Using MoEngage, Piramal Finance was able to:

- From 4 hours to 45 minutes– Drop in go-live time for campaigns

- A 20% Uplift in month-on-month Revenue

Uplift in month-on-month Revenue

Drop in go-live time for campaigns

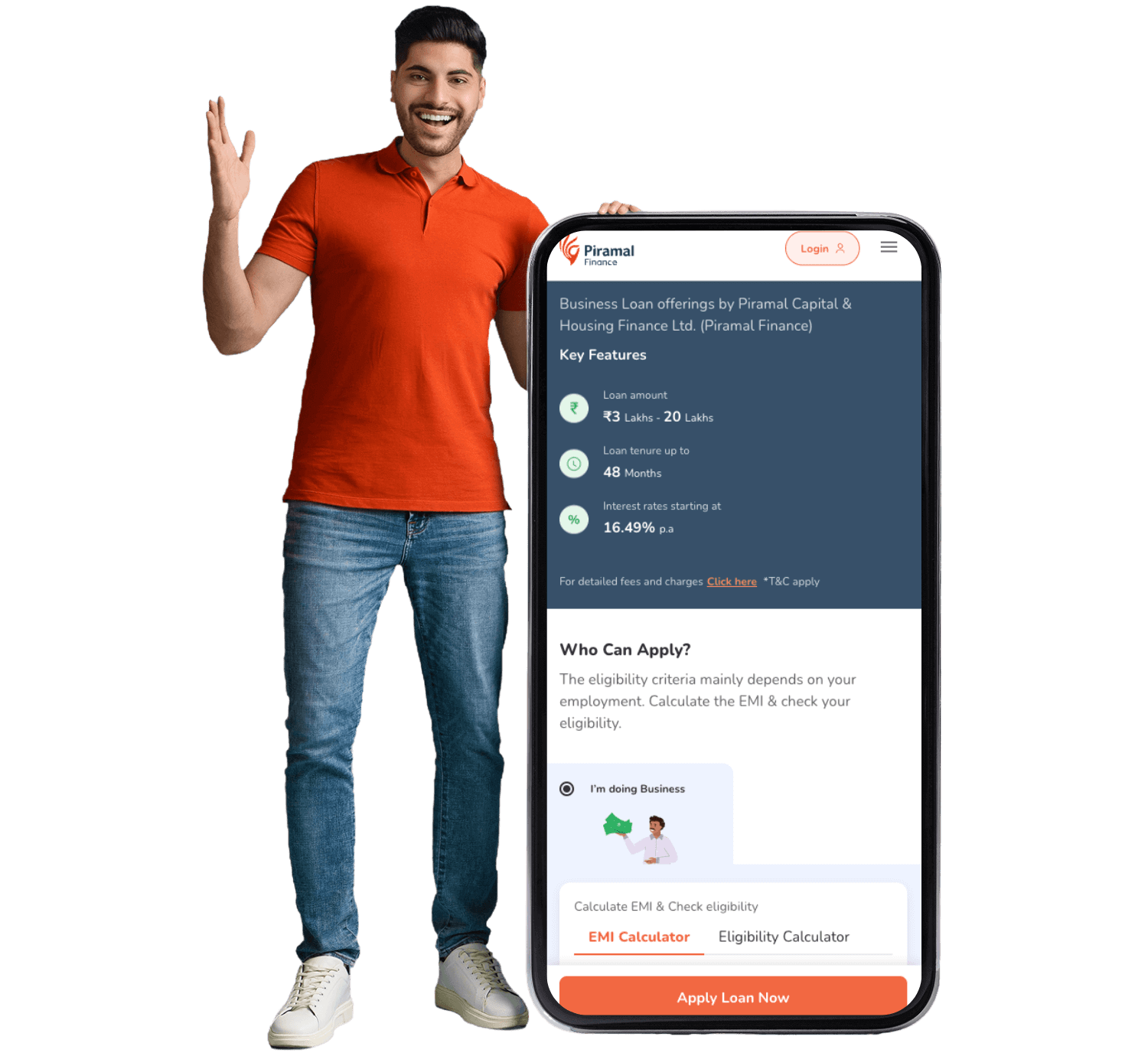

Piramal Capital & Housing Finance Ltd. (referred as Piramal Finance), a wholly owned subsidiary of Piramal Enterprises Ltd., is a leading Indian NBFC-HFC offering retail and wholesale lending. It has over 1.3 million active customers and a presence in 26 states with a network of 501 branches, as on 30th June 2024. It offers multiple products, including home loans, loan against property, used car loans, small business loans to Indian budget conscious customers at the periphery of metros and in Tier I, II and III cities.

Piramal Finance's dedication to enhancing customer engagement and its growth trajectory drove it to streamline its customer engagement further. The brand was keen on improving its approach to creating precise customer segments, an initiative that demonstrates its commitment to optimizing its processes. Therefore, the team wanted to onboard a platform that came with stellar segmentation prowess, was agile and offered end-to-end campaign automation to further reinforce their dedication to excellent customer experiences.

We saw a significant impact on our revenue metrics, within the first nine months of onboarding MoEngage. The platform integrated smartly and seamlessly with our system and automated the entire process- with zero manual efforts. With MoEngage, we were able to execute drop-off management for our digital PL product successfully by cueing us into what stages customers were dropping off at and retargeting them effectively. Currently, we are experiencing a 20% increase in revenue, month-on-month, on an average.

Dheeraj Mali

Head- Digital Marketing at Piramal Finance

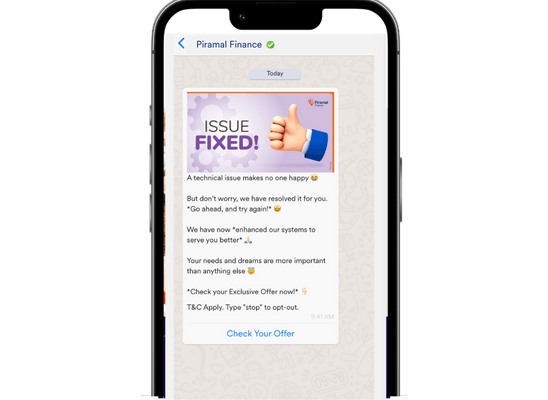

With the launch of Piramal Finance's digital PL product, managing engagement was proving to be challenging due to lack of real-time customer communication.

MoEngage's insights-led engagement platform significantly reduced the time it took for these communications to go out after disbursements, ensuring that customers received the information promptly. For example, in case of a technical glitch, the issue would be resolved and the same would be communicated to the customer promptly, improving the overall customer experience.

With MoEngage, Piramal Finance started capitalizing on channels like SMS, push notifications, WhatsApp, etc., to drive business revenue. Flows and Periodic Campaigns were some of the key features the brand used to automate customer journeys end-to-end.

MoEngage's advanced segmentation capabilities also allowed the brand to precisely segment its customers based on their preferences and behavior, a task that was previously manual.

The MoEngage Professional Services team provided active and immediate support to the financial services giant from the get go. The team actively supported the Piramal Finance's dev team, aiding with proper documentation and helping resolve the queries with immediate effect.

An example of the team's effectiveness was how they went about successfully completing the arduous, 13-step long process of setting up emails in 4 working days for Piramal Finance!

Customer Insights & Analytics

Create omnichannel, personalized experiences using AI-powered insights and analytics.

Customer Journey Orchestration

Create unique, seamless experiences at every stage of your customer’s journey.

On-site Messaging

Engage your visitors with personalised on-site messages tailored to their preferences and behavior.

Using MoEngage, Piramal Finance was able to:

Aza Fashions Boosts In-app Revenue by 25% Using MoEngage’s AI-powered Personalization

Bisleri Achieves 50% Retention Growth Through Strategic Customer Engagement with MoEngage

How GIVA Uses MoEngage to Drive Deeper Customer Analysis and Omnichannel Engagement

How HT Digital Mastered Real-Time News Personalization and Engagement with MoEngage

MoEngage is an insights-led platform trusted by 1,350+ global brands like McAfee, Flipkart, Domino’s, Nestle, Deutsche Telekom, and more. MoEngage’s powerful analytics, personalization, and AI capabilities give a 360-degree view of your customers and help you create journeys across digital channels.

© Copyright 2026 MoEngage. All Rights Reserved.

Please wait while you are redirected to the right page...