Is Your Customer Data Strategy Stuck in the 2010s? The Case for Offline-Online (O2O)Integration

From silos to synergy: A simplified guide to overcoming offline-online data integration challenges

Reading Time: 7 minutes

Every company has trillions of terabytes of raw data. But the problem is that the data is present in silos, making it harder for marketing and product teams to derive incisive insights and see the entire picture.

Why seamless offline-online integration is crucial for B2C brands?

Today’s consumer expects a seamless and integrated experience across brand channels—from the retail outlet to a kiosk to an email campaign or a social media post. Your consumers won’t accept anything that’s even slightly inconsistent.

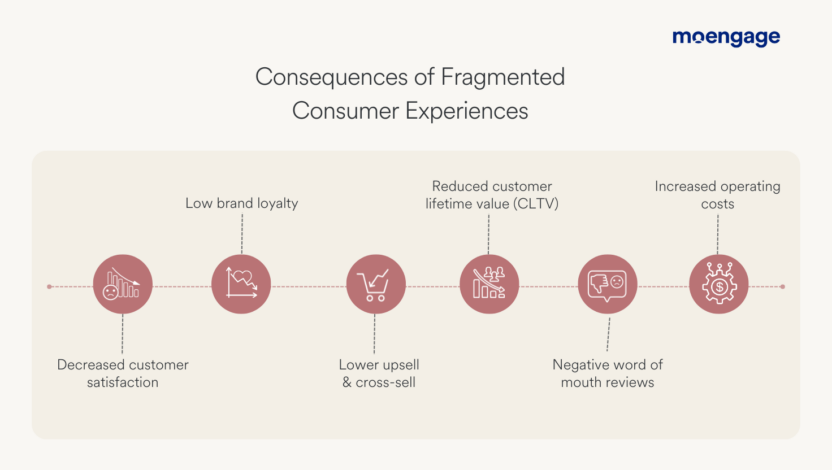

Fragmented consumer experiences, especially across offline and online channels, can result in customer dissatisfaction, negative reviews, lower customer lifetime value (CLV), and customer churn.

Fragmentation in consumer experiences can irk current or potential customers. If one of your channels is not up to par with others, that can significantly impact your brand’s customer satisfaction (CSAT) scores. The effect can cascade down on customer spending, loyalty, and revenue.

This is especially true for legacy or traditional brands. More often than not, the average legacy brand is still catching up on adopting newer digital channels while making sense of billions of zero-party and first-party data. At the same time, they have trillions of data points stored offline (on-prem databases, older hardware and software, etc.).

|

The Legacy Bank Challenge: Personalizing Customer Experience Imagine a bank, 50 years strong, launching its mobile app in 2019. 🏦 They’re sitting on a goldmine of data:

The Scenario: Sam’s Home Loan 🏡💰 The goal? Offer Sam personalized home loan recommendations. But first, the bank needs to understand Sam’s creditworthiness. 📈 This means:

The Data Disconnect 📂 Sam’s journey:

The Bottom Line: Without a unified data infrastructure, connecting offline (branch 🏢, ATM 🏧, credit card 💳) and online (deposits 🌐, app behavior 📱, bill payments 🧾) data, sending personalized emails 📧 or push notifications 🔔 becomes nearly impossible. |

Is there a way for legacy brands to seamlessly integrate offline and online data to build a complete customer profile?

The answer is YES, but most B2C brands often encounter numerous difficulties when achieving seamless offline-online integration.

What are the challenges faced by B2C brands in offline-online integration?

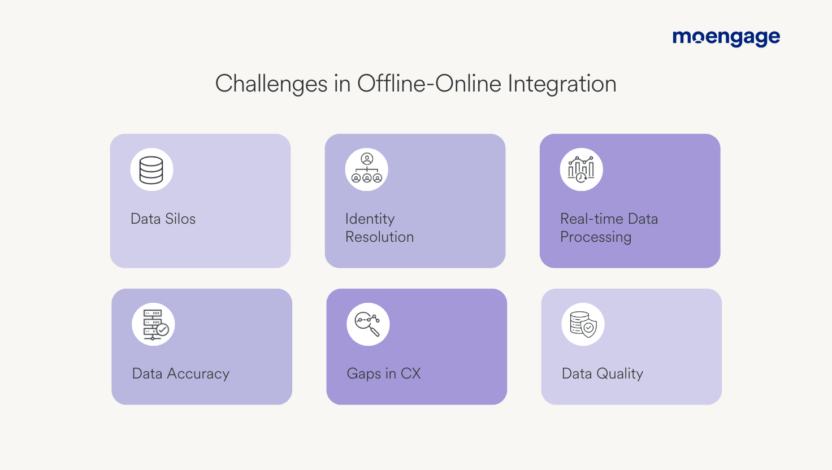

Some of the most common yet persistent challenges faced by B2C brands include:

1. Data silos

Offline data (in-store purchases, call center interactions, loyalty CRMs) and online data (website, app, social media, digital ads) are often stored in separate systems, adding complexities to offline-online integration.

2. Identity resolution

Some potential areas of friction in identity resolution include the following:

- Many legacy CDPs (Customer Data Platforms) rely on pre-defined identity graphs, which might not meet your brand’s specific needs.

- Identity resolution across offline and online touchpoints may lack real-time syncing, leading to mismatched profiles.

- Many data management solutions (like Salesforce Data Cloud or Adobe Experience Cloud) don’t natively integrate, resulting in internal data silos.

3. Real-time data processing

Offline data may take hours or days to update, while online data flows in real-time. This delay in syncing data can cost brands in terms of opportunities for customer engagement.

4. Data accuracy and quality

Offline data is often manually entered into the POS systems, which can cause errors, duplications, and inconsistencies. Online data, while it flows in real time, runs the risk of misattributions and misinterpretations. The effects of poor data accuracy and quality can cascade down to campaign performance and customer perception.

5. Gaps in customer experience

The issues in integrating offline data in real-time can result in a fragmented customer experience. Example: A customer receiving online recommendations for an item returned by the customer in the store can irk the customer.

Do you need a CDP for offline-online integration?

The answer is a yes and a no.

Legacy CDPs have existed since 2013. CDPs were designed to collect, unify, and manage customer data from multiple sources, including offline and online channels, to create a single customer view and enable more personalized marketing efforts.

However, in reality, legacy CDPs have created more internal silos than fulfill the promise of unifying customer profiles from various sources. Additionally, most CDPs have a complex implementation process and high maintenance costs, which only adds fuel to the additional data fragmentation problems they pose.

Many B2C brands now store data in warehouses and expect an embedded CDP that can build 360-degree customer profiles, segment audiences, and personalize communications, all using data directly from the warehouse.

How Does MoEngage Help Brands with Seamless Offline-Online Integration?

MoEngage’s best-in-class data management capabilities help B2C brands effectively collect and orchestrate data.

Advanced Identity Resolution

Identity resolution links and matches individual attributes from offline and online sources to create a unified identity representation. By combining various data elements, it establishes connections and creates a comprehensive view of the customers.

Identity resolution enables marketers to accurately segment and personalize the customers based on data collected across various online and offline resources and avoid duplications and errors.

| 📚With Identity Resolution, integrate multiple profiles of the same user obtained from online and offline data sources (Data APIs, SDKs installed in your app, and CSV files). When various sources include clear identity information- such as customer ID, email ID, or phone number, combine these attributes to build a unified customer profile. This helps you to maintain a single source of truth (SSOT) for each user, allowing you to seamlessly track their behavior on your app and regulate your business strategies accordingly. |

Seamless Integration with Data Warehouses and Cloud Storage

MoEngage allows seamless integration with data warehouses such as Snowflake, Amazon RedShift, and Google BigQuery. MoEngage also enables seamless integration with cloud storage like SFTP, Amazon S3, Google Cloud Storage, and Microsoft Azure Blob.

These integrations can help:

- Reduce dependencies on tech teams

- Accelerate data processing

- Reduce integration timelines

Leveraging Seamless Offline-Online(O2O) Integration Across Industries

Brands across industries can leverage offline-online integration capabilities to solve critical business use cases:

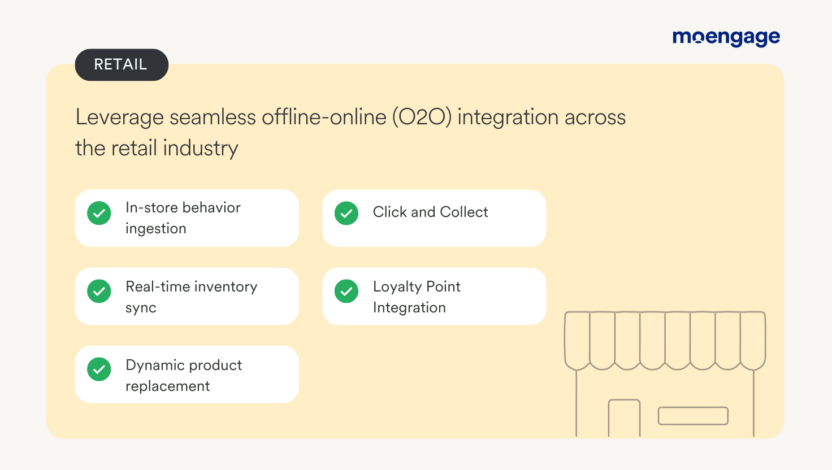

1) Retail/ E-commerce-

- In-Store Behavior Integration: Retail brands can track offline interactions (e.g., loyalty card usage in-store purchases) and combine them with digital behavior (app browsing, online orders) to create a 360-degree customer profile. (For example, if a customer purchases gluten-free pasta in-store at a grocery supermarket, brands can trigger a personalized email or a push notification with gluten-free recipes.)

- Real-time Inventory Sync: Retail brands can automatically pause campaigns for out-of-stock items (Eg, Stopping ads for sold-out seasonal products like strawberries or Christmas hams.)

- Dynamic Product Replacement: Retail brands can suggest alternatives if a product in a customer’s cart is unavailable (Eg, If Honey Nut Cheerios is out-of-stock, the store can suggest similar in-stock options)

- Click-and-Collect (BOPIS—Buy Online, Pick Up In-Store): Customers can order online and pick up their items from the nearest store. Benefits: Reduced delivery costs and increase in foot traffic

- Loyalty Points Integration: If a customer earns points in a retail outlet, with seamless offline-online integration, brands can automatically update their online profiles in real time, thereby enabling personalized offers based on their loyalty tier.

| Find out how Decathlon creates a seamless offline-online customer experience. |

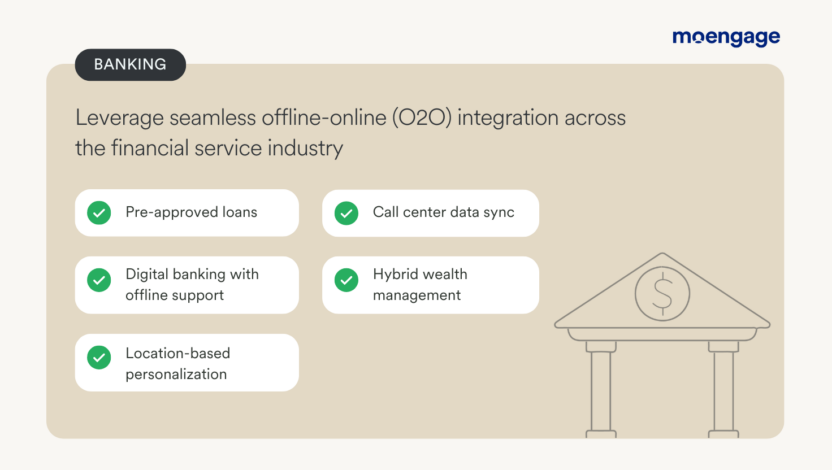

2) Financial Services-

- Pre-Approved Loans: Banks can send pre-approved loan offers to customers with good credit scores. Customers can then finalize the application at a branch.

- Call Center Data Sync: Customers’ interactions with the call center can be synced with their online profile, allowing financial service brands to offer tailored support and offers based on past interactions.

- Digital Banking with Offline Support: Customers can utilize self-service to manage most transactions but visit branches for complex queries. With seamless online-offline integration, advisors can access full online activity history and help customers troubleshoot quickly.

- Location-based Personalization: Banks can leverage geo-fencing to notify mobile app customers of personalized branch offers when they visit.

- Hybrid Wealth Management: Financial service brands can engage/ educate customers online. Customers can then choose to conduct the high-value transactions in person.

Read more about the importance of offline and online data integration for financial service institutions to leverage AI to the fullest.

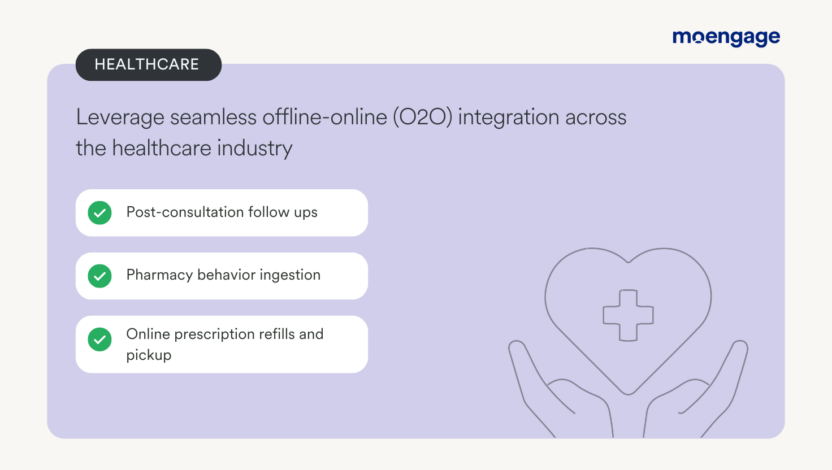

3) Healthcare

- Post-Consultation Follow-ups: After a consultation, hospitals/ healthcare providers can trigger a post-consultation email or push notification asking the patient to choose their follow-up slot.

- Pharmacy behavior ingestion: Pharmacies/ drug stores can send product recommendations online based on in-store purchases/ pick-ups.

- Online Prescription Refills and Pickup: Pharmacies and drug stores can send customers reminders about medication refills and let the customer pick them up from the pharmacy.

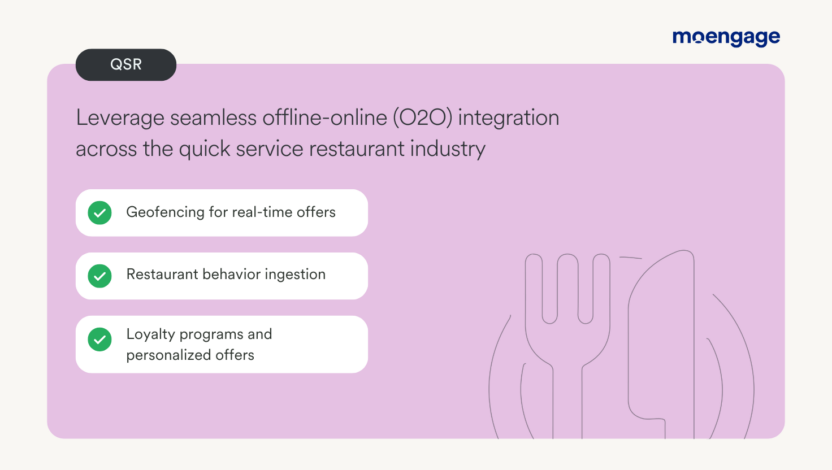

4) Quick-Service Restaurants (QSR)

- Geofencing for Real-Time Offers: Restaurants can send customers location-based promotions to app customers in the vicinity.

- Loyalty Programs and Personalized Offers: Customer loyalty points earned at physical locations and online will be updated in real-time, enabling QSR brands to personalize offers and recommendations based on their loyalty tier.

- Restaurant behavior ingestion: QSR brands can integrate offline purchase details with digital behavior (app browsing, cart abandonment, past orders) to create a 360-degree customer profile.

Conclusion

Offline-online integration (O2O) is a necessity for brands to stay competitive and ensure customers stay loyal. Consumers expect seamless, personalized experiences across every touchpoint, and fragmented data silos only lead to missed opportunities, lower engagement, and customer churn. While traditional CDPs promised a unified customer view, many have fallen short. The future lies in integrated customer data and engagement platforms that break down silos and power real-time personalization.

Leading consumer brands like Sephora, McAfee, Flipkart, Samsung, Nestle, Poshmark, Citibank, 7-Eleven, and many more are already leveraging seamless O2O integration to drive revenue and retention.

Want to know more about how you can drive O2O integration at your enterprise? Talk to our sales team to see how we can help you unlock the full potential of your customer data.