🔥 [Panel] Personalization, AI, Trust—What Top BFSI Marketers Are Doing Differently.

Register Now

GoTyme Bank, a regulated bank by the Bangko Sentral ng Pilipinas, is a joint venture between the Gokongwei group of companies and the multi-country digital banking group Tyme. Powered by the extensive ecosystem of the Gokongwei Group, customers can bank where they shop, eat, and relax. Through its award-winning mobile app, kiosk, and debit card, the bank offers products and services built around security, simplicity, and beauty that open up new ways of saving, spending, investing, and managing its customers’ money.

GoTyme Bank was let down by outdated and expensive legacy platforms with limited engagement capabilities, reach and campaign execution. They were also too many time-consuming manual processes and insights were far and few. Additionally, the absence of a unified customer view dashboard to view common customer insights which was critical to their KPIs.

But GoTyme Bank's team knew the areas that needed improvements and set their goals to automate engagement, unify scattered databases in the company, and decrease dependency on external teams. To scale at growth, they also knew they had to leverage a customer engagement platform's (CEP) capabilities like segmentation, personalization, analytics, etc.

They wanted to expand their reach to ensure every customer felt like they had a personal banker in their pocket.

From 1 month to 1 hour - By leveraging MoEngage’s capabilities, we’re now able to execute campaigns faster than ever before, significantly boosting operational efficiency and growth!

MoEngage Automated Flows (Customer journey orchestration) has been a game-changer for us. It boosted our overall customer conversions by 37% and took away the mundane and repetitive manual efforts, allowing us more time for planning and strategizing to drive customer, revenue and business growth.

MoEngage feels truly global due to the sheer number of physical branches available and delivering 2 trillion+ messages per month across the world. The super-easily reachable local support feel like they truly care about their customers.

While evaluating different platforms, their #1 priority was to make sure the marketing automation solution would have the best capabilities in:

- Security and Compliance

- Data Integration and Accessibility

- Automation, Analytics and Reporting

- Omnichannel Engagement

- Cutting Operational Costs and Driving Revenue

Based on these criteria, they evaluated a group of platforms and chose MoEngage as their trusted marketing automation partner.

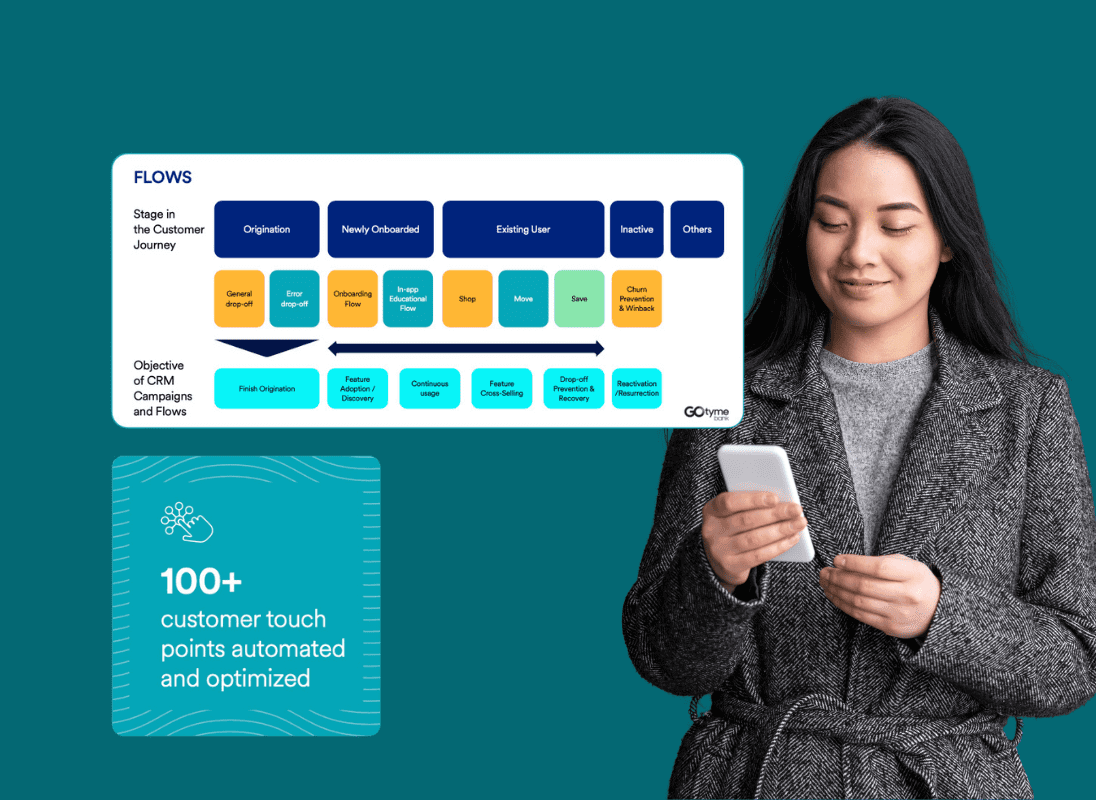

GoTyme Bank were now able to set up automation-triggered points in the customer journey and get real-time reports without depending on external teams. Using the drag-and drop builder, they were able to create campaigns quickly and go-live in very little to no time.

The first touch-point in the customer journey didn't start with registration. For any questions the customer had even before registration, GoTyme Bank were resolving queries that moved their customers down the funnel.

Using MoEngage Flows, they found out what the exact drop-off points were in their customer journey. They then provided timely and relevant touch-point communications through the channels and format their customers most likely enjoyed consuming.

After unifying the multiple siloed databases with over 3 million customers accounts for, GoTyme Bank leveraged MoEngage's in-depth analytics to make insights-driven business decisions.

They were now able to scale their business growth using MoEngage. However, they still found room to optimize by creating a segment of their inactive customers. Targeting this dormant cohort with personalized emails, they were able to bring them back onto the platform and convert them to active customers.

Additionally, they were also able to use custom dashboards to understand parts of the bank's processes where informative dashboards weren't previously available at all.

Using MoEngage, GoTyme Bank was able to shake up the banking landscape in the Philippines by:

Please wait while you are redirected to the right page...