlation with the LTV of the use as they would prefer to engage with the brand for a longer time. EarlySalary uses emails to interact with the customer in a personalized way.

How to build a smart marketing automation strategy to reduce user drop-offs?

We asked Anuj how he built a marketing automation strategy for his company. Here are a few tips that he shared based on his experience

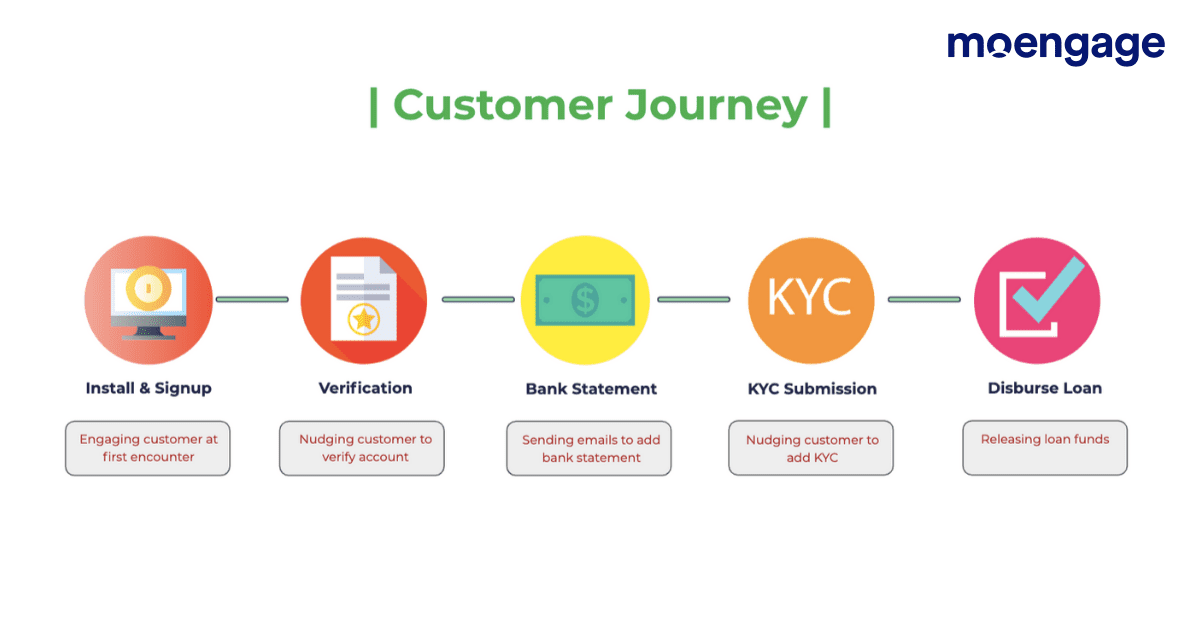

Step # 1 – Define user journey

The customer journey of a fintech app will be different from that of a retail app. In EarlySalary, for example, the user has to upload his personal profile details, provide his bank details, and complete his KYC to get a loan. However, some users may drop off at a certain stage. For instance, users may not be willing to upload their bank statements due to a lack of trust. As a marketer, you must identify stages where the user drop-offs are high and find out ways to nurture and reduce the drop-off rates.

Step # 2 – Identify the channels

To reduce drop-offs, you must think from a user’s perspective. EarlySalary creates various hypotheses to understand why users are unwilling to complete a particular step. They ask questions such as – is the step too difficult to complete, or is there a trust deficit? Depending upon the reasons, they find out channels they can use to solve the problem. For example, if it is a trust issue, they send testimonials to the users to increase credibility. If it is an unwillingness to complete the profile, they talk about the end goal to excite the user. Once you identify the solution, you can create a marketing mix for that stage. Anuj recommends constant experimentation until you achieve synchronization at all the stages.

Step # 3 – Measure the impact

Once you implement your marketing automation strategy, measure the outcome to check if the drop-offs have reduced. Check if people are receiving the messages in the right way. Is it engaging enough? Is it compelling them to take action? Do it at each stage, and tweak your communication until the drop-offs reduce and the funnel becomes rich.

Why email marketing is still a relevant strategy for fintech marketers?

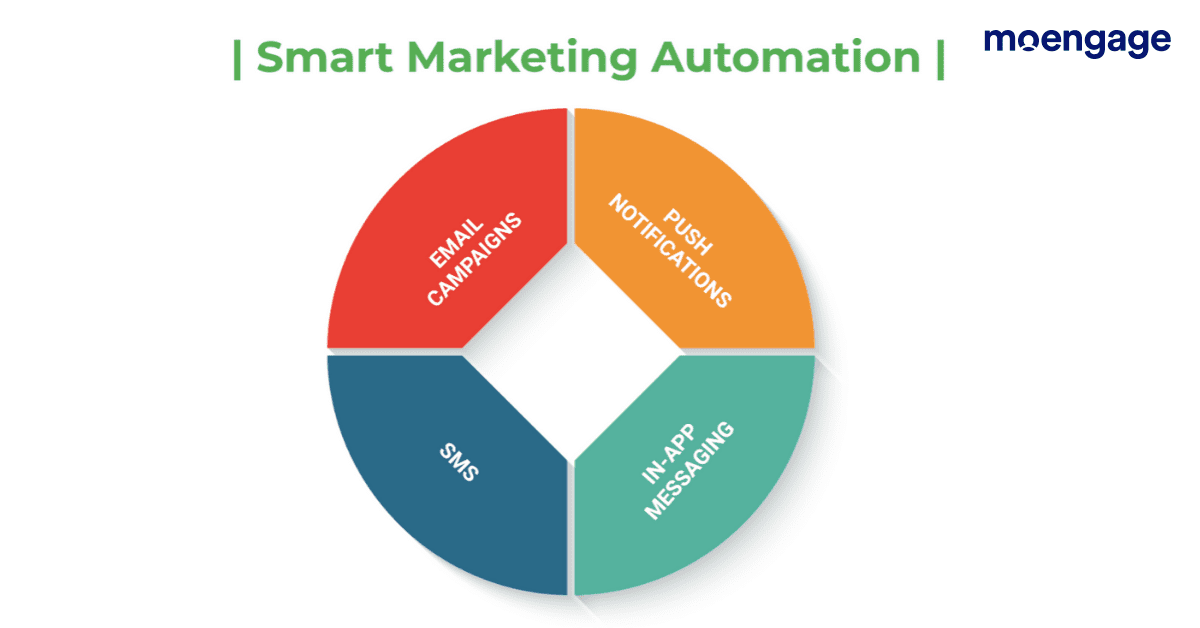

You can choose from an array of channels such as push notifications, SMS, and in-app messaging to engage with your customers. However, emails are the most effective medium of communication for fintech companies.

Marketers may be quick to dismiss emails as an old channel. But do you know, it can increase your ROI by 30x? In a field like a fintech, where a consumer requires a lot of information before making a decision, email marketing can work wonders. It gives you more real estate to provide educational content and guidance to your users as compared to an SMS or a push.

But there’s a problem.

Your users may not be receiving your emails in their inboxes due to poor email deliverability. And that could impact the overall purpose of your email marketing strategy.

How to improve email deliverability?

Three factors affect email deliverability. Here are a few steps that you must follow to improve it.

- Email domain authentication: You should do this before the start of the email campaign. All email providers look for basic authentication checks. So, build your credibility by configuring the ISPs. If the sending volume is too high, then we recommend you to have emails in a dedicated IP. This way, your email performance is insulated from other email brands if they are in shared IP. At MoEngage, for instance, we ensure that each domain gets its dedicated IP.

- Audience list management: Gmail and Microsoft expect marketers to do permission-based marketing. This means that you must acquire users organically. We recommend you avoid acquiring users from a third-party list. Once you acquire the users, ensure that the opt-ins and subscribes are in place. After this step, ensure that you regularly perform list maintenance. This will help you to identify and remove users who have not interacted with your email from the list.

- Message content: Gmail or Microsoft look for three things to mark your email as spam. The first is spam words such as free, discount, cash, etc. If you have been using these words, be careful to avoid making your communication look spam. Gmail’s evolved algorithm considers single image emails as spam. So, ensure that you use at least 40-50% text in an email. We also recommend you avoid link shorteners in your email. Ensure that the links have legitimate domains.

What can you learn from EarlySalary about email deliverability?

Like most companies, EarlySalary’s email marketing campaigns were not being effective. Most of their emails were landing in the spam box. MoEngage started an email deliverability consulting practice and did an end-to-end email audit for EarlySalary. We checked 30-40 different things such as infrastructure, domain reputation, IP reputation, and if the domain or IP is listed in blacklists. We found 3-4 problem areas. Here’s how we solved it.

- Repaired the content: We found that the image hosting domain had a bad reputation. This led the emails to land in spam. Things started to improve once we moved it to a healthy domain.

- Improved the email to text ratio: We worked on the template, improved the email to text ratio, and combined personalization to make it a legitimate email. By personalizing the subject line and content, we were able to send more than 80% of the emails into the primary folder.

- Worked upon user segmentation: We created micro-segments based on the user’s historical activity. For example, we targeted active users first. We optimized them for frequency and sent time. We created different templates for each micro-segment and sent them emails at an optimized frequency at a particular time. When we analyzed the data, we found that the email deliverability rate had improved by 90%, the CTR had increased by 9%, and the overall drop-off rate had reduced by 5%.

So, if you have been facing issues with your email deliverability, we recommend you to check parameters such as the content, domain authentication, etc. This will help you to create a more successful email marketing campaign.

Here’s What You Can Do Next

|