Website Personalization For BFSI Brands: How To Tailor Personalized Financial Web Experiences For Customers

Reading Time: 11 minutes

Internet banking and electronic payments have become increasingly popular lately. 73% of consumers globally use online banking at least once a month. 38.4% of smartphone consumers make in-store payments at least twice a year. The total number of global online banking customers will exceed 3.6 billion by 2024.

Online banking has become popular because consumers love convenience, security, and the wide range of financial services available on their computers and smartphones. The adoption of digital forms of banking is now widespread, peaking in some northern European countries where the adoption is close to 100%.

Here are some of the key reasons why customers are increasingly preferring internet banking:

- Security Assured: Online banking is highly secure, as banks use encryption to protect client information and prevent security breaches

- Easy Access: Online banking allows for transactions anytime from the comfort of home, without the need to physically visit the bank

- No Hidden Fees: Making online transactions is convenient and does not involve hidden fees, only a nominal transaction convenience charge

- Convenience Guaranteed: Online banking eliminates the need to wait in long queues at the bank, making banking highly convenient

With digital finance on the rise, companies seek a differentiating factor to improve the customer experience and engagement on the apps/websites. To facilitate more digital transactions, focusing on one key differentiating factor, website personalization for BFSI brands, is critical.

Let’s read more about it and how MoEngage can supercharge these for you.

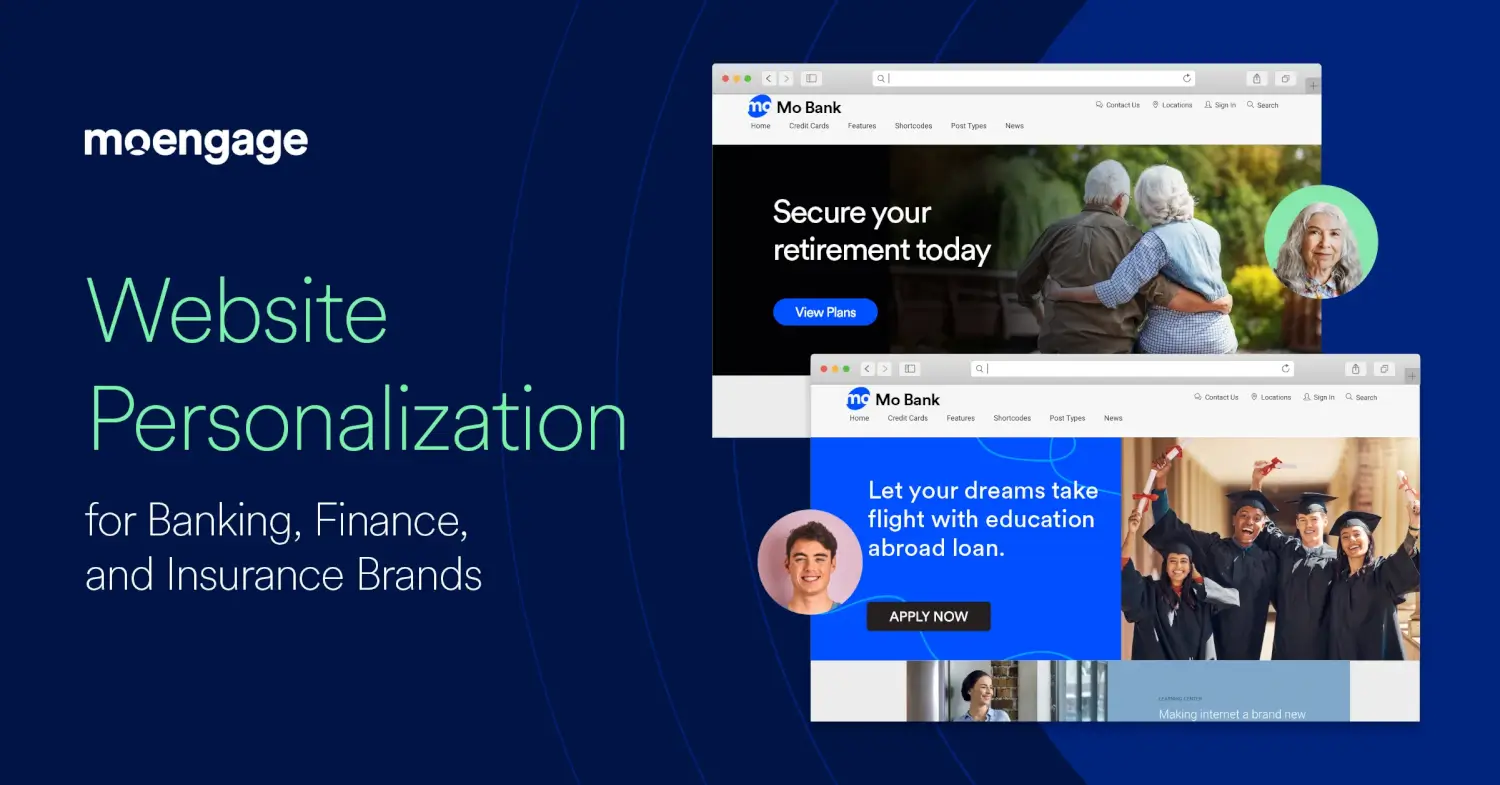

Website Personalization For BFSI Brands Based On Personalized Customer Experiences

Website personalization for BFSI brands entails improving the onboarding completion rates and minimizing drop-offs by welcoming customers and guiding them through the setup process is essential in building long-term customer relationships. Personalized messages allow the conversation to continue on other channels to bring back customers who dropped off.

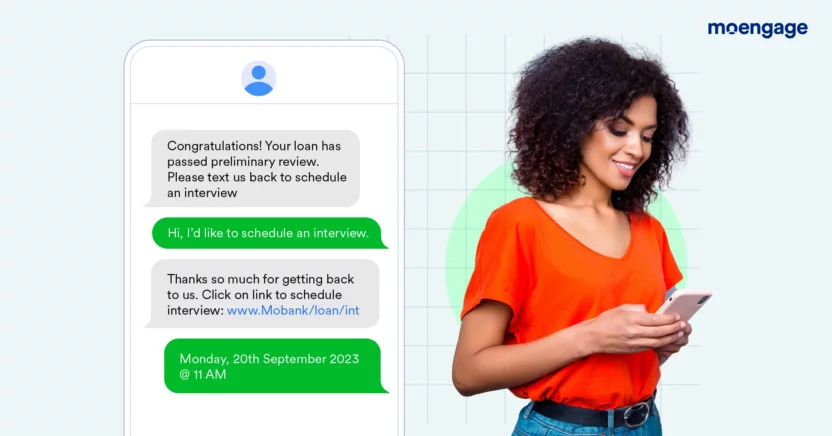

For BFSI brands, this includes sending personalized messages such as bill payment notifications, and loan qualifications, or finding a nearby branch location based on previous transactions and browsing history, location, and using personalization best practices to win back your inactive or lost customers, boost customer engagement, and conversions.

A great way to do this is by letting an AI-powered platform, such as MoEngage through personalized offers, help provide predictive recommendations to stimulate upsells or cross-sells, and much more!

The Advantages Of Website Personalization With MoEngage For BFSI Brands

- Develop integrated reporting, evaluate customer actions, and respond immediately, all in one place

- Generate customer experiences that are customized and captivating

- Anticipate and stop customers from leaving your website or app

- Enhance customer involvement and boost the customer lifetime value

Let’s take a deep dive into the various use cases the MoEngage empowers for BFSI brands.

Website Personalization Use-cases For BFSI Brands

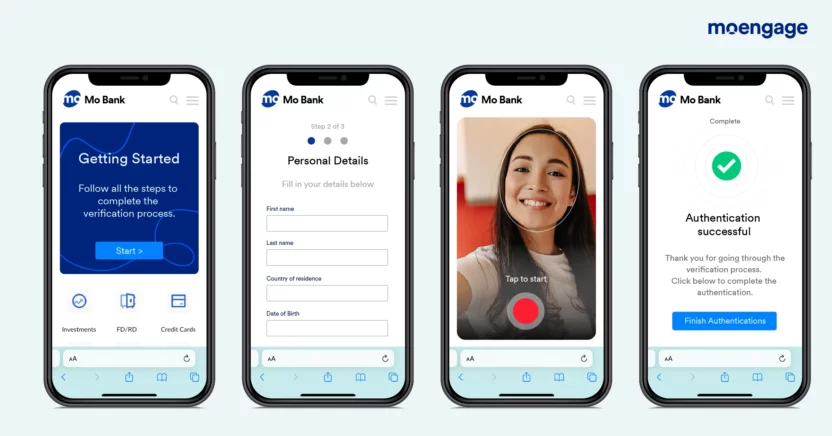

Onboarding and KYC

Benefits:

- Personalization can help reduce friction in the sign-up process by pre-filling forms with known information

- Customized messages and offering help in improving app install rates and sign-ups

How To Do It With MoEngage

Journey stage: Onboarding

Goal: To help new and existing customers complete their KYC / onboarding quickly

Scenarios and Solutions:

|

Scenario 1: For Existing customers – Banks want to encourage their customers to digital adoption, i.e., install the app and do their KYC so they can begin transacting digitally. Solution: Banks can offer personalized recommendations based on the transaction history of their existing customers. Regular communication through email, SMS, or push notifications to inform customers of new features and improvements in the app can also provide the required nudge to the customers. Scenario 2: New Customers: Banks want to encourage new customers to complete their KYC quickly and smoothly. Solution: Banks can simplify onboarding, provide incentives such as cashback or rewards, and offer personalized recommendations. Banks can also leverage social media and other marketing channels to raise awareness of their digital offerings. |

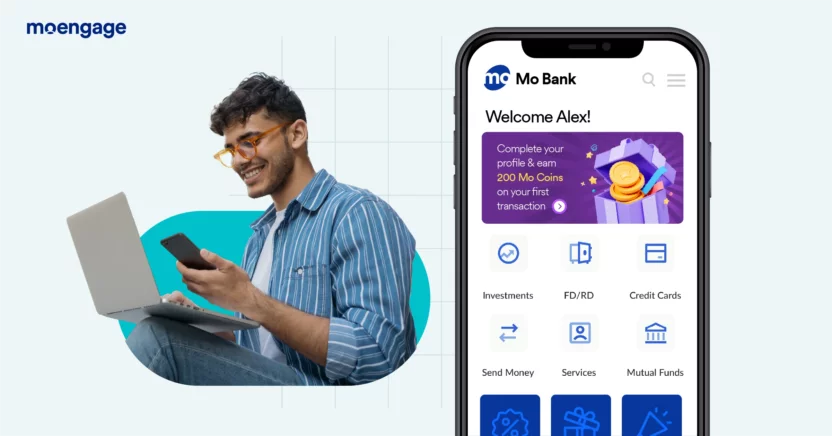

Nudge Customers Towards First-use With Personalization

Benefits:

- More transactions mean more in-app engagement and an improved Customer Acquisition Cost (CAC)

- Customized offers result in more visits and transactions on the company’s website/app

- Encourages first-time consumers to complete their KYC process and start transacting on your app/website

How To Do It With MoEngage

Journey stage: Onboarding

Goal: Nudge customers toward activation

Scenario and Solution:

|

Scenario: New customers are on your website, but need help understanding the core purpose / AHA moment of what your website offers. Solution:

|

Create Tailored Experiences Based On Traffic Source

Benefits:

- Targeted advertisements and relevant messaging on the landing page will improve on-site engagement and experience

- Pre-filled application details and exclusive offers can improve conversion rates

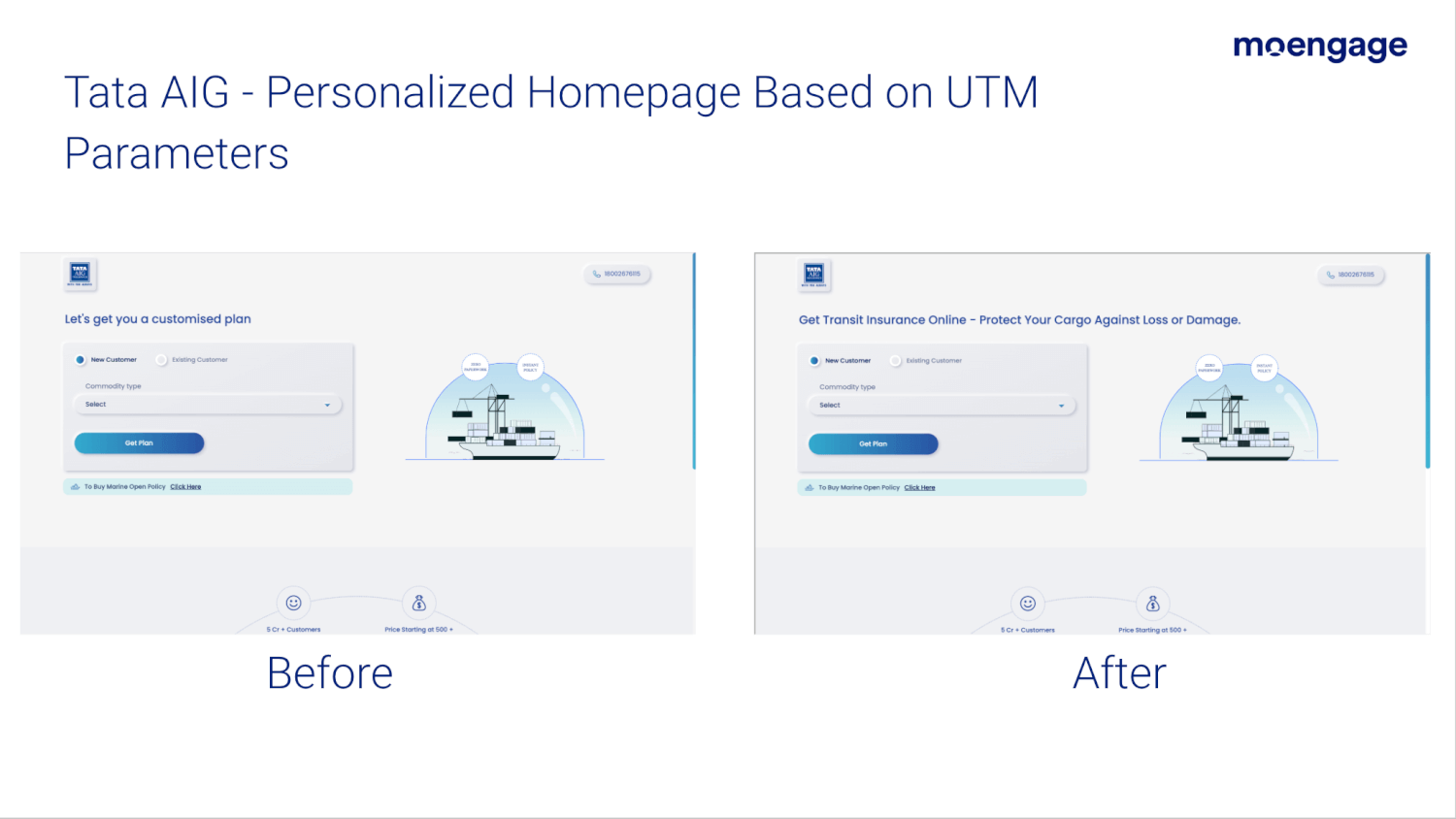

Below, is an example how Tata AIG personalizes their homepage based on UTM parameters. Depending on the user source, Tata AIG wants to changes the message on their homepage (for example – utm_source as google).

How To Do It With MoEngage

Journey stage: Engagement and retention

Goal: Improve customer experience and create symmetric experiences

Scenarios and Solutions:

|

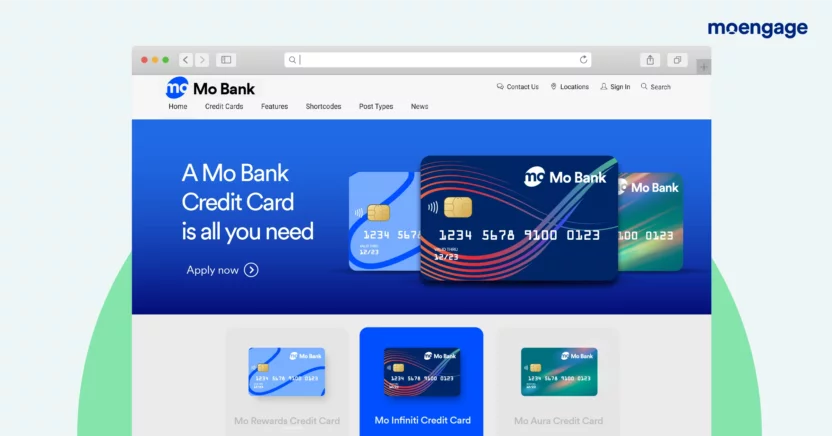

Scenario 1: Customers visit your website from a social media ad that talks about credit card rewards. Solution: Personalizing communication and offers based on traffic sources can help create a more targeted and relevant experience for potential customers. For example, if the customer has come after watching a rewards-based credit card advertisement, then you can show personalized recommendations for similar reward-based cards on the landing page. Scenario 2: Customers visit your website after clicking on an affiliate email about Home Loan interests. Solution: You can increase the chances of a successful conversion by showing personalized messaging and offers related to home loans. Sending follow-up communication through email or SMS can help keep the consumer engaged and informed throughout the loan application process. |

Engage Returning Visitors With Personalized Content

Benefits:

- Offers and discounts on a particular offering can improve conversion rates on the app/website

- Offering free educational content will improve customer experience and boost overall engagement

How To Do It With MoEngage

Journey stage: Engagement and retention

Goal: Improve customer experiences. Nudge towards activation/transaction

Scenarios and Solutions:

|

Scenario 1: A customer with product purchase intent revisits your website. Solution: Using data on their previous browsing behavior and product interest, you can showcase a banner highlighting relevant products or offers that align with their intent. For example, if the customer had previously viewed a specific product, you could showcase a banner that offers a promotion or discount on that product, incentivizing them to make a purchase. Scenario 2: A customer with no purchase intent revisits the site – and is shown a promotion offer crafted for the customer. Solution: By using the customers’ browsing history or demographics, you can create a personalized offer that aligns with their interests or needs. For example, you could offer them a promotion for a free e-book or report related to their financial interests. |

Encourage Existing Engagement With Website Personalization

Benefits:

- Ongoing engagement can help nurture leads and build stronger relationships with potential customers, resulting in the final process of the loan

- Regular engagement can help keep your brand top of mind and encourage visitors to return to your site or app

How To Do It With MoEngage

Journey stage: Reactivation

Goal: Complete purchase / submit the application

Scenarios and Solutions:

|

Scenario 1: A customer fills the loan calculator with personal loan, home loan, and Abandoned loan (PL, HL, AL) details and does not complete the form and drops off. Solution: You can send follow-up communication, offer personalized assistance, simplify the application process, and highlight the benefits of the loan calculator. Once the customer revisits the site, they are nudged to complete the form along with previously filled and filled-in variables. Scenario 2: A customer fills in the loan calculator details on the site but does not apply. Solution: Try and provide additional information, offer assistance, simplify the application process, and highlight the benefits of the loan. Show them a personalized banner based on customer online variables such as loan amount, tenure, interest rate, and EMI. |

Upsell And Cross-sell Based On Customer Tier

Nudge customers to upgrade their accounts, apply for a higher-tier credit card, share exclusive loan offers, and check their credit scores.

Benefits:

- Personalized offers will result in more visits and more conversions on the website

- Customers availing exclusive discounts might result in increased repurchase rates from the same card

How To Do It With MoEngage

Journey stage: Retain and grow

Goal: To get customers to purchase additional products and services from the bank and encourage them to use their cards

Scenarios and Solutions:

|

Scenario 1: The customer is comfortable with transacting digitally. The bank wants to up-sell/ cross-sell other products. Solution: Once customers are comfortable transacting digitally, it is an excellent opportunity to cross-sell/ up-sell other financial products based on their a/c balance, borrowing history, credit history, and more. Banks can send customers personalized communication highlighting the benefits and provide time-sensitive offers. Banks can also engage them with offers that are applicable exclusively to their cards. Pro tip: Use RFM (recency, frequency, monetary) analysis to know who are your loyal customers to offer a personalized experience nudging them to sign-up for your loyalty program. RFM considers three factors: how recently customers have made transactions, how frequently they transact, and how much they spend. RFM analysis can help you optimize your loyalty program and boost customer engagement. |

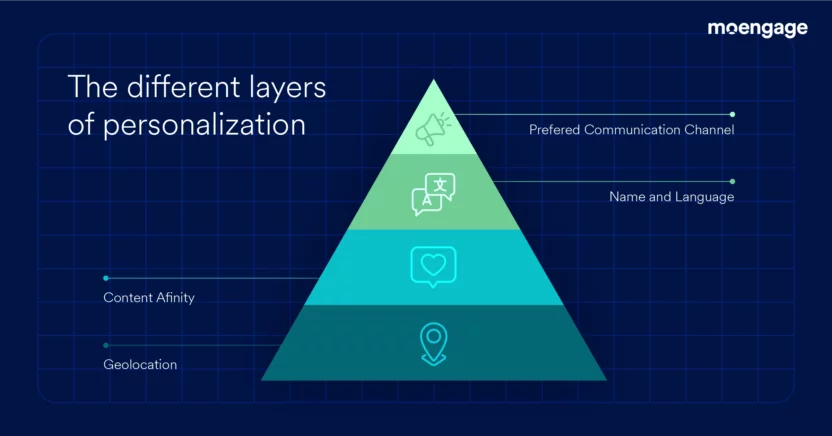

Personalize Based On User Attributes

Benefits:

- A more personalized experience enhances the visitor’s perception of your brand and builds loyalty over time

- Personalized communication based on specific groups and their intentions will increase engagement on your website

How To Do It With MoEngage

Journey stage: Upsell, retain, grow

Goal: To get customers to find what they are looking for and get them to purchase additional products and services

Scenarios and Solutions:

|

Scenario 1: Website visitors are from different geographies interested in curated products or services based on location. Solution: Personalizing the website experience to showcase content, products, and offers based on visitor location can improve the relevance and appeal of your website to the visitor. By leveraging the visitor’s location data, you can display information that is specific to their location, such as local news, events, or promotions. Scenario 2: You have multiple products and want to showcase different products based on customer intent, age, and banking tier. Solution: By leveraging visitor attributes, you can display information and offers that are specifically tailored to their needs and interests, increasing the likelihood of engagement and conversion. For example, if the customer is a senior citizen and belongs to the bank’s highest tier of customers, the website could display information about special savings accounts with higher interest rates for seniors. |

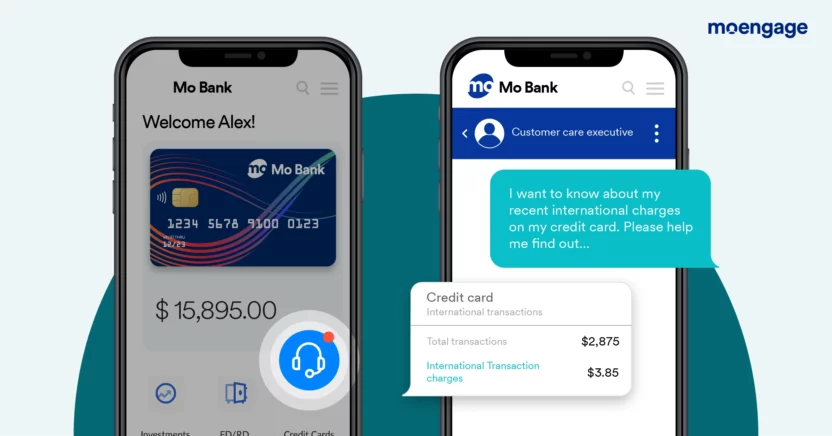

Reduce Conversion Funnel Abandonment With Real-time Messaging

Benefits:

- Continuous nudges and assistance will likely result in reduced drop-offs from your website/app

- Additional information and offers will improve on-site conversion

How To Do It With MoEngage

Journey stage: Acquisition and retention

Goal: Improve on-site conversion and reduce site drop-offs

Scenarios and Solutions:

|

Scenario 1: Financial decisions can be difficult – they involve a deep level of reasoning and assessment, calculations that generally require higher cognitive efforts. As a result, customers may not always convert on your website and drop off. Solution: By triggering personalized messaging on key pages, events, or when they are idle, banks can proactively engage with customers and offer relevant support. For example, when a customer is browsing a page related to loans, the bank can trigger a personalized message offering to answer any questions they may have or provide additional information about the different loan options available. Pro tip: Take an omnichannel approach with a personalized message to create a more connected experience. Learn how you can create connected experiences with MoEngage’s Google Ads Audience Sync. |

Product Recommendations

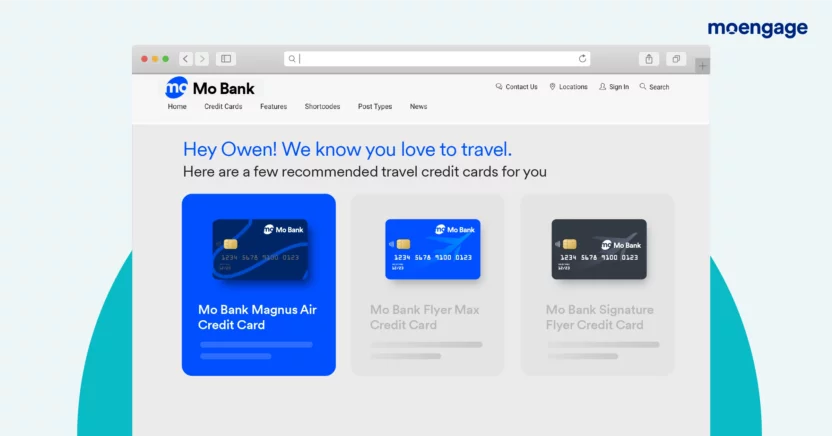

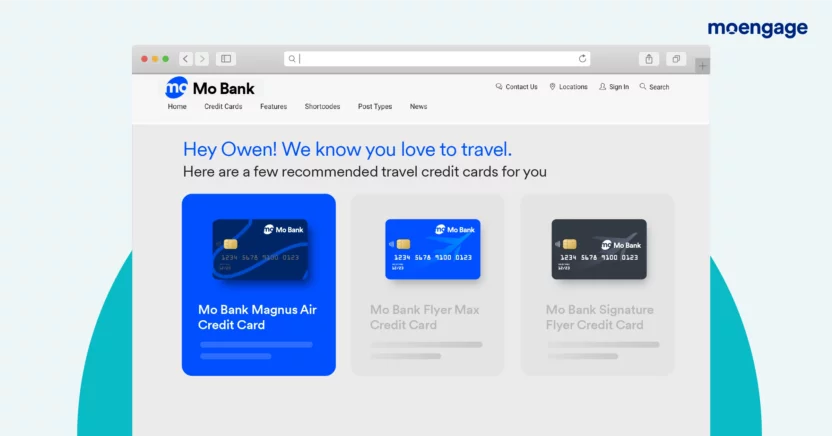

Create personalized product recommendations based on intent, account information, previous transactions, and the current context.

Benefits:

- Tailor-made recommendation to new users helps improve conversion rates and reduces the Cost of Acquisition (CAC)

- By providing existing customers with favorable offers, organizations can increase the LifeTime Value (LTV) of customers

How To Do It With MoEngage

Journey stage: Acquisition, upsell

Goals:

– Acquire new customers

– Upsell/cross-sell to existing customers

Scenarios and Solutions:

|

Scenario 1: An existing customer with product intent revisits the website. Solution: Banks can offer personalized recommendations by leveraging the customer’s existing banking tier and products viewed. For example, suppose a customer is browsing credit card options on a bank’s website. In that case, the bank can show a credit card with a higher cash-back rate for customers who frequently use their card for online shopping or a travel rewards card for customers who frequently travel abroad. Scenario 2: A new prospect re-visits the website. Solution: Personalized product recommendations can be a powerful way for BFSI companies to engage new prospects and offer them relevant products and services. For example, if a new prospect is browsing a bank’s website and shows an interest in savings accounts, the brand can use location data and browsing behavior to recommend a savings account with a competitive interest rate. Pro Tip: MoEngage’s Dynamic Product Messaging (DPM) is built to help you communicate relevant products and services from your existing catalog based on the customer’s previous browsing history through web or app push notifications and emails. It is built upon MoEngage’s proprietary Sherpa Interaction Graph, which connects each customer’s behavior with your catalog’s products/services/content and recommends these product recommendations. |

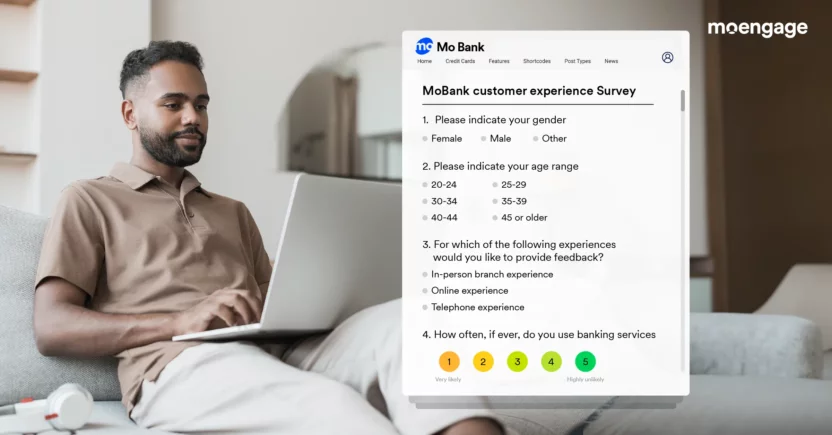

Self-Segmentation Surveys

Benefits:

- Understanding the preferences of the customer helps organizations improve their website experience, thus increasing customer engagement

- Providing relevant offers means more conversions and reduced Cost of Acquisition (CAC)

How To Do It With MoEngage

Journey stage: Acquisition, onboarding

Goal: Improve customer acquisition and onboarding experience

Scenario and Solution:

|

Scenario 1: A new prospect or existing customer visits the website. However, after spending some time on the site, they are unable to find what they are looking for. Solution: Triggering a time-based self-segmentation survey can be an effective way for banks to personalize the website experience for new prospects. By allowing these new customers to select “what is right for you,” banks can gain insights into their preferences and tailor the website experience accordingly. The survey might ask the new prospect about their financial goals, investment preferences, and risk tolerance. Based on their responses, the bank can personalize the website experience to showcase products and services that are most relevant to them. |

Website personalization for BFSI brands is becoming increasingly important as it provides a way to tailor customer experiences, increase engagement, and improve customer satisfaction. Advanced analytics and machine learning algorithms enable financial institutions to anticipate the needs of their customers and provide them with relevant products and services.

With website personalization, banks and financial institutions can also improve their customer retention rates by predicting and preventing customer churn, ultimately driving increased customer lifetime value (LTV). Website personalization for BFSI brands is now a key differentiator for brands looking to stand out in a competitive marketplace and deliver superior customer experiences.

About MoEngage

MoEngage’s AI-driven, personalized messages include bill payment notifications, loan qualifications, and finding a nearby branch location. The platform helps banks to nudge new and existing customers towards activation, improve customer experience, and create symmetric experiences based on the traffic source.

Moreover, you can create highly targeted segments of customers that share a similar app or web behavior, such as completing an onboarding campaign or a bank transfer within the last week. We help you schedule and automate campaigns to reach your customers at the right time and right channel to drive optimal value and results.

To help you with this, MoEngage User Paths helps visualize how your customers interact with every brand touch point, from onboarding through engagement and growth. This helps you to spot friction areas and optimize your campaign’s performance and results.

MoEngage Personalize enables you to accomplish these goals quickly and efficiently without requiring any coding. Are you eager to discover how your brand can incorporate website personalization? If you’re a customer, please reach out to your favorite customer success manager. If you’re new to MoEngage, you can consult with our specialist here.

Bonus Reads

- What Is Conversational Commerce and How Can It Help Your Business?

- Website Personalization Examples: How Are Leading Brands Doing It?

- Personalization: Missing Ingredient of a Great Customer Experience Strategy

- MoEngage Flows: Create Personalized Experiences With An Enterprise-Ready Automated Customer Journey Builder

- [Customer Spotlight] How GIVA Recorded 120% Uplift in Conversions Using MoEngage’s Newly Launched Smart Recommendations!