OTT Platform Marketing in a Pandemic: How Can These Brands Keep Winning?

Reading Time: 8 minutes

Unlike The Great Recession, the impact of The Coronavirus Recession is evenly distributed across geographies but varies by industry. This recession, however, is no reason to halt your marketing and advertising efforts.

| Bonus Content

👉 Push Notification Benchmarks for Media & Entertainment Mobile Apps, 2021 [Download Report] |

In fact, if you look at historic recessions, the brands that came out stronger, were those that faced down the impossibilities with bold strategies. Here are two well-known examples from the OTT media space:

- In 2008, MTV.co.uk hosted almost 1m paid-for downloads and more than 7m clip streams of shows such as The Hills. The broadcaster continued to invest significantly in its digital offering and increased its focus on providing value to its audience – whether through partnering with brands to provide discounts and goods, or offering free exclusive high-quality content online. Additionally, MTV continued to invest in new technology, such as its mobile platform.

- One of the most successful businesses during the recession came as a response to the dying but once profitable video rental store and the new video-on-demand services made available through Comcast or Apple – Netflix. In 2009, Netflix gained 3 million members thanks to their new tv/movie streaming plan, which allowed subscribers to stream an unlimited amount of entertainment a month, along with their disc-delivery service.

HBR recently found that companies that cut marketing costs faster and deeper than their rivals later have the lowest probability (21%) of pulling ahead of the competition once times improve!

During these times, it is important to know how consumer behavior has shifted, what impact it has had on metrics – particularly new users and user activity, how OTT media apps and marketers are responding to this change, and what channels can businesses leverage during these times. To help Media & Entertainment brands, Ravi, the CEO and founder of MoEngage, spoke to Ronen, the President and Managing Director of APAC at Appsflyer on a webinar. You can check it out below:

In this discussion, Ravi and Ronen talk about:

- The impact of the Coronavirus Recession on OTT media apps, and how consumer behavior has changed

- How OTT brands are coping with these changes

- What is the messaging and narrative that OTT players are using to drive engagement

How has The Coronavirus Recession affected the OTT and Entertainment industry and how has consumer behavior changed?

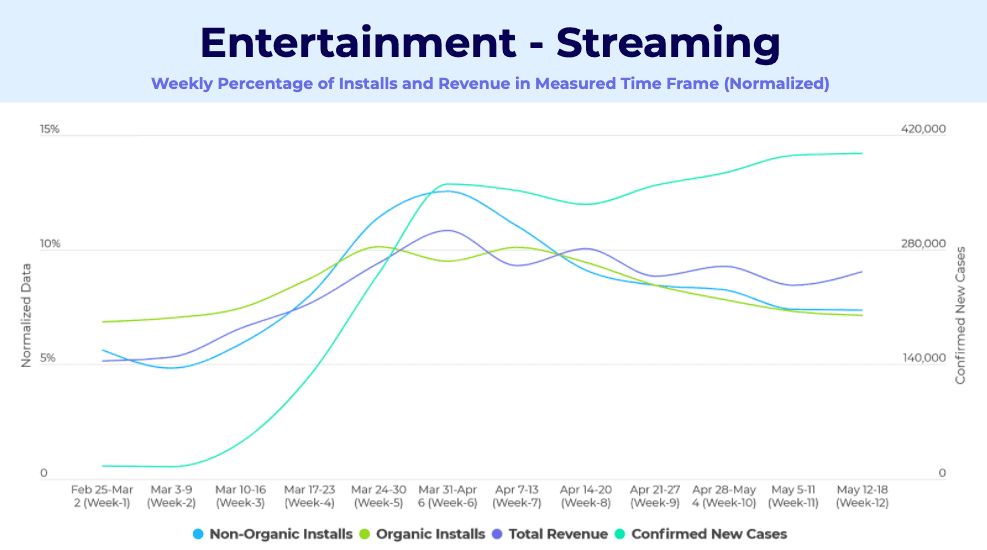

A comparison of OTT Media and Entertainment active users and confirmed COVID cases in Asia-Pacific (source: Appsflyer)

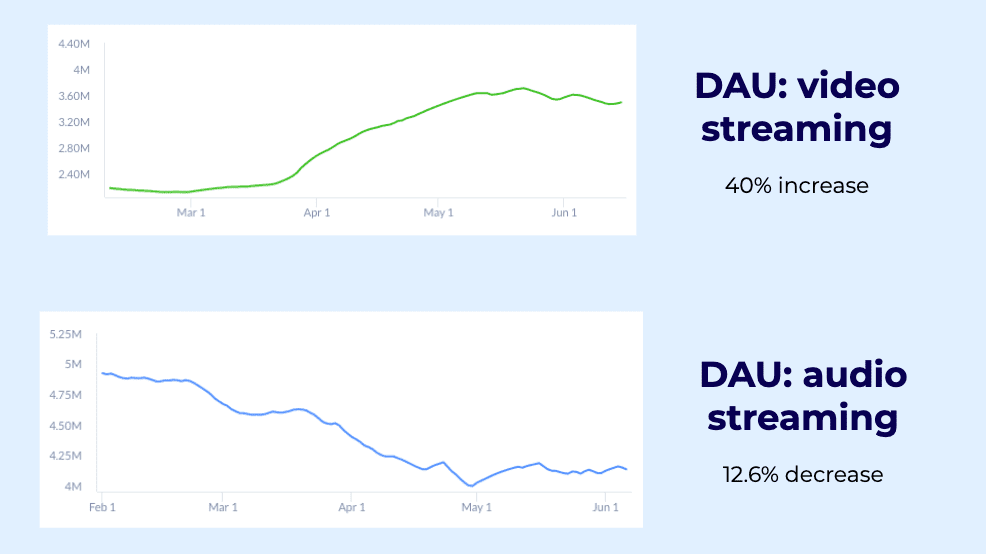

OTT consumption in Asia-Pacific has seen an upward curve in the last three years. The COVID-19 pandemic has only increased the average viewer’s appetite for OTT content further. Entertainment apps, especially OTT video services, have seen a significant increase in new and active users, while OTT audio streaming apps have seen a slight decrease.

Recreation has shifted online. In the few months under lockdown, people have already shifted to social media, gaming, and digital OTT platforms, from theatres, events, and theme parks for recreation and entertainment.

OTT media apps are seeing:

- A rise in paid subscribers

- Increase in view time on OTT video services

- Growth in DAU and downloads

- Boost in user retention trends

In the present scenario, with more people across different cities and ages becoming familiar with OTT, there is an added advantage for this sector’s potential – localization. The availability of TV shows and movies in multiple languages has resulted in a higher retention rate on OTT media apps.

Within OTT media services, the online consumption of video has overtaken audio streaming. Most people prefer to stream audio while commuting or working out at gyms. With both of these out of the picture, the average time spent listening to audio online has decreased. People are reportedly consuming more online video content than streaming audio. A lack of live sports events has also contributed to this trend.

A few production houses in Asia-Pacific have announced that they will be opting for a direct-to-OTT release in the months of April and May. Back in 97, when Netflix started as a DVD rental service, it reshaped the way people consumed long-form video content – primarily due to the convenience factor of watching a movie on-demand in the comfort of your home, without any commercials. The Coronavirus Recession is perhaps an indication of another major shift that will be spoken about for years to come. This is a win-win situation for OTT brands since now they can leverage this exclusive content to increase their number of paid subscribers.

In the coming months, digital consumption in Asia-Pacific will see rapid incremental growth led primarily by India – where currently an estimated 76 million people spend at least two hours every week on an OTT platform and this is expected to grow 22% YoY.

How are OTT media brands coping with these changes?

OTT businesses need to pay attention to two things now:

- increased competition, and

- disruption of content production pipelines

Shift from ad-based to subscription-based revenue models. Although there has been a perceptible increase in media consumption during the last few weeks, monetization is posing a huge challenge. The OTT sector gets a huge chunk of revenue from advertising spends by FMCG, financial services, automotive, eCommerce, and real estate companies – most of which are reeling from the recessionary impact of the pandemic. Due to this, more and more OTT apps are considering either pivoting to a subscription-based revenue model completely or implementing a hybrid of the two models.

Leverage your existing content to engage and attract users. The COVID-19 outbreak has brought the normal day-to-day functioning of the industry to a standstill and halted all the shoots for the time being. OTT players depend on new additions to the content library in order to increase their user base.

As a brand, you need to leverage the strength of your existing library and extract more value from that, and/or potentially think differently about content-acquisition strategies like partnerships. A big piece of using your existing content is ensuring flawless content recommendation. With more and more viewing and listening patterns being formed during these times, delivering a hyper-personalized experience is vital. Since the competition in this space is high, you can lose a user to a competitor almost immediately if they feel your recommendations do not align with what TV show they want to see or the music track they want to listen to. As the usage of OTT media apps is increasing, marketers are also revisiting their user personas – and are making changes to their app interface to make it more user-centric and user friendly – making app navigation simpler and intuitive. For all of this, OTT apps are relying on technology – on analytics and insights-driven by intelligence.

It’s important that teams think carefully to ensure they’re reaching the right people in the right way.

What messaging and narrative should OTT media brands use to drive mobile engagement?

A few points discussed in this webinar were:

- OTT video apps that partner up with news houses can send daily updates on the number of coronavirus cases and the latest news about anything COVID-19 related via push notifications and SMS. By collecting geographical data, brands can also personalize this by showcasing news from nearby locations

- OTT music streaming apps are taking personalization a step further by recommending playlists tweaked to working from home and staying productive. In fact, Wynk Music, one of the top music apps in India, is also conducting virtual concerts and sharing the playlists to their users via push notifications

- By looking at user habits, OTT video apps can send two kinds of recommendations – one to continue watching the movie/show from where the user left off last time, and the other to watch related content. Timing is really crucial here – you cannot send recommendations to watch a show during work hours!

- When monthly/annual subscriptions or trial periods are coming to an end, OTT brands can show a friendly gesture by extending the period for a couple of days. This could lead to effective word-of-mouth marketing and enhance the virality factor of your mobile apps

- Since OTT media apps have a huge content library at their disposal, they can leverage this to share clips and trailers from movies/shows related to users’ viewing habits via push notifications and get them to start viewing by deeplinking the content

- Avoid images and video clips of human interaction. In fact, the use of such stock media has dropped by 27.4% on social ads (source).

How can OTT media brands drive ROI from different marketing touchpoints?

COVID-19 has caused an increase in social media usage as well. Facebook disclosed massive increases in traffic, messaging, and bandwidth usage in a public report and there has been a 50% increase in messaging across their platforms. For brands, this has resulted in as much as a 76% increase in daily accumulated likes on ad posts since early March 2020. More social media users give brands an opportunity to increase ROI from advertising.

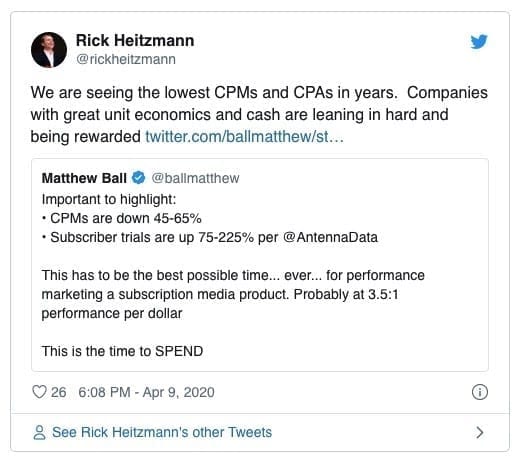

Advertisement CPCs on Facebook plunged by more than half from December 2019 to the end of March 2020, while ad prices on Twitter have declined by about 40% (source). This is an indication that your competitors are cutting down their budgets. When they do this, the “noise level” in your category drops, giving you more visibility to either introduce a new addition to your content library or promote your best-selling ones.

The fact that many advertisers have reduced their budgets, means there is less competition for each impression, which lowers the cost and increases the effectiveness of your ads. This means increased reach and visibility on your existing advertising budget. A few studios are shifting up timetables for home rental or streaming launches while making a few movies available to watch from home while they are still in cinemas. Twitter is seeing new advertisers and ad dollars shifting to support these digital content releases.

YouTube, Facebook, and Instagram are major social platforms and should be part of every social media plan due to their expansive reach and targeting capabilities. There are a few other options to explore as well. Snapchat and TikTok have proven to be reliable channels to reach younger audiences. Pinterest is a great platform to promote family-focused content. And, Twitch and Reddit can reach more tech-driven audiences.

Conclusion and key takeaways

- Entertainment apps, especially OTT video services, have seen a significant increase in new and active users.

- The availability of TV shows and movies in multiple languages has resulted in a higher retention rate.

- OTT media apps are considering either pivoting to a subscription-based revenue model completely or implementing a hybrid of the ad-based and subscription-based models.

- Leveraging customer segmentation data to personalize content recommendation is more important than ever. Learn how MoEngage helps Media & Entertainment apps like yours here.

- Advertisement CPCs on Facebook plunged by more than half from December 2019 to the end of March 2020, opening up opportunities to double down on social promotion.