Your Mobile App Isn’t the Silver Bullet for Mobile Banking Growth

Reading Time: 7 minutes

Bonus Content

|

What’s the key to your mobile banking growth? Most banks would say it’s offering an effective mobile banking app, but they’d only be partly right. Not only do banks need a compelling app, but they also need to think about how to correctly position their app within their business.

The rise of the internet and mobile devices has resulted in a host of new channels: apps, websites, social media, email, and more. These additional channels offer exciting possibilities, but many marketers make the mistake of just stacking them on top of each other rather than carefully thinking through what an ideal structure might look like.

For banks, rather than looking at a mobile banking app as simply an additional channel, think of the leverage you could realize if you placed the app as a central hub around which you built out your omnichannel consumer engagement strategy. Doing so will put you in an ideal position—as mobile adoption increases, mobile apps are becoming one of the main touchpoints for banking customers.

Customers use multiple channels when interacting with businesses. According to research from Google, consumers typically switch between three to four screens before completing a task. Thus, businesses (including banks) need to adopt an omnichannel marketing strategy in order to capture those sales.

Omnichannel Marketing for Mobile Banking Growth

Omnichannel marketing uses all the marketing channels at its disposal to achieve an integrated and seamless user experience from beginning to end. The key is how the user experiences the marketing that is directed toward them. They should be able to move from channel to channel and experience the same branding and messaging throughout, regardless of whether they’re using an app, social media, or a website via desktop.

To achieve a truly seamless experience, all the channels must be integrated. A customer should be able to move from the app to desktop seamlessly while having email, push messages, and more support the experience in a synchronized dance. Invesp found that those companies that use omnichannel strategies retain 89% of their customers on average, compared to only 33% of those with weak omnichannel customer engagement.

Customer experience is the touchstone to successful marketing, and the key to ensuring a positive experience is consistency.

How can you achieve this?

Simplify Concepts, Transactions, and Navigation

Many customers find financial topics to be confusing and dull, which can make it difficult to market financial products to them. Digital banking providers should consider making short videos that help explain complex financial concepts in a simple, straightforward manner. According to research from Retail Dive, 72% of consumers would rather use a video to learn about a product or service than any other channel.

There is clearly a demand for this type of content given that 68% of consumers find content that either informs or educates is more valuable than other forms. A report by TD Bank indicates that a majority of millennials believe they could benefit from some advice on savings (32%), credit cards (26%), creating a budget (30%), and other financial topics. By acting as a reliable source of information that demystifies intimidating financial concepts, you can teach your customers about your products and gently nudge them toward your offerings.

Customers also have short attention spans. According to research from Chartbeat, more than 50% of website visitors leave a site within 15 seconds, so it’s crucial to make things simple. To improve mobile app adoption, a banking app should be easy to navigate, and its products need to be easy to use. For example, regular transactions such as paying off a credit card should be straightforward and require as few steps as possible.

Why should you care? The average uninstall rate for apps in the finance industry is 44.98%, according to a report by Statista. Furthermore, research from Comscore shows that usability issues are the main reasons other than security for not converting on mobile devices:

- Security concerns 20.2%

- Cannot see product detail 19.6%

- Navigating is difficult 19.3%

- Can’t browse multiple screens or compare 19.w6%

- Too difficult to input details 18.6%

The bottom line is that if your app isn’t easy to use, your customers are unlikely to use it.

Make Your App the Main Customer Touchpoint

Generation Z wants to be self-sufficient. That means they want to have minimal friction between themselves and the product or service they’re using. So rather than imposing customer support staff on them, invest in technology that provides access and enables them to solve their own problems. Banks that do this effectively will improve banking app adoption.

Live chat is one solution that fits this bill. Wells Fargo witnessed a double-digit hike in conversions and improved customer satisfaction rates after it implemented live chat. Comprehensive FAQ sections are another way to address the most common questions and problems experienced by customers. Data from live chat interactions can be used to either add content to FAQ sections or to train chatbots that can be available to customers around the clock.

Chatbots can also act as guides to customers to either navigate the app or answer questions about products and services. HDFC Life was the first chatbot in India to help customers choose life insurance. Using a 60-second assessment quiz, the bot computed an “Insurance Quotient” that allowed it to recommend suitable plans. It worked: 8.03% of users expressed an interest in purchasing the product after interacting with the bot; traditional web-based forms only generate up to 2% interest.

Bonus Tip: Take a look at Pros and Cons of AI Chatbots

Use Data to Understand Your Customers

Customers leave a treasure trove of data about their browsing habits, preferences, and interests with every interaction, and this has only increased as mobile adoption has scaled. These interactions offer an opportunity to extract data that you can use to help gain insight into how to serve that customer better. Each channel is capable of gathering its own data, but an effective omnichannel strategy enables you to connect the dots between the different channels to help create a complete profile of your customers.

When you understand your customer’s behavior and preferences, you can message them via their preferred channel to increase engagement, delivering the right message at the right time. This might involve analyzing a customer’s profile to determine the right time to offer them a credit limit increase, a low-interest mortgage, or a new account product, and to choose to do it via push message, email, or direct mail.

Use AI and Personalization to Enhance Customer Experience

Once you have an understanding of your customers and their preferences, you can use AI and personalization to enhance their experience. A RedPoint survey found that 63% of consumers expect personalization as a standard of service and believe they are recognized as individuals when they get special offers. Consumers want personalized services and are willing to share personal information to get it. One Deloitte survey found that 48% of shoppers are willing to share data in return for personalized services, and even more (58%) millennials are. They’re willing to share their locations and personal data to get more personalized emails with recommendations and suggestions targeted to their preferences.

A well-designed mobile app can remind customers of pending bills and upcoming payments, offer personalized product or service messages, and share information about ancillary products, all of which act to make the customer feel personally cared for while boosting engagement and visibility of your products.

Take note that these expectations for personalization highlight the need for a smoothly integrated omnichannel marketing operation. The RedPoint survey also noted that “Interactions consumers label as ‘very frustrating’ include being sent an offer for a recently purchased item (34 percent), offers that aren’t relevant (33 percent), or when a brand fails to recognize them as an existing customer (31 percent).” Personalization can backfire when it is executed poorly.

For expert advice on personalization, register for the webinar below.

Get Started with Omnichannel Marketing for Your Bank

In an era of short attention spans and increased demands for seamless, personalized experiences, banks need to meet customers where they are. Simplifying financial transactions will make it easier for your clients to do business with you, which will improve customer experience and satisfaction.

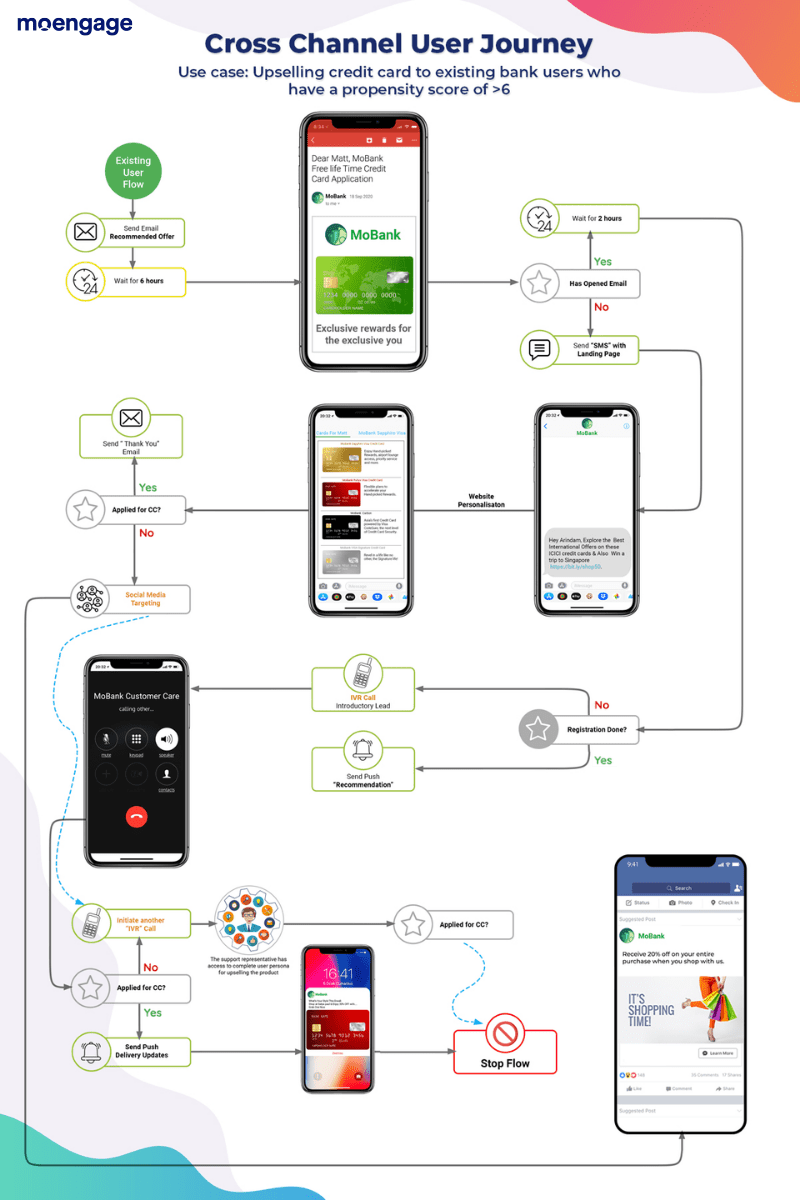

MoEngage’s platform for BFSI is built for our mobile-first world, helping companies orchestrate campaigns across push notifications, emails, in-app messaging, web push, and SMS. Our platform helps companies create, visualize, and deploy omnichannel campaigns that reach users at the right time through the right channels, and with the right message.

Get a single view of customers

Integrate your customer’s behavioral, demographic, and geographical data to build experiences that matter. Use our AI-powered automation and analytics platforms to design personalized experiences for each of your customers.

Provide a seamless experience across touchpoints

Your users expect real-time experience across all touchpoints. According to a PwC survey from 2018, the number of segments that placed more importance on positive user experience than on higher interest rates increased by 21% over just three years before. With our powerful personalization and segmentation tools, you can create intelligent coherent campaigns that engage customers in a timely and relevant manner.

Personalize based on behavior and physical location

Activate campaigns that engage your customers when they enter, dwell, or exit from a specified location. For example, you could send a timely notification about an international card activation facility to your customers when they are at the airport.

Reduce customer complaints and call center volume

Automate standard and powerful responses by preempting general customer queries and requests. Smart banking goes a step further by reducing call center volumes and increasing micro-moment engagement.

Create, visualize, and deploy lifecycle campaigns for your customers. Engage your users wherever they are. Send rich, personalized messages to guide them along their banking journey and drive mobile banking growth.

Here’s What You Can Read Next: |