Mobile Banking Trends: Where Consumer Engagement in Banking Usually Fails, and How to Get It Right

Reading Time: 6 minutes

As the world of online banking grows to maturity, many financial institutions are embracing the mobile banking channel as a means to generate more business with dynamic new audiences. The trend in 2020 is toward mobile financial apps that offer great convenience for consumers, and great business opportunities for the banks themselves. According to Business Insider Intelligence’s Mobile Banking Competitive Edge Study, 89 percent of consumers – and a whopping 97 percent of millennials – say they use mobile banking.

The biggest problem, however, is that banks often lack the technical and pragmatic expertise to engage these “digital-only” and “mobile-only” audiences. They try to adapt their web and brick-and-mortar customer service best practices for the mobile crowd, only to find that their efforts fall short. Mobile banking can be a particularly vexing environment for financial institutions as they try to acquire, upsell, retain and engage consumers throughout the entire customer lifecycle.

| Bonus Content

👉 State of Mobile Finance in 2021 [Download Ebook] 👉 Banking in the Era of the Connected Customer [Download Ebook] 👉 Your Guide to a Winning Customer Experience in Financial Services in 2021 [Download Ebook] |

The following are four challenging scenarios that banks often face, how they usually fail, and ways they can find the winning formula for mobile customer engagement.

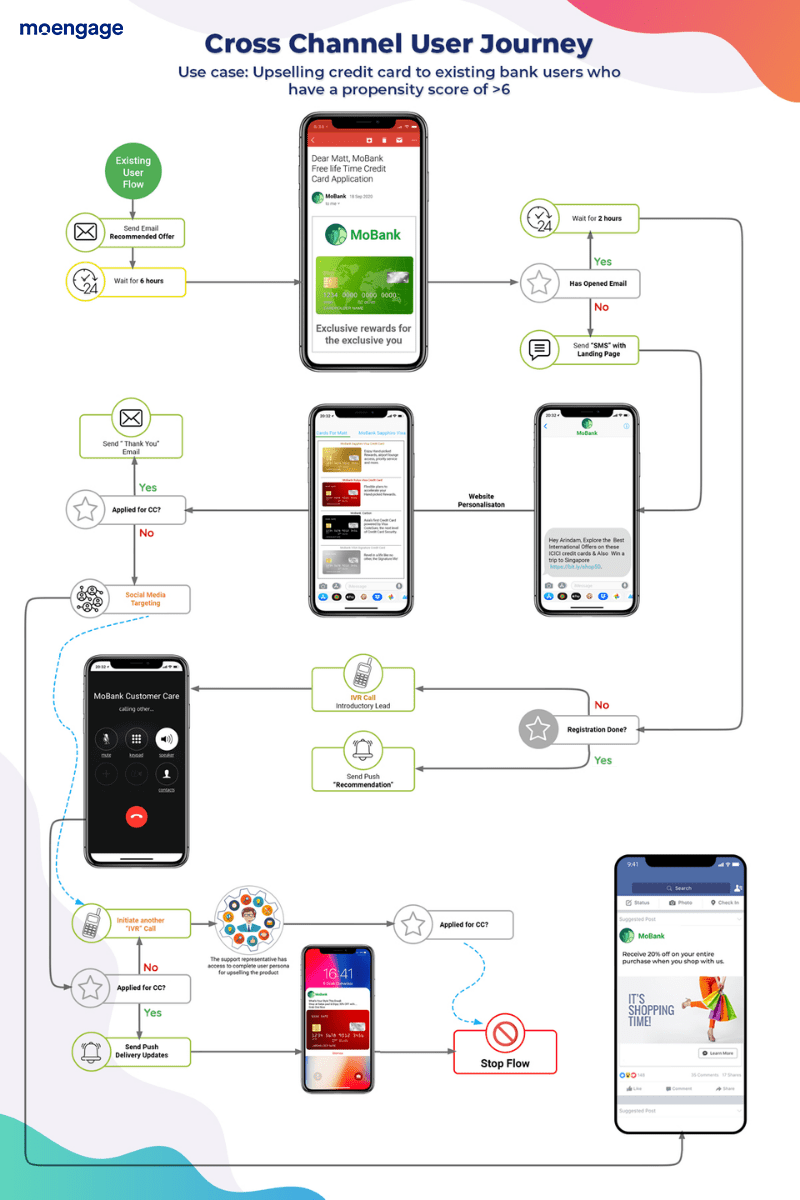

Fail #1: You Haven’t Connected the Mobile Customer Journey with Other Channels

Financial institutions often have a “one-step-at-a-time” mentality when it comes to customer service and engagement. They roll out features and functionality on their websites piecemeal as they are developed, such as chat-based support, financial planning, automated payments, knowledge libraries and more. But their ongoing engagement efforts are also done one-off, making it difficult to connect the dots between various digital channels. An important customer service chat that originated on a website may have identified an important mobile-based product upsell opportunity, but a lack of integration between the silos of different engagement channels diminishes visibility and can hurt business expansion.

How can you fix this?

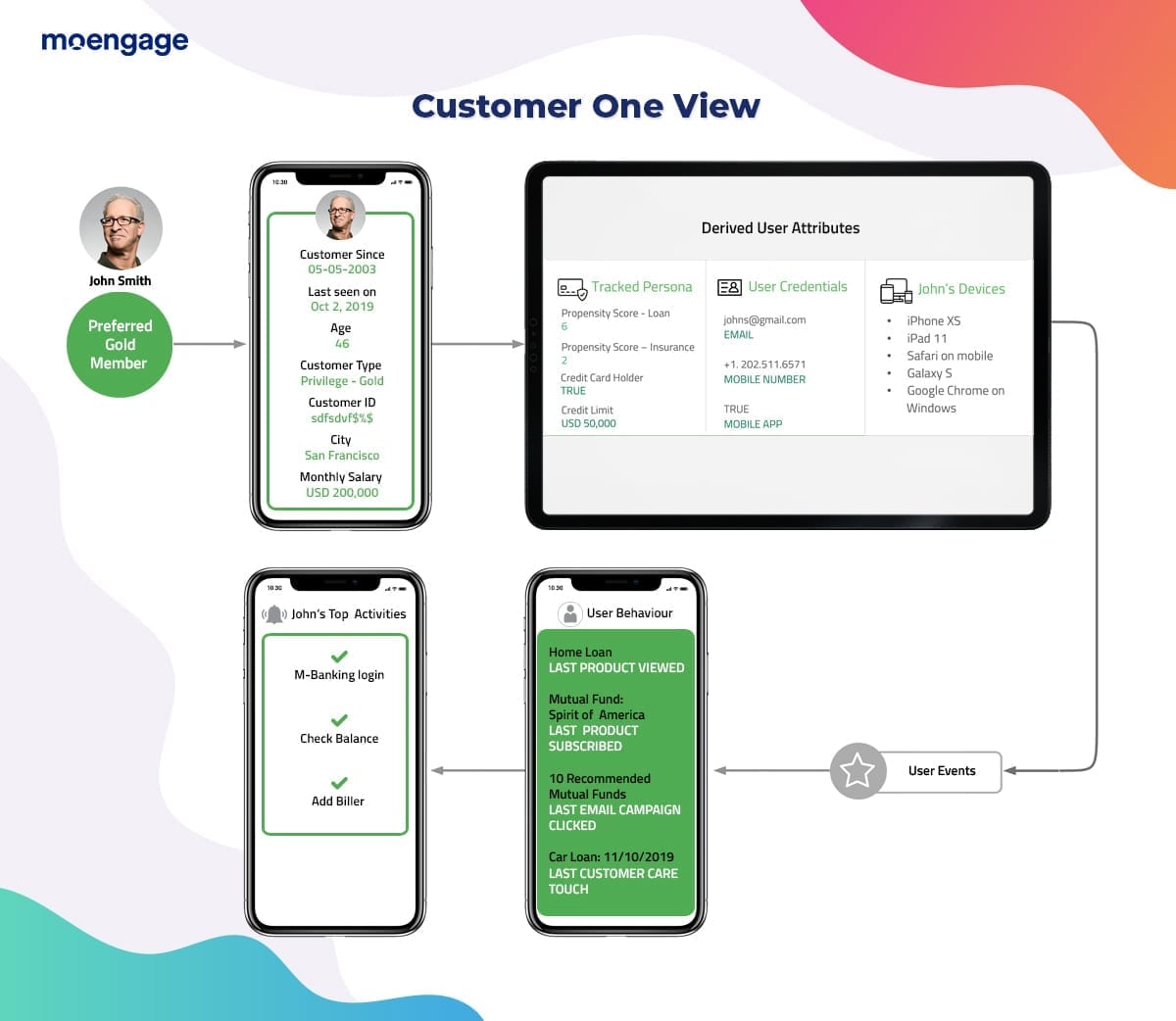

The solution is to take a complete omnichannel approach to user engagement from the get-go. MoEngage helps you build and maintain complete customer profiles that collect information across email, web, in-app mobile activity and SMS, and automatically synchronize customer data cross-channel. You’ll glean insights from the activity on your website, for example, to help you create the right engagement campaigns on mobile, all personalized and customized for each individual. By integrating your customers’ behavioral, demographical and geographical data across channels, you’ll better understand their spending and savings habits, what services they’re interested in, and how to create digital experiences that matter.

Take a look at 3 Ways Banks and Fintech Brands Earn Trust With Gen Z and Millennials

Fail #2: Your Mobile Engagement Efforts Are Repetitive or Irrelevant

There’s nothing more frustrating to a loyal customer than receiving repetitive marketing emails or notifications for services they’re already using or don’t have a use for in the first place. Retail banking customers tell us all the time how frequently they receive offers to go paperless or activate their mobile wallet, when they may have already declined these services from the bank (often multiple times), or are already using it. Oftentimes they also receive the same offer from different bank departments or marketing groups. All of these missteps conspire to hurt your credibility and negatively impact your brand, illustrating that engagement isn’t really a part of your company’s digital DNA.

With 77 percent of consumers wanting to receive personalized content online, financial institutions must learn to read and interpret each individual’s needs and provide a seamless experience across all user touchpoints.

How can you fix this?

MoEngage’s powerful personalization and segmentation tools enable you to create smart campaigns that engage customers in a timely and relevant manner, delivering personalized content, offers, and alerts. MoEngage is designed to give you a complete view of each customer and help you track how successful (or unsuccessful) certain campaigns and offers were for each individual or market segment.

Related Read: Built a mobile app for your banking business? Here’s what you need to do next to see mobile growth.

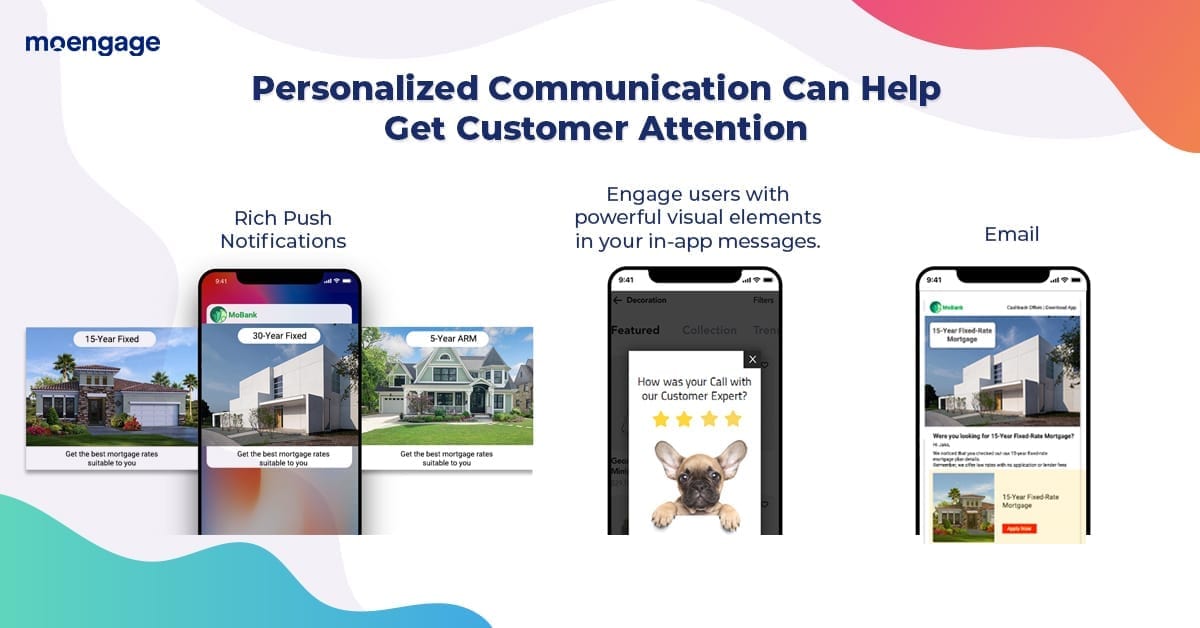

Fail #3: You Can’t Get Your Customer’s Attention Quickly on Mobile – Or Keep It

Mobile users these days have a particularly short attention span. That means the faster you can pique the interest of your customers – and the longer you can keep them engaged – the better chances you have of delivering great service and maximizing revenue. But the engagement challenge is harder than it may seem for mobile financial applications. Users are inclined to move on from your app or website if they don’t see what they want within a few seconds, and that’s hard to do when you can’t provide a visually appealing center to your services.

The first key is showcasing the types of services that mobile users are excited about as visibly as possible. For example, users respond favorably to services that can improve their financial position and make them feel more confident in their financial future. A recent Citibank study reported that 82 percent of mobile banking users feel more confident that a bank can truly help improve their state of financial wellness, compared to 62 percent of non-users. You can appeal to mobile users by placing relevant investment and money-saving opportunities front and center on your app.

How can you fix this?

MoEngage leverages powerful visual elements that keep users engaged the moment they open your app and keeps them engaged throughout the marketing automation flow.

Fail #4: You’ve Invested Too Heavily in Old-school Customer Service Practices

Many financial institutions try the age-old approach of adding more customer service reps in an effort to keep customers happy when they have a question or problem. But call centers are not the ideal way to keep customers engaged long-term, especially when it comes to mobile. Call centers solve short-term problems, rather than helping mobile-minded customers solve problems on their own and at their own convenience.

How can you fix this? MoEngage helps banks produce a digital experience tailored for mobile that puts the right information at the fingertips of demanding mobile consumers.

Take a look at An In-depth Report on Global Mobile Consumer Trends, 2020

According to one report, 48 percent of millennials prefer a do-it-yourself service solution. Live chat on mobile can also be a great way to keep users engaged on their mobile devices without having to resort to the phone or website. By taking a proactive approach to user engagement, you can actually pre-empt common customer queries and requests, reduce customer complaints, and become less dependent on call center volume.

Conclusion: Follow the Clear Mobile Banking Trend to Better Consumer Engagement

Mobile banking consumers expect a lot from the financial applications they use every day. They insist on relevant, personalized content, a seamless journey across mobile and other channels, and a visual experience that keeps them actively engaged at every touchpoint with your financial institution. By rolling out comprehensive customer engagement solutions like those from MoEngage, you’ll show how dedicated you are to each individual’s needs and improve the confidence customers have in your digital banking technology and your banking brand.

Here’s What You Can Do Next

|