The State of Media & Entertainment Cross-Channel Marketing

Reading Time: 10 minutes

The dynamic Media & Entertainment industry is a playground for consumers looking to immerse themselves in experiences beyond the realm of everyday life.

However, with the endless potential for scrolling and limited attention spans plaguing today’s society, brands must find innovative ways to stand out and not only keep up with the latest trends but also be trend amplifiers themselves.

But how can these businesses anticipate consumer preferences and deliver cross-channel experiences that resonate with their target audience?

Our comprehensive survey of 730 marketers, including 95 respondents from this space, reveals intriguing insights into how this industry navigates cross-channel marketing, customer engagement, and personalization.

What stands out most is not their fierce focus on driving customer retention and loyalty, but their advanced usage of personalization strategies, AI capabilities, and customer data to create a cross-channel, multi-touch approach.

Yet, the path toward understanding marketing channel effectiveness and the full customer journey is ridden with technological hurdles. With over half relying on manual processes, one can see why they struggle with real-time analytics and marketing channel attribution.

This article will dig into these compelling findings, exploring the balance Media & Entertainment organizations must adopt between building brand loyalty, navigating budget constraints, and consistently breaking through the noise to produce content their audiences love.

Let’s get to it.

Who We Surveyed: Methodology + Demographics

Responses We Analyzed:

- All Responses: 730

- Media & Entertainment: 95

Roles and Company Size

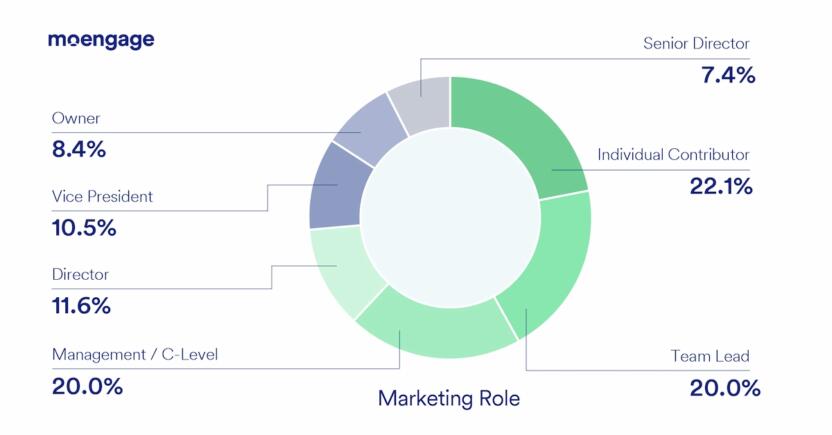

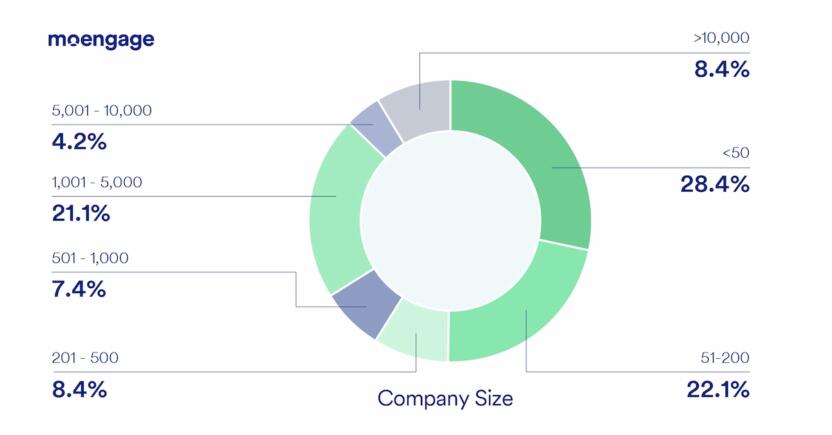

The majority of respondents said they are Individual Contributors (22.1%) with 30.5% saying they are VP or C-Level executives. In terms of company size, 49.5% represent organizations with over 200 employees.

Channels

According to our broad set of survey results, the most popular engagement channels that B2C marketers use are:

- Email (89.6%),

- Social Media (80.3%),

- Desktop Website (67.1%),

- Mobile Website (65%),

- Mobile App (49)%

When it comes to the most used channels within the Media & Entertainment industry, you’ll find that they place a higher significance on the Mobile App than the general group of respondents.

This might be because, with more people now consuming content on their phones, apps have become a key way for the industry to connect with audiences.

They’re not just about watching videos or listening to music; they allow for a personalized experience, sending notifications and offering interactive elements that keep users engaged.

Plus, there’s the financial side – apps can open up various revenue streams like subscriptions or ads. Also, the insights gained from app usage help shape future content and strategies, which is why mobile apps are essential for brands in this space.

Objectives

For Media & Entertainment brands, increasing customer engagement or loyalty is the top objective for 54.7% of respondents, which was significantly higher than for the general respondent group, who prioritize finding new customers above all else.

This is likely because, for these brands, the connection with the audience isn’t just a one-time deal. They aim to create lasting relationships because, in the long run, having a loyal audience can be more valuable than constantly seeking new customers.

Engaged viewers or listeners are more likely to subscribe, make in-app purchases, or consume more content, which directly affects the brand’s revenue and stability.

Let’s not forget that in this industry where choices are abundant, keeping an existing audience hooked is crucial. It’s not just about grabbing attention initially; it’s about holding onto it. This space is very dynamic and competitive, so brands that successfully maintain high levels of engagement and loyalty can stand out and ensure a steady flow of revenue, even in a crowded market.

Two examples of media and entertainment brands that excel in customer engagement and loyalty are HBO and Netflix.

HBO, particularly with its hit series “Game of Thrones,” utilized social media to create a buzz and foster a sense of community among fans back in 2017. They shared visually stunning content and exclusive behind-the-scenes looks, and encouraged fans to share their fan art and theories using specific hashtags.

This approach helped HBO to not only engage with its audience in a fun and creative way but also to build a loyal fan base around the series.

Netflix, on the other hand, stands out for its use of data and personalization to keep customers engaged. By analyzing viewer behavior and preferences, Netflix creates and recommends content that resonates with its audience, making the viewing experience hyper-personalized. This strategy has been successful in keeping viewers coming back for more, thereby maintaining high levels of customer loyalty.

Both HBO and Netflix demonstrate how understanding and catering to the needs and interests of their audiences, through engaging content and personalized experiences, can lead to increased customer loyalty and engagement.

That’s why, compared to other industries where the push might be more towards acquiring new customers, Media & Entertainment businesses lean heavily into nurturing their existing audience base.

Of course, attracting new customers is still essential for growth, so that’s why it shows up as the second objective for brands in this space.

AI Usage

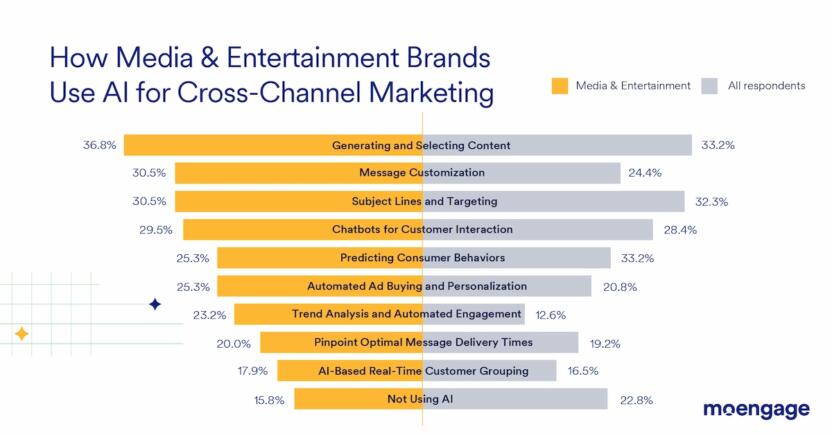

Based on the graph, you can see that, when it comes to AI in cross-channel marketing in Media & Entertainment, one key use case stands out:

- “Generating and selecting content”

This is not surprising because this industry is known for its vast output, where audiences crave diverse and engaging content across multiple platforms.

AI steps in as a powerhouse, capable of handling the sheer volume of content, ensuring that what gets delivered is not just relevant, but also tailored to individual preferences. This personalized approach enhances user engagement, making viewers or listeners feel like the content speaks directly to them.

On top of that, AI doesn’t just stop at personalization. It’s also about efficiency.

By automating content generation and selection, media companies can significantly cut down on time and costs, allowing for more resources to be allocated to creative and strategic endeavors. Plus, AI’s ability to analyze data in real-time means that content strategies can be constantly refined to maximize audience retention and engagement.

Also worth noting is the disparity between how Media & Entertainment brands are using AI for trend analysis and automated engagement versus the overarching group of respondents (23.2% vs. 12.6%).

This is due to the unique needs and dynamics of the media industry. As discussed earlier, Media & Entertainment companies operate in a fast-paced environment where trends can shift rapidly, and staying ahead of these changes is crucial.

They rely on AI for trend analysis to quickly identify and capitalize on emerging trends, ensuring content remains relevant and engaging to their audience.

In contrast, industries outside of Media & Entertainment may not face the same pressure to constantly adapt to new trends or engage users at such a granular level, leading to a lower overall reliance on these AI capabilities.

For these companies, leveraging AI in these areas is not just a strategic advantage; it’s a necessity to stay competitive and maintain a strong connection with their audience.

Challenges

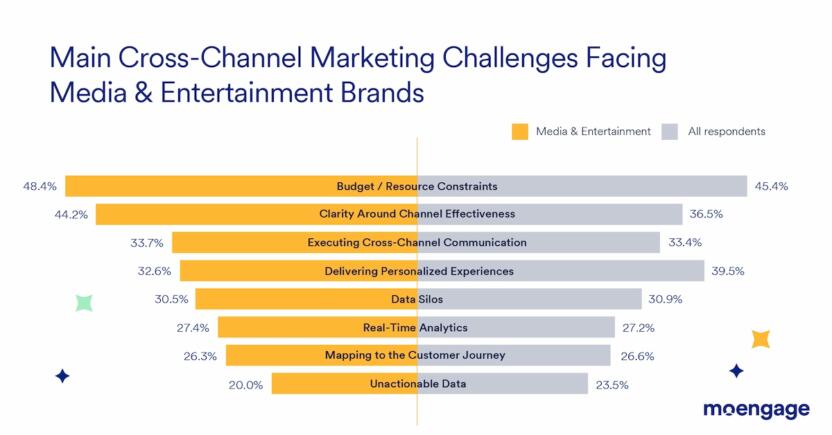

In Media & Entertainment, businesses were most likely to say that budget and resource constraints were their greatest challenge (48.4%), followed by lacking clarity around marketing channel effectiveness, with 44.2% noting the struggle here.

Their focus on issues with understanding channel effectiveness stands out from the main group and could stem from the challenge of accurately measuring and attributing the impact of different channels in a multi-touch consumer journey.

With the convergence of traditional and digital media, audiences now interact with content across multiple platforms and devices, making it harder for Media & Entertainment businesses to pinpoint which channels are truly driving engagement and contributing to their bottom line.

Also, the rapid evolution of technology and media consumption patterns means that what worked yesterday might not be as effective today.

Media & Entertainment companies are therefore more likely to feel the pressure to constantly reassess and adapt their marketing strategies to stay relevant and effective in connecting with their audience.

This ongoing challenge of understanding channel effectiveness underscores the need for advanced analytics and data-driven decision-making in the industry.

Blind Spots

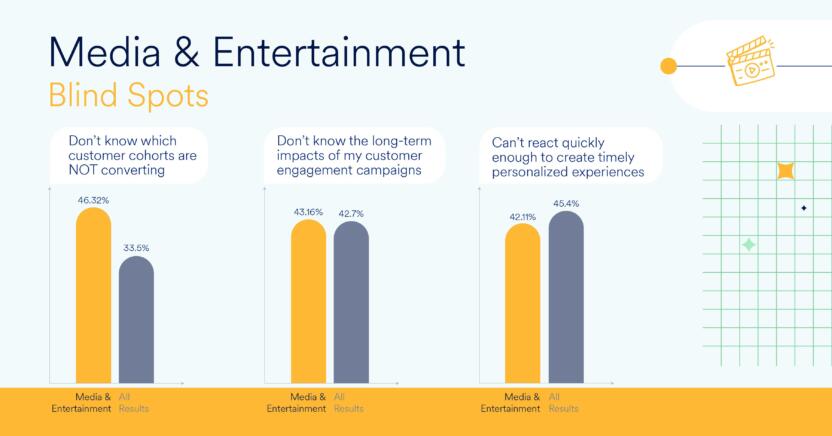

When diving into the primary blind spots for Media & Entertainment organizations, it’s interesting to note that 46.3% admitted to not knowing which customer cohorts are not converting. This blind spot appears unique to marketers in this industry.

As noted, this industry contains inherent complexities in audience behavior and content interaction. Consumer preferences shift frequently and are influenced by trends, cultural shifts, and new content releases, making it challenging to analyze conversion pathways consistently.

Unlike industries with more straightforward product offerings, the success of content in Media & Entertainment can be influenced by subjective factors such as storytelling quality, genre popularity, and celebrity influence, which can fluctuate widely and affect conversion rates.

Technology

From our survey, we found that the majority of Media & Entertainment marketers (20%) are using spreadsheets and manual processes to manage cross-channel marketing programs.

Unfortunately, spreadsheets, while flexible, are prone to human error and can become unwieldy with complex campaigns or large data sets. They also lack real-time analytics and automation features that modern marketing platforms offer.

These challenges can prevent marketers from effectively analyzing campaign performance across channels, personalizing customer interactions, and adapting to market changes swiftly. Ultimately, this can impact the ROI of marketing efforts and the ability to compete against more advanced operations.

To tackle their blind spots, Media & Entertainment brands can lean on customer engagement software, which can help them identify patterns in their customer data. This software can stitch together data from various channels, offering a complete picture of how different customer groups interact with content.

It helps identify who isn’t converting and why, enabling brands to craft personalized campaigns that hit the mark. It’s also great for testing out different strategies to see what resonates best, ensuring that marketing efforts are always on the cutting edge.

Best Practices

When we explored the essentials for a successful cross-channel marketing strategy, leveraging customer data analytics for strategic marketing decisions was identified as the key factor across all industries, including within Media & Entertainment.

Digging deep into customer data sheds light on vital insights regarding consumer behaviors, preferences, and evolving trends. Armed with this knowledge, marketers are in a prime position to devise strategies that precisely target and meet customer needs.

This approach enables the crafting of personalized experiences that not only resonate deeply with the audience but also encourage their continued loyalty and engagement. It’s about striking the perfect balance between professionalism and personal touch to keep customers engaged and returning.

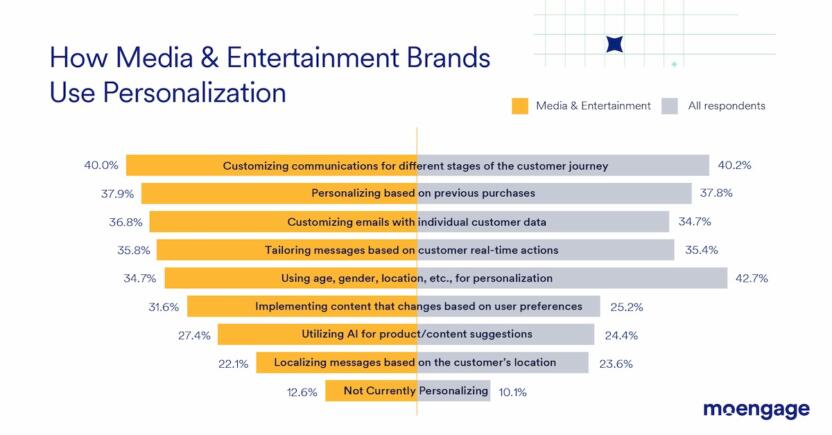

In terms of how these organizations are using personalization, customizing communications for different stages of the customer journey was the most popular response, with 40% of survey participants noting that they are personalizing in this manner.

It is beneficial for Media & Entertainment organizations to use personalization in this way because it aligns the content and messaging with the evolving needs and interests of the audience.

As consumers move through the journey, from awareness to interest, decision, and loyalty, their expectations and engagement levels change. By customizing communications at each stage, organizations can ensure that they are delivering relevant, timely, and engaging content that resonates with the audience.

Something else that stands out is that only 34.7% of Media & Entertainment marketers are using basic personalization like age, gender, or location as opposed to the 42.7% of general respondents. On top of that, a higher percentage responded that they aren’t using personalization at all (12.6%).

This indicates that personalization might not be a key area of customer engagement focus for brands in this space. Unlike Ecommerce & Retail, where personalization based on demographics can significantly influence purchasing decisions, media consumption is often driven by content preferences that transcend these basic demographic categories.

For instance, a movie or a hit TV show can appeal to a wide range of ages, genders, and locations. Media & Entertainment brands might be focusing more on content preferences, viewing history, and behavioral data to personalize experiences, rather than just basic demographic information.

They might find that these factors are more predictive of what content will resonate with their audience, leading to better engagement and retention.

Something else to note is that the creative aspect of media content means that success can often be driven by broader trends and viral phenomena, which don’t always align neatly with demographic segmentation.

Brands in this space may also be cautious about over-personalization due to privacy concerns and the desire to maintain a broad appeal across diverse audiences.

Therefore, while personalization is crucial, the approach in the Media & Entertainment industry might be more nuanced, focusing on the richness of content interaction and user behavior rather than basic demographic data.

Media & Entertainment Cross-Channel Marketing: Closing Thoughts

In wrapping up our deep dive into the state of cross-channel marketing within the Media & Entertainment industry, it’s evident that brands in this space face unique challenges and opportunities.

The industry’s emphasis on content creation and distribution necessitates a nuanced approach to customer engagement, where understanding the dynamic nature of consumer preferences and the competitive landscape is crucial.

While personalization is still key, it extends beyond basic demographics, focusing on behavioral insights and content interaction to connect with audiences effectively. The adoption of advanced technologies like AI for trend analysis and automated engagement underscores the industry’s need to stay agile and responsive to rapidly changing market conditions.

Overall, the Media & Entertainment industry’s approach to cross-channel marketing reflects its complex, ever-evolving nature, highlighting the importance of innovative, data-driven strategies to captivate and retain audiences in a saturated market.

The future of cross-channel marketing in this industry hinges on embracing technologies that allow these brands to foster deeper trust and loyalty, ensuring their competitive edge in a rapidly evolving digital ecosystem.

To discover how MoEngage’s cross-channel marketing platform can level up your Media & Entertainment business’s strategy, schedule a demo today.