MoEngage Gets Additional $180M in Series F; Completes Liquidity Event for Employees & Investors.

Read More

Armed with smartphones and easy data connectivity, technology-savvy customers now have a different set of expectations from their bankers. Read this eBook to understand the changing needs.

• The shifts in banking for millennials and gen-Z

• How to onboard app users with minimum drop-offs

• Long-term impact of a pandemic on banking

Is it possible to create the ‘Netflix of banking’? Compared to their predecessors, modern-day customers have different expectations from banks.

Millennials expect banks to keep them updated through mobile push notifications, e-newsletters, mobile app alerts and similar modern communication channels.

Online and mobile banking make customers’ lives easier by eliminating the need to visit a branch and getting things done from any place, at any time that suits them.

Online banking, mobile banking, digital wallets etc. have become essential as customers can manage them on their own without having to go through a bank’s bureaucracy.

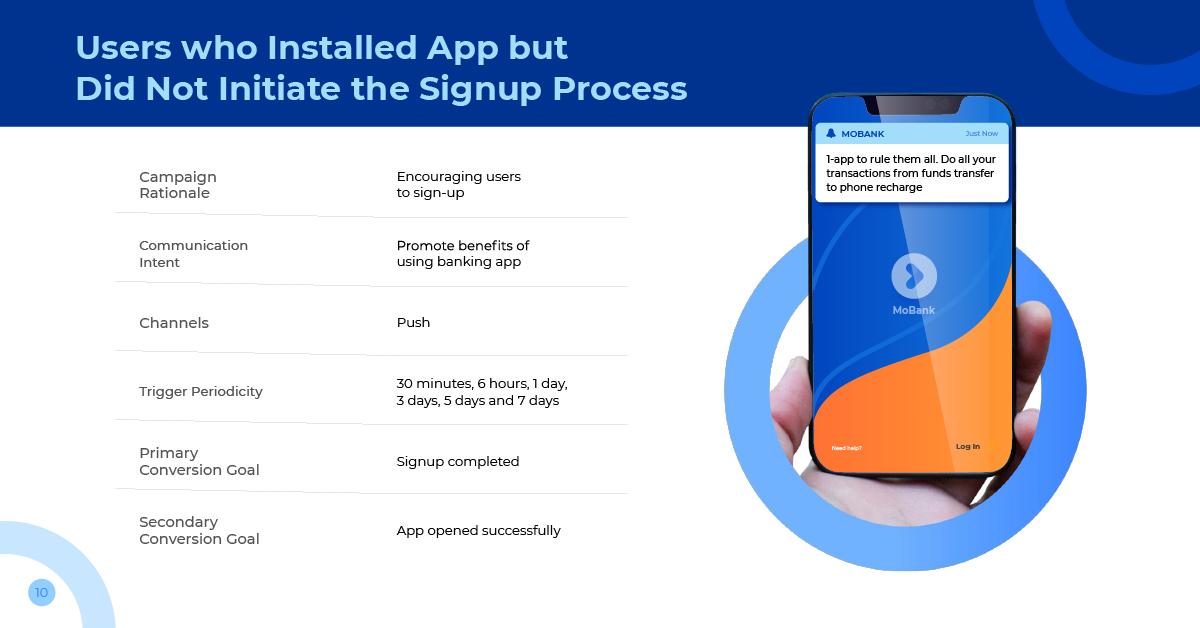

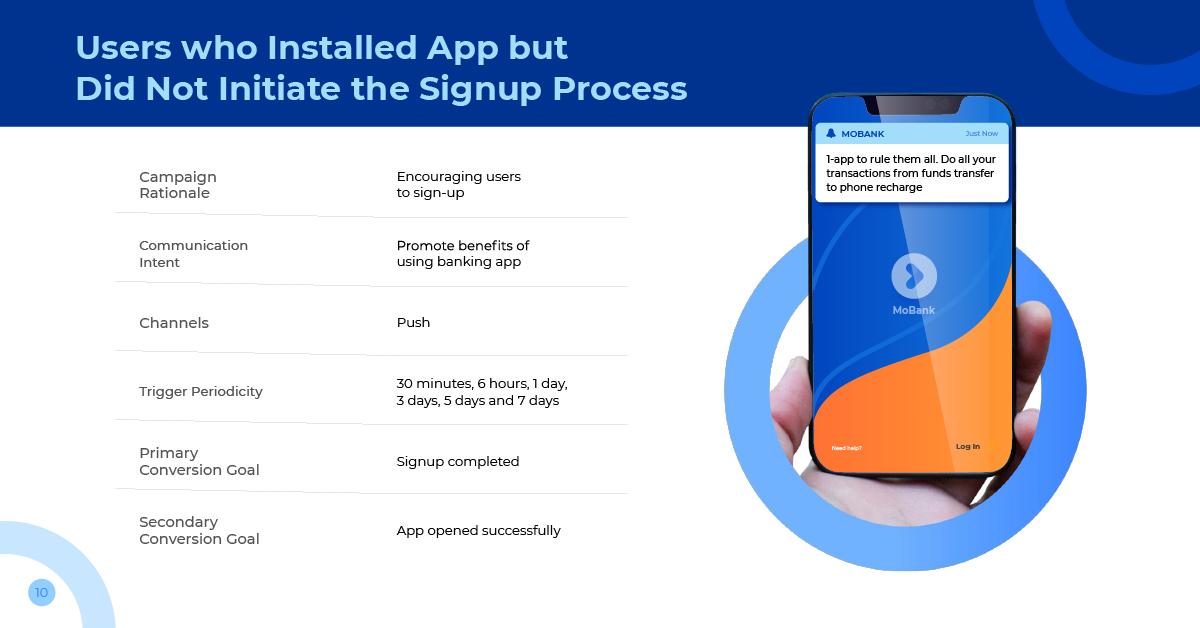

Ensuring minimum drop-offs involves tracking drop-offs, keeping them engaged and onboarding them successfully. The following template shows your action plan for users who installed the app but did not initiate the signup process. Read this eBook to get access to 10 easy-to-use templates that ensure seamless onboarding of your banking customers.

The 5 main steps in a customer onboarding experience in digital banking include providing a consistent experience throughout the customer lifecycle, having a mobile-friendly version, ease of use for the customer, transparency in the process and efficiency in delivering services.

Customer onboarding means showcasing all the offerings and processes to customers so that they can easily avail your services with minimal issues. It is the most important factor in creating first impressions and building long-term relationships with customers.

Onboarding a new customer is a six-step process that involves setting up meetings to set expectations, going through the specific use case and associated responsibilities, discussing the expected results, predicting any roadblocks and having a future-proof plan, seeking feedback and diligently following up.

Digital onboarding, also known as online or remote onboarding, is the virtual equivalent of offline customer onboarding. This process eliminates all the hassles of in-person meetings and long waiting hours, thus providing a highly secure environment to avail banking services anytime anywhere.

Millennial banking customers want transparency in communication such the ability to see pricing or fee without any hidden costs and know how their data is being used by banks. They want the flexibility to access and update products anytime.

As per the Insider Intelligence’s Mobile Marketing Competitive Edge Study 2020, around 97% of millennials in the United States use mobile banking for checking their credit score, view their account balance, make online transfers, depot check and more.

MoEngage is an insights-led platform trusted by 1,350+ global brands like McAfee, Flipkart, Domino’s, Nestle, Deutsche Telekom, and more. MoEngage’s powerful analytics, personalization, and AI capabilities give a 360-degree view of your customers and help you create journeys across digital channels.

© Copyright 2025 MoEngage. All Rights Reserved.

Please wait while you are redirected to the right page...