The Customer Engagement Benchmarks Report 2022 For Southeast Asia is Here

Reading Time: 5 minutes

👉 Grab your free copy of the latest Customer Engagement Benchmarks Report here! |

If there is one part of the world where mobile and internet penetration is booming, it has got to be Southeast Asia. And it is booming how! In 2020 alone, more than 40 million people in six Southeast Asian countries came online for the very first time, pushing the total percentage of internet users in these countries to about 70%. With this impressive feat, the region is now the world’s fastest growing internet market, with some of the most engaged online users.

During this rapid digital adoption, which is also a direct result of the Covid-19 pandemic forcing businesses to pivot to an online-first model, consumer behavior has shifted rapidly as well. For brands, it translates into an opportunity to understand their users’ preferences and expectations in order to capitalize on the shift towards mobile.

For example, do E-commerce app users engage better on email, or mobile? Are users still hooked to OTT apps or has fatigue set in? Are fintech app users delighted when they receive personalised product recommendations? These are just some of the questions that brands need to be able to answer, and rejig their engagement strategies accordingly.

The Customer Engagement Benchmarks Report 2022

Deep-dive into trends from online shopping, banking and fintech, and digital entertainment

We set out to create this report to help our readers and customers understand how digital consumers from Southeast Asia interact with online communication from verticals such as online shopping, banking and fintech, and digital entertainment.

Through this report, brands will be able to gauge how their customer engagement fares against that of their peers in these industries, and decide their course of action. You will also find benchmarks for Clickthrough Rates (CTRs) and Conversion Rates from digital communication channels like push notifications, in-app messages, emails, and website sessages in this report. You will also find how daily active users (DAU) and monthly active users (MAU) have changed in these sectors from January till April 2021.

In addition to the insights gleaned from our primary research, we have also included first-hand stories and testimonials from how some of the leading brands in Southeast Asia such as Zilingo, Bukalapak, NTUC, Kredivo, OVO, Gramedia, and POPS Worldwide are gunning for growth, and the path that they are going to take to achieve the same.

For the sake of comprehensiveness and quality of data, we studied over 6.6 million users from Southeast Asia – primarily from Indonesia, Singapore, Malaysia, the Philippines, Thailand, and Vietnam.

Download your free report here

Major takeaways from the report

While we do deep dive into the three verticals – online shopping, banking and fintech, and digital entertainment in the report, here are the top 10 takeaways:

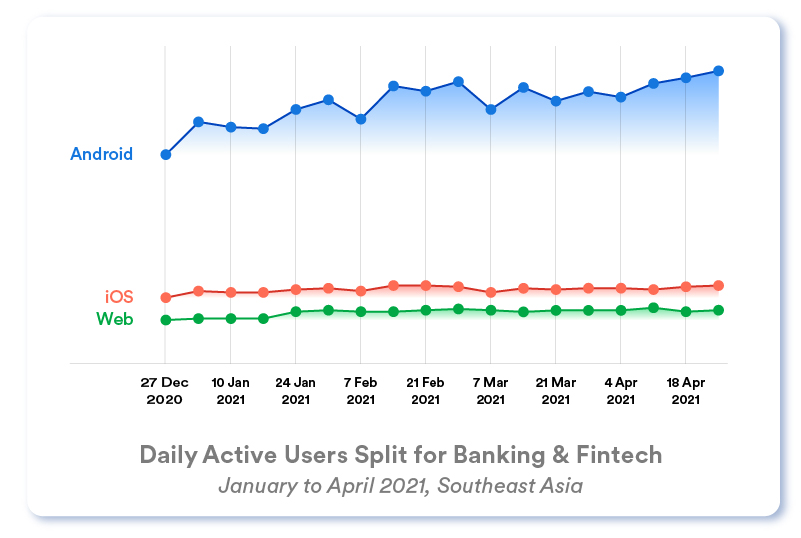

- An increase in DAUs was the highest for banking and fintech on Android apps at 50.07%, which can be attributed to an overall increase in internet users in Southeast Asia, affordability of Android phones, and the accelerated digitization of the banking sector (since it had become an essential service, even more important than shopping)

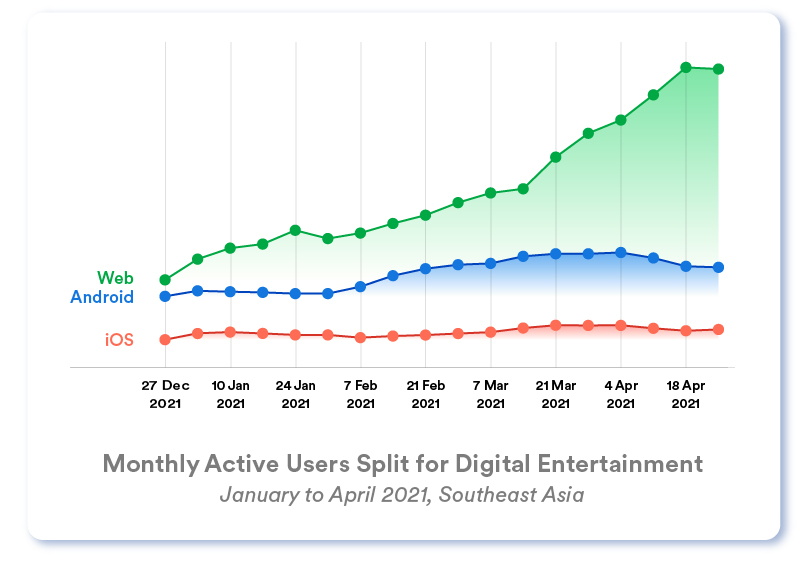

- An increase in MAUs was the highest for digital entertainment on the web at 60.24%, showing more consumers have started preferring websites as their go-to platform for recreation over mobile.

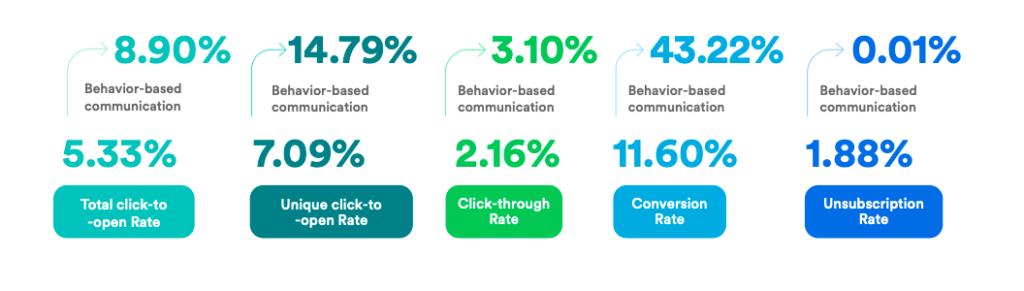

- Shopping brands that sent out personalized communication saw an improvement of up to 30% in conversions from just sending out generic broadcasts. Showing a clear benefit of leveraging personalization for engagement vs. the traditional approach

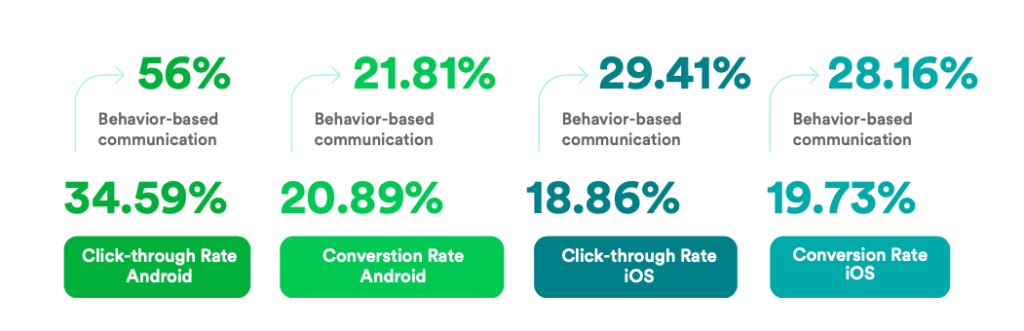

- For push notifications, online shopping brands that deployed behavior-based targeting boosted clicks by 40%, leading to a 20% better conversion as compared to generic broadcasts

- For email marketing, banking and fintech brands that leveraged behavior-based emails enjoyed a boost in conversions by 2.72X as compared to generic broadcasts, pointing to the fact that personalization works agnostic of the vertical, and is equally rewarded by consumers across each one. Also, digital entertainment brands that deployed behavior-based email marketing saw a jump by 2.4X in CTR

- For in-app push, digital entertainment brands that made use of behavior-based targeting witnessed an 89.2% better CTR leading to a 42.7% increase in conversions as compared to generic broadcasts

What leading experts have to say about their customer engagement strategy in 2022

For our report, we gathered actionable tactics and insights straight from the horse’s mouth, that is, marketing and customer engagement leaders from some of the most admired consumer brands in the region.

We asked Kushal Manupati, the Head of Digital at Zilingo, a leading shopping retailer headquartered in Singapore, how a brand should decide what engagement metrics to focus on. Here’s what he had to say about the same:

“Engagement metrics need to be looked into from the context of the stakeholder and across the different stages. The user journey is becoming more complex with the plethora of channels available, and users have their own affinity towards a channel. It is important to have a good lifecycle framework to understand what life stage the user is in, understand where you want the user to go, and what relevant KPIs matter for that particular stage. You can use a robust tool to achieve all this and more.”

The potential of using customer segmentation for effective marketing cannot be emphasized enough. For Indira Andamari, VP of Marketing at Kredivo, prioritizing customer cohorts based on their usage and behavior comes first in their aim to provide a personalized user experience:

“We use a data science model to score the demographics, geographic, and psychographic information. This results in a heat map, which helps us to prioritize which segment to focus on. Once we collect this data, we profile each segment to get a user persona. Within that segment, we then see if you have similar characteristics and then personalize the messaging for A/B testing with a control group. The idea is to test all hypotheses before launching a full-fledged campaign.”

And the story isn’t any different across other verticals, especially digital entertainment, where POPS Worldwide, a leading OTT brand from the region drives crucial business decisions through data, and data alone:

“As next-gen marketers, it’s our job to drive the business by understanding the next ‘trigger’ that’s informed by data. This also helps acquaint customers with that ‘unknown new’ to enable lasting business growth. Organizations tend to define their success metrics in silos for different departments rather than look at it as a common success metric; one which can then cascade into individual departments. Having a common metric can help minimize the gap. This can be done by aligning our organization’s goals to department goals with respect to marketing, product, or customer service.”

For more such insights, get your free copy now

They say change is the only constant, and in order to embrace change, you need to be able to gain a first-hand understanding of what your peers in the industry and the world at large are up to. The insights and quotes shared above are just the tip of the iceberg compared to what we have packed in the report, all you need to do to access it is save your free copy by clicking here. Happy engaging!