Mobile Banking Trends: Here’s How AI is a Game Changer for Finance Marketers

Reading Time: 5 minutes

Introduction – The Need for AI in Banking

The field of artificial intelligence (AI) has certainly made its presence known across a wide range of industries, but it’s not usually as a stand-alone solution. Rather, it plays a key role when integrated properly with other core applications. And when it comes to the latest mobile banking trends, AI can be a real game-changer for mobile banking applications.

If you are a financial marketer chances are that you want to grow and maintain a happy customer base by creating a user experience so appealing that they keep coming back for more. A recent BCG survey of global executives concurs that 90 percent of marketers are now using AI to optimize the customer journey, transform how they engage consumers, and deliver the most rewarding experience. Improving customer experience can go a long way to supercharging channel performance and fueling revenue growth and profits.

| Bonus Content

👉 State of Mobile Finance in 2021 [Download Ebook] 👉 Banking in the Era of the Connected Customer [Download Ebook] 👉 Alodokter Witnesses 45% Uplift in Engagement using AI [Case Study] |

Clearly, AI is driving improvements in several areas of the banking sector. Here are 3 ways in which you should make AI work for you:

Use Case 1 – Personalize your Customer Interactions at Scale with AI

The key to modern digital marketing is customization and personalization. Gone are the days of bulk marketing campaigns that look too “vanilla” for people to appreciate. According to Salesforce’s report, today’s consumers expect seamless, personalized, predictive user journeys, with 64 percent now wanting to see engagement customized based on their previous interactions, and 62 percent expect companies to adapt based on the customer’s behavior. AI works so fast and efficiently that it can deliver personalization at scale to a huge number of users.

One example is how AI can curate and generate content that is tailored for each individual and can put it in front of them at exactly the right moment. For web and mobile banking apps, AI can be a game-changer by helping build hyper-targeted campaigns, each based on what actions the individual has taken in the past.

Once you know if a user has researched investment advice on several occasions, for example, money management articles, advice, or targeted service offerings like SoFi Invest can be delivered automatically. Personalization is also important when it comes to delivering messages and notifications, such as push notifications being delivered at just the right time to maximize the probability of conversion.

Listen to Forrester’s Research Analyst, Alyson Clarke as she shares the finer details of how to improve personalization in banking:

Use Case 2 – Raise the Customer Lifetime Value, using AI

Increasing the value of the customer over the long term is not a simple challenge to solve. It relies on a number of factors, not the least of which is the ability to keep the individual engaged through multiple touchpoints, such as linking to original articles or blog posts from your mobile app, responding to a bill pay offer on email, or just managing transactions and balances on your website.

As was highlighted recently by a PWC Digital Banking Survey, securing a customer doesn’t automatically guarantee they’ll stay with you, and they are statistically just as likely to open their next account with a new bank as stay with yours. The survey concludes that customer retention requires banks to make “relentless efforts” to earn their long-term trust and maximize customer lifetime value.

Customer engagement solutions that are driven by AI can help raise customer value by constantly registering user interactions and learning from the performance of a campaign over time.

For example, you can create an A/B test of two variations of an email campaign, one offering a financial discount on a service, the other offering an industry report on that type of service. The AI engine then dynamically measures impressions, clicks, and click-through rates (CTRs) and see which variant is predicted to perform better.

It also then automatically drives traffic to the top-performing content, eliminating the need for marketing personnel to make those determinations manually. The benefits of such technology include:

- Knowing exactly what time to send a message to ensure the highest response rates. AI eliminates the guesswork.

- Saving time so marketers don’t need to actively test program variations or experiment with different time windows.

- Adjusting send times automatically in real-time to ensure that no customer engagement opportunities are missed.

- Delivering the right message at the right time to maximize performance rates of campaigns, driving more action from end-users, and generating higher ROI.

As popular as AI is becoming in the marketing and banking fields, studies show that most companies still have a hard time generating value with AI. By establishing hard metrics like conversions and lifetime value, and using AI to prove those results, you can build a great justification for deploying automated customer engagement solutions.

Use Case 3 – Make Smarter Marketing Predictions, leveraging AI

Artificial intelligence employs sophisticated algorithms that can quickly analyze data and dynamically predict outcomes. It then puts that analysis to immediate use to optimize business results. One example is how AI uses predictive analytics to evaluate patterns in customer behavior, create forward-looking insights, and act on them in real-time.

A recent article in MarTech Advisor reported that 62 percent of marketers believe that AI is positioned to have a significant impact on subscriber engagement, helping marketers track user interactions, predict subsequent interests and disinterests throughout the customer journey, and provide important insights on which campaigns will perform best for different market segments.

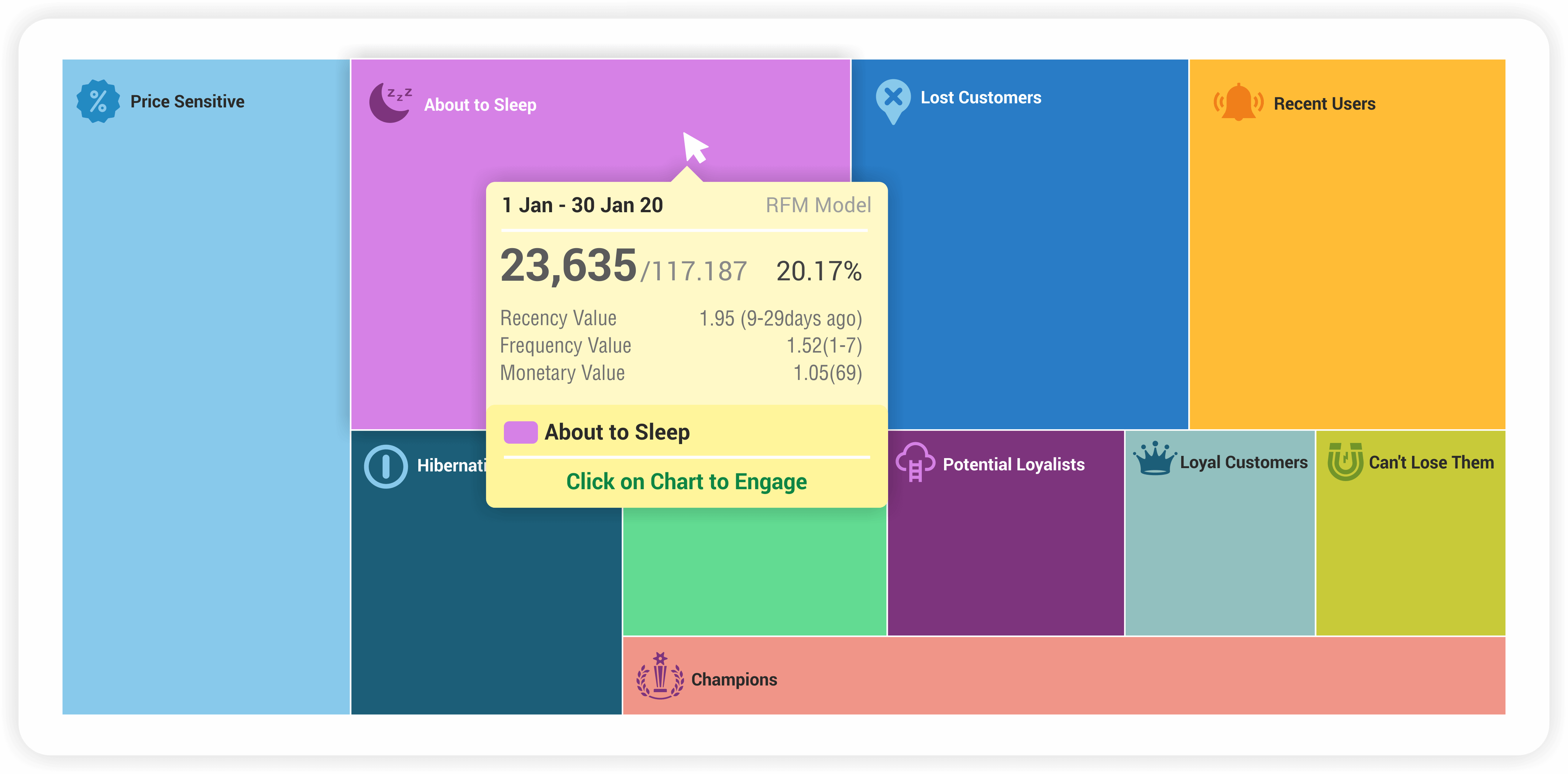

You can use AI to perform a fast and insightful segmentation analysis to make accurate predictions with your own banking customer base. AI can segment users into like-minded groups based on their behavior, brand preference, spending patterns, and types of content they like. Different user personas and segments – such as price-sensitive, recently lost, hybernating, about to sleep, needs attention, potentially loyal, or loyal brand champion – will determine AI’s course of action. A customer that AI predicts will soon leave your brand based on rapidly diminishing activity on your mobile app may need enticing offers to keep them in the fold.

Accurate customer segmentation is a powerful tool to help you narrow down customer expectations, target your market spend, and personalize interactions for each group at scale. AI gives you the data to make better decisions automatically, and eliminate the need to make hunches (which many financial marketers, unfortunately, are forced to do when they lack the right tools).

Conclusion – AI is Faster and Smarter, and That’s a Good Thing

Banking consumers, especially younger generations that are working primarily on mobile banking apps, can be a hard group to satisfy. Marketers often don’t quite know how to make the right decisions without AI-generated customer engagement data, and that can slow down their marketing efforts. AI technology embedded in marketing engagement tools helps you do your job faster, smarter, and more efficiently. Let AI do the heavy lifting for you, and you’ll be looking at a happier customer base and better marketing results.

Here’s what you should do next

- Get a free product demo of Sherpa, our state-of-the-art AI engine, which automatically maximizes campaign engagement by predicting and sending the right message at the right time.

- Learn why your mobile app is not the silver bullet for growth in mobile banking.

- Read how Mashreq, one of Middle-East’s largest bank and our customer, leveraged AI and won the Efma-Capgemini Financial NewTech Challenge 2020 Award.

- Identify 4 situations where customer engagement fails and how to get it right for your banking customers.