The State of Cross-Channel Marketing in Financial Services: 2025

Reading Time: 9 minutes

The current state of cross-channel marketing in the financial services industry is in flux.

To help BFSI marketers like you stay on top of all the changes, we decided to do another edition of The State of Cross-Channel Marketing in Financial Services: 2025.

This year’s report:

- Analyzes findings from a survey of 150+ BFSI professionals

- Uncovers how BFSI marketing has evolved from 2024 and how it compares to the broader market

- Includes insights from experts at Treasure Data, a customer data platform (CDP) and Artefact, a global data and AI consulting company.

- Features cartoons from Tom Fishburne i.e. Marketoonist

Here are the top 5 findings from the report:

💰 Mobile apps are considerably more popular for BFSI marketers (68.6%) than they are for the general group of respondents (51.6%). Also, their usage has grown significantly from last year (49%).

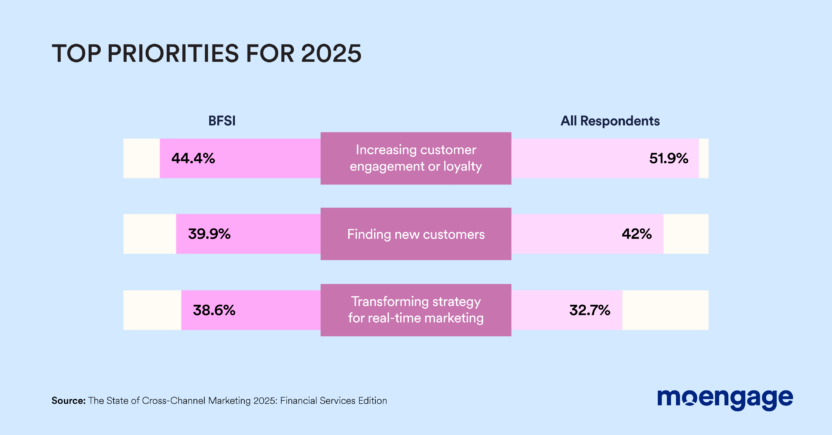

💰 As BFSI marketers start focusing on more sustainable marketing practices, the #1 business objective in 2025 is “increasing customer engagement or loyalty” (44.4%).

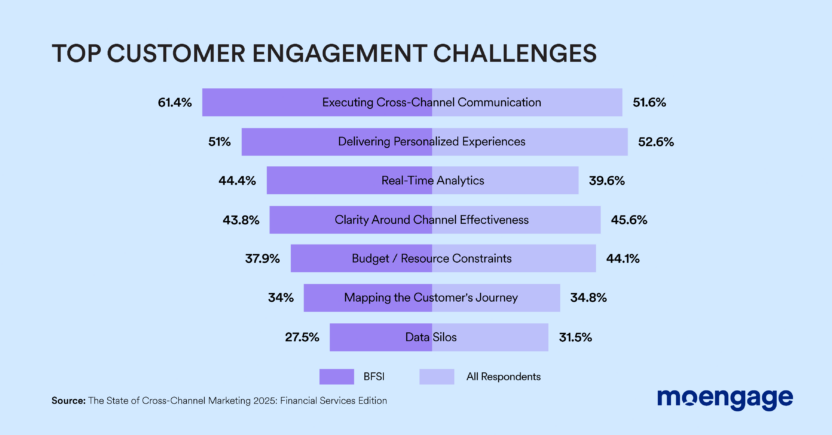

💰 BFSI marketers are still struggling the most with “executing effective cross-channel communication” (61.4%) and this number has grown significantly from last year (33.3%).

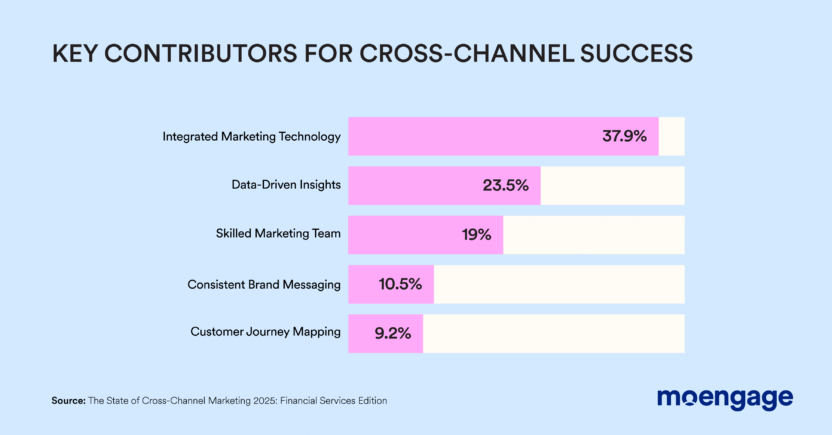

💰 When asked what has contributed the most to building an effective cross-channel marketing strategy, integrated marketing technology was the #1 response (37.9%).

💰 81.1% of BFSI marketers plan to invest more in marketing technology to improve customer experiences in the next 12 months.

Want to read more such takeaways? Then download your copy of The State of Cross-Channel Marketing in Financial Services: 2025.

If you’re interested, below are highlights from last year’s report.

The State of Cross-Channel Marketing in Financial Services: 2024

This year, the Financial Services industry stands at a unique intersection of tradition and innovation.

Our comprehensive survey of 730 marketers, including 147 respondents from this space, reveals intriguing insights into how this industry navigates cross-channel marketing in today’s digital-first landscape.

What stands out is not just their reliance on trusted channels like email and social media, but also their strategic approach to personalization and the challenges they face with legacy systems.

Surprisingly, they emphasize personalizing the customer journey at various stages, a tactic more prevalent in this sector than within the broader market. Yet, the path toward effective customer engagement is fraught with technological hurdles, with over half relying on outdated systems or manual processes.

This article will explore these compelling findings, exploring the balance financial services brands strike between security, personalization, and innovation.

Let’s dive in.

Who We Surveyed: Methodology + Demographics

Responses We Analyzed:

- All Responses: 730

- Financial Services: 147

Roles and Company Size

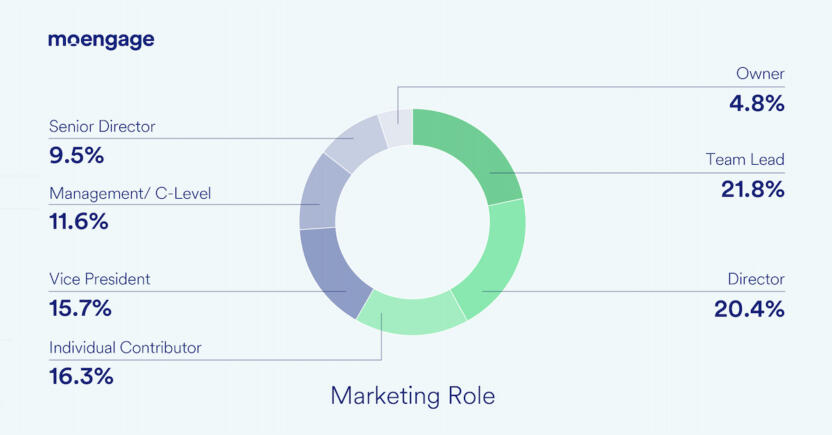

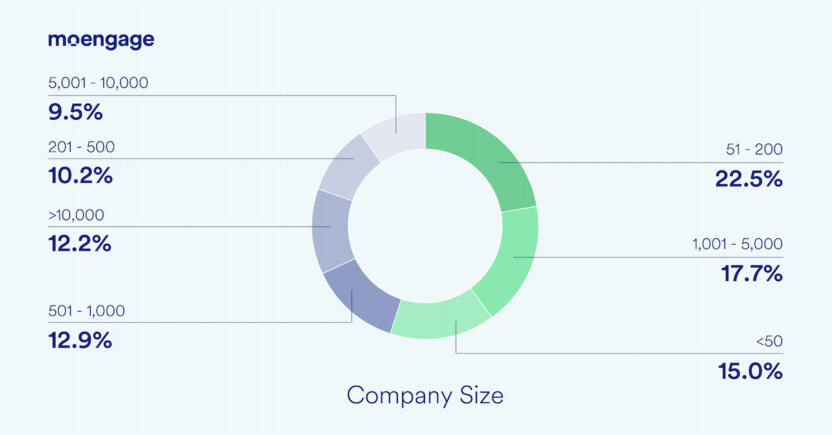

The majority of respondents said they are a Team Lead (21.8%) with 27.3% saying they are VP or a C-Level executive. In terms of company size, 22.5% of respondents represent organizations with 51 – 200 employees, and 62.5% represent companies with more than 200 employees.

Channels

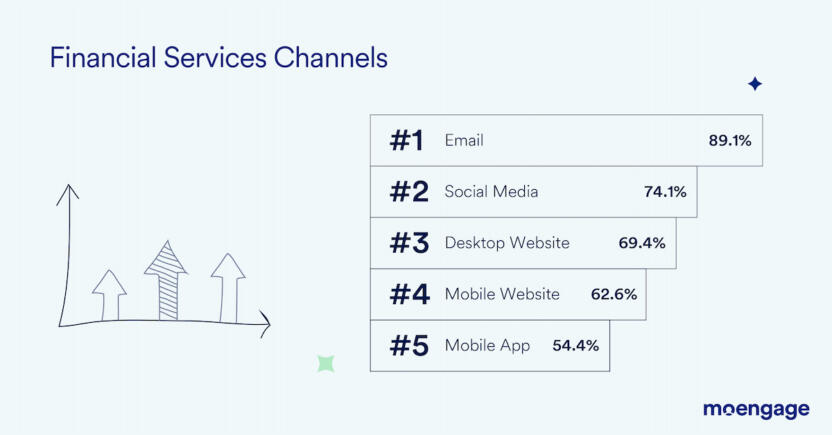

According to our broad set of survey results, the most popular engagement channels that B2C marketers use are:

- Email (89.6%),

- Social Media (80.3%),

- Desktop Website (67.1%),

- Mobile Website (65%),

- Mobile App (49)%

While other industries we’ve explored as part of this series (like Ecommerce & Retail and Food & Beverage) have differed from the general group of respondents in some areas, when looking specifically at the Financial Services industry, we found that these brands’ channel usage mirrors what we found in the overarching group.

This might be due to the nature of their audience’s preferences and the nature of their content. Email, as the primary channel, offers a direct, personalized, and secure way to communicate sensitive financial information, which is paramount in this industry. Social media ranks second, serving as a platform for broader engagement and brand awareness. Desktop and mobile websites follow, providing accessible information and services, while mobile apps, though fifth, offer on-the-go convenience for more engaged users.

This prioritization reflects a balance between security, accessibility, and user engagement specific to the financial sector’s needs.

Objectives

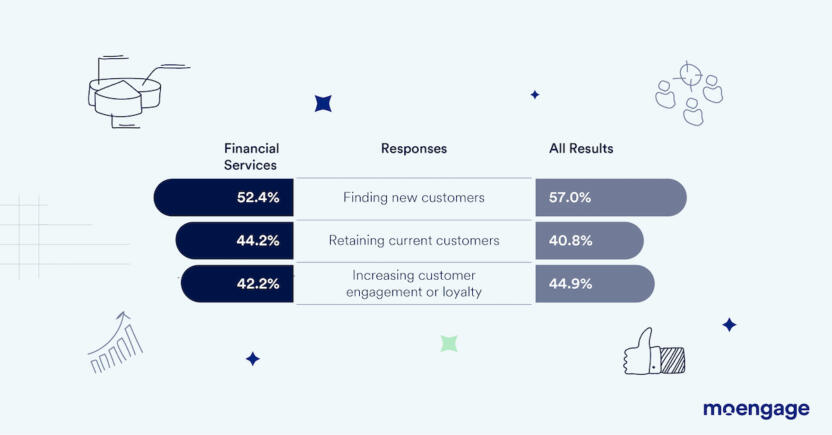

For Financial Services brands, attracting new customers is the top objective for 52.4% of respondents. Nevertheless, maintaining existing customer relationships is deemed more crucial (44.2% vs. 40.8%) than enhancing customer engagement or fostering loyalty.

This is likely because this industry is competitive and each long-term customer relationship is highly valuable. Of course, attracting new customers is essential for growth and market share expansion.

However, retaining existing customers is also critical, as it’s generally more cost-effective than acquiring new ones, and loyal customers can provide a stable revenue stream through continued business and potential upselling opportunities. This focus reflects the strategic balance financial services must maintain between growth and sustainability, emphasizing the importance of both acquiring and nurturing customer relationships for overall success.

AI Usage

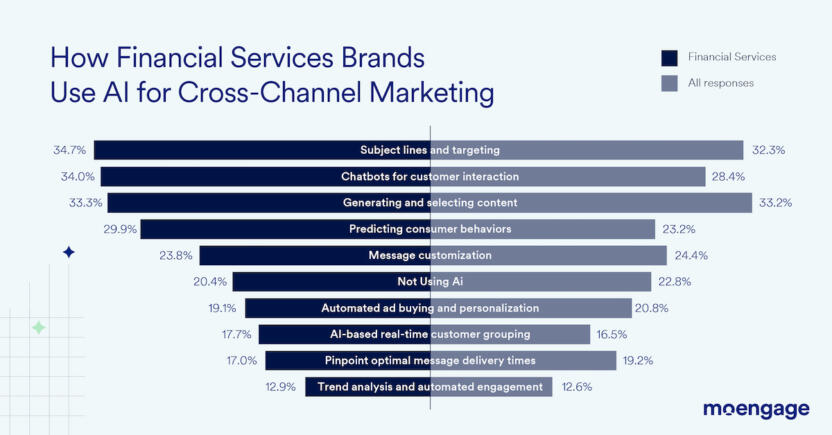

Based on the graph, you can see that when it comes to AI in cross-channel marketing in banking and Financial Services, two key use cases stand out:

- “AI-enhanced subject lines and targeting” and

- “AI Chatbots for instant customer interaction”

But why might this be the case?

Well, using AI-enhanced subject lines and targeting is pivotal because AI’s ability to tailor communications not only increases email open rates but also ensures the right messages reach the right customers at the right time, enhancing the relevance and trustworthiness of financial advisories or offers.

And regarding the use of AI Chatbots, their significance lies in providing immediate, round-the-clock assistance for a range of financial inquiries, from account management to transaction support. This capability is crucial in the financial sector, where timely and accurate information can impact customers’ financial decisions and trust in their provider.

By offering instantaneous support, financial services can elevate customer satisfaction, loyalty, and confidence in their services, setting a high standard for customer experience in an industry where trust and reliability are paramount.

Challenges

In Financial Services, businesses pinpoint delivering personalized experiences as a top challenge, with 42.9% highlighting it as a key hurdle, even above budget and resource limitations. This concern for personalization is understandable given the industry’s focus on managing substantial customer assets, which naturally raises the bar for customized services. However, navigating the complexities of sensitive financial data to provide these tailored experiences is no small feat.

Interestingly, financial constraints are slightly less of a concern, possibly due to the typically larger budgets this industry enjoys. But, there’s still a pronounced emphasis on deciphering the effectiveness of marketing channels.

In an industry as competitive as financial services, understanding which channels deliver the best bang for the buck is crucial. This need is compounded by the strict regulatory environment and compliance requirements, underscoring the importance of clear insights into marketing channel performance.

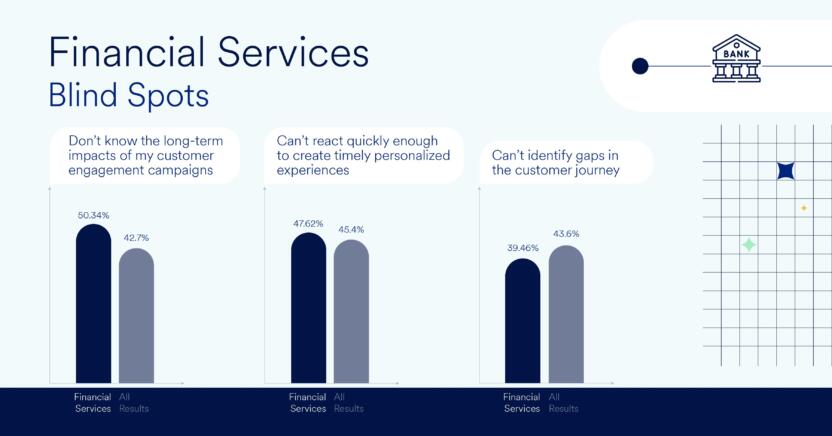

When diving into the primary blind spots for Financial Services organizations, it’s interesting to note that over half of the survey participants (50%) pointed out their struggle with grasping the long-term effects of customer engagement initiatives—this is in contrast to just 42.7% from the broader group feeling the same way.

This indicates a unique challenge in this industry: understanding the enduring impact of their marketing on customer loyalty and lifetime value, which isn’t always easy to measure over extended periods.

On the flip side, concerns about spotting weaknesses in the customer journey seem less pressing for these organizations, with only 39.5% flagging it. This might be because the customer journey within financial services is often well-charted and regulated, offering fewer surprises.

Plus, given the critical importance of safeguarding financial information, these firms likely have strong systems already in place to smooth out the customer experience, making significant journey gaps less of a worry.

This focus reflects the industry’s emphasis on cultivating long-term customer relationships and the built-in measures to ensure a seamless experience, despite the intricate challenges of tracking long-term engagement outcomes.

Technology

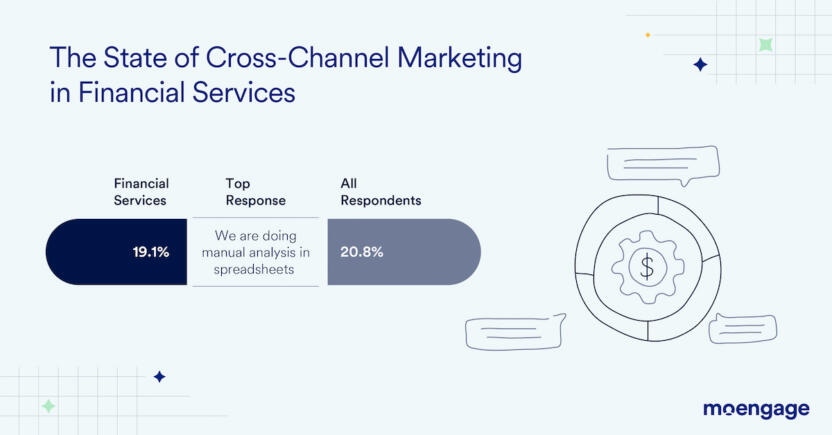

From our survey, we found that the majority of Financial Services marketers (53.1%) are either using clunky legacy systems, spreadsheets, or in-house solutions to manage their cross-channel marketing programs.

Unfortunately, there are a few problems we need to address with this martech strategy.

Legacy systems often lack the integration capabilities needed to seamlessly connect different marketing channels, leading to siloed data and a disjointed customer experience.

Spreadsheets, while flexible, are prone to human error and can become unwieldy with complex campaigns or large data sets. They also lack real-time analytics and automation features that modern marketing platforms offer.

And in-house solutions may be tailored to specific needs but can be resource-intensive to maintain and may not keep pace with the evolving marketing technology landscape.

These challenges can prevent Financial Services marketers from effectively analyzing campaign performance across channels, personalizing customer interactions, and adapting to market changes swiftly. Ultimately, this can impact the ROI of marketing efforts and the ability to compete against more advanced operations.

Investing in a dedicated Customer Engagement Platform (CEP) is key to streamlining processes, improving collaboration, and providing robust analytics for better decision-making and personalized experiences.

Best Practices

When we explored the essentials for a successful cross-channel marketing strategy, leveraging customer data analytics for strategic marketing decisions was identified as the key factor across all industries.

Digging deep into customer data sheds light on vital insights regarding consumer behaviors, preferences, and evolving trends. Armed with this knowledge, marketers are in a prime position to devise strategies that precisely target and meet customer needs.

This approach enables the crafting of personalized experiences that not only resonate deeply with the audience but also encourage their continued loyalty and engagement. It’s about striking the perfect balance between professionalism and personal touch to keep customers engaged and returning.

Personalization

In terms of how these organizations are using personalization, something that stands out is that 45.6% are customizing communications for different stages of the customer journey. Only 40.2% of general respondents are doing this with the majority relying only on the most basic form of personalization (name, age, gender, etc).

A small portion of Financial Services respondents admitted to not personalizing at all (8.8%) versus the general group at 10.1%. However, this industry is less interested in implementing content that changes based on user preferences (15% vs. 25.2%) and using AI for product or content suggestions (20.4% vs. 24.4%).

As we noted earlier, marketers in this space seem to have a deeper understanding of the customer lifecycle and journey than marketers in other industries like Ecommerce & Retail or Food & Beverage, who expressed difficulties with customer journey mapping.

The personalization approach being used within Financial Services goes beyond the basics to tailor interactions based on where the customer is in their journey with the brand. It’s a more strategic use of personalization, recognizing that the needs and interests of customers evolve as they move from awareness to consideration and decision-making stages.

The fact that a smaller percentage of financial services firms are not personalizing at all, compared to the general group, reflects the industry’s recognition of personalization’s value in building relationships and trust. Financial services deal with sensitive and personal matters, so even a small effort to personalize can significantly impact customer trust and loyalty.

However, the reluctance to implement content that adapts based on user preferences or to heavily invest in AI for product or content suggestions might stem from the industry’s nature.

Financial services involve complex products and regulatory constraints that may not lend themselves as easily to dynamic content personalization or AI-driven suggestions. These organizations might prioritize accuracy, security, and compliance over hyper-personalization, focusing on personalization strategies that align with the industry’s regulatory environment and the nature of their products and services. It’s a balance between offering personalized experiences and ensuring those experiences meet the stringent standards of the financial industry.

Financial Services Cross-Channel Marketing: Closing Thoughts

In wrapping up our deep dive into the state of cross-channel marketing within the financial services industry, it’s evident that navigating this digital-first landscape requires a nuanced approach. Our survey highlighted a sector committed to leveraging traditional communication channels like email and social media, underscored by a keen focus on security and direct engagement due to the sensitive nature of financial information.

Key takeaways include the industry’s emphasis on personalized, journey-specific communications and the challenges faced due to reliance on outdated technologies. These insights point to a critical gap between the desire for deeper customer engagement and the tools currently at their disposal.

MoEngage offers a range of solutions that can help Financial Services companies close that gap. With 2.2 billion experiences delivered monthly across multiple channels, you can ensure that your message reaches your customers effectively.

Schedule a demo today to see how MoEngage can help your Financial Services business deliver excellent customer experiences.